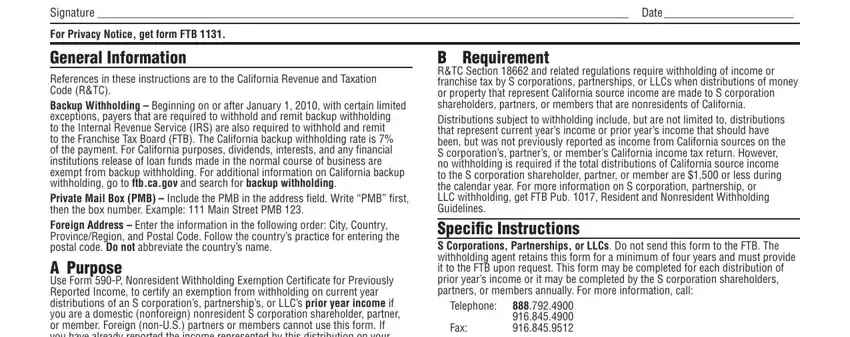

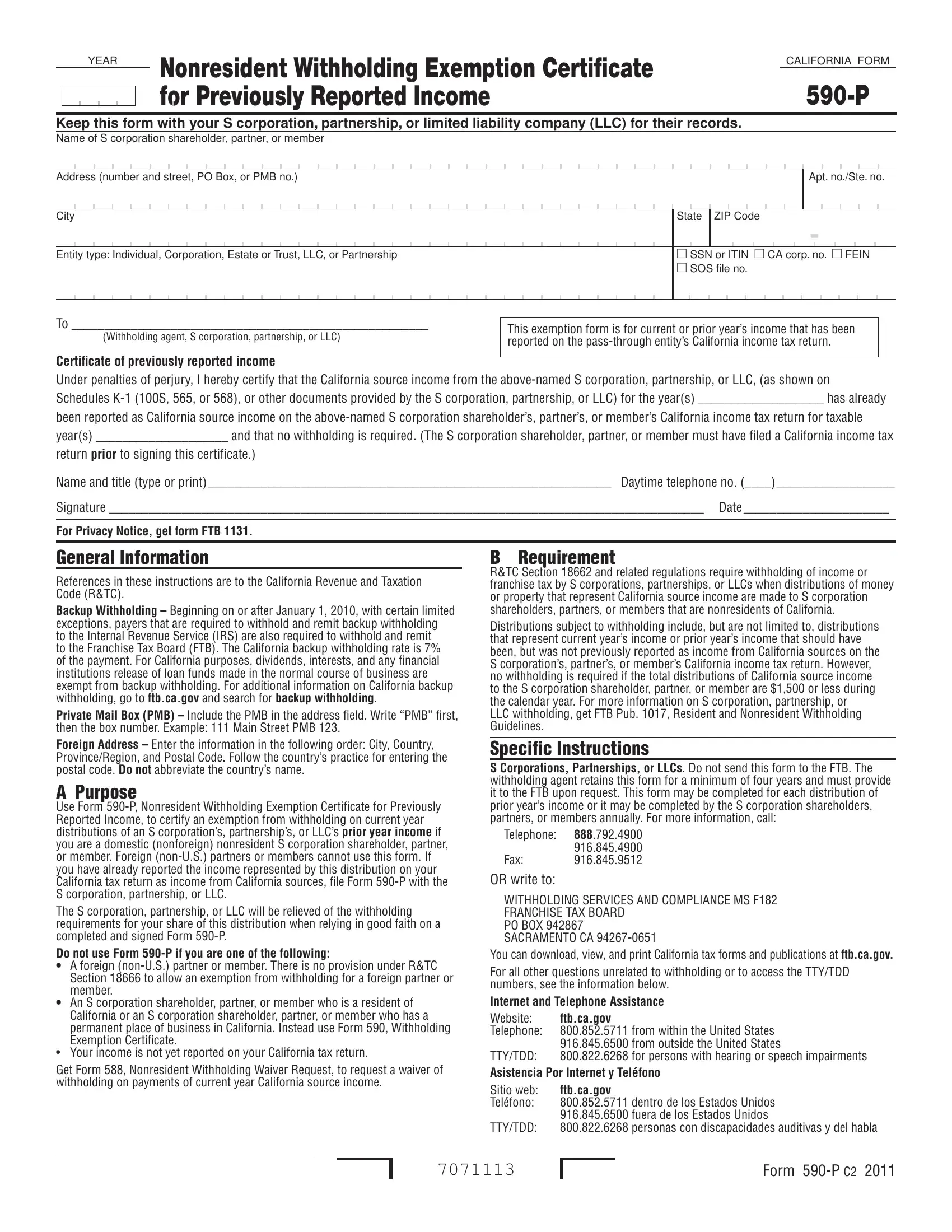

General Information

References in these instructions are to the California Revenue and Taxation Code (R&TC).

Backup Withholding – Beginning on or after January 1, 2010, with certain limited exceptions, payers that are required to withhold and remit backup withholding to the Internal Revenue Service (IRS) are also required to withhold and remit

to the Franchise Tax Board (FTB). The California backup withholding rate is 7% of the payment. For California purposes, dividends, interests, and any inancial institutions release of loan funds made in the normal course of business are exempt from backup withholding. For additional information on California backup withholding, go to ftb.ca.gov and search for backup withholding.

Private Mail Box (PMB) – Include the PMB in the address ield. Write “PMB” irst, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country, Province/Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

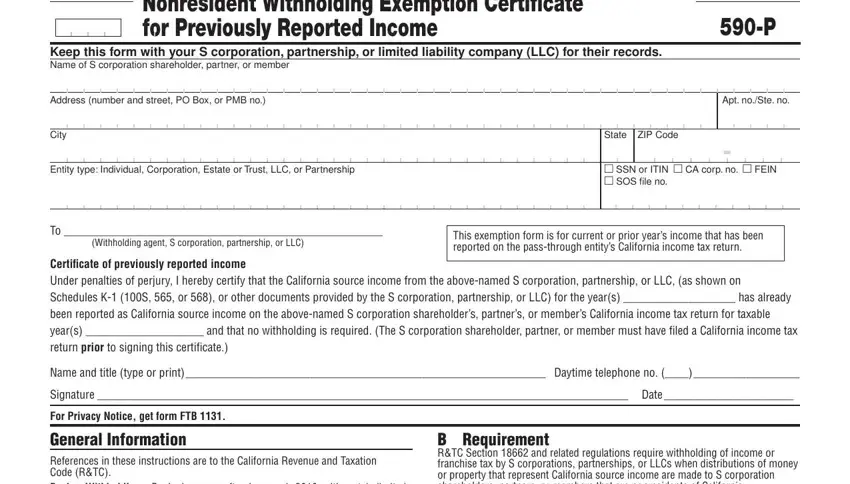

A Purpose

Use Form 590-P, Nonresident Withholding Exemption Certiicate for Previously Reported Income, to certify an exemption from withholding on current year distributions of an S corporation’s, partnership’s, or LLC’s prior year income if you are a domestic (nonforeign) nonresident S corporation shareholder, partner, or member. Foreign (non-U.S.) partners or members cannot use this form. If you have already reported the income represented by this distribution on your California tax return as income from California sources, ile Form 590-P with the S corporation, partnership, or LLC.

The S corporation, partnership, or LLC will be relieved of the withholding requirements for your share of this distribution when relying in good faith on a completed and signed Form 590-P.

Do not use Form 590-P if you are one of the following:

•A foreign (non-U.S.) partner or member. There is no provision under R&TC Section 18666 to allow an exemption from withholding for a foreign partner or member.

•An S corporation shareholder, partner, or member who is a resident of California or an S corporation shareholder, partner, or member who has a permanent place of business in California. Instead use Form 590, Withholding Exemption Certiicate.

•Your income is not yet reported on your California tax return.

Get Form 588, Nonresident Withholding Waiver Request, to request a waiver of withholding on payments of current year California source income.

B Requirement

R&TC Section 18662 and related regulations require withholding of income or franchise tax by S corporations, partnerships, or LLCs when distributions of money or property that represent California source income are made to S corporation shareholders, partners, or members that are nonresidents of California.

Distributions subject to withholding include, but are not limited to, distributions that represent current year’s income or prior year’s income that should have been, but was not previously reported as income from California sources on the S corporation’s, partner’s, or member’s California income tax return. However, no withholding is required if the total distributions of California source income to the S corporation shareholder, partner, or member are $1,500 or less during the calendar year. For more information on S corporation, partnership, or

LLC withholding, get FTB Pub. 1017, Resident and Nonresident Withholding Guidelines.

Specific Instructions

S Corporations, Partnerships, or LLCs. Do not send this form to the FTB. The withholding agent retains this form for a minimum of four years and must provide it to the FTB upon request. This form may be completed for each distribution of prior year’s income or it may be completed by the S corporation shareholders, partners, or members annually. For more information, call:

Telephone: 888.792.4900 916.845.4900

Fax:916.845.9512

OR write to:

WITHHOLDING SERVICES AND COMPLIANCE MS F182 FRANCHISE TAX BOARD

PO BOX 942867 SACRAMENTO CA 94267-0651

You can download, view, and print California tax forms and publications at ftb.ca.gov.

For all other questions unrelated to withholding or to access the TTY/TDD numbers, see the information below.

Internet and Telephone Assistance

Website: |

ftb.ca.gov |

Telephone: |

800.852.5711 from within the United States |

|

916.845.6500 from outside the United States |

TTY/TDD: |

800.822.6268 for persons with hearing or speech impairments |

Asistencia Por Internet y Teléfono |

Sitio web: |

ftb.ca.gov |

Teléfono: |

800.852.5711 dentro de los Estados Unidos |

|

916.845.6500 fuera de los Estados Unidos |

TTY/TDD: |

800.822.6268 personas con discapacidades auditivas y del habla |