Through the online PDF editor by FormsPal, it is possible to fill out or change california schedule r right here. Our expert team is always endeavoring to enhance the tool and enable it to be even faster for clients with its cutting-edge features. Bring your experience to the next level with constantly improving and exceptional options available today! Getting underway is simple! All you have to do is follow these basic steps down below:

Step 1: Hit the "Get Form" button above. It is going to open up our editor so that you could begin filling out your form.

Step 2: Once you open the editor, you'll notice the document all set to be filled out. Other than filling in different blanks, you could also do other actions with the Document, such as writing custom textual content, modifying the original text, inserting illustrations or photos, signing the form, and much more.

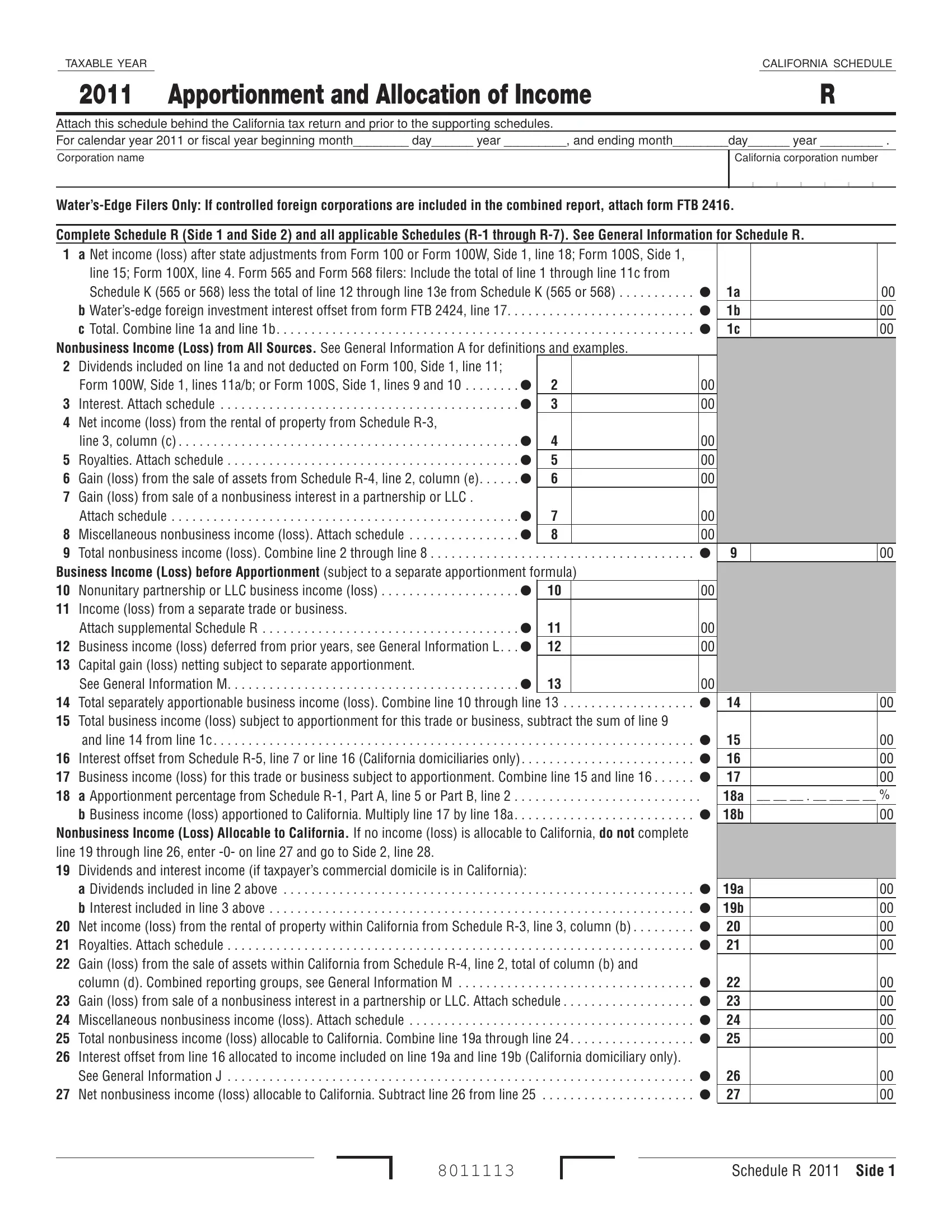

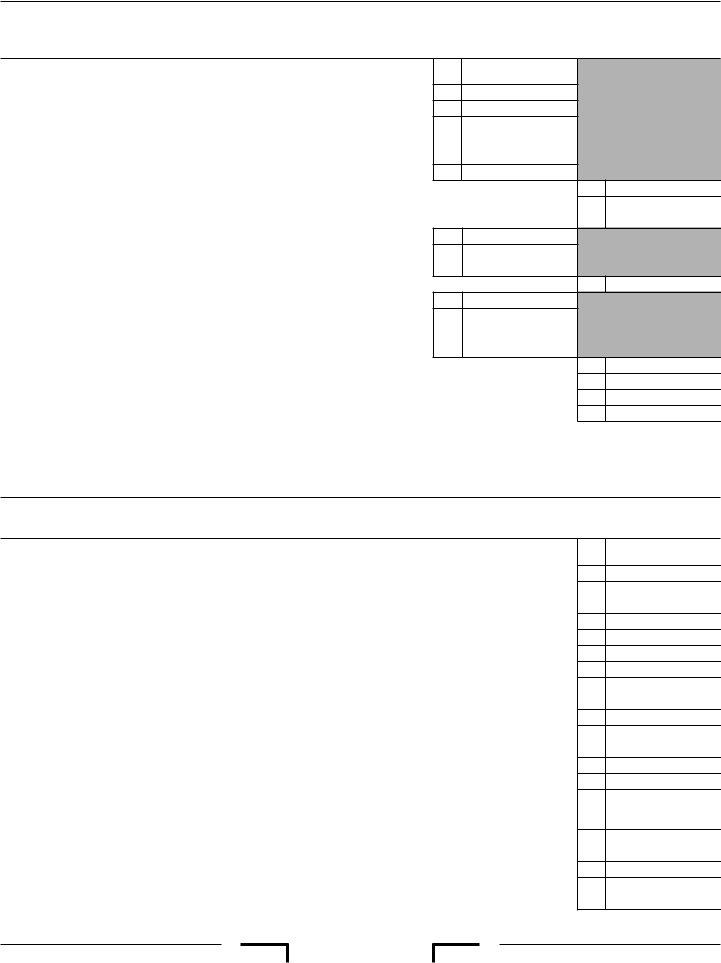

As for the blank fields of this specific PDF, here's what you should consider:

1. To start with, once filling in the california schedule r, start in the section that contains the next blank fields:

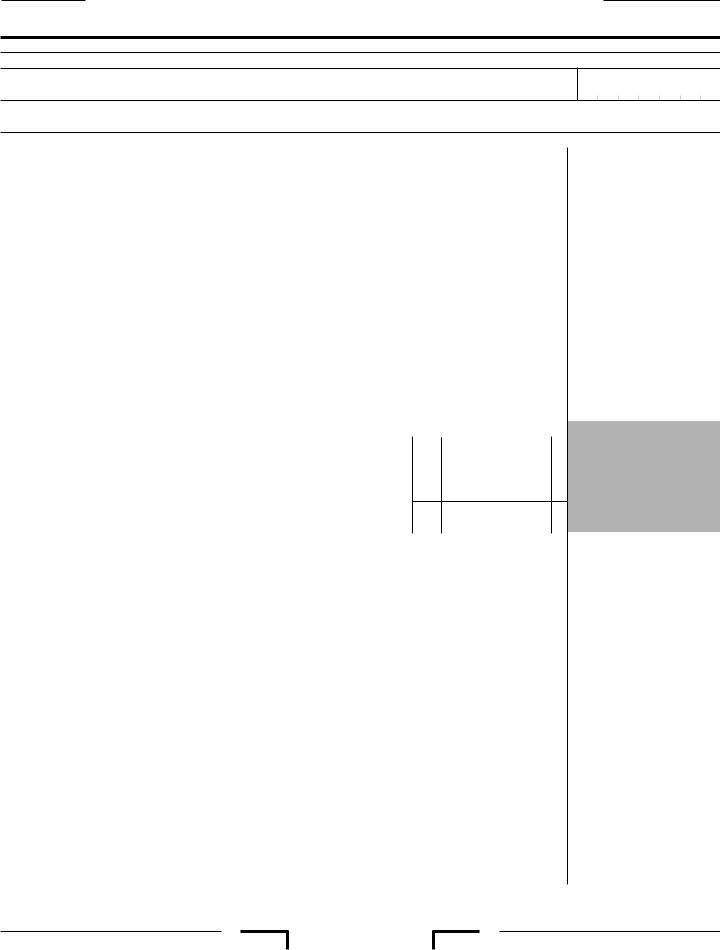

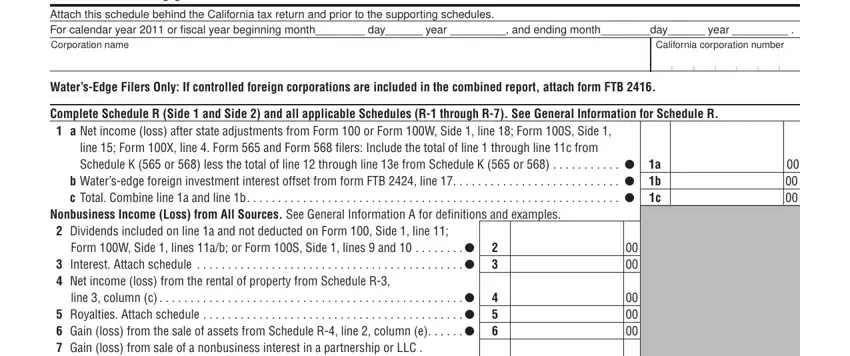

2. Given that the previous part is complete, you're ready to insert the needed particulars in Form W Side lines ab or Form S, Business Income Loss before, Capital gain loss netting subject, Income loss from a separate trade, Total business income loss, Total separately apportionable, a Dividends included in line , and Gain loss from the sale of assets so you're able to go further.

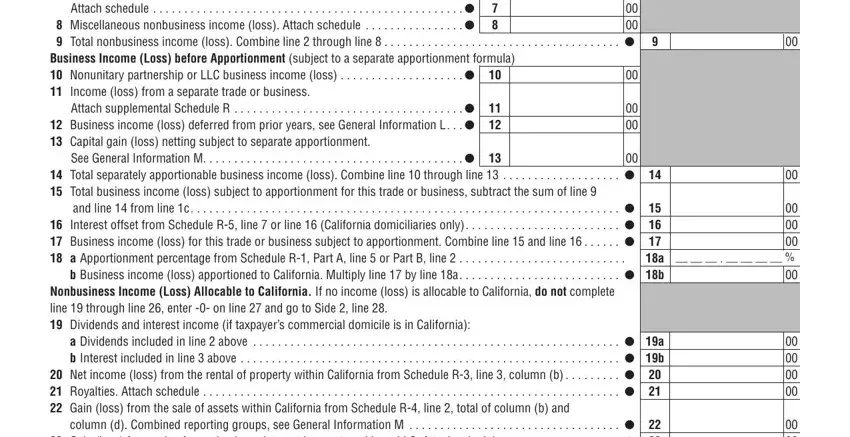

3. This next section is considered rather simple, a Dividends included in line , Interest offset from line , and Schedule R Side - every one of these empty fields is required to be filled out here.

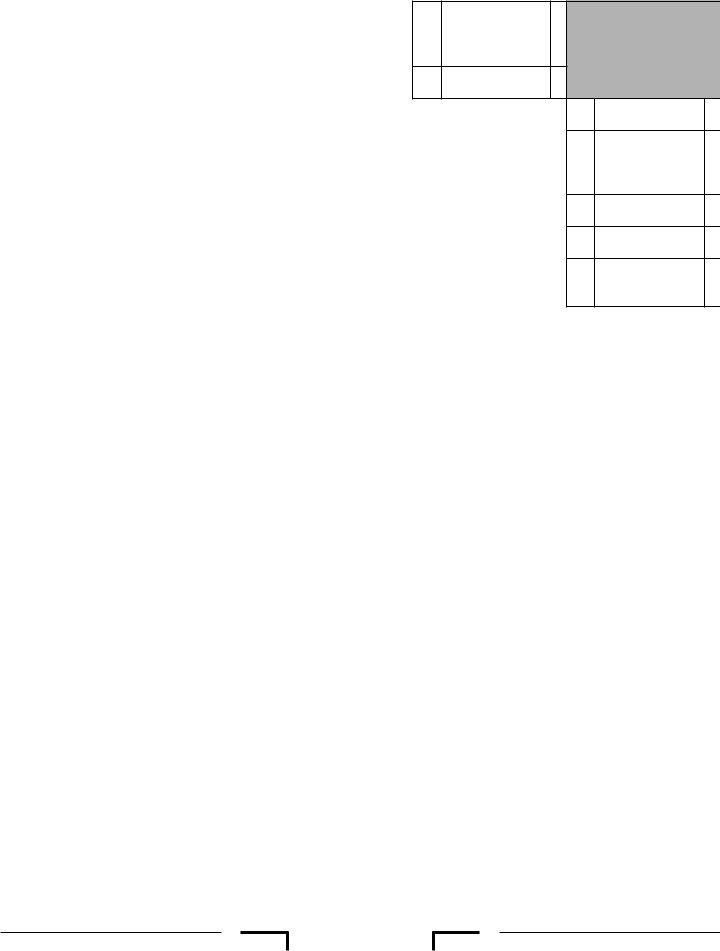

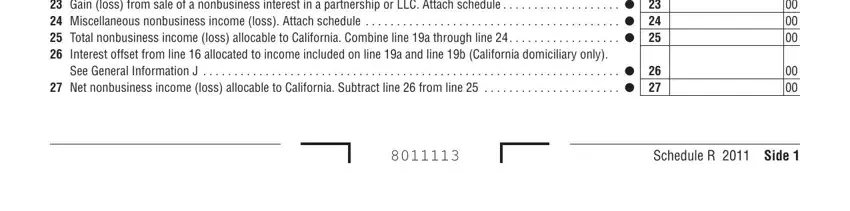

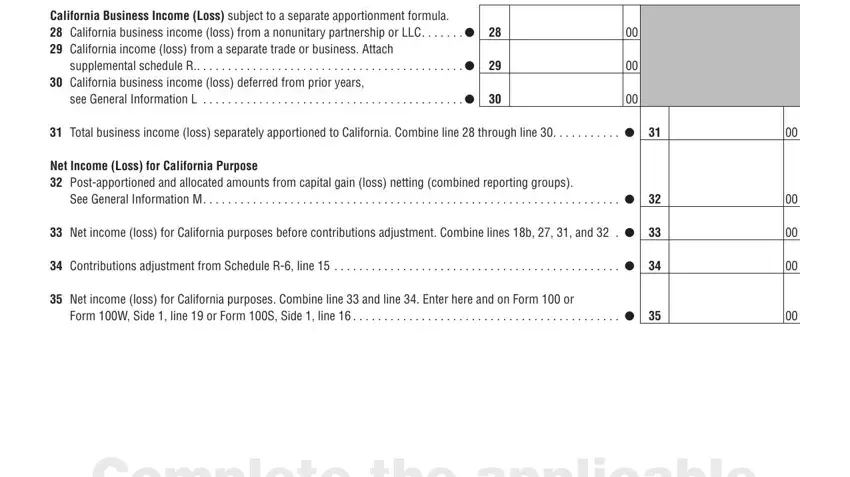

4. To go forward, this section requires filling in a few blank fields. Included in these are California Business Income Loss, California business income loss, California income loss from a, Total business income loss, Net Income Loss for California, See General Information M , Net income loss for California, Form W Side line or Form S Side , and Complete the applicable, which you'll find fundamental to moving forward with this form.

It's easy to make an error while filling out your Complete the applicable, for that reason ensure that you go through it again prior to when you finalize the form.

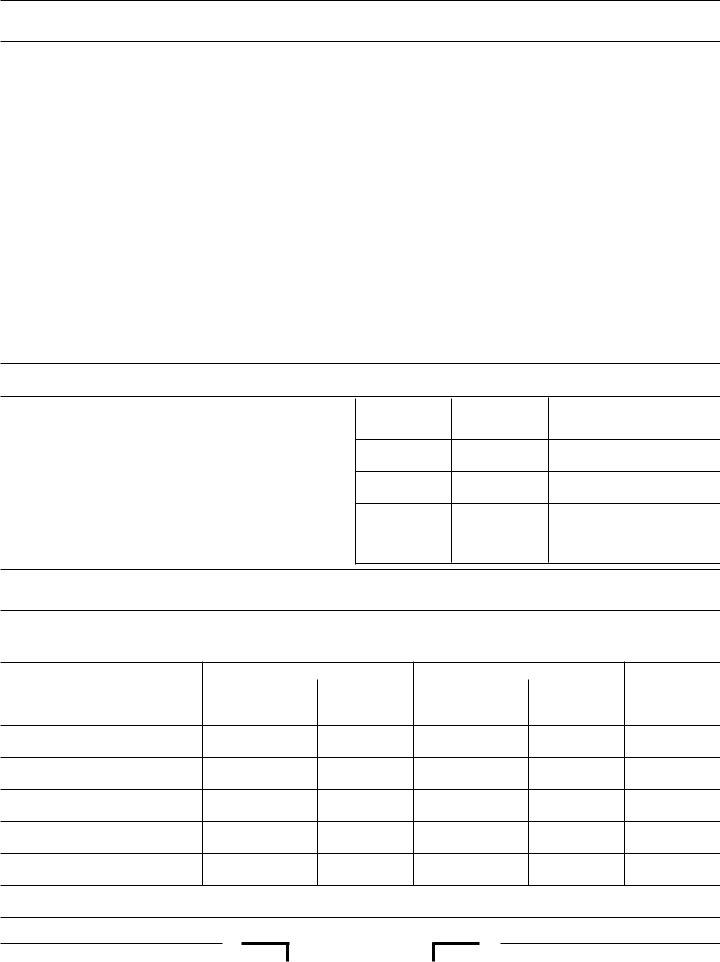

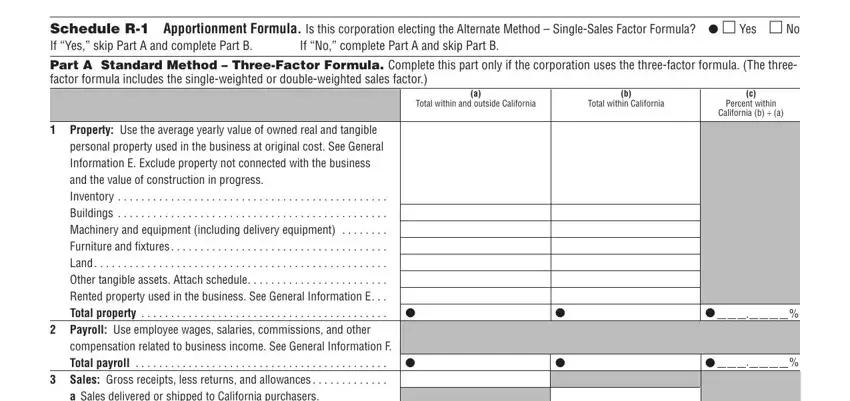

5. Lastly, this final subsection is precisely what you'll have to wrap up before submitting the document. The blanks in question include the following: Schedule R Apportionment Formula, If Yes skip Part A and complete, If No complete Part A and skip, Part A Standard Method , Total within and outside California, Total within California, Percent within, California b a, Total property , compensation related to business, Total payroll , Property Use the average yearly, and a Sales delivered or shipped to.

Step 3: After you've reread the information you filled in, click on "Done" to finalize your form. Create a 7-day free trial option at FormsPal and obtain immediate access to california schedule r - download, email, or change from your FormsPal account page. FormsPal is committed to the privacy of our users; we always make sure that all personal data entered into our tool stays protected.