Understanding the nuances of the Canada T1 OVP E form is crucial for individuals who find themselves navigating the complexities of managing excess contributions to their Registered Retirement Savings Plan (RRSP). This form serves as a tool for taxpayers who have overstepped their contribution limits and are required to address the tax implications of these excess payments. Specifically, it calculates a 1% tax on over-contributions for each month they remain in the RRSP, a provision that underscores the Canada Revenue Agency's (CRA) efforts to regulate contributions and ensure fairness in the retirement savings process. With a deadline set for March 31, 2010, for the tax year 2009, individuals must promptly complete and submit this form along with any due payment to their tax centre to comply with CRA requirements. Furthermore, the form outlines a step-by-step process for identifying excess contributions, calculating the tax owed, and making the necessary payments. It also includes provisions for contributions made before 1991, showcasing its comprehensive approach to managing RRSP contributions across different tax years. By navigating through identification, calculation, and certification steps, taxpayers are guided through the process of rectifying their excess contributions scenario, reinforcing the importance of vigilance and accuracy in personal financial management related to retirement savings.

| Question | Answer |

|---|---|

| Form Name | Canada Form T1 Ovp E |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | gc, t1ovp 2019, 2010, t1 ovp 2019 fillable |

2009 INDIVIDUAL TAX RETURN FOR

RRSP EXCESS CONTRIBUTIONS

If you made excess contributions to a registered retirement savings plan (RRSP), you may have to pay a 1% tax on your excess contributions for every month they are left in the plan. For more information concerning excess contributions, read "Tax on RRSP excess contributions" in Guide T4040, RRSPs and Other

Registered Plans for Retirement.

If your 2009 unused RRSP contributions are subject to tax, you have to complete and send this return with your payment to your tax centre no later than March 31, 2010.

If you have RRSP excess contributions made before 1991 that are subject to tax, also complete and file

Excess Contributions Made Before 1991 that are Subject to Tax, which is available from our Web site at www.cra.gc.ca/forms or by calling

Step 1 – Identification

Last name |

First name and initials |

|

Social insurance number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

Step 2 – Calculating your unused RRSP contributions at the end of December 2008

Complete this step if you made contributions to your own RRSPs or your spouse's RRSPs or your

If you filed a |

|

negative, enter "0"). If you did not file a |

1 |

enter the amount from column D for 2008. |

|

Enter the total RRSP contributions you deducted on line 208 of your 2008 tax return (see Note 2 on the back of this return). |

|

|

|

|

2 |

||||||

|

|

|

|

|

||||||||

|

Line 1 minus line 2 (if negative, enter "0"). This is the total of your unused RRSP contributions at the end of December 2008. |

|

|

|

|

3 |

||||||

|

Enter this amount under January on line 1 in Part A of the chart on the middle pages of this return. |

|

|

|

|

|||||||

|

Enter the total of all RRSP contributions made after February 26, 1995, and before January 1, 2009. |

|

|

|

4 |

|||||||

|

|

|

|

|

||||||||

|

Line 3 minus line 4 |

|

|

|

|

|

|

|

5 |

|||

|

Enter the total of all RRSP and registered retirement income fund (RRIF) payments that you included in income for 1995 to |

|

|

|

6 |

|||||||

|

2008 that can be considered contributions made after February 26, 1995. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

Line 5 plus line 6. |

|

|

|

|

|

|

|

|

7 |

||

|

Enter this amount under January on line 11 in Part B of the chart on the middle pages of this return. |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 3 – Calculating the amount of tax you have to pay |

|

|

|

|

|

|

|

|

|

|||

|

Before completing this step, complete the chart on the middle pages of this return to calculate the amount subject to tax. |

|

|

|

|

|

||||||

|

Enter the total of all 12 amounts from line 27 in Part D of the chart on the middle pages of this return. |

|

|

|

|

8 |

||||||

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||

|

If you completed a |

|

|

|

|

|

||||||

|

amount from line 4 of that schedule. Otherwise, enter "0". |

|

|

|

|

|

|

|

9 |

|||

|

RRSP Excess Contributions (Line 8 plus LINE 9). |

|

|

|

|

|

|

|

10 |

|||

|

|

|

|

|

|

|

|

|

|

11 |

||

|

Applicable rate |

|

|

|

|

|

1% |

|||||

|

|

|

|

|

Tax on RRSP |

|

|

|

|

|

||

|

Multiply line 10 by line 11 |

Excess Contributions |

|

|

|

12 |

||||||

|

Generally, we do not charge an amount of $2 or less. |

|

|

|

|

|

|

|

|

|

||

|

Payment: Attach a cheque or money order made payable to the Receiver General. |

|

|

|

|

|

|

|

|

|

||

|

Your payment is due no later than March 31, 2010. |

|

Amount enclosed |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 4 – Certification |

|

|

|

|

|

|

|

|

|

||

|

I certify that the information on this return is, to the best of my knowledge, correct and complete. |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

Date |

Telephone number |

|

|

|

||||||

|

It is a serious offence to make a false return. |

|

|

|

|

|

||||||

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca OU AU |

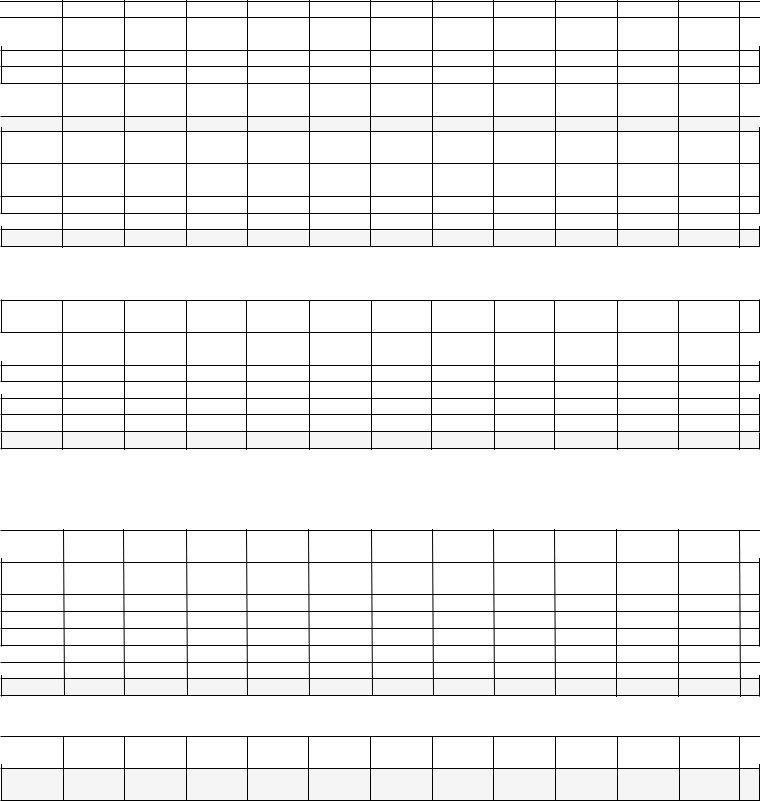

Chart to calculate the amount of unused RRSP contributions you made after 1990

that are subject to tax for 2009

The chart below will help you determine whether your unused RRSP contributions are subject to tax for 2009. To determine if you have to complete the entire chart, read the instructions at the beginning of each part.

To complete a particular part, start with the column for the month of January, and complete all the lines for that month before going on to the next month. Complete all the months in each part before going on to the next part.

Part A – Complete this part if you completed Step 2 of this return, or if you made contributions to your own RRSPs or your spouse's RRSPs or

1.For January, enter the amount from line 3 of Step 2 of this return. If you did not have to complete Step 2, enter "0" for January. For all other months, enter the amount from line 5 of the previous month.

2.Enter the RRSP contributions you made during the month (see Note 3 on the back of this return).

3.Line 1 plus line 2

4.Enter the RRSP and RRIF payments that you included or will include in income for 2009. Enter them in the column for the month that you received or are considered to have received them (see Note 4 on the back of this return).

5.Line 3 minus line 4 (if negative, enter the amount in brackets).

6.Enter, in each column, your 2009 RRSP deduction limit without considering your 2009 net past service pension adjustment (PSPA) (see note 5 on the back of this return).

7.Enter the total of all your pension adjustment reversals (PARs) (box 2 of all your 2009 T10 slips) in each column, as long as this amount is not already included in line 6 above. Otherwise, enter "0".

8.Line 6 plus line 7 (if the total is negative, enter it in brackets).

9.Enter $2,000 in each column if you were 19 years old or older at any time in 2009.

10. Line 8 plus line 9 (if the total is negative, enter it in brackets).

Part B – Complete this part only if you completed Part A, you were 33 years old or older at any time in 2009, and you contributed amounts to your own RRSPs or your spouse's RRSPs from January 1, 1991, to February 26, 1995, that you did not deduct on line 208 of your 1990 to 2008 tax returns.

11.For January, enter the amount from line 7 of Step 2 of this return. If you did not have to complete Step 2, enter "0" for January.For all other months, enter the amount from line 13 of the previous month.

12.Enter the RRSP and RRIF payments that you included or will include in income for 2008 that represent contributions you made before February 27, 1995. Enter them in the column for the month that you received or are considered to have received them (see Note 4 on the back of this return).

13.Line 11 minus line 12

14.Enter, in each column, the total contributions you made from January 1, 2009 to March 1, 2009, that you deducted on your 2007 tax return.

15.Line 13 minus line 14

16.If the amount on line 15 is more than zero, enter the result of line 15 minus line 10 (if negative, enter "0"). Otherwise, enter "0".

17.Enter the amount from line 16 or $6,000, whichever is less.

Part C – Complete this part only if you completed Part A and you made mandatory contributions to a group RRSP in 2008 or 2009. Such contributions are the result of an irrevocable agreement (usually between employee and employer) which determines the percentage of your remuneration to be contributed to the group RRSP. If you made such contributions in 2007 but did not file a

18.Under each month, enter the amount contributed from January 1, 2009, to the end of that month for your participation in a group RRSP, or $21,000, whichever is less.

19.If you filed or completed a

20.Line 8 minus line 19 (if negative, enter "0").

21.Line 18 minus line 20 (if negative, enter "0").

22.Enter the amount from line 18 or line 21, whichever is less.

23.Line 10 plus line 17

24.Line 5 minus line 23 (if negative, enter "0").

25.Enter the amount from line 22 or line 24, whichever is less.

Part D – Complete this part to calculate the total amount subject to tax for each month.

26.Add lines 10, 17, and 25. If you did not have to complete Part B or Part C of this chart, use "0" for the amount on line 17 or line 25, whichever applies. If the result is negative, enter "0".

27.Line 5 minus line 26. This is the total amount subject to tax for the month. Add the amounts for all months and enter the total on line 8 of Step 3 (if negative, enter "0").

January |

February |

March |

April |

May |

June |

July |

August |

September |

October |

November |

December |

1

2

3

4

5

6

7

8

9

10

If (for each month) the amount on line 5 is less than the amount on line 10, you do not have to complete the rest of this return as your contributions are not subject to tax.

If you deducted all your RRSP contributions made before February 27, 1995, on your 1990 to 2008 tax returns, go to Part C.

11

12

13

14

15

16

17

If you did not participate in a group RRSP in 2008 or 2009, go to Part D

18

19

20

21

22

23

24

25

26

27

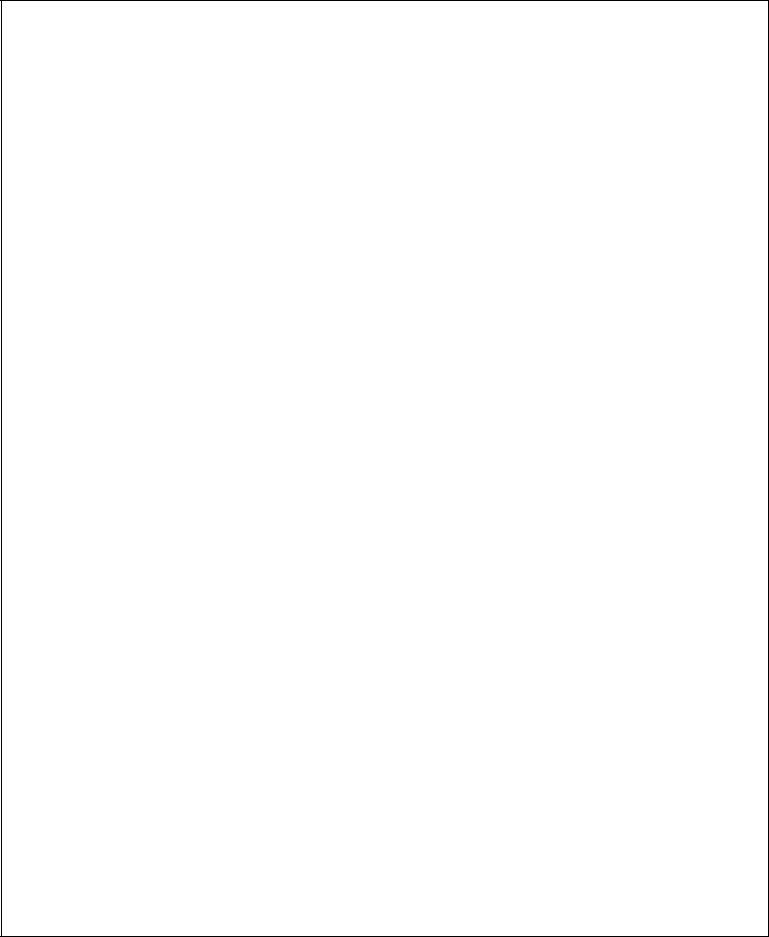

Notes

1. Complete the chart below to determine the amount to enter on line 1 of Step 2 of this form. When completing the chart:

only enter consecutive years ending with 2008 in which you had unused RRSP contributions. For example, if you had unused RRSP contributions in 2002 to 2004 and deducted them in 2005, then you had other unused contributions in 2006 to 2008, only complete the chart for 2006, 2007, and 2008; and

do not complete column E for the 2008 tax year. Attach a separate sheet if you need more space.

|

|

A |

B |

C |

D |

E |

|

|

|

Unused RRSP contributions at |

RRSP contributions |

|

|||

|

|

RRSP contributions |

RRSP and RRIF payments |

|

|||

Year |

the end of the preceding year |

(col. A plus col. B) |

deducted on line 208 |

|

|||

made during the year |

included in income for the |

|

|||||

|

|

(col. D minus col. E of the |

minus col. C * |

of your tax return |

|

||

|

|

(see Note 3) |

year (see Note 4) |

|

|||

|

|

previous year) * |

|

(see Note 2) |

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*If the result is negative, enter "0".

2.Do not include amounts you deducted for:

contributions you made to your own RRSPs or your spouse's RRSPs or your

contributions you made to your RRSPs in the year for the following types of income you received and transferred to your RRSPs:

– the eligible part of a retiring allowance; |

– an RRSP commutation payment; |

– the eligible part of a |

– the eligible amount of a RRIF designated benefit; |

– an RRSP refund of premiums; |

– a RRIF excess amount; or |

a contribution you returned to your RRSPs because you did not need the funds to have a

3.Include any gifts made to your RRSPs (a gift is any amount contributed to your RRSPs by someone other than you or your spouse or

contributions you made during the first 60 days of the year to your own RRSPs or your spouse's RRSPs or

contributions you made to your RRSPs that you designated as repayments under the Home Buyers' Plan or the Lifelong Learning Plan;

contributions you made to your RRSPs for amounts you deducted or will deduct for the year for the following types of income you received and transferred to your RRSPs:

– the eligible part of a retiring allowance; |

– an RRSP commutation payment; |

|

– the eligible part of a |

– |

the eligible amount of a RRIF designated benefit; |

– an RRSP refund of premiums; |

– |

a RRIF excess amount; or |

amounts that were transferred directly to your RRSPs from another RRSP, RPP, deferred profit sharing plan (DPSP), or from the Saskatchewan Pension Plan for which you were not issued an official receipt or slip; or

contributions you have returned to your RRSPs because you did not need the funds to have a PSPA certified.

4. Include amounts that your spouse or

have calculated these amounts on Form T2205, Amounts From a Spousal or |

. |

|

Do not include: |

|

|

amounts shown on |

|

|

the part of amounts you received for which you will deduct an amount for the year as a transfer to another RRSP. This applies to: |

|

|

– an RRSP refund of premiums; |

– the eligible amount of a RRIF designated benefit; and |

|

– an RRSP commutation payment; |

– a RRIF excess amount. |

|

If you are completing line 4 in Part A of the chart on the middle pages of this return, do the following: If the amount received or considered received from the RRSP is shown in box 26 of a T4RSP slip, enter the amount under the column for the date the RRSP is considered deregistered.

Contact the RRSP issuer to determine this date.

5.Go to www.cra.gc.ca/myaccount or call

Negative RRSP deduction room at the end of 2008 |

|

|

(i) |

|

|

|

|

|

|

Complete Steps 2, 3, 4, and 5 of chart 3 in the 2009 version of Guide T4040, RRSPs and Other |

|

|

(ii) |

|

Registered Plans for Retirement, and enter the amount from line 33. |

|

|||

|

|

|

||

|

|

|

|

|

Line (i) plus line (ii) (the result can be negative). Enter this amount under each month on line 6 in |

|

|

(iii) |

|

Part A of the chart on the middle pages of this return. |

|

|||

|

|

|

|

|

6.If you were allowed an extension for making deductible RRSP contributions in a year, use the number of days of the extended deadline for that year instead of "60 days". For example, the reference to "60 days" in notes 2 and 3 should be read as "90 days" for qualifying individuals affected by the ice storms in early 1998, since the deadline for making deductible 1997 RRSP contributions was extended to March 31,1998.