We've used the efforts of the best computer programmers to make the PDF editor you can take advantage of. Our application will assist you to fill out the inventory assets new york file without trouble and don’t waste time. All you need to undertake is adhere to these easy-to-follow actions.

Step 1: The first thing requires you to press the orange "Get Form Now" button.

Step 2: So you are on the form editing page. You can enhance and add information to the file, highlight specified content, cross or check specific words, insert images, insert a signature on it, delete needless areas, or eliminate them completely.

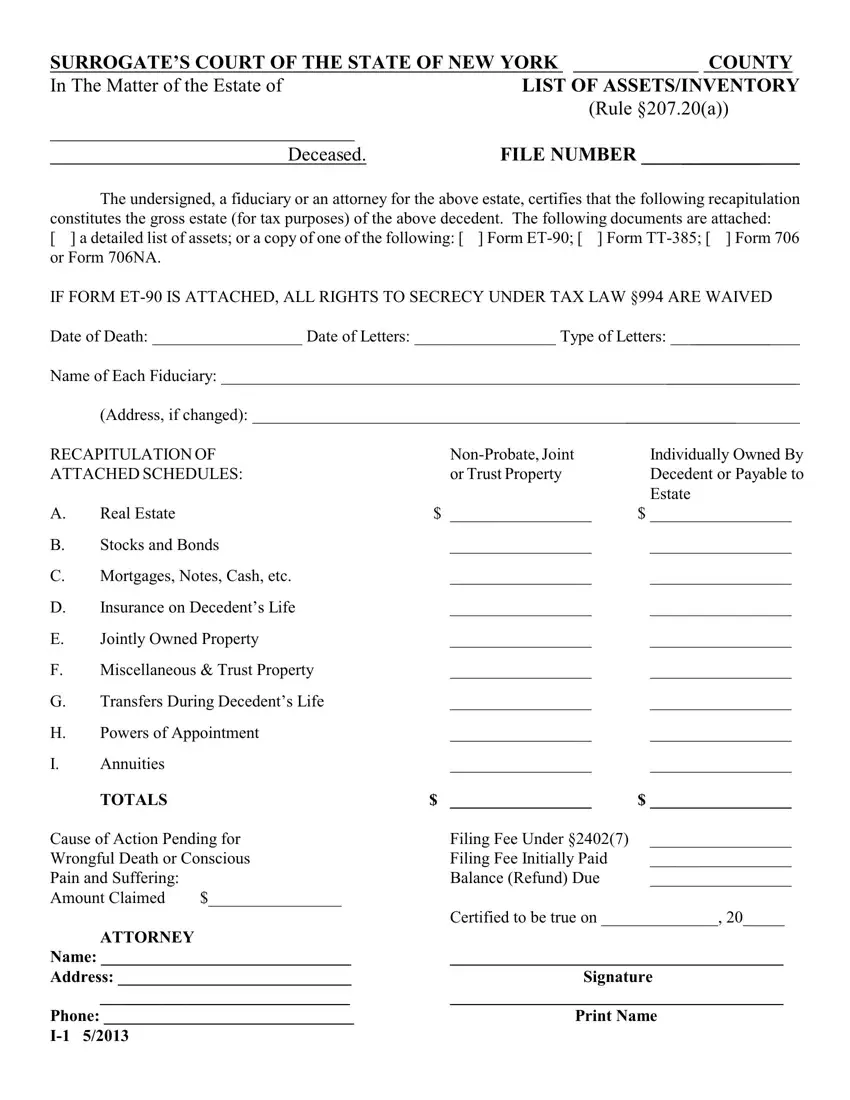

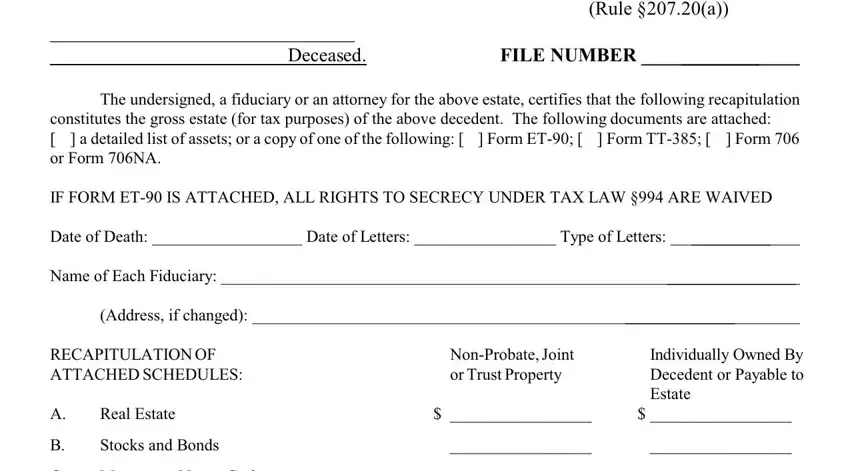

The next few parts will help make up your PDF form:

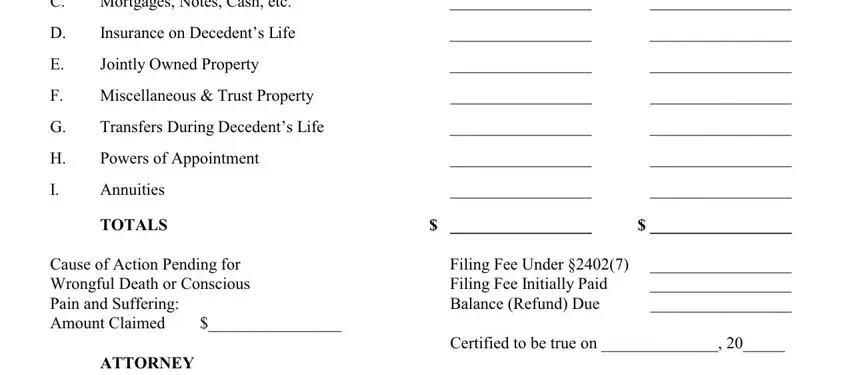

Put the expected details in the Mortgages Notes Cash etc, Insurance on Decedents Life, Jointly Owned Property, Miscellaneous Trust Property, Transfers During Decedents Life, Powers of Appointment, Annuities, TOTALS, Cause of Action Pending for, ATTORNEY, Filing Fee Under Filing Fee, and Certified to be true on box.

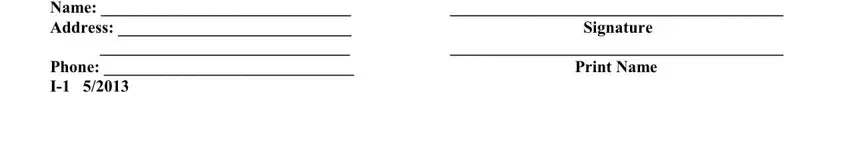

You could be requested for particular key information if you need to prepare the Name Address Phone I, Signature, and Print Name box.

The space Description, Date of Death Value, STOCKS AND BONDS Individually Owned, Description Including Face Amount, and Date of Death Value should be where one can indicate all sides' rights and responsibilities.

End by reviewing these areas and submitting the appropriate details: Description, and Date of Death Value.

Step 3: As soon as you've hit the Done button, your document should be readily available export to any kind of device or email you indicate.

Step 4: It will be simpler to have duplicates of your file. You can be sure that we are not going to display or read your information.