By using the online editor for PDFs by FormsPal, it is possible to fill in or alter 231D here. Our team is aimed at providing you with the perfect experience with our tool by consistently introducing new functions and upgrades. Our tool is now even more helpful with the latest updates! At this point, editing PDF documents is a lot easier and faster than ever. In case you are looking to start, this is what it will require:

Step 1: Simply press the "Get Form Button" above on this site to launch our pdf form editing tool. This way, you'll find all that is necessary to fill out your file.

Step 2: As you start the online editor, you will see the document prepared to be filled out. Aside from filling out various blank fields, you can also do various other actions with the file, such as putting on your own text, editing the initial text, inserting graphics, putting your signature on the PDF, and more.

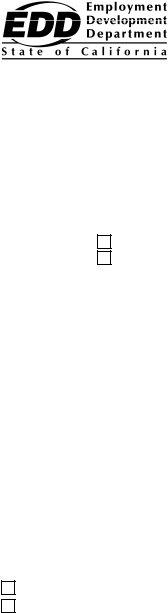

This PDF doc will involve specific details; to guarantee accuracy, you should bear in mind the following suggestions:

1. The 231D needs particular information to be inserted. Ensure that the subsequent blanks are completed:

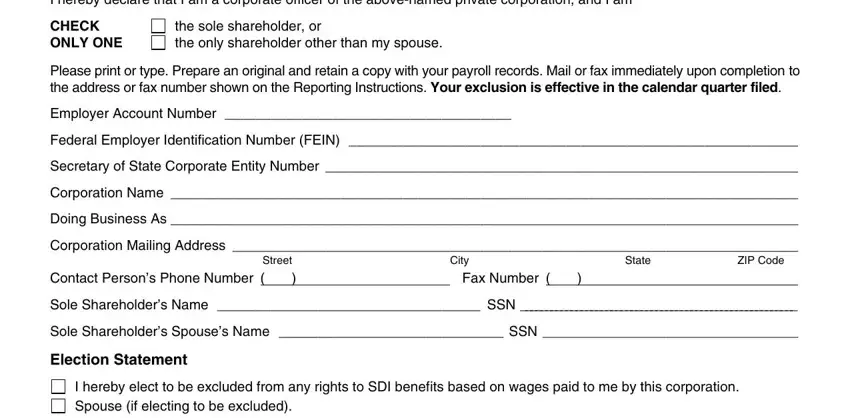

2. After finishing this part, head on to the subsequent stage and complete all required particulars in these blank fields - I understand that this statement, Sole Shareholders Signature Date, Sole Shareholders Spouses, FOR DEPARTMENT USE ONLY, EFF DATE LTR SENT, EXAMINER DATE, SEE THE FOLLOWING REPORTING, DE Rev INTERNET, and Page of.

In terms of Sole Shareholders Spouses and Sole Shareholders Signature Date, make sure you don't make any errors here. The two of these are surely the most significant ones in the form.

Step 3: Once you have looked once more at the details in the blanks, click on "Done" to complete your form. Make a 7-day free trial subscription at FormsPal and obtain instant access to 231D - which you can then use as you wish in your FormsPal cabinet. We do not share or sell any details that you enter whenever filling out forms at our site.