The DD Form, specifically known as the Commercial Insurance Solicitation Record, plays a crucial role in the facilitation and documentation of life insurance policies for military personnel, particularly those in the pay grades of E-1, E-2, and E-3. This form serves multiple purposes, including ensuring that service members are fully informed about the insurance policies they acquire and that these transactions are consistent with military regulations. By design, it captures detailed information about the insurance policy being sold, including the type of policy, the coverage amount, the effective date, and the monthly premium, among other financial details. Moreover, it encompasses sections that allow both the insurance company representative and the applicant to document pertinent information. This facilitates a clear understanding for the service member about the terms of the agreement and the benefits available, helping to safeguard their interests and those of their dependents. Furthermore, the DD Form contributes to the overall regulatory framework within which military personnel can securely engage with commercial insurance entities, thereby illustrating the Department of Defense's commitment to the welfare of its service members through structured and transparent procedures.

| Question | Answer |

|---|---|

| Form Name | Dd Form 2056 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | dd form 2056 word document, SGLI, E-3, E-2 |

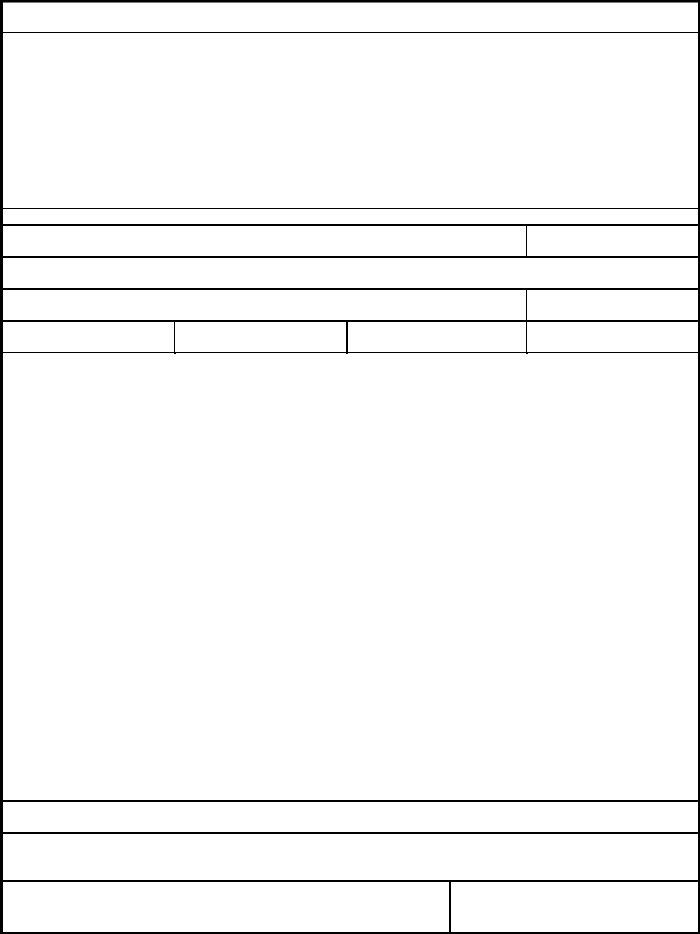

COMMERCIAL INSURANCE SOLICITATION RECORD

For use of this form, see AR

DATA REQUIRED BY THE PRIVACY ACT

AUTHORITY: Title 10 USC, Section 3012.

PRINCIPAL PURPOSE: To furnish information regarding the insurance policy sold to members in pay grades

ROUTINE USES: Information used by Insurance Officer to counsel the member to insure that he understands the terms of the insurance policy. DISCLOSURE OF REQUESTED INFORMATION IS VOLUNTARY, HOWEVER, FAILURE TO PROVIDE THE INFORMATION WILL PRECLUDE THE PROCESSING OF ALLOTMENT FOR MEMBERS IN PAY GRADES

SECTION I - (COMPLETED BY INSURANCE COMPANY REPRESENTATIVE AND GIVEN TO APPLICANT)

TO: (CO, Military Organization of Applicant)

DATE

APPLICATION FOR AN INSURANCE POLICY ON HIS/HER LIFE HAS BEEN SUBMITTED TO MY COMPANY BY THE FOLLOWING INDIVIDUAL

LAST NAME - FIRST NAME - MIDDLE INITIAL OF APPLICANT

GRADE

TYPE OF POLICY

AMOUNT OF LIFE INSURANCE

EFFECTIVE DATE OF POLICY

MONTHLY PREMIUM

PREMIUM |

DEATH |

PAID UP INSURANCE |

EXTENDED |

GUARANTEED |

TOTAL AMOUNT OF |

YEAR END |

BENEFIT |

OR ENDOWMENT |

INSURANCE |

CASH VALUE |

PREMIUMS PAID |

|

|

|

|

|

|

1ST |

|

|

|

|

|

|

|

|

|

|

|

2D |

|

|

|

|

|

|

|

|

|

|

|

3D |

|

|

|

|

|

|

|

|

|

|

|

4TH |

|

|

|

|

|

|

|

|

|

|

|

5TH |

|

|

|

|

|

|

|

|

|

|

|

10TH |

|

|

|

|

|

|

|

|

|

|

|

15TH |

|

|

|

|

|

|

|

|

|

|

|

20TH |

|

|

|

|

|

|

|

|

|

|

|

REMARKS (Agent will fill in here any information he deems pertinent, and will include remarks concerning any exclusions or restrictive clauses which appear in the policy applied for.)

I HAVE CURRENT AUTHORIZATION TO SOLICIT INSURANCE BUSINESS ON THIS INSTALLATION AND THE ABOVE SOLICITATION WAS ACCOMPLISHED IN ACCORDANCE WITH ALL APPLICABLE REGULATIONS

NAME AND ADDRESS OF HOME OFFICE OF COMPANY

NAME AND LOCAL ADDRESS OF REPRESENTATIVE

SIGNATURE OF REPRESENTATIVE

DA FORM 2056, AUG 2010 |

PREVIOUS EDITIONS ARE OBSOLETE. |

Page 1 of 2 |

APD PE v1.00ES

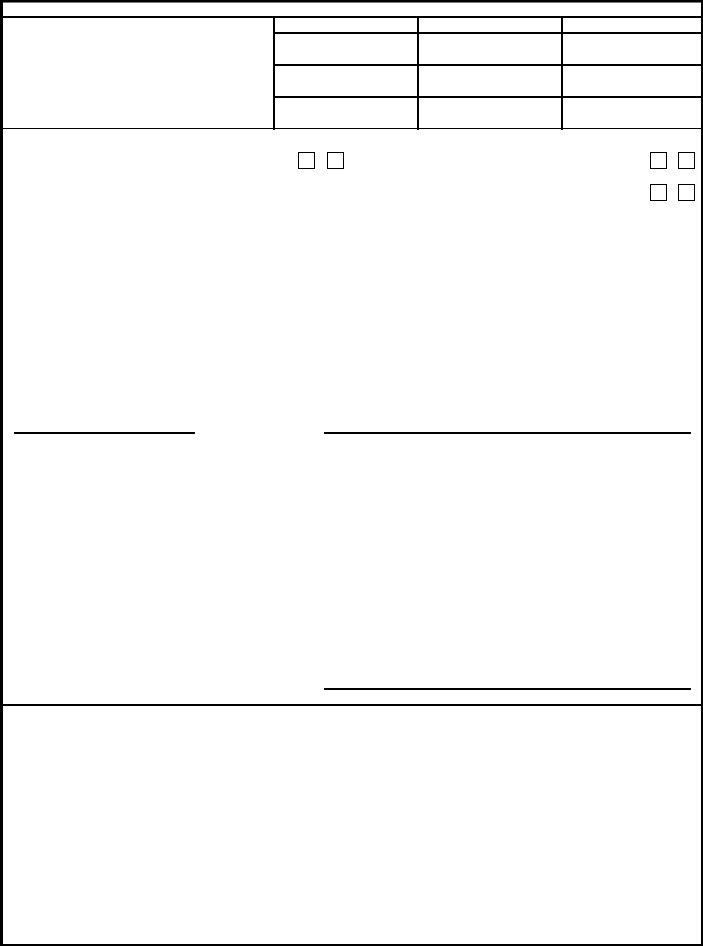

SECTION II - (COMPLETED BY APPLICANT AND FORWARDED TO INSURANCE OFFICER)

I HAVE THE FOLLOWING INSURANCE IN FORCE

(List in sequence. If additional space is necessary, continue in "REMARKS" below.)

(Include SGLI)

TYPE OF POLICY |

AMOUNT |

AMOUNT OF PREMIUM |

$ PER

$ PER

$ PER

(Check appropriate boxes) |

YES |

NO |

|

(Check appropriate boxes) |

YES |

NO |

|||

|

|

|

|

|

|

|

|

|

|

IS IT INTENDED THAT THE INSURANCE YOU ARE |

|

|

|

|

|

|

DO YOUR PARENTS DEPEND ON YOU |

|

|

PURCHASING WILL REPLACE AN EXISTING POLICY? |

|

|

|

|

|

|

FOR SUPPORT? |

|

|

|

|

|

|

|

|

|

|

|

|

ARE YOU MARRIED? |

|

|

|

|

|

|

IS ANY OF YOUR PAY ALLOTTED FOR THE |

|

|

|

|

|

|

|

|

|

SUPPORT OF YOUR DEPENDENTS? |

|

|

DO YOU HAVE ANY MINOR CHILDREN? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATEMENT OF APPLICANT

I fully understand that the Department of the Army does not favor, sponsor, or endorse any individual commercial life insurance company. I specifically understand that the filing of an allotment is merely a convenience afforded military personnel, and does not constitute an approval by the Department of the Army of either the policy purchased or the company concerned. I further understand that the purchase of a life insurance contract, which involves the use of the allotment system for payment of premiums on such contract, is definitely a personal transaction between myself and the insurance company.

I have been advised that there are certain benefits available to survivors of service personnel, such as: payment of six times my current monthly basic pay as

gratuity (subject to a minimum payment of $800.00 or a maximum payment of $3,000.00), payment of a monthly compensation by the Veterans Administration to a widow (at the rate of $215.00 per month for the widow of an

In addition, the rate payable for widow with one or more children (under age 18) is increased by $26.00 monthly for each successive child, to a child or children and/or dependent parents educational assistance (as much as $270.00 per month) to a widow and to children, and Social Security Benefits. I further understand the valuable provisions of the class B allotment system for the purchase of United States Savings Bonds.

I request that an allotment be initiated in favor of the insurance company. The information in this section is correct and is in conformance with my desires at this time.

|

(Date) |

(Signature of Applicant) |

|

|

|

|

SECTION III - |

(TO BE COMPLETED BY INSURANCE COUNSELOR) |

|

|

|

FROM: |

Insurance Counselor |

DATE: |

TO: |

Personnel Officer |

|

1.Applicant has been counseled in accordance with existing instructions.

2.Applicant has had provisions of existing benefits for survivors of military personnel explained to him.

3.The essential features of type of insurance applied for appear to be understood by applicant.

4.An allotment initiated to effect regular monthly payment of premium for insurance contract can be processed.

5.If the applicant has less than $20,000 SGLI, the valuable provisions of that insurance program have been explained to him.

6.If this intended purchase of insurance will replace an existing policy, the applicant has been advised that such an action may not be in his best interest, and he should obtain advice from the company which issued the existing policy.

(Signature of Insurance Counselor)

REMARKS

DA FORM 2056, AUG 2010 |

Page 2 of 2 |

APD PE v1.00ES