The Canada Form T2220 E is used to report gifts and income from foreign sources. This form must be filed by all Canadians with income from outside of Canada, including both those who reside in Canada and those who are temporarily abroad. The deadline for filing the T2220E is usually April 30th of the following year, although it may be extended if you are out of the country on that date. Penalties may apply for late or incorrect submissions. Make sure you know what information to include on the T2220E and how to file it correctly!

| Question | Answer |

|---|---|

| Form Name | Canada Form T2220 E |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | annuitant, t2220, T4RIF, Transferees |

Canada Customs |

Agence des douanes |

and Revenue Agency |

et du revenu du Canada |

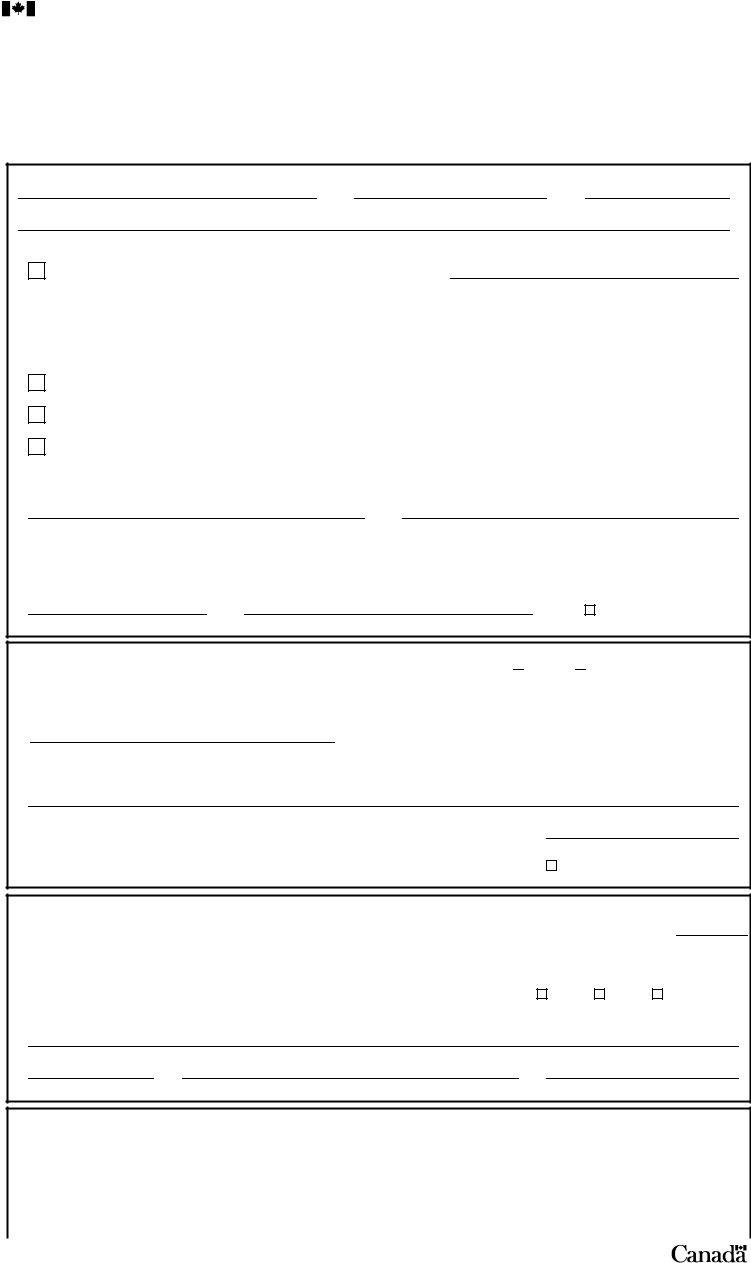

TRANSFER FROM AN RRSP OR A RRIF TO ANOTHER RRSP OR RRIF ON BREAKDOWN OF MARRIAGE OR

A transfer of property that is not made under a decree, order, or judgment of a competent tribunal, or a written separation agreement, can cause both the annuitant, and the annuitant’s current or former spouse or

Attach a copy of the decree, order, judgment, or written separation agreement. Also attach any necessary letters (see Areas I and II). Tick the boxes that apply to you, and see the back of this form for definitions and more instructions.

Area I – Annuitant

Name |

Social insurance number |

Telephone |

Address

Part A – Transfer from an unmatured RRSP or a RRIF

I am the annuitant of the unmatured RRSP.

|

|

|

|

Individual plan number, and name |

|

I am the annuitant of the RRIF. |

|

||

|

|

|||

|

|

|

|

|

|

|

|

|

Individual fund number, and name |

|

|

|

|

|

|

Name of RRSP issuer or RRIF carrier |

Address |

||

Part B – Description of amount to be transferred

Please transfer $ |

|

|

, which is all of the property from the RRSP or RRIF identified in Part A. |

|

Please transfer |

|

|

% of the property from the RRSP or RRIF identified in Part A. |

|

Please transfer $ |

|

|

of the property from the RRSP or RRIF identified in Part A. |

|

Part C – Destination of transfer

Please transfer the

Name of RRSP issuer or RRIF carrier |

|

Individual plan or fund number, and name |

|

|

|

|

Address |

|

|

|

|

Current or former spouse’s or |

|

Social insurance number |

or

Date |

Annuitant’s signature |

See letter attached

Area II – Transferee

1.We agree to the request for a transfer of property. When we receive the property, we will credit it to the RRSP or RRIF of the current or former spouse or

We will check the plan or fund identification in Part C of Area I, and add or correct information as necessary.

Specimen plan or fund number, and name

2.The plan or fund is registered under the Income Tax Act, or if the plan or fund is not registered, we will apply for such registration according to Information Circulars

|

|

Transferee’s name |

|

|

|

|

|

Date |

|

Authorized person’s signature |

|

|

|

|

or |

Date |

|

Current or former spouse’s or |

|

Position or office

See letter attached

Area III – Transferor (Issue a T4RSP or T4RIF slip for the amount transferred to the annuitant identified in Part A of Area I)

1. We have transferred $ |

|

from the RRSP or RRIF identified in Part A of Area I to the transferee named in Part C of Area I. |

Date of transfer

2. The value of the property in the annuitant’s RRSP or RRIF just before the transfer was $ |

|

. |

3.Is the transfer from a "qualifying RRIF," as defined under "Definitions" on the back of this form? The information in this area is true, correct, and complete.

Yes

No

Does not apply

Transferor’s name

Date |

Authorized person’s signature |

Position or office |

Area IV – Receipt by transferee (Do not issue a receipt for tax purposes)

We have received $ |

|

|

, which we will credit to the account of |

|

|

, according to |

||||

|

|

|

|

|

|

|

|

|

|

|

the instructions in Area I. |

|

|

|

Current or former spouse’s or |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transferee’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

Authorized person’s signature |

|

Position or office |

||||

|

|

|

|

|

|

|

|

|

|

|

T2220 E (01/12) |

|

|

Privacy Act personal information bank number |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

(Ce formulaire existe en français.)

Instructions

Who should use this form?

If you are the issuer of an unmatured registered retirement savings plan (RRSP) or the carrier of a registered retirement income fund (RRIF), you should use this form to directly transfer all or part of the property of an annuitant’s RRSP or RRIF, to the RRSP or RRIF of the annuitant’s current or former spouse or

Who completes this form?

Area I – The annuitant who requests the transfer completes and signs Area I. A transferor who completes Area I for the annuitant can attach a signed letter from the annuitant requesting the direct transfer, in place of a signature. If the transferor does not have complete information about the current or former spouse's or

Area II – The transferee completes and signs Area II, and it is countersigned by the current or former spouse or

Area III – The transferor completes and signs Area III.

Area IV – The transferee completes and signs Area IV.

Note

The annuitant does not have to reveal the contents of the court order or separation agreement to the issuer or carrier. However, the annuitant has to make it available (in a sealed envelope if desired) to the transferor.

Are there reporting requirements?

A direct transfer as described above does not cause the amount transferred to become income for the year in which the amount is transferred. However, the transferor will report the amount on a T4RSP or T4RIF slip issued to the annuitant identified in Part A of Area I. Similarly, the transferee should not issue an official receipt, since the amount transferred cannot be deducted.

Definitions

Annuitant – The person who is entitled to receive payments from an RRSP or a RRIF.

Individual plan number or individual fund number – The individual account, contract, certificate, or other identifier number that the RRSP issuer or RRIF carrier assigns.

Qualifying RRIF – A RRIF established before 1993, that has no property transferred or contributed to it after 1992, or any RRIF established after 1992, that contains only property transferred from a qualifying RRIF.

RRIF carrier – A person described in subsection 146.3(1), with whom an annuitant has an arrangement that is a RRIF.

RRSP issuer – A person described in subsection 146(1), with whom an annuitant has a contract or arrangement that is an RRSP.

Spouse or

Transferee – The issuer of the plan, the carrier of the fund, or the issuer of the annuity to whom the property is transferred.

Transferor – The issuer of the plan, the carrier of the fund, or the issuer of the annuity from whom the property is transferred.

The subsections and paragraphs referred to in this form are references to the Income Tax Act.

If you have questions about this form, please contact your tax services office.

Printed in Canada