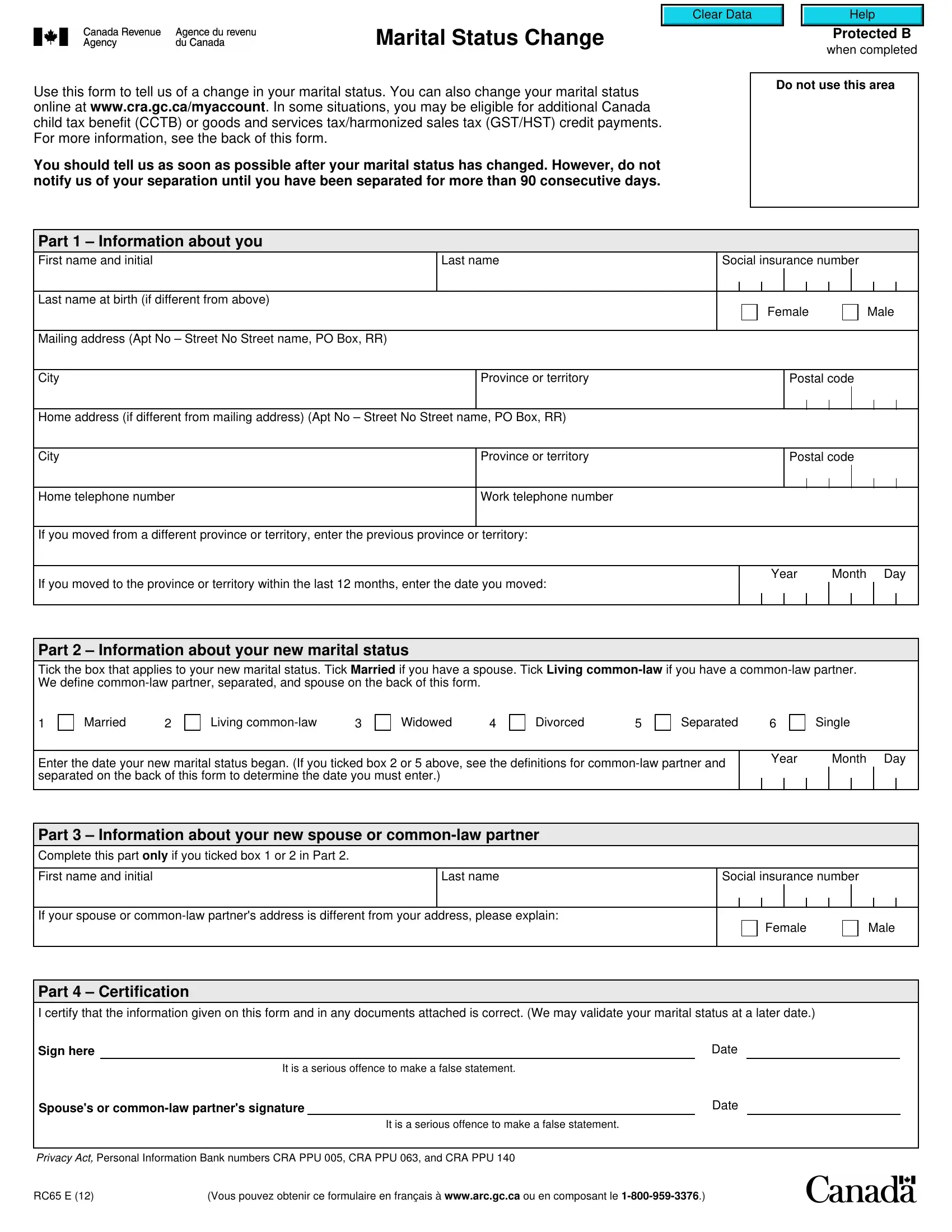

Canada child tax benefit (CCTB)

Has your marital status changed?

When we get notification of your change in marital status, we will recalculate your CCTB taking into consideration your new marital status, your new adjusted family net income, and your province or territory of residence. Your CCTB will be adjusted the month following the month that your marital status changed.

Note

If you have become separated, do not notify us until you have been separated for at least 90 days.

Are you now married or living common-law?

If you or your new spouse or common-law partner have children who are living with you, we will move all the children to the female parent's account. However, if the male parent is primarily responsible, see Booklet T4114, Canada Child Benefits. If your spouse or common-law partner is a person of the same sex, one of you will get the CCTB for all the children.

To continue getting the CCTB, you and your spouse or common-law partner each have to file an income tax and benefit return every year, even if you have no income to report.

Are you now separated, widowed, or divorced?

We will recalculate your benefit based on the number of children under 18 years of age you have in your care and your adjusted net income.

If a child for whom you were getting benefits no longer lives with you on a full-time basis, stops living with you, or has died, call

1-800-387-1193.

For more information about the CCTB, go to www.cra.gc.ca/cctb or see Booklet T4114, Canada Child Benefits.

Goods and services tax/harmonized sales tax (GST/HST) credit

Are you now married or living common-law?

You or your spouse or common-law partner will now get the credit for both of you. We will recalculate the next GST/HST credit payment based on your adjusted family net income.

Are you now separated, widowed, or divorced?

If you did not apply for the GST/HST credit on your last income tax

and benefit return, you can apply now by including a letter with this form stating that you would like to apply for the GST/HST credit.

When applicable, we will recalculate your credit and send you a GST/HST credit notice showing your revised calculation.

For more information about the GST/HST credit, go to www.cra.gc.ca/gsthstcredit or see Booklet RC4210, GST/HST Credit.

Do you share custody of a child?

If you share custody of a child, see Booklet T4114, Canada Child Benefits, follow the "Shared custody" link at www.cra.gc.ca/cctb or call 1-800-387-1193.

Has your direct deposit information changed?

You can have your payments deposited directly into your account at a financial institution in Canada. To get this service or change your banking information, go to www.cra.gc.ca/myaccount

or attach a completed Form T1-DD(1), Direct Deposit Request – Individuals, to this form.

Definitions

Common-law partner – This applies to a person who is not your spouse, with whom you are living in a conjugal relationship, and to whom at least one of the following situations applies. He or she:

a)has been living with you in a conjugal relationship for at least 12 continuous months;

b)is the parent of your child by birth or adoption; or

c)has custody and control of your child (or had custody and control immediately before the child turned 19 years of age) and your child is wholly dependent on that person for support.

In addition, an individual immediately becomes your common-law partner if you previously lived together in a conjugal relationship for at least 12 continuous months and you have resumed living together in such a relationship. Under proposed changes, this condition will no longer exist. The effect of this proposed change is that a person (other than a person described in b) or c) above) will be your common-law partner only after your current relationship with that person has lasted at least 12 continuous months. This proposed change will apply to 2001 and later years.

Reference to "12 continuous months" in this definition includes any period that you were separated for less than 90 days because of a breakdown in the relationship.

Separated – You are separated when you start living separate and apart from your spouse or common-law partner because of a breakdown in the relationship for a period of at least 90 days and you have not reconciled.

Once you have been separated for 90 days (because of a breakdown in the relationship), the effective day of your separated status is the day you started living separate and apart.

Spouse – This applies only to a person to whom you are legally married.

For more information

For more information, go to www.cra.gc.ca/benefits or call 1-800-387-1193.

To get our forms and publications, go to www.cra.gc.ca/forms or call 1-800-959-2221.

Where do you send this form?

Send this completed form (or your letter) to the tax centre that serves your area. Use the chart below to find out the address.

|

If your tax services office is |

Send your correspondence |

|

located in: |

to the following address: |

|

|

|

|

|

Surrey Tax Centre |

|

British Columbia, Regina, or Yukon |

9755 King George Boulevard |

|

|

Surrey BC V3T 5E1 |

|

|

|

|

Alberta, London, Manitoba, |

Winnipeg Tax Centre |

|

Northwest Territories, Saskatoon, |

PO Box 14005, Station Main |

|

Thunder Bay, or Windsor |

Winnipeg MB R3C 0E3 |

|

|

|

|

Barrie, Sudbury (the area |

Sudbury Tax Centre |

|

of Sudbury/Nickel Belt only), |

|

1050 Notre Dame Avenue |

|

Toronto Centre, Toronto East, |

|

Sudbury ON P3A 5C1 |

|

Toronto North, or Toronto West |

|

|

|

|

|

|

Laval, Montréal, Nunavut, Ottawa, |

Shawinigan-Sud Tax Centre |

|

Rouyn-Noranda, Sherbrooke, |

|

PO Box 3000, Station Main |

|

or Sudbury (other than the |

|

Shawinigan-Sud QC G9N 7S6 |

|

Sudbury/Nickel Belt area) |

|

|

|

|

|

|

Chicoutimi, Montérégie-Rive-Sud, |

Jonquière Tax Centre |

|

Outaouais, Québec, Rimouski, or |

PO Box 1900, Station LCD |

|

Trois-Rivières |

Jonquière QC G7S 5J1 |

|

|

|

|

Kingston, New Brunswick, |

St. John's Tax Centre |

|

Newfoundland and Labrador, |

|

PO Box 12071, Station A |

|

Nova Scotia, Peterborough, |

|

St. John's NL A1B 3Z1 |

|

or St. Catharines |

|

|

|

|

|

|

Belleville, Hamilton, Kitchener/ |

Summerside Tax Centre |

|

102 – 275 Pope Road |

|

Waterloo, or Prince Edward Island |

|

Summerside PE C1N 5Z7 |

|

|

|

|

|