ftb 5870a 2020 can be completed without difficulty. Just use FormsPal PDF editing tool to do the job fast. To maintain our tool on the forefront of convenience, we strive to put into action user-oriented capabilities and enhancements on a regular basis. We're at all times pleased to receive feedback - assist us with remolding PDF editing. It just takes a few basic steps:

Step 1: Open the PDF inside our editor by clicking on the "Get Form Button" in the top section of this page.

Step 2: With our online PDF tool, it's possible to do more than just complete blank fields. Try all the features and make your documents appear professional with custom textual content added, or adjust the original input to perfection - all accompanied by an ability to incorporate any kind of images and sign the PDF off.

It will be easy to fill out the document with this practical guide! This is what you want to do:

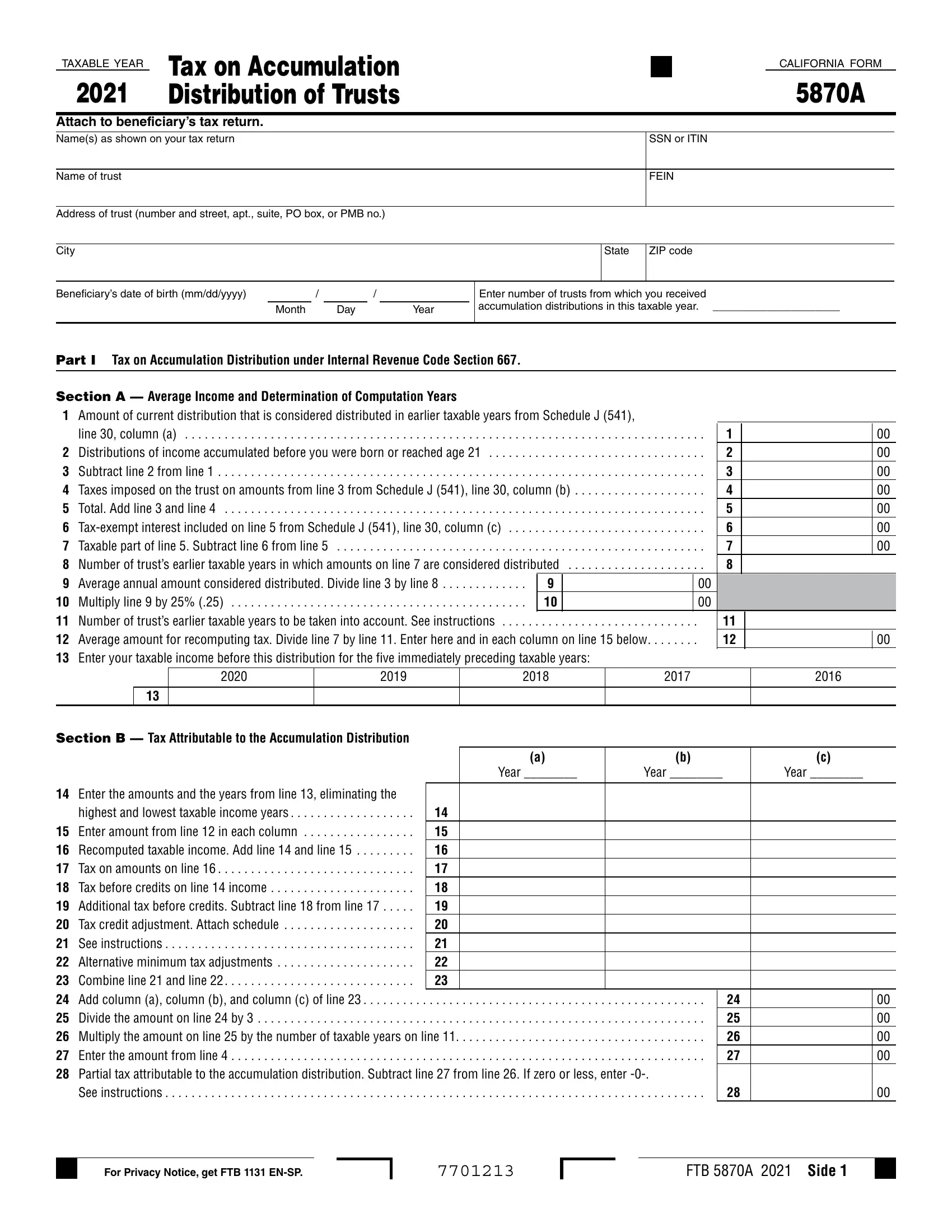

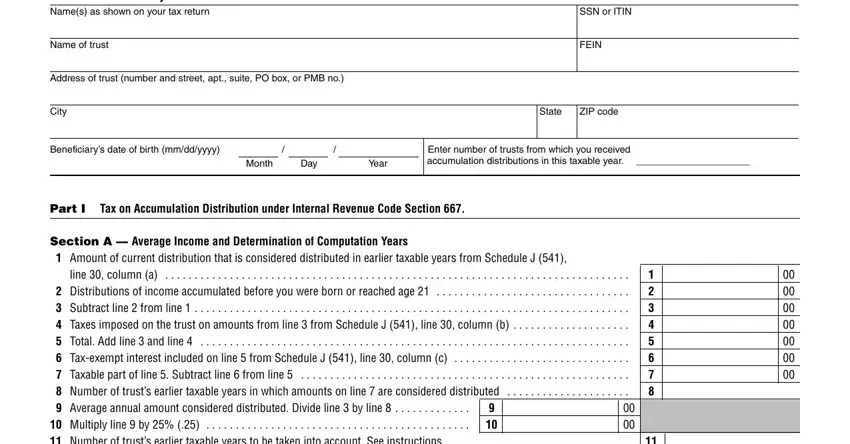

1. Begin filling out your ftb 5870a 2020 with a selection of essential fields. Gather all the important information and make sure not a single thing neglected!

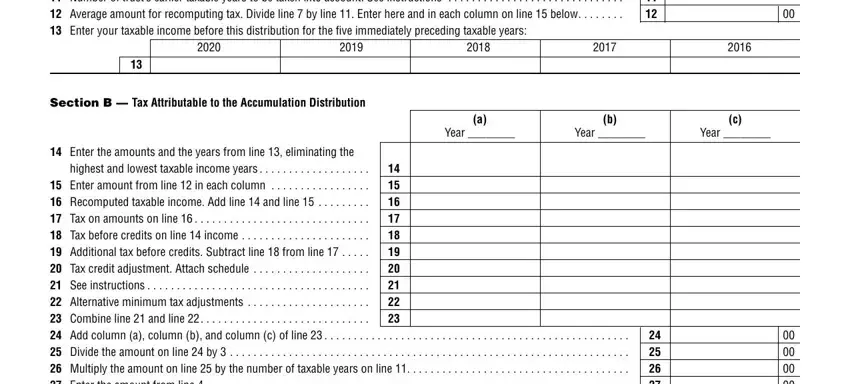

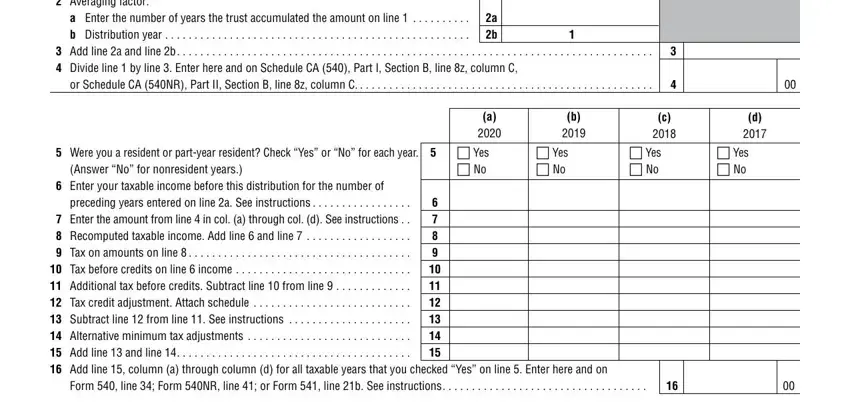

2. Immediately after this section is filled out, go on to enter the suitable details in these: line column a , Section B Tax Attributable to the, Year , Year , Year , and Enter the amounts and the years.

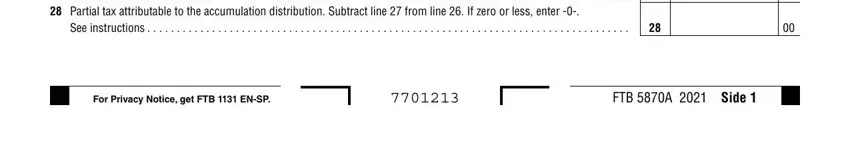

3. In this particular part, have a look at Enter the amounts and the years, See instructions , For Privacy Notice get FTB ENSP, and FTB A Side . Every one of these need to be filled out with utmost attention to detail.

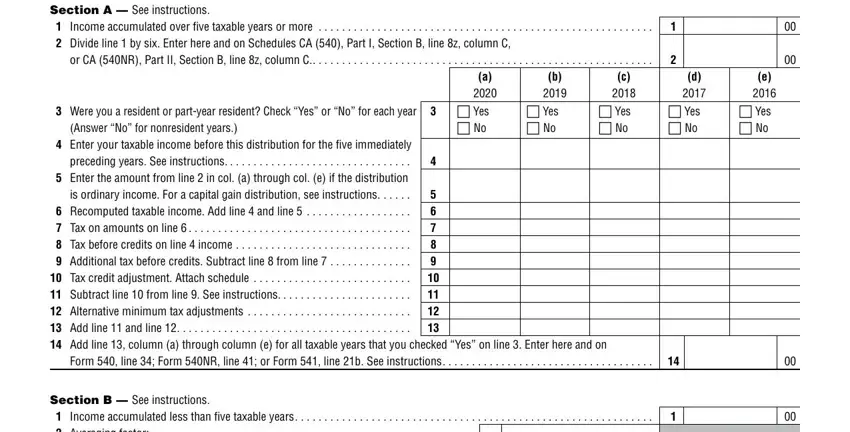

4. The fourth part arrives with the next few blanks to consider: Answer No for nonresident years, b Yes No, or CA NR Part II Section B line z, Section A See instructions , Form line Form NR line or Form , c Yes No, d Yes No, Section B See instructions , and e Yes No.

You can potentially get it wrong when filling out the c Yes No, thus you'll want to look again before you decide to finalize the form.

5. To finish your form, the final area includes a number of extra blank fields. Completing Section B See instructions , a Enter the number of years the, or Schedule CA NR Part II Section, a b, Yes No, Yes No, Yes No, Answer No for nonresident years, Were you a resident or partyear, and Form line Form NR line or Form will certainly conclude the process and you will be done in a short time!

Step 3: Before finalizing the document, check that all blank fields have been filled out as intended. The moment you’re satisfied with it, click “Done." Join FormsPal today and instantly obtain ftb 5870a 2020, available for downloading. All alterations made by you are preserved , which means you can change the document at a later stage if needed. FormsPal guarantees protected form tools devoid of personal information recording or any kind of sharing. Be assured that your data is in good hands here!