With the online PDF tool by FormsPal, you'll be able to fill in or edit hawaii employment record certification form here. FormsPal team is ceaselessly working to expand the tool and help it become even easier for users with its extensive functions. Enjoy an ever-evolving experience today! Here's what you will need to do to begin:

Step 1: First, access the tool by clicking the "Get Form Button" above on this site.

Step 2: With our handy PDF file editor, it is possible to do more than just complete blanks. Try all of the features and make your documents seem high-quality with customized textual content added, or fine-tune the file's original content to perfection - all that comes with an ability to incorporate any type of graphics and sign it off.

Be attentive when completing this document. Make sure that every field is done properly.

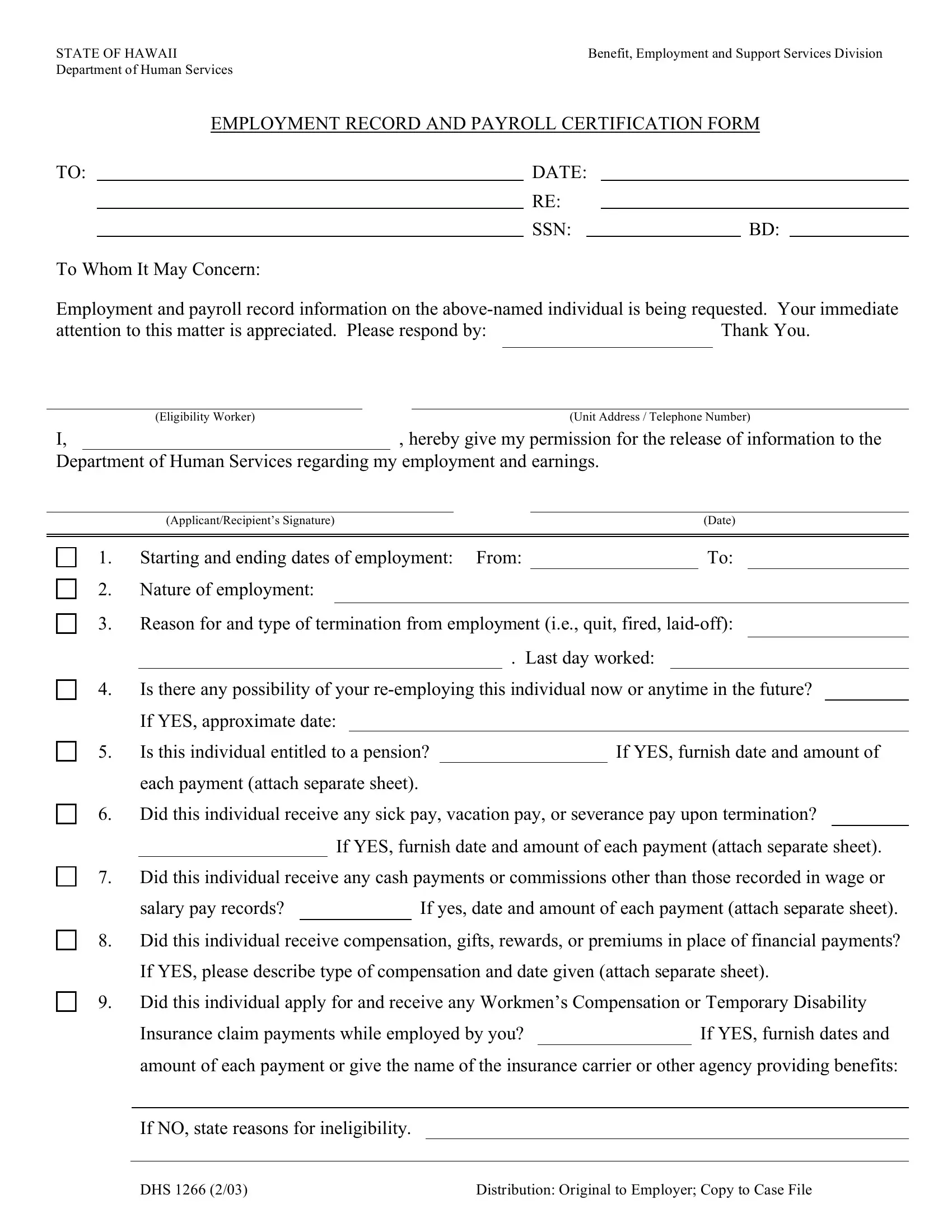

1. While submitting the hawaii employment record certification form, make sure to incorporate all needed fields within its relevant section. This will help speed up the work, allowing for your information to be processed fast and properly.

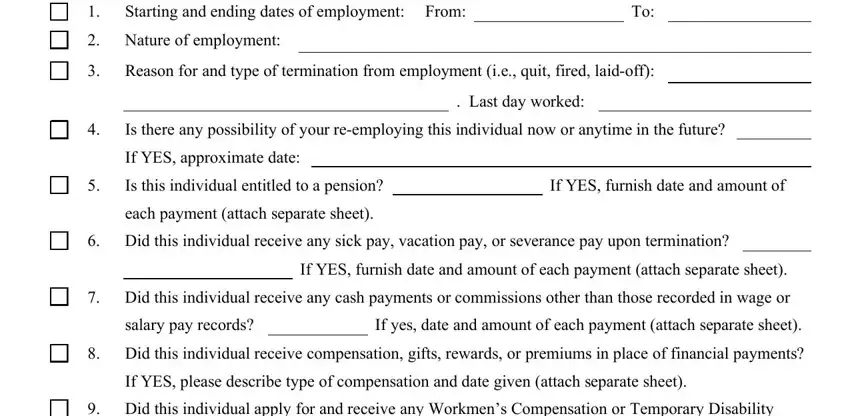

2. Just after performing the previous step, go on to the subsequent part and enter all required details in these blanks - Starting and ending dates of, Nature of employment, Reason for and type of, Last day worked, Is there any possibility of your, If YES approximate date, Is this individual entitled to a, If YES furnish date and amount of, each payment attach separate sheet, Did this individual receive any, If YES furnish date and amount of, Did this individual receive any, salary pay records, If yes date and amount of each, and Did this individual receive.

Always be extremely mindful when completing Is there any possibility of your and Did this individual receive, because this is where many people make errors.

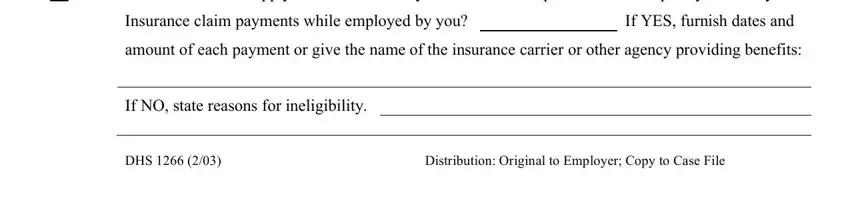

3. Within this part, have a look at Did this individual apply for and, Insurance claim payments while, If YES furnish dates and, amount of each payment or give the, If NO state reasons for, and Distribution Original to Employer. All these are required to be filled out with highest focus on detail.

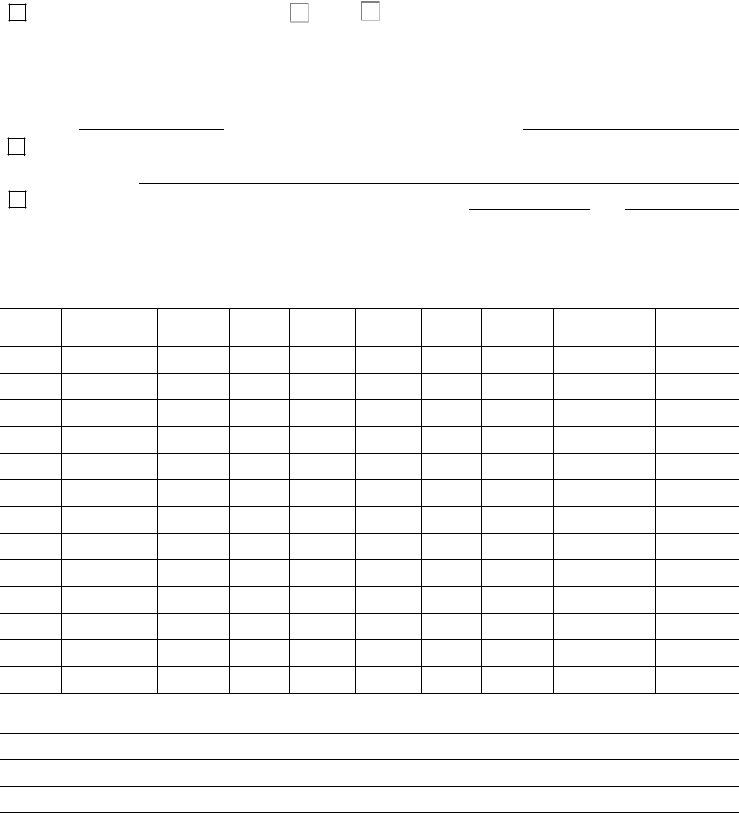

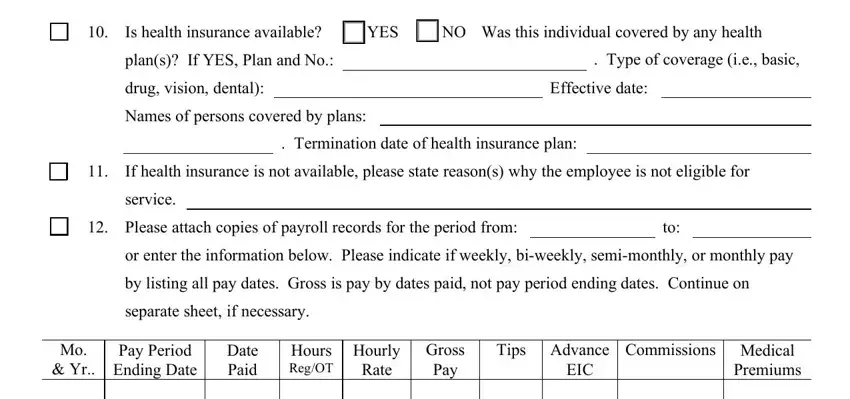

4. To move onward, your next part will require filling out a couple of fields. These include Is health insurance available, YES, NO Was this individual covered by, plans If YES Plan and No, Type of coverage ie basic, drug vision dental, Effective date, Names of persons covered by plans, Termination date of health, If health insurance is not, service, Please attach copies of payroll, or enter the information below, by listing all pay dates Gross is, and separate sheet if necessary, which you'll find fundamental to going forward with this process.

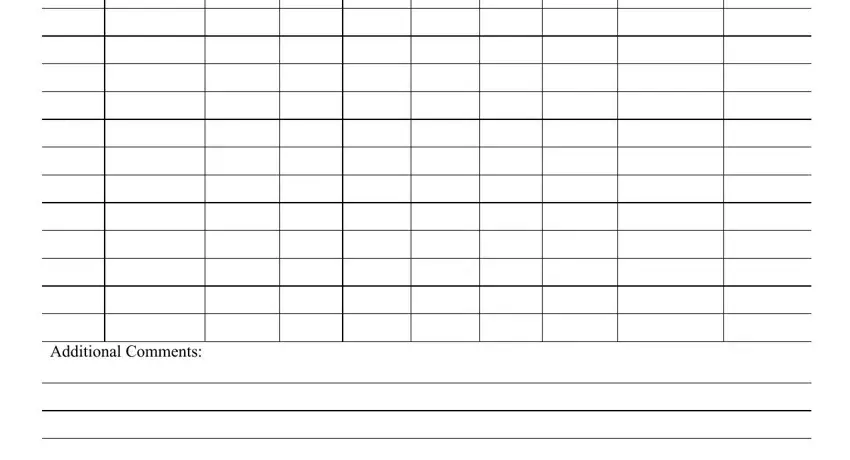

5. To finish your form, the particular subsection has a few additional blanks. Filling in Additional Comments, and I the undersigned certify that the should finalize everything and you can be done in a flash!

Step 3: Make sure that the information is correct and then click "Done" to continue further. Sign up with us right now and instantly get hawaii employment record certification form, prepared for downloading. All changes you make are saved , allowing you to edit the document at a later point when required. At FormsPal, we aim to guarantee that your information is stored protected.