Our PDF editor allows you to complete the what is tax organizer form. It will be easy to generate the file immediately through using these simple actions.

Step 1: Click on the button "Get Form Here".

Step 2: So, you can start editing your what is tax organizer. The multifunctional toolbar is available to you - add, delete, alter, highlight, and conduct similar commands with the words and phrases in the document.

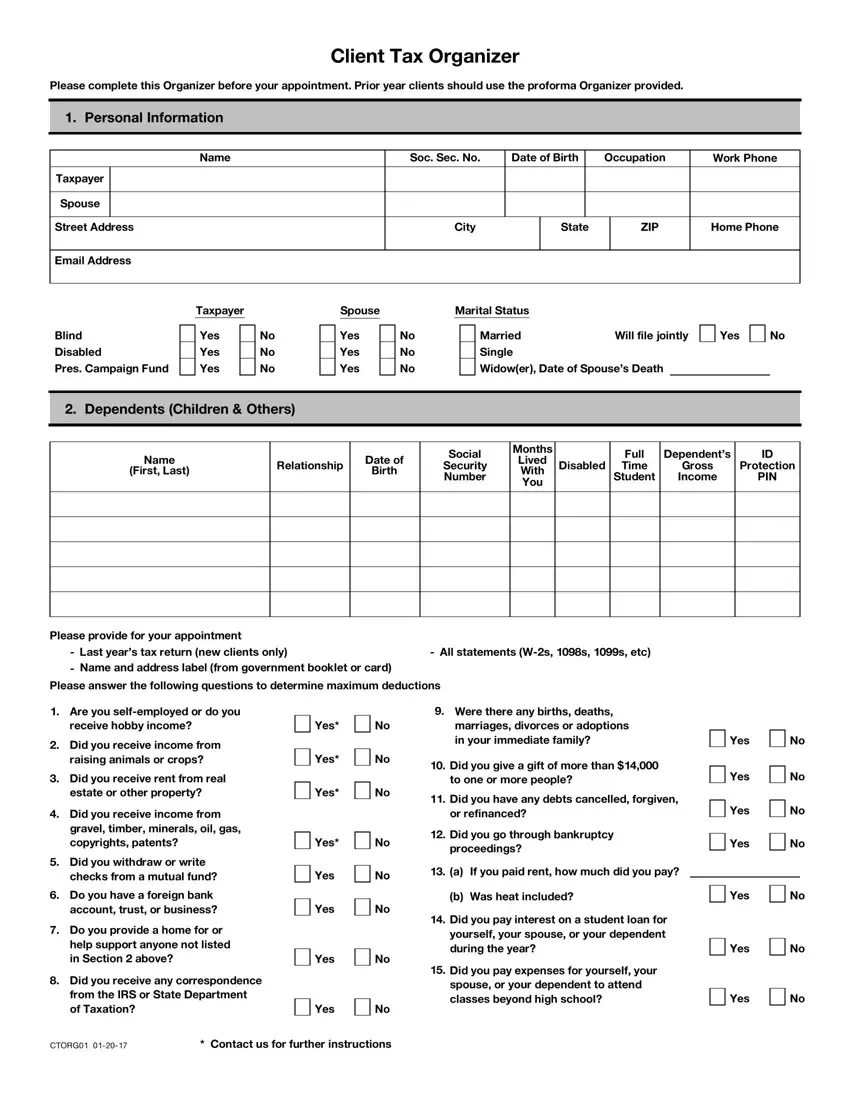

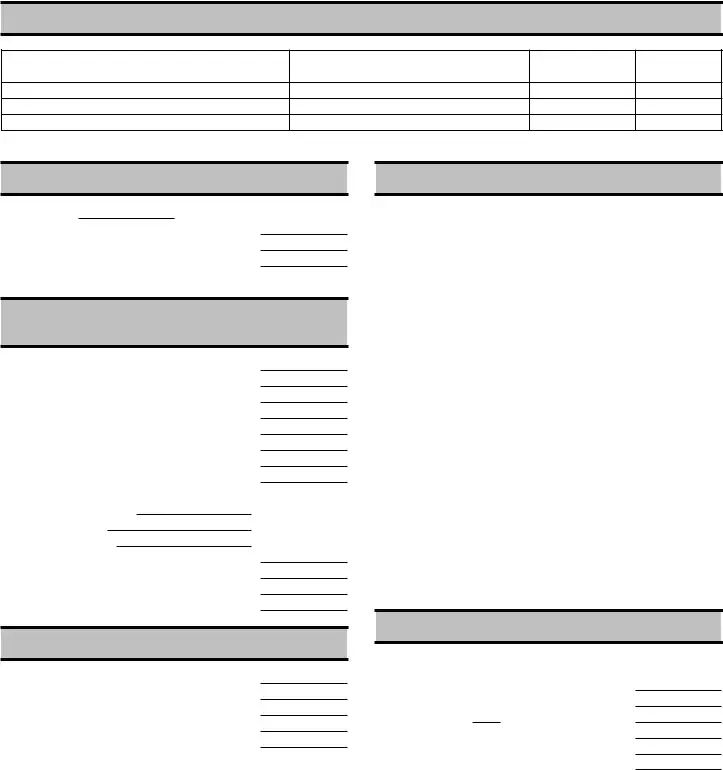

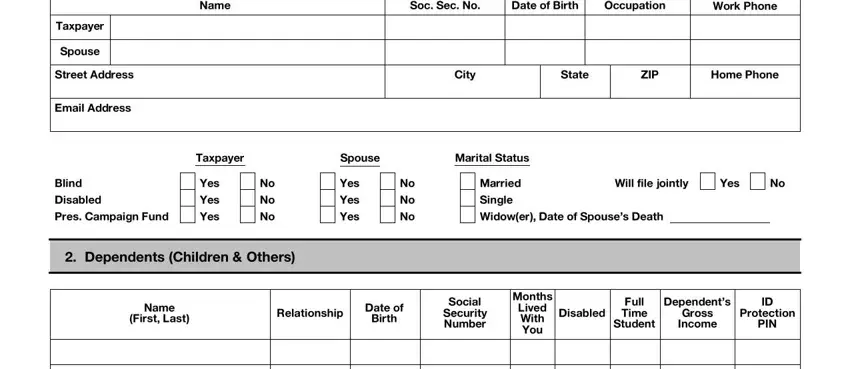

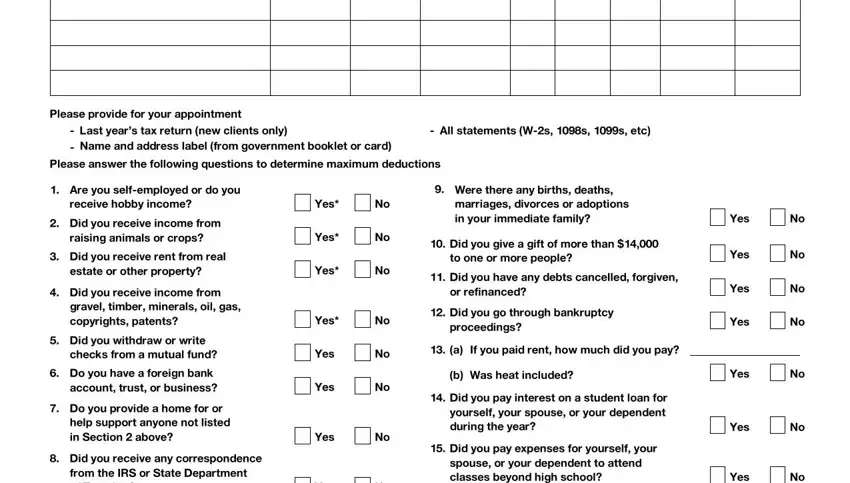

Make sure you provide the following information to fill out the what is tax organizer PDF:

Make sure you submit your data inside the part Please provide for your appointment, Last years tax return new clients, All statements Ws s s etc, Please answer the following, Are you selfemployed or do you, receive hobby income, Did you receive income from, Did you receive rent from real, Did you receive income from, gravel timber minerals oil gas, Did you withdraw or write, checks from a mutual fund, Do you have a foreign bank, Do you provide a home for or, and help support anyone not listed in.

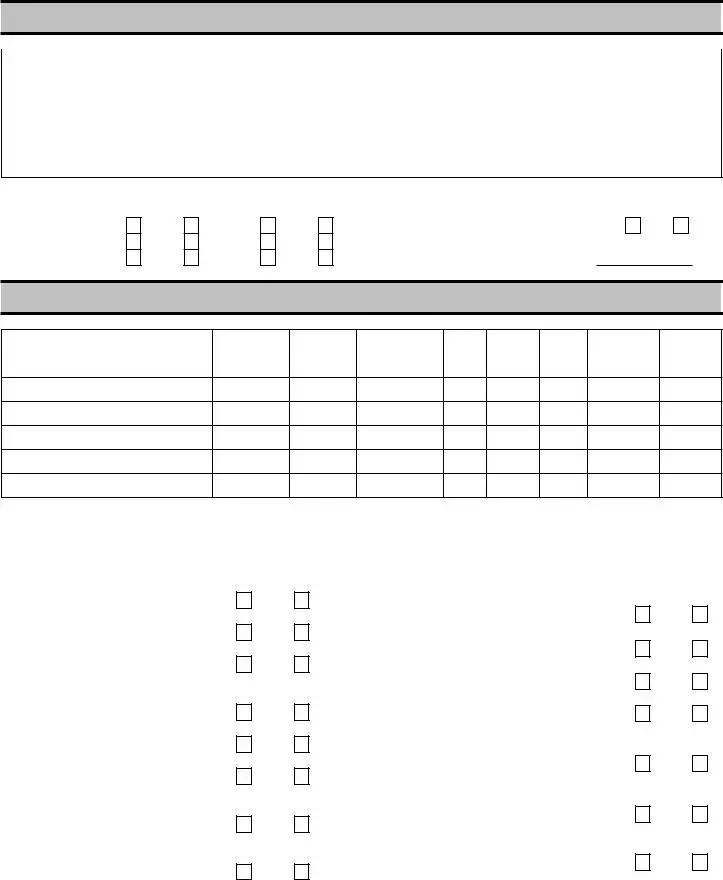

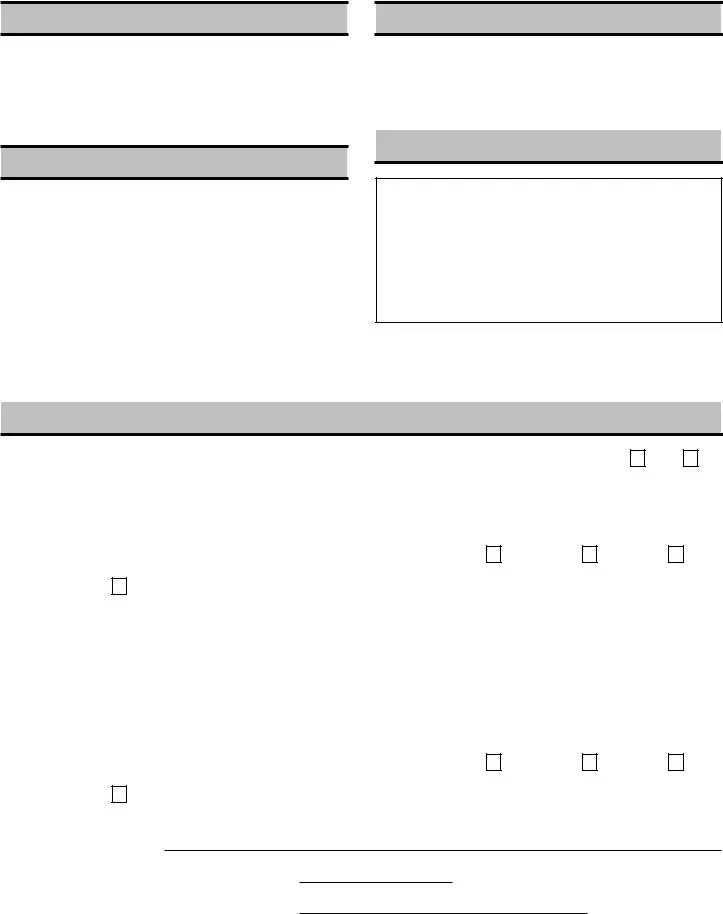

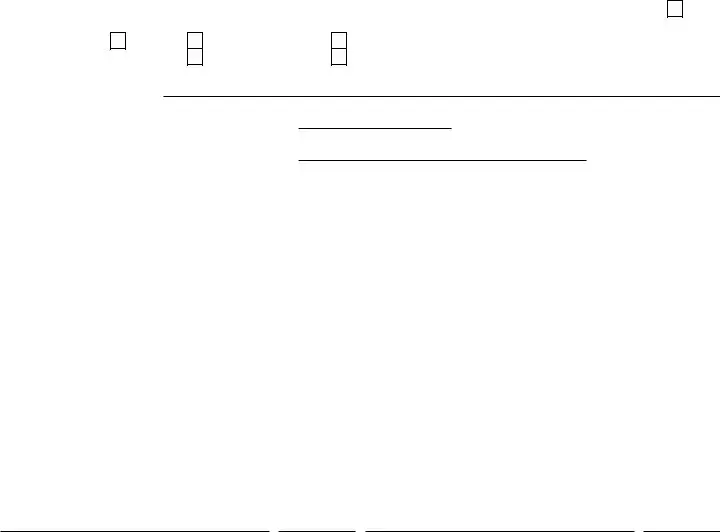

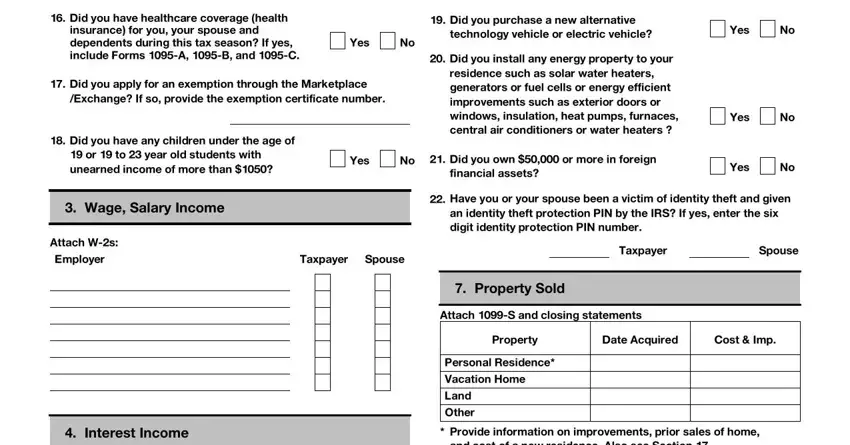

Type in the significant particulars since you are on the Did you have healthcare coverage, Yes, Did you apply for an exemption, Exchange If so provide the, Did you have any children under, or to year old students with, Wage Salary Income, Attach Ws Employer, Did you purchase a new alternative, technology vehicle or electric, Yes, Did you install any energy, Yes, Yes, and Yes field.

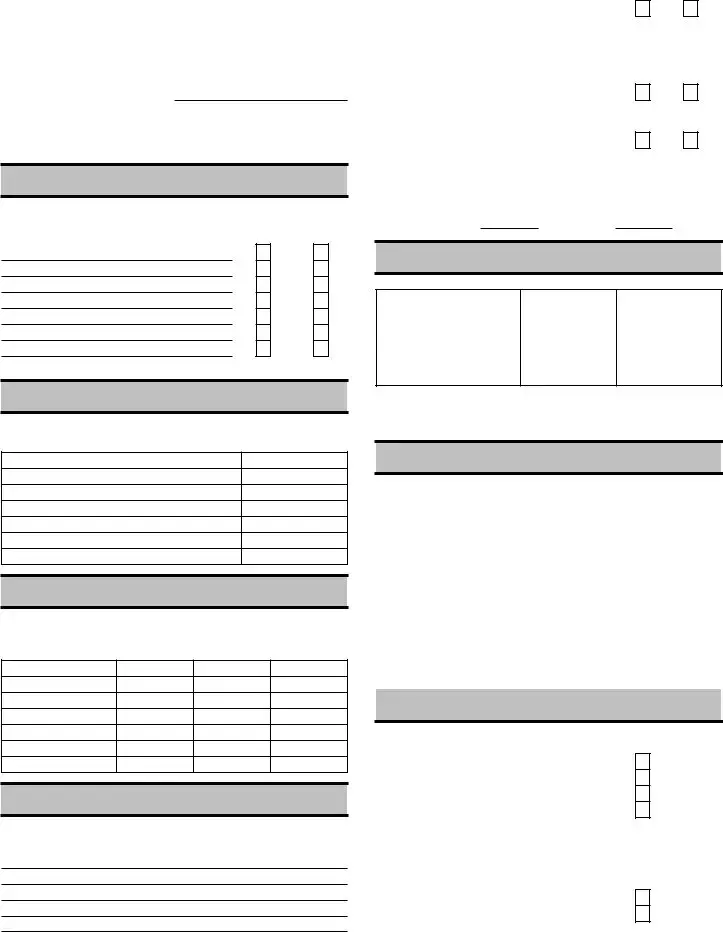

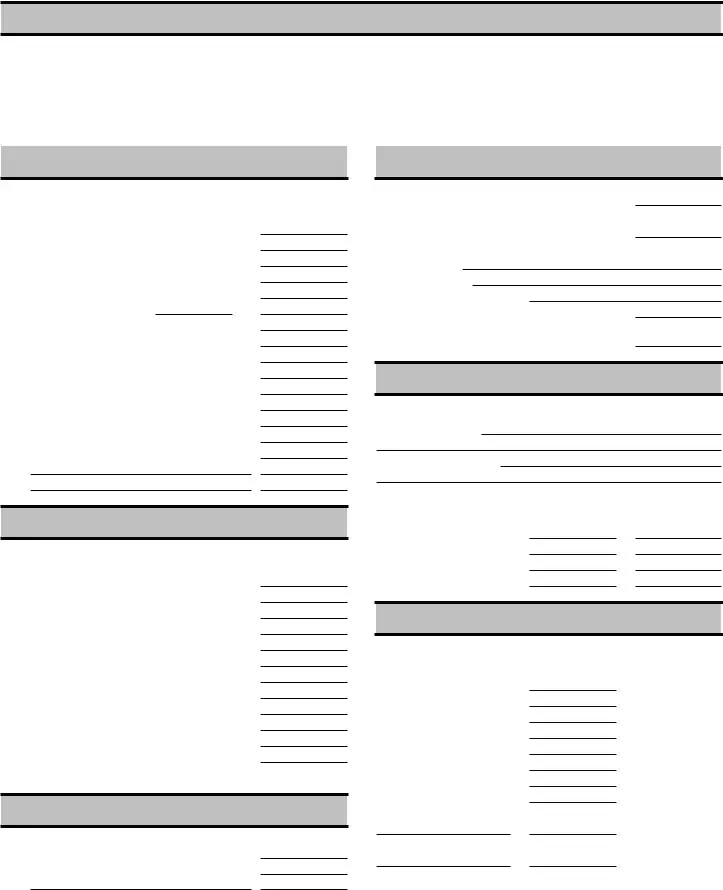

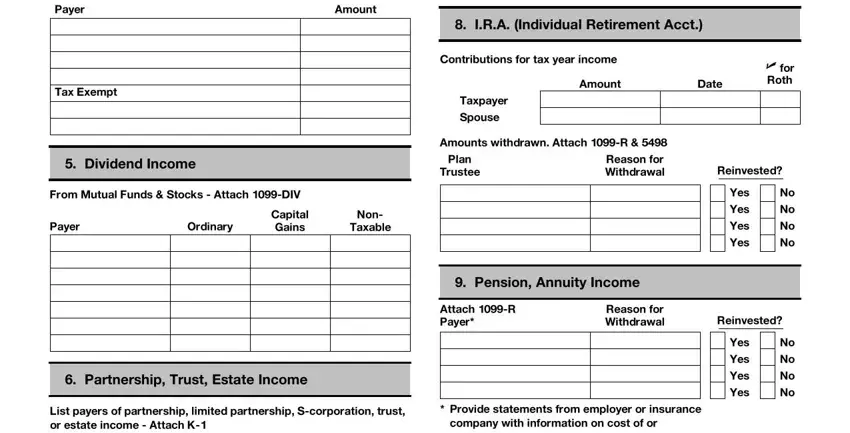

It is essential to describe the rights and responsibilities of every party in section Attach INT Form BTC broker, Amount, IRA Individual Retirement Acct, Contributions for tax year income, Amount, Date, U for Roth, Tax Exempt, Dividend Income, From Mutual Funds Stocks Attach, Payer, Ordinary, Capital Gains, Non Taxable, and Taxpayer Spouse.

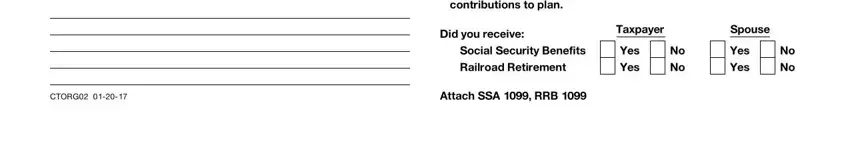

Finish by looking at the following areas and filling them in as required: company with information on cost, CTORG, Attach SSA RRB, Did you receive, Taxpayer, Spouse, Social Security Benefits, Railroad Retirement, Yes, Yes, Yes, and Yes.

Step 3: Hit the "Done" button. So now, it is possible to transfer your PDF file - download it to your electronic device or deliver it by means of electronic mail.

Step 4: You will need to generate as many duplicates of your form as you can to prevent future misunderstandings.