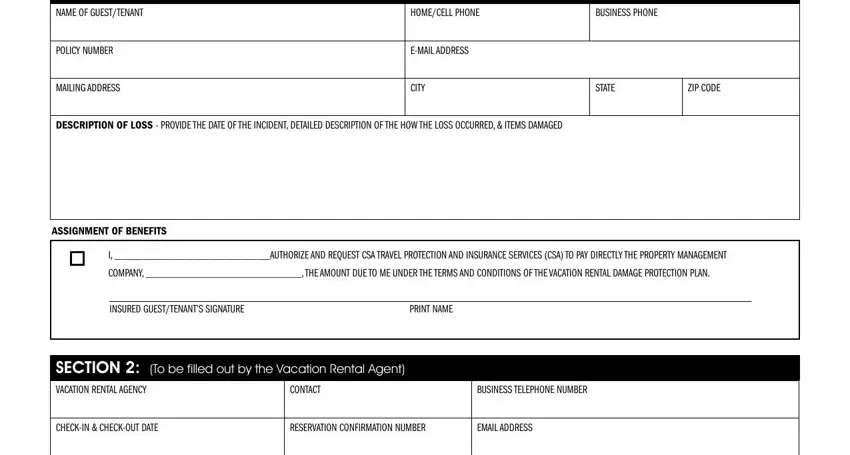

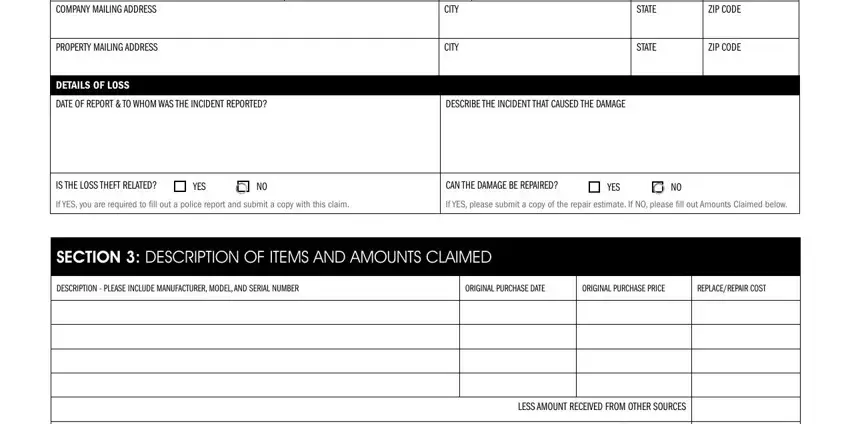

VACATION RENTAL DAMAGE COVERAGE CLAIM FORM

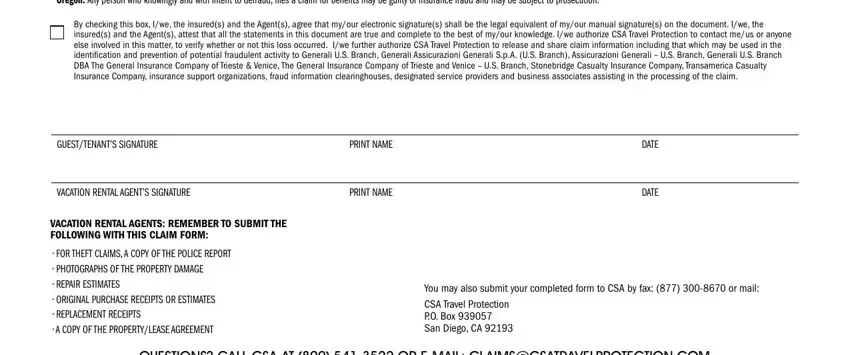

SECTION 4: (GUEST/TENANT & VACATION RENTAL AGENT: PLEASE READ NOTICE BELOW & SIGN)

FRAUD WARNINGS AND DISCLOSURES

Arizona: For your protection Arizona law requires the following statement to appear on this form: Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

Alaska, Minnesota, New Hampshire: A person who knowingly and with intent to injure, defraud, or deceive an insurance company iles a claim containing false, incomplete, or misleading information may be prosecuted under state law.

Arkansas, Louisiana, New Mexico, Texas, West Virginia: Any person who knowingly presents a false or fraudulent claim for payment of a loss or beneit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil ines and criminal penalties.

California: For your protection California law requires the following to appear on this form: Any person who knowingly presents false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to ines and coninement in state prison.

Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to any insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, ines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

Maine, Virginia, Tennessee, Washington: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company or any other person. Penalties include imprisonment and/or ines. In addition, an insurer may deny insurance beneits if false information materially related to a claim was provided by the applicant.

Delaware, Idaho, Indiana: Any person who knowingly, and with intent to injure, defraud or deceive any insurer iles a statement of claim containing any false or misleading information is guilty of a felony.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any employer or employee, insurance company, or self insured program iles a statement of claim or an application containing any false or misleading information is guilty of a felony of the third degree.

Hawaii: For your protection, Hawaii law requires you to be informed that presenting a fraudulent claim for payment of a loss or beneit is a crime punishable by ines or imprisonment, or both.

District of Columbia: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or ines. In addition, an insurer may deny insurance beneits, if false information materially related to a claim was provided by the applicant.

Oklahoma: Warning: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Kentucky, Pennsylvania: Any person who knowingly and with intent to defraud any insurance company or other person, iles an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Kansas: Any person who knowingly and with intent to defraud any insurance company or other person iles an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto may be guilty of insurance fraud as determined by a court of law.

Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or beneit or knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to civil ines and criminal penalties.

New Jersey: Any person who knowingly iles a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New York: Any person who knowingly and with intent to defraud any insurance company or other person iles an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed ive thousand dollars and the stated value of the claim for each violation.

Ohio: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or iles a claim containing a false or deceptive statement is guilty of insurance fraud.

Oregon: Any person who knowingly and with intent to defraud, iles a claim for beneits may be guilty of insurance fraud and may be subject to prosecution.

By checking this box, I/we, the insured(s) and the Agent(s), agree that my/our electronic signature(s) shall be the legal equivalent of my/our manual signature(s) on the document. I/we, the insured(s) and the Agent(s), attest that all the statements in this document are true and complete to the best of my/our knowledge. I/we authorize CSA Travel Protection to contact me/us or anyone else involved in this matter, to verify whether or not this loss occurred. I/we further authorize CSA Travel Protection to release and share claim information including that which may be used in the identiication and prevention of potential fraudulent activity to Generali U.S. Branch, Generali Assicurazioni Generali S.p.A. (U.S. Branch), Assicurazioni Generali – U.S. Branch, Generali U.S. Branch DBA The General Insurance Company of Trieste & Venice, The General Insurance Company of Trieste and Venice – U.S. Branch, Stonebridge Casualty Insurance Company, Transamerica Casualty Insurance Company, insurance support organizations, fraud information clearinghouses, designated service providers and business associates assisting in the processing of the claim.

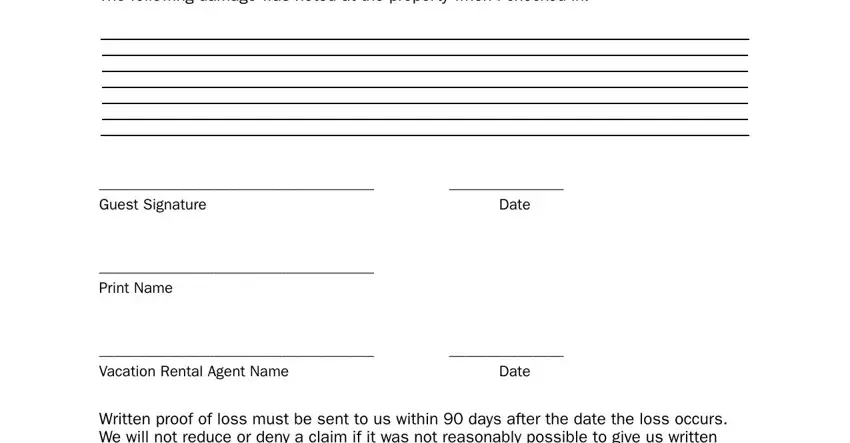

GUEST/TENANT’S SIGNATURE |

PRINT NAME |

DATE |

|

|

|

VACATION RENTAL AGENT’S SIGNATURE |

PRINT NAME |

DATE |

VACATION RENTAL AGENTS: REMEMBER TO SUBMIT THE

FOLLOWING WITH THIS CLAIM FORM:

•FOR THEFT CLAIMS, A COPY OF THE POLICE REPORT

•PHOTOGRAPHS OF THE PROPERTY DAMAGE

• REPAIR ESTIMATES |

You may also submit your completed form to CSA by fax: (877) 300-8670 or mail: |

|

• ORIGINAL PURCHASE RECEIPTS OR ESTIMATES |

CSA Travel Protection |

|

• REPLACEMENT RECEIPTS |

P.O. Box 939057 |

• A COPY OF THE PROPERTY/LEASE AGREEMENT |

San Diego, CA 92193 |

QUESTIONS? CALL CSA AT (800) 541-3522 OR E-MAIL: CLAIMS@CSATRAVELPROTECTION.COM