|

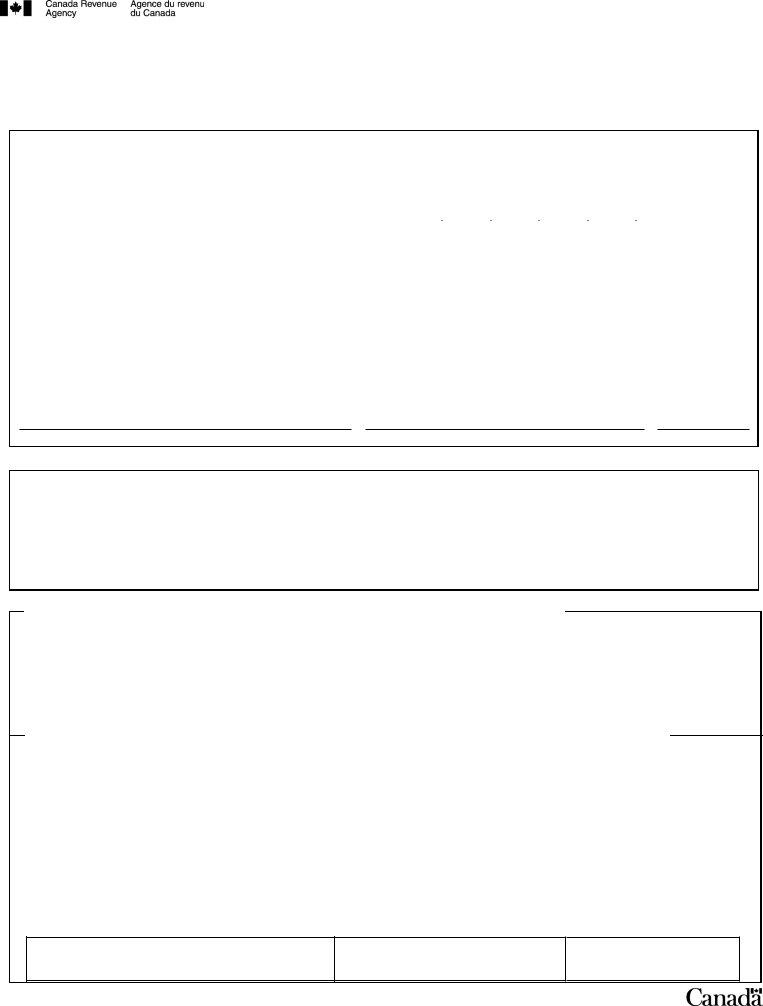

TUITION, EDUCATION, AND TEXTBOOK AMOUNTS CERTIFICATE – |

Year: |

20 _ _ |

|

UNIVERSITY OUTSIDE CANADA |

|

|

|

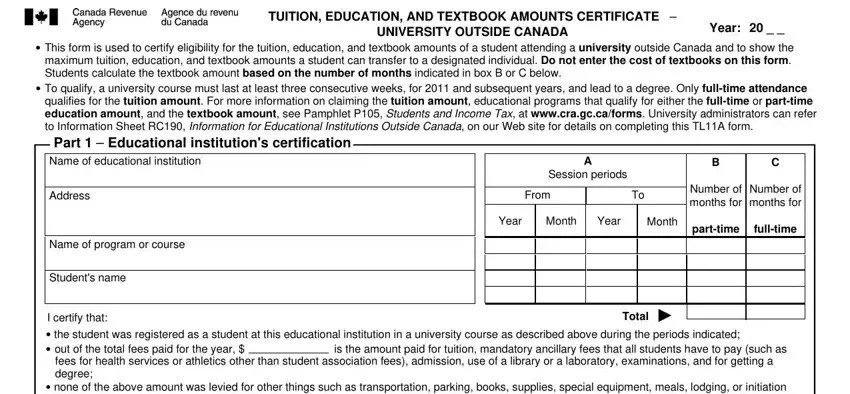

This form is used to certify eligibility for the tuition, education, and textbook amounts of a student attending a university outside Canada and to show the maximum tuition, education, and textbook amounts a student can transfer to a designated individual. Do not enter the cost of textbooks on this form. Students calculate the textbook amount based on the number of months indicated in box B or C below.

To qualify, a university course must last at least three consecutive weeks, for 2011 and subsequent years, and lead to a degree. Only full-time attendance qualifies for the tuition amount. For more information on claiming the tuition amount, educational programs that qualify for either the full-time or part-time education amount, and the textbook amount, see Pamphlet P105, Students and Income Tax, at www.cra.gc.ca/forms. University administrators can refer to Information Sheet RC190, Information for Educational Institutions Outside Canada, on our Web site for details on completing this TL11A form.

Part 1 – Educational institution's certification

Name of educational institution |

|

|

|

|

|

|

A |

|

|

B |

C |

|

|

|

|

|

|

Session periods |

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of |

Number of |

Address |

|

|

|

|

From |

|

|

To |

|

|

|

|

|

|

months for |

months for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

Month |

|

Year |

|

Month |

part-time |

full-time |

|

|

|

|

|

|

|

|

|

|

|

Name of program or course |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Student's name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that: |

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

the student was registered as a student at this educational institution in a university course as described above during the periods indicated; |

|

out of the total fees paid for the year, $ |

|

is the amount paid for tuition, mandatory ancillary fees that all students have to pay (such as |

fees for health services or athletics other than student association fees), admission, use of a library or a laboratory, examinations, and for getting a degree;

none of the above amount was levied for other things such as transportation, parking, books, supplies, special equipment, meals, lodging, or initiation or entrance fees for professional organizations; and

the total eligible tuition fees indicated above include the eligible tuition fees paid by scholarship income.

Authorized officer's name and title (print) |

Authorized officer's signature |

Date |

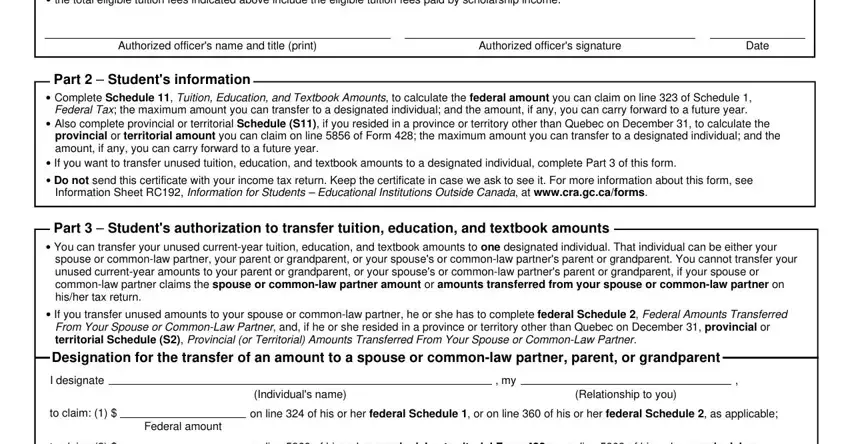

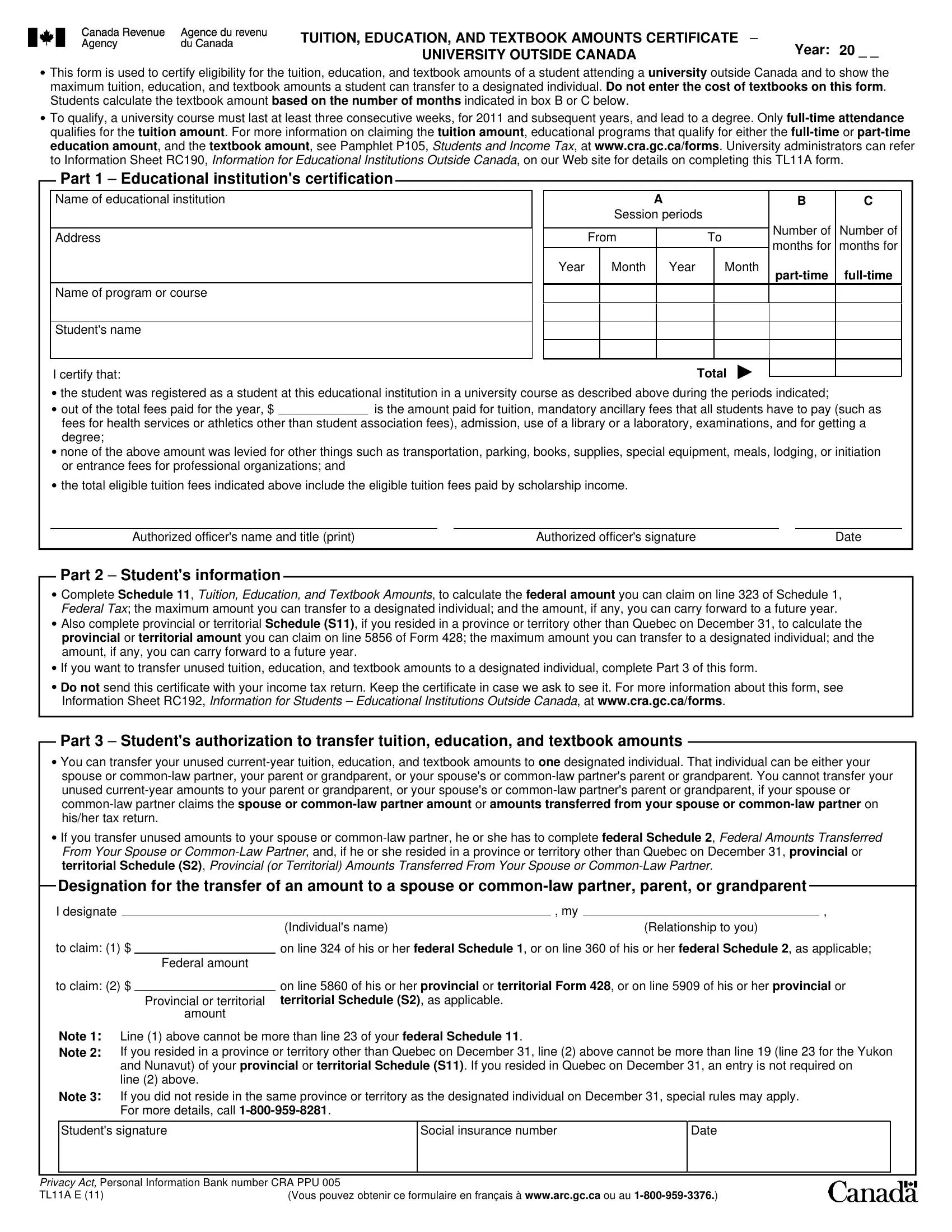

Part 2 – Student's information

Complete Schedule 11, Tuition, Education, and Textbook Amounts, to calculate the federal amount you can claim on line 323 of Schedule 1, Federal Tax; the maximum amount you can transfer to a designated individual; and the amount, if any, you can carry forward to a future year. Also complete provincial or territorial Schedule (S11), if you resided in a province or territory other than Quebec on December 31, to calculate the provincial or territorial amount you can claim on line 5856 of Form 428; the maximum amount you can transfer to a designated individual; and the amount, if any, you can carry forward to a future year.

If you want to transfer unused tuition, education, and textbook amounts to a designated individual, complete Part 3 of this form.

Do not send this certificate with your income tax return. Keep the certificate in case we ask to see it. For more information about this form, see Information Sheet RC192, Information for Students – Educational Institutions Outside Canada, at www.cra.gc.ca/forms.

Part 3 – Student's authorization to transfer tuition, education, and textbook amounts

You can transfer your unused current-year tuition, education, and textbook amounts to one designated individual. That individual can be either your spouse or common-law partner, your parent or grandparent, or your spouse's or common-law partner's parent or grandparent. You cannot transfer your unused current-year amounts to your parent or grandparent, or your spouse's or common-law partner's parent or grandparent, if your spouse or common-law partner claims the spouse or common-law partner amount or amounts transferred from your spouse or common-law partner on his/her tax return.

If you transfer unused amounts to your spouse or common-law partner, he or she has to complete federal Schedule 2, Federal Amounts Transferred From Your Spouse or Common-Law Partner, and, if he or she resided in a province or territory other than Quebec on December 31, provincial or territorial Schedule (S2), Provincial (or Territorial) Amounts Transferred From Your Spouse or Common-Law Partner.

Designation for the transfer of an amount to a spouse or common-law partner, parent, or grandparent

I designate |

|

|

|

, my |

|

, |

|

|

|

(Individual's name) |

(Relationship to you) |

to claim: (1) |

$ |

|

on line 324 of his or her federal Schedule 1, or on line 360 of his or her federal Schedule 2, as applicable; |

|

|

Federal amount |

|

|

to claim: (2) |

$ |

|

on line 5860 of his or her provincial or territorial Form 428, or on line 5909 of his or her provincial or |

|

|

Provincial or territorial territorial Schedule (S2), as applicable. |

|

|

|

|

amount |

|

|