The concept behind our PDF editor was to make it as intuitive as possible. You'll find the overall process of completing charles withdrawal form pdf simple in case you adhere to the next steps.

Step 1: To begin with, click on the orange "Get form now" button.

Step 2: Now it's easy to update your charles withdrawal form pdf. The multifunctional toolbar permits you to insert, remove, transform, and highlight content or carry out several other commands.

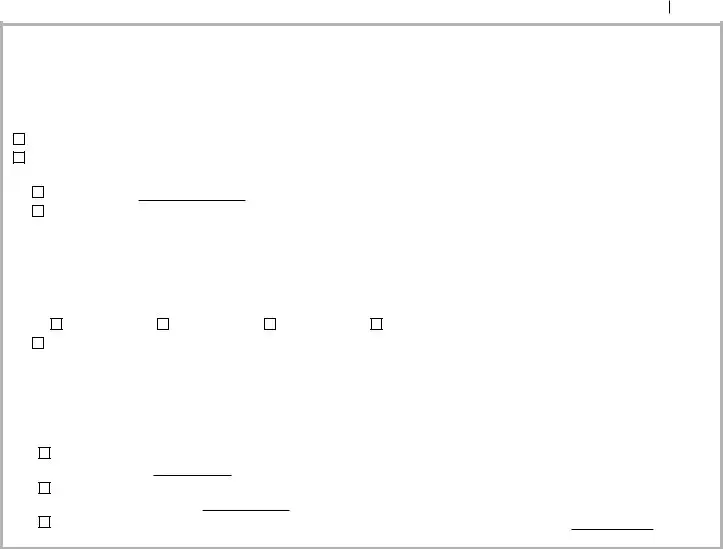

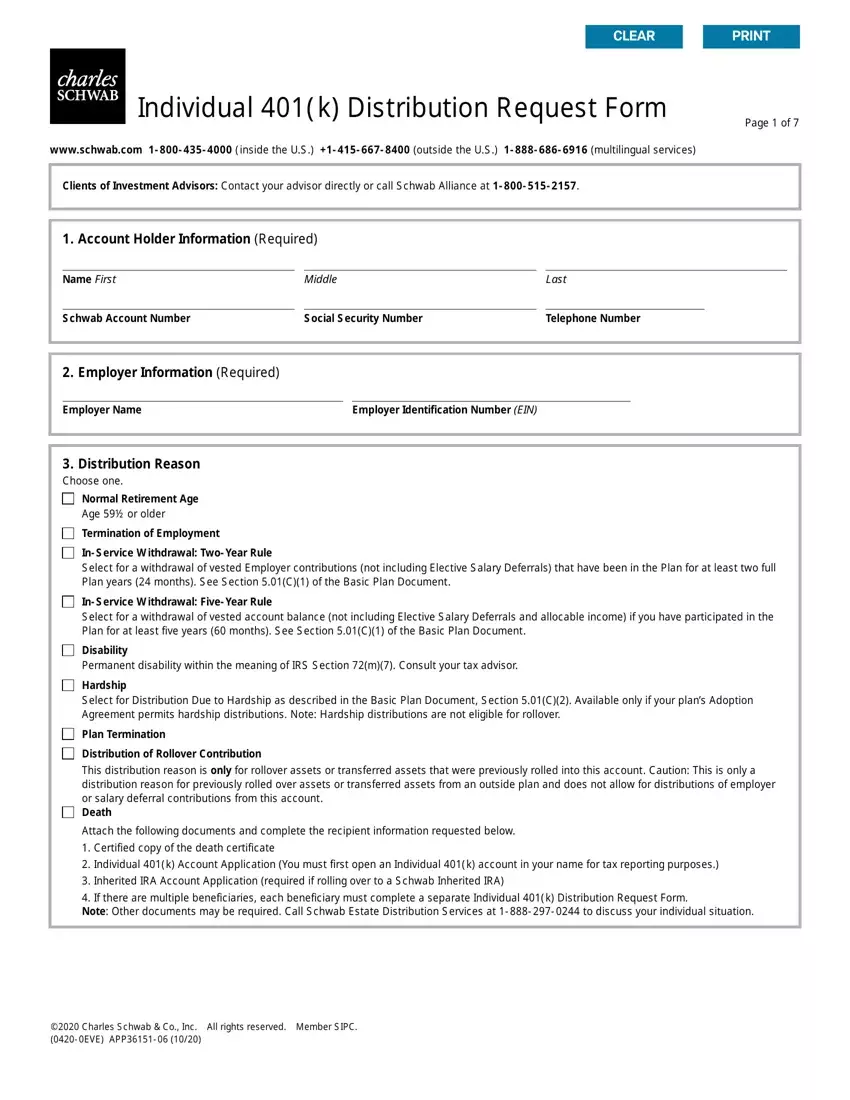

Make sure you type in the next details to complete the charles withdrawal form pdf PDF:

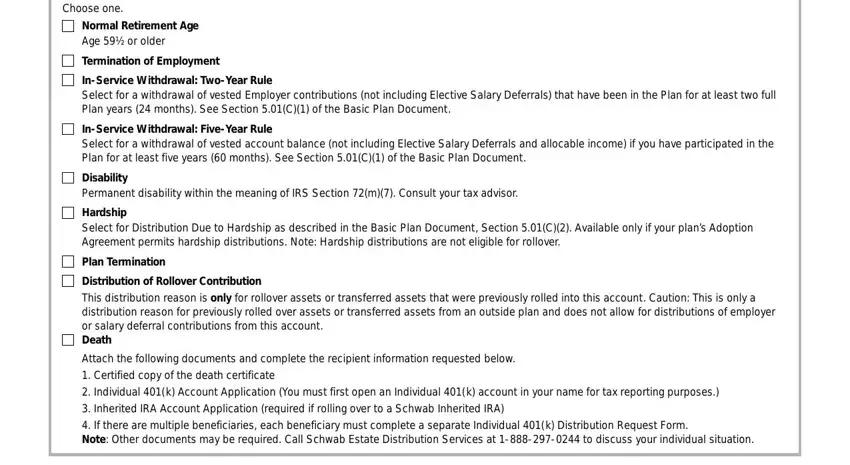

Fill in the Distribution Reason Choose one, Normal Retirement Age Age or older, Termination of Employment, InService Withdrawal TwoYear Rule, InService Withdrawal FiveYear Rule, Disability Permanent disability, Hardship Select for Distribution, Plan Termination, Distribution of Rollover, Attach the following documents and, Certified copy of the death, Individual k Account Application, Inherited IRA Account Application, and If there are multiple field with the particulars required by the system.

You're going to be asked to write down the data to help the program fill out the area Charles Schwab Co Inc All rights.

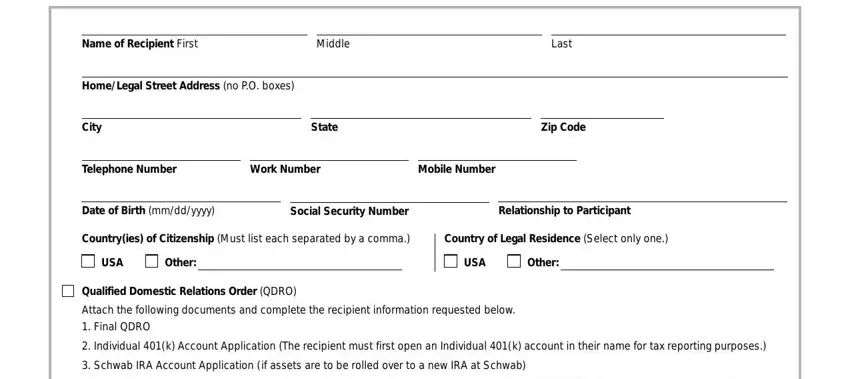

The Name of Recipient First, Middle, Last, HomeLegal Street Address no PO, City, State, Zip Code, Telephone Number, Work Number, Mobile Number, Date of Birth mmddyyyy, Social Security Number, Relationship to Participant, Countryies of Citizenship Must, and Country of Legal Residence Select field is the place to add the rights and responsibilities of both sides.

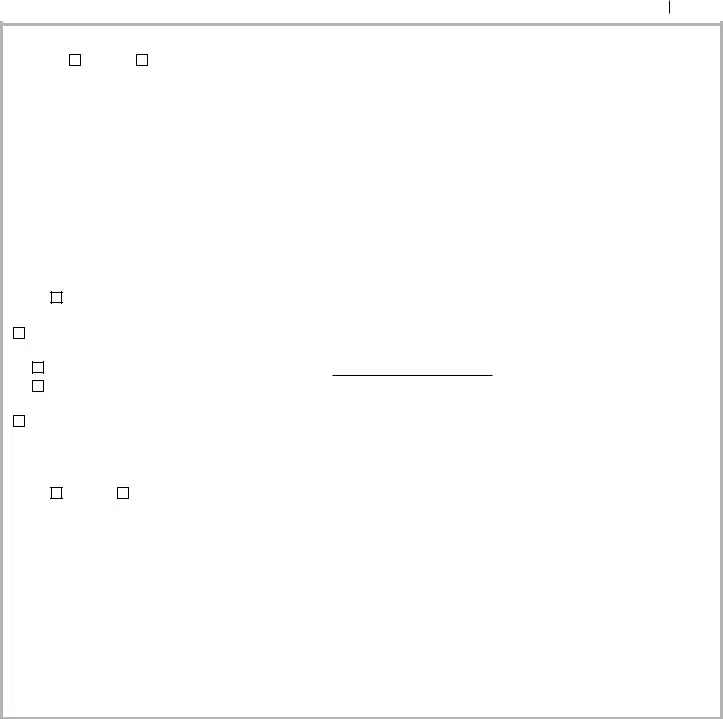

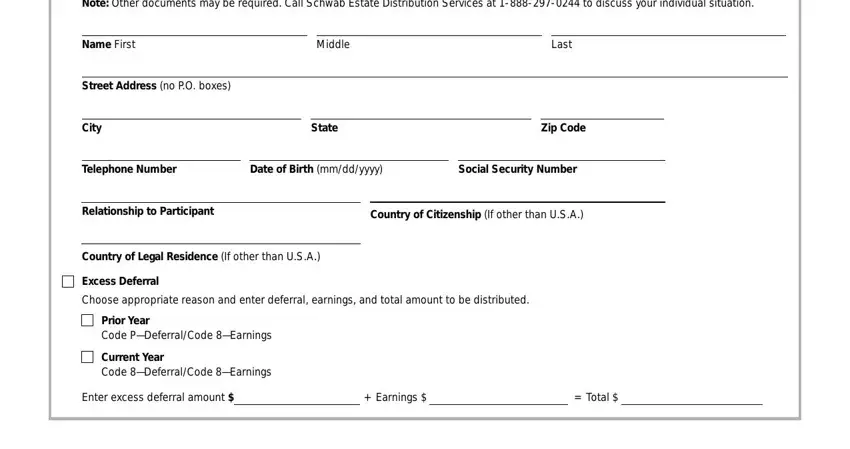

Finish by looking at the following areas and completing them as required: Note Other documents may be, Name First, Middle, Last, Street Address no PO boxes, City, State, Zip Code, Telephone Number, Date of Birth mmddyyyy, Social Security Number, Relationship to Participant, Country of Citizenship If other, Country of Legal Residence If, and Excess Deferral.

Step 3: After you select the Done button, your ready form can be simply exported to each of your gadgets or to email specified by you.

Step 4: Create copies of your template. This would protect you from potential misunderstandings. We do not read or display your details, therefore you can relax knowing it is secure.

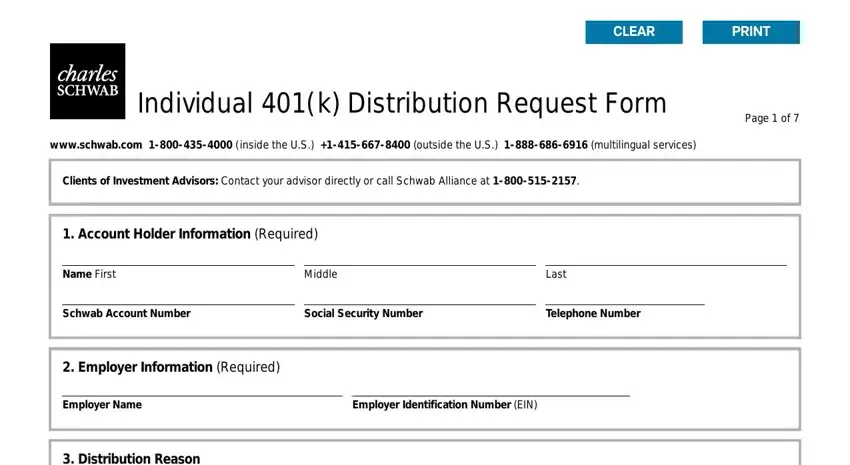

Individual 401(k) Distribution Request Form

Individual 401(k) Distribution Request Form

Other:

Other: