3.3.1 Drop Shipments |

DRAFT |

|

|

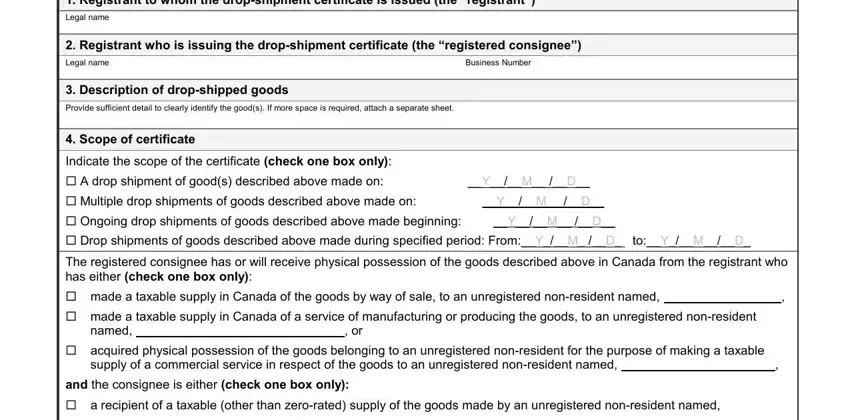

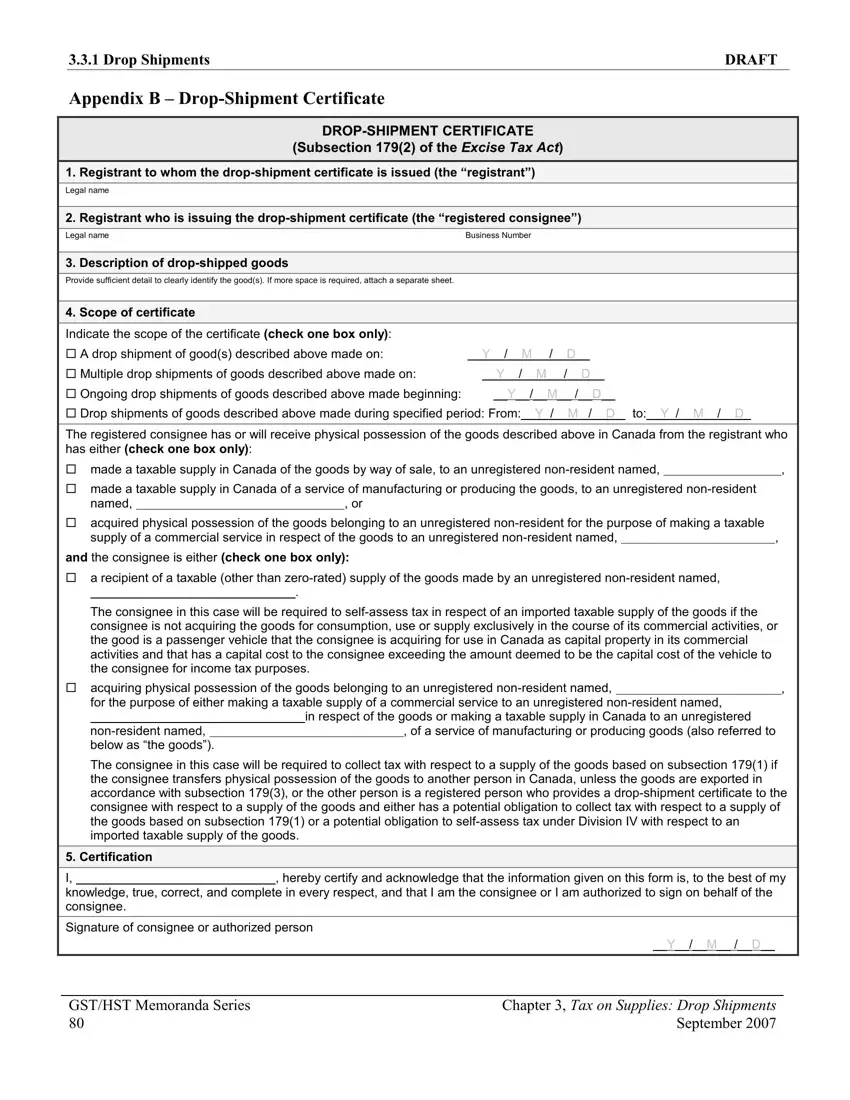

Appendix B – Drop-Shipment Certificate

DROP-SHIPMENT CERTIFICATE

(Subsection 179(2) of the EXCISE TAX ACT)

1. Registrant to whom the drop-shipment certificate is issued (the “registrant”)

Legal name

2. Registrant who is issuing the drop-shipment certificate (the “registered consignee”)

Legal nameBusiness Number

3. |

Description of drop-shipped goods |

|

|

|

|

|

Provide sufficient detail to clearly identify the good(s). If more space is required, attach a separate sheet. |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Scope of certificate |

|

|

|

|

|

Indicate the scope of the certificate (check one box only): |

|

|

|

|

|

|

A drop shipment of good(s) described above made on: |

__Y__/__M__ /__D__ |

|

Multiple drop shipments of goods described above made on: |

__Y__/__M__ /__D__ |

|

|

|

|

|

|

|

|

Ongoing drop shipments of goods described above made beginning: |

|

|

__Y__/__M__ /__D__ |

|

Drop shipments of goods described above made during specified period: From:__Y_/__M_ /__D_ to:__Y_/__M__/__D_

The registered consignee has or will receive physical possession of the goods described above in Canada from the registrant who has either (check one box only):

made a taxable supply in Canada of the goods by way of sale, to an unregistered non-resident named, |

|

, |

|

|

|

|

|

|

made a taxable supply in Canada of a service of manufacturing or producing the goods, to an unregistered non-resident |

|

|

named, |

|

, or |

|

|

acquired physical possession of the goods belonging to an unregistered non-resident for the purpose of making a taxable |

|

|

supply of a commercial service in respect of the goods to an unregistered non-resident named, |

|

, |

|

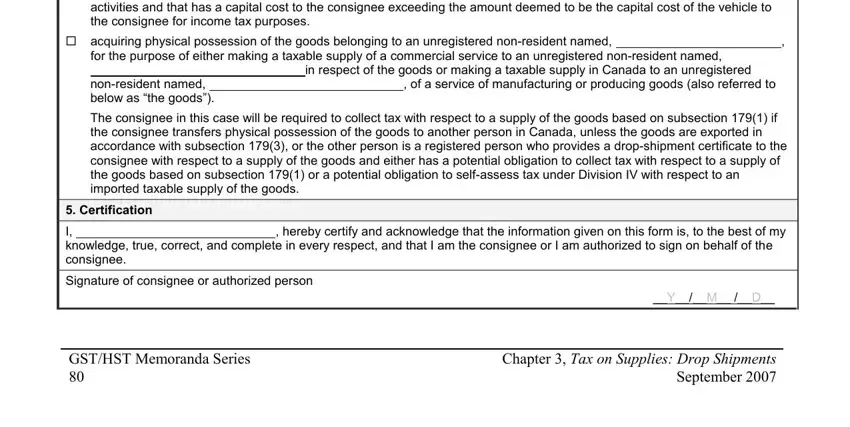

and the consignee is either (check one box only):

arecipient of a taxable (other than zero-rated) supply of the goods made by an unregistered non-resident named,

.

The consignee in this case will be required to self-assess tax in respect of an imported taxable supply of the goods if the consignee is not acquiring the goods for consumption, use or supply exclusively in the course of its commercial activities, or the good is a passenger vehicle that the consignee is acquiring for use in Canada as capital property in its commercial activities and that has a capital cost to the consignee exceeding the amount deemed to be the capital cost of the vehicle to the consignee for income tax purposes.

acquiring physical possession of the goods belonging to an unregistered non-resident named, |

|

, |

for the purpose of either making a taxable supply of a commercial service to an unregistered non-resident named, |

|

|

|

in respect of the goods or making a taxable supply in Canada to an unregistered |

|

non-resident named, |

|

|

, of a service of manufacturing or producing goods (also referred to |

|

below as “the goods”). |

|

|

|

|

The consignee in this case will be required to collect tax with respect to a supply of the goods based on subsection 179(1) if the consignee transfers physical possession of the goods to another person in Canada, unless the goods are exported in accordance with subsection 179(3), or the other person is a registered person who provides a drop-shipment certificate to the consignee with respect to a supply of the goods and either has a potential obligation to collect tax with respect to a supply of the goods based on subsection 179(1) or a potential obligation to self-assess tax under Division IV with respect to an imported taxable supply of the goods.

5. Certification

I,, hereby certify and acknowledge that the information given on this form is, to the best of my

knowledge, true, correct, and complete in every respect, and that I am the consignee or I am authorized to sign on behalf of the consignee.

Signature of consignee or authorized person

|

|

__Y__/__M__ /__D__ |

|

|

|

|

|

|

|

|

|

|

GST/HST Memoranda Series |

Chapter 3, Tax on Supplies: Drop Shipments |

|

|

80 |

September 2007 |

|