california cpa criminal conviction disclosure form can be completed online without any problem. Simply make use of FormsPal PDF editor to perform the job promptly. Our tool is constantly evolving to provide the very best user experience attainable, and that is thanks to our commitment to constant improvement and listening closely to feedback from users. Starting is simple! All you should do is take the next simple steps directly below:

Step 1: Firstly, access the pdf editor by pressing the "Get Form Button" above on this page.

Step 2: This tool allows you to modify almost all PDF forms in various ways. Improve it with customized text, correct existing content, and include a signature - all at your disposal!

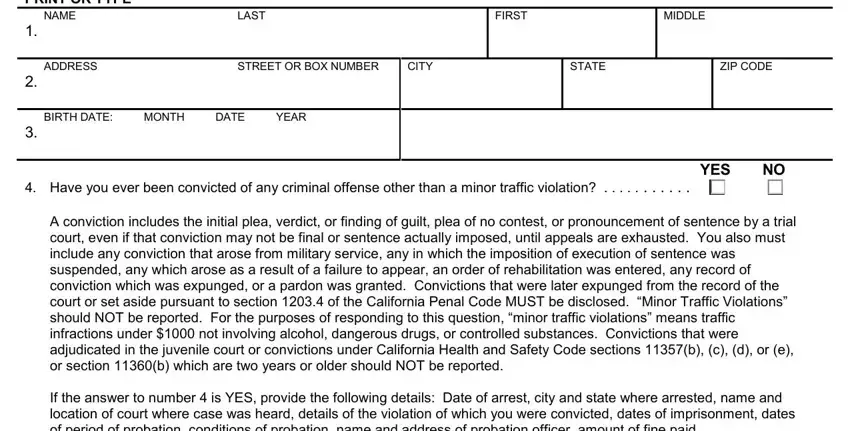

So as to finalize this document, be sure you type in the information you need in every blank:

1. While filling out the california cpa criminal conviction disclosure form, be sure to incorporate all of the essential blanks in the associated area. It will help to speed up the process, allowing for your information to be processed efficiently and appropriately.

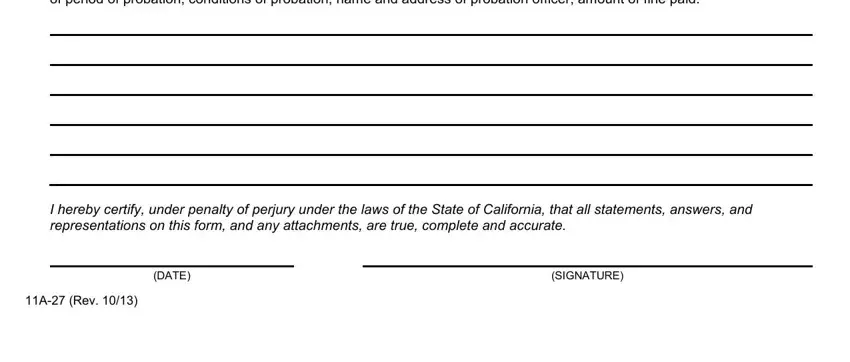

2. Once your current task is complete, take the next step – fill out all of these fields - If the answer to number is YES, I hereby certify under penalty of, DATE, SIGNATURE, and A Rev with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to get it wrong when filling out the A Rev, consequently make sure that you look again before you'll finalize the form.

Step 3: Prior to finishing this document, double-check that all blanks have been filled in as intended. Once you’re satisfied with it, click “Done." Join us today and instantly get california cpa criminal conviction disclosure form, all set for download. All modifications made by you are kept , so that you can edit the form later if necessary. When using FormsPal, you can certainly complete documents without being concerned about data incidents or data entries getting distributed. Our protected platform helps to ensure that your personal information is maintained safely.