In case you desire to fill out California Form 592 F, it's not necessary to download any kind of applications - just use our PDF tool. The tool is continually updated by our team, acquiring additional functions and turning out to be more convenient. It just takes a couple of simple steps:

Step 1: First of all, access the tool by clicking the "Get Form Button" in the top section of this page.

Step 2: The tool provides the capability to work with PDF files in many different ways. Improve it by writing personalized text, correct original content, and place in a signature - all possible within a few minutes!

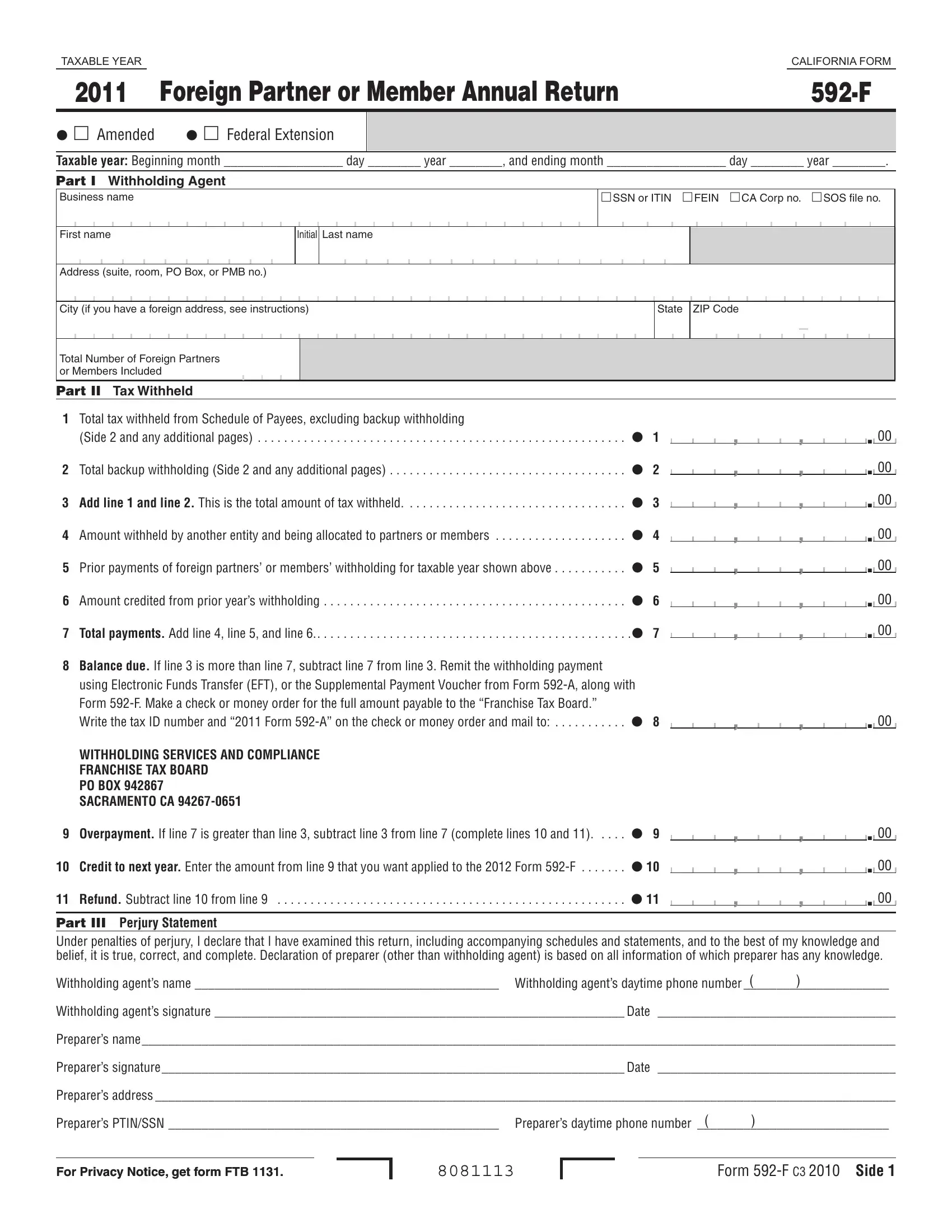

With regards to the blanks of this specific form, here is what you need to know:

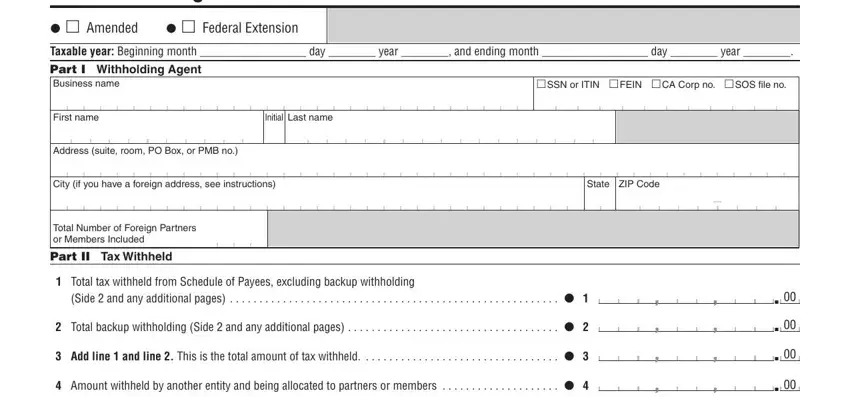

1. You'll want to complete the California Form 592 F properly, hence take care while filling in the sections including all of these blank fields:

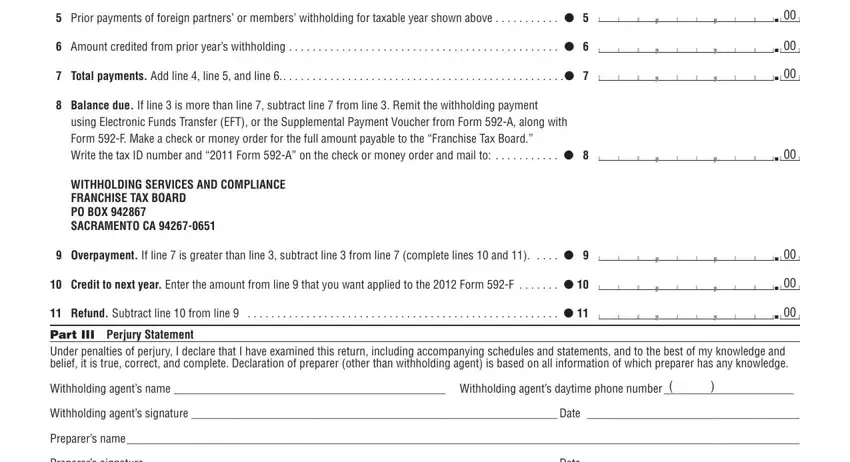

2. Just after the previous section is completed, proceed to type in the relevant details in these: Side and any additional pages , Balance due If line is more than, using Electronic Funds Transfer, Write the tax ID number and Form, WITHHOLDING SERVICES AND COMPLIANCE, FRANCHISE TAX BOARD PO BOX , Overpayment If line is greater, Part III Perjury Statement Under, Withholding agents name , Withholding agents signature Date , Preparers name , and Preparers signature Date .

Those who work with this document often make errors while filling in WITHHOLDING SERVICES AND COMPLIANCE in this section. Ensure that you read again whatever you enter here.

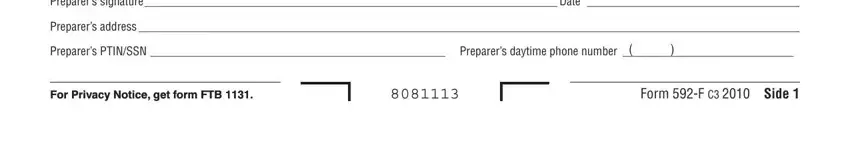

3. Throughout this part, check out Preparers signature Date , Preparers address , Preparers PTINSSN Preparers, For Privacy Notice get form FTB , and Form F C Side . Every one of these will have to be completed with greatest precision.

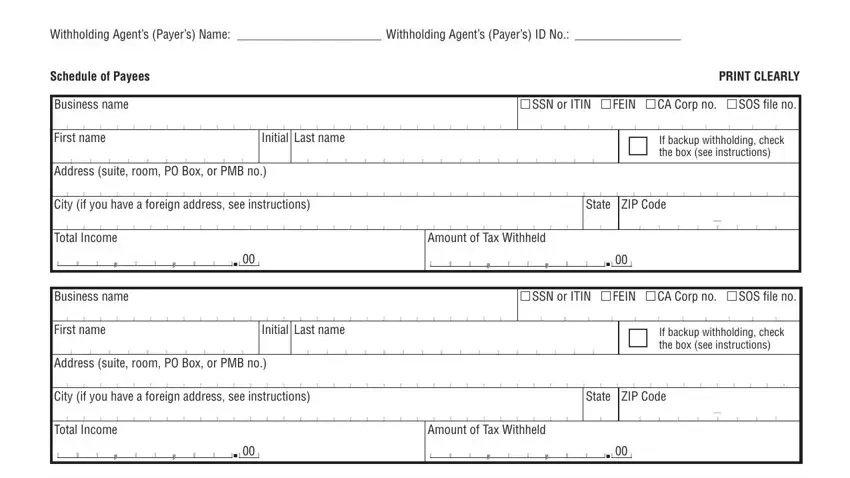

4. To move forward, this next form section will require filling in several fields. Examples of these are Withholding Agents Payers Name , Schedule of Payees, Business name, First name, Initial Last name, Address suite room PO Box or PMB no, SSN or ITIN FEIN CA Corp no , PRINT CLEARLY, If backup withholding check the, City if you have a foreign address, State ZIP Code, Total Income, Amount of Tax Withheld, Business name, and First name, which are integral to carrying on with this particular PDF.

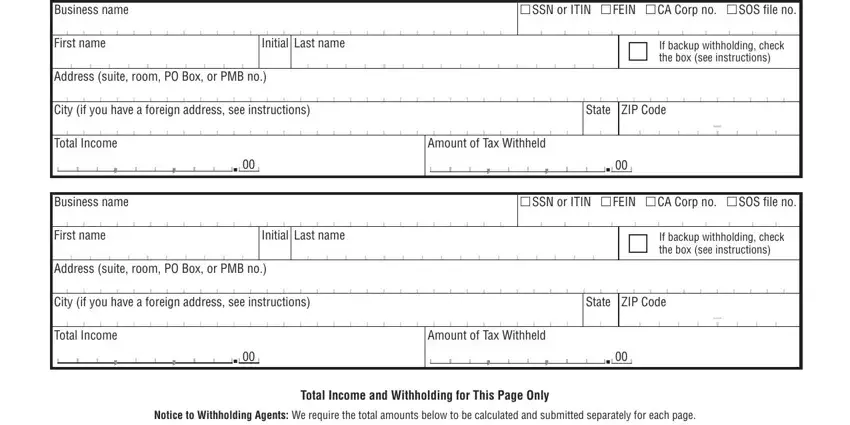

5. As a final point, this final section is what you have to finish prior to submitting the PDF. The blank fields here include the following: Business name, First name, Initial Last name, Address suite room PO Box or PMB no, SSN or ITIN FEIN CA Corp no , If backup withholding check the, City if you have a foreign address, State ZIP Code, Total Income, Amount of Tax Withheld, Business name, First name, Initial Last name, Address suite room PO Box or PMB no, and SSN or ITIN FEIN CA Corp no .

Step 3: Before moving on, it's a good idea to ensure that blank fields are filled out right. When you believe it is all good, click on “Done." Create a 7-day free trial subscription with us and gain instant access to California Form 592 F - download, email, or edit inside your personal cabinet. We don't share the details you enter when completing forms at our site.