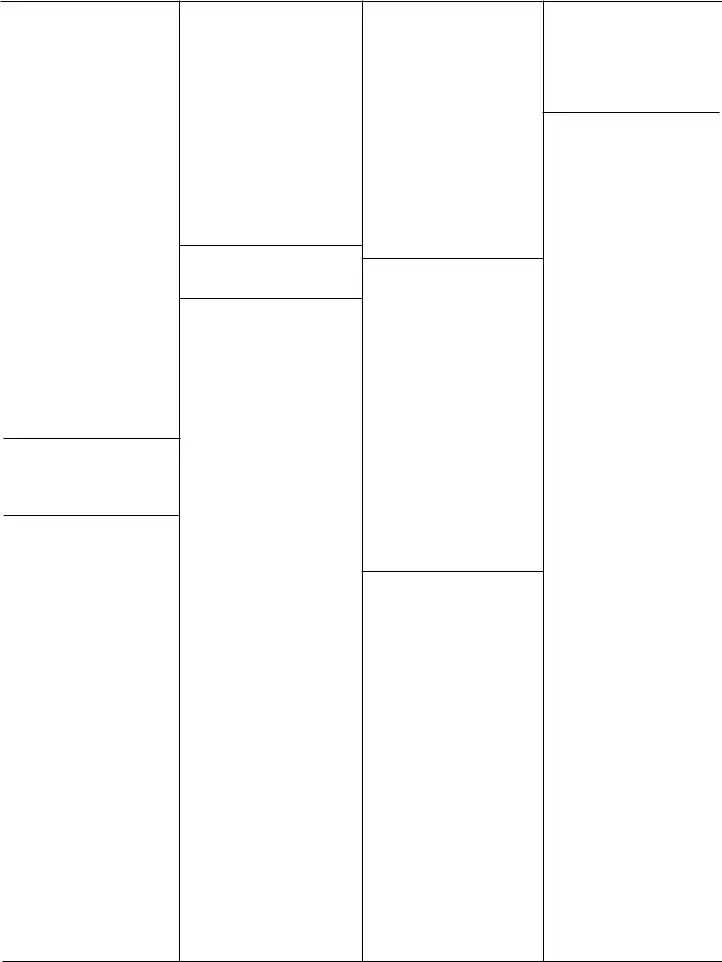

Code

Wholesale Trade, Durable Goods

422700 Petroleum & Petroleum

Products Wholesalers

422800 Beer, Wine, & Distilled Alcoholic

Beverage Wholesalers

422910 Farm Supplies Wholesalers

422920 Books, Periodical, & Newspaper

Wholesalers

422930 Flower, Nursery Stock &

Florists’ Supplies Wholesalers

422940 Tobacco & Tobacco Product

Wholesalers

422950 Paint, Varnish, & Supplies

Wholesalers

422990 Other Miscellaneous

Nondurable Goods Wholesalers

Retail Trade

Motor Vehicle and Parts Dealers

441110 |

New Car Dealers |

441120 |

Used Car Dealers |

441210 |

Recreational Vehicle Dealers |

441221 |

Motorcycle Dealers |

441222 |

Boat Dealers |

441229 |

All Other Motor Vehicle Dealers |

441300 |

Automotive Parts, Accessories, |

|

& Tire Stores |

Furniture and Home Furnishings Stores

442110 Furniture Stores

442210 Floor Covering Stores

442291 Window Treatment Stores

442299 All Other Home Furnishings

Stores

Electronics and Appliance Stores

443111 Household Appliance Stores

443112 Radio, Television, & Other

Electronics Stores

443120 Computer & Software Stores

443130 Camera & Photographic

Supplies Stores

Building Material and Garden Equipment and Supplies Dealers

444110 |

Home Centers |

444120 |

Paint & Wallpaper Stores |

444130 |

Hardware Stores |

444190 |

Other Building Material Dealers |

444200 |

Lawn & Garden Equipment & |

|

Supplies Stores |

Food and Beverage Stores

445110 Supermarkets and Other

Grocery (except Convenience)

Stores

445120 Convenience Stores

445210 Meat Markets

445220 Fish & Seafood Markets

445230 Fruit & Vegetable Markets

445291 Baked Goods Stores

445292 Confectionery & Nut Stores

445299 All Other Specialty Food Stores

445310 Beer, Wine, & Liquor Stores

Health and Personal Care Stores

446110 Pharmacies & Drug Stores

446120 Cosmetics, Beauty Supplies, &

Perfume Stores

446130 Optical Goods Stores

446190 Other Health & Personal Care

Stores

Gasoline Stations

447100 Gasoline Stations (including convenience stores with gas)

Clothing and Clothing Accessories Stores

448110 Men’s Clothing Stores

448120 Women’s Clothing Stores

448130 Children’s & Infants’ Clothing

Stores

448140 Family Clothing Stores

448150 Clothing Accessories Stores

448190 Other Clothing Stores

448219 Shoe Stores

448310 Jewelry Stores

448320 Luggage & Leather Goods

Stores

Code

Sporting Goods, Hobby, Book, and Music Stores

451110 Sporting Goods Stores

451120 Hobby, Toy, & Game Stores

451130 Sewing, Needlework, & Piece

Goods Stores

451140 Musical Instrument & Supplies

Stores

451211 Book Stores

451212 News Dealers & Newsstands

451220 Prerecorded Tape, Compact

Disc, & Record Stores

General Merchandise Stores

452110 Department Stores

452900 Other General Merchandise Stores

Miscellaneous Store Retailers

453110 |

Florists |

453210 |

Office Supplies & Stationery |

|

Stores |

453220 |

Gift, Novelty, & Souvenir Stores |

453310 |

Used Merchandise Stores |

453910 |

Pet & Pet Supplies Stores |

453920 |

Art Dealers |

453930 |

Manufactured (Mobile) Home |

|

Dealers |

453990 |

All Other Miscellaneous Store |

|

Retailers (including tobacco, |

|

candle, & trophy shops) |

Nonstore Retailers

454110 Electronic Shopping & Mail-

Order Houses

454210 Vending Machine Operators

454311 Heating Oil Dealers

454312 Liquefied Petroleum Gas

(Bottled Gas) Dealers

454319 Other Fuel Dealers

454390 Other Direct Selling

Establishments (including door-

to-door retailing, frozen food

plan providers, party plan

merchandisers, & coffee-break

service providers)

Transportation and Warehousing

Air, Rail, and Water Transportation

481000 Air Transportation

482110 Rail Transportation

483000 Water Transportation

Truck Transportation

484110 General Freight Trucking, Local

484120 General Freight Trucking, Long-

distance

484200 Specialized Freight Trucking

Transit and Ground Passenger Transportation

485110 Urban Transit Systems

485210 Interurban & Rural Bus

Transportation

485310 Taxi Service

485320 Limousine Service

485410 School & Employee Bus

Transportation

485510 Charter Bus Industry

485990 Other Transit & Ground

Passenger Transportation

Pipeline Transportation

486000 Pipeline Transportation

Scenic & Sightseeing Transportation

487000 Scenic & Sightseeing

Transportation

Support Activities for Transportation 488100 Support Activities for Air

Transportation

488210 Support Activities for Rail Transportation

488300 Support Activities for Water Transportation

488410 Motor Vehicle Towing

488490 Other Support Activities for Road Transportation

488510 Freight Transportation

Arrangement

Code

488990 Other Support Activities for Transportation

Couriers and Messengers

492110 Couriers

492210 Local Messengers & Local Delivery

Warehousing And Storage

493100 Warehousing & Storage (except lessors of miniwarehouses & self-storage units)

Information

Publishing Industries

511110 Newspaper Publishers

511120 Periodical Publishers

511130 Book Publishers

511140 Database & Directory Publishers

511190 Other Publishers

511210 Software Publishers

Motion Picture and Sound Recording Industries

512100 Motion Picture & Video

Industries (except video rental)

512200 Sound Recording Industries

Broadcasting and

Telecommunications

513100 Radio & Television Broadcasting

513200 Cable Networks & Program

Distribution

513300 Telecommunications (including

paging, cellular, satellite, &

other telecommunications)

Information Services and Data Processing Services

514100 Information Services (including

news syndicates, libraries, &

on-line information services)

514210 Data Processing Services

Finance and Insurance

Depository Credit Intermediation

522110 Commercial Banking

522120 Savings Institutions

522130 Credit Unions

522190 Other Depository Credit

Intermediation

Nondepository Credit Intermediation

522210 Credit Card Issuing

522220 Sales Financing

522291 Consumer Lending

522292 Real Estate Credit (including

mortgage bankers & originators)

522293 International Trade Financing

522294 Secondary Market Financing

522298 All Other Nondepository Credit

Intermediation

Activities Related to Credit

Intermediation

522300 Activities Related to Credit Intermediation (including loan brokers)

Securities, Commodity Contracts, and

Other Financial Investments and

Related Activities

523110 Investment Banking & Securities

Dealing

523120 Securities Brokerage

523130 Commodity Contracts Dealing

523140 Commodity Contracts

Brokerage

523210 Securities & Commodity

Exchanges

523900 Other Financial Investment

Activities (including portfolio

management & investment

advice)

Code

Insurance Carriers and Related Activities

524140 Direct Life, Health, & Medical

Insurance & Reinsurance

Carriers

524150 Direct Insurance & Reinsurance

(except Life, Health & Medical)

Carriers

524210 Insurance Agencies &

Brokerages

524290 Other Insurance Related

Activities

Funds, Trusts, and Other Financial Vehicles

525100 Insurance & Employee Benefit

Funds

525910 Open-end Investment Funds

525920 Trusts, Estates, & Agency

Accounts

525930 Real Estate Investment Trusts

525990 Other Financial

Vehicles

“Offices of Bank Holding Companies” and “Offices of Other Holding Companies,” are located under

Management of Companies (Holding Companies)

Real Estate and Rental and Leasing

Real Estate

531110 Lessors of Residential Buildings & Dwellings

531114 Cooperative Housing

531120 Lessors of Miniwarehouses & Self-Storage Units

531190 Lessors of Other Real Estate Property

531210 Offices of Real Estate Agents & Brokers

531310 Real Estate Property Managers

531320 Offices of Real Estate Appraisers

531390 Other Activities Related to Real Estate

Rental and Leasing Services

532100 Automotive Equipment Rental &

Leasing

532210 Consumer Electronics &

Appliances Rental

532220 Formal Wear & Costume Rental

532230 Video Tape & Disc Rental

532290 Other Consumer Goods Rental

532310 General Rental Centers

532400 Commercial & Industrial

Machinery & Equipment Rental

& Leasing

Lessors of Nonfinancial Intangible Assets (except copyrighted works) 533110 Lessors of Nonfinancial

Intangible Assets (except copyrighted works)

Professional, Scientific, and Technical Services

Legal Services

541110 Offices of Lawyers

541190 Other Legal Services

Accounting, Tax Preparation,

Bookkeeping, and Payroll Services

541211 Offices of Certified Public

Accountants

541213 Tax Preparation Services

541214 Payroll Services

541219 Other Accounting Services

Architectural, Engineering, and Related Services

541310 Architectural Services

541320 Landscape Architecture

Services

541330 Engineering Services

541340 Drafting Services