Navigating the intricacies of filing annual income tax returns requires thorough preparation and precision, a process made smoother for taxpayers through the use of the eBIRForms Package. This system is designed to facilitate the electronic submission of BIR Form No. 1702 - RT, among others, making it imperative for users to first establish a User Profile. Required details such as the taxpayer's 9-digit Tax Identification Number (TIN), the Regional District Office (RDO) Code, and specifics regarding their line of business as per their Certificate of Registration (BIR Form 2303) must be entered accurately. Additionally, contact information including the registered name, address, zip code, and contact number are essential for completing the User Profile. After this, taxpayers can navigate through the list of available BIR forms, select the appropriate one for their needs, and proceed to fill it out with the required financial information, indicating the type of return, any overpayments, and the applicable method of deduction. Detailed guidelines on filling out the tax return, from specifying the tax year to the complexities of Schedules 1 and 2 – Sales/Revenues/Receipts/Fees, and Cost of Sales, respectively – underline the meticulous attention to detail necessary for compliance with the Bureau of Internal Revenue's requirements. This digital approach not only streamlines the filing process but also ensures accuracy and efficiency in meeting tax obligations.

| Question | Answer |

|---|---|

| Form Name | Ebirforms Package Form |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | ebirform, ebir forms download, ebirforms, ebir form download |

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

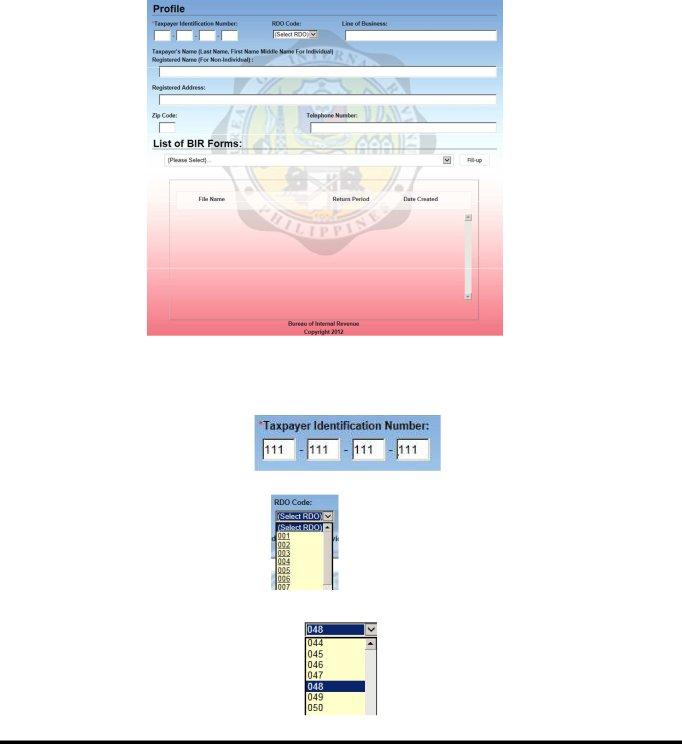

Before an Offline eBIR Form can be filled up, User has to create a User Profile.

1)User can proceed to the Offline eBIRForms Profile Page.

2)Upon display of Profile Page, type in the 9 digits series Tax Identification Number (TIN) on the boxes provided.

3)Find the appropriate RDO Code from the RDO Code dropdown list.

4)Click the selected code to allow system to include it in information file.

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

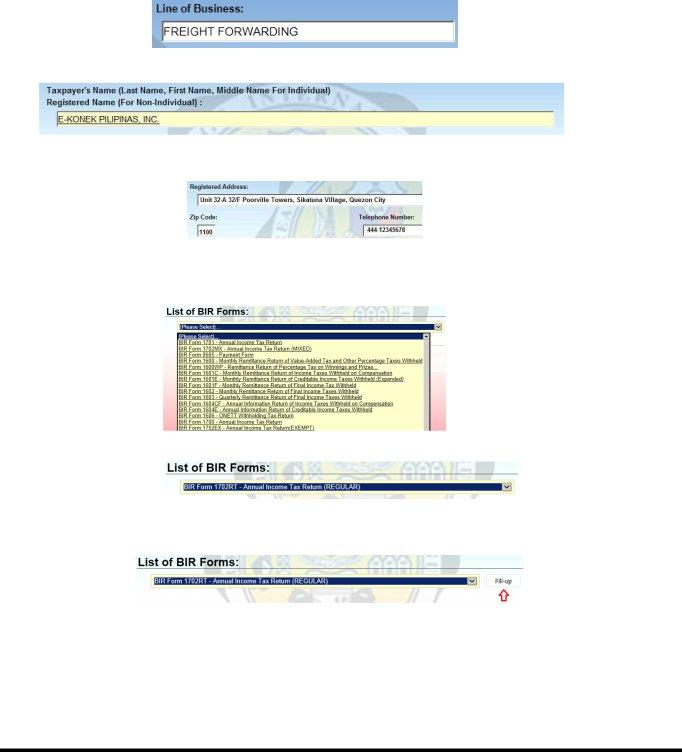

5)Type in the specific Line of Business based on the Certificate of Registration (BIR Form 2303)

6)Enter Registered Name

7)Type in the Registered Address, Zip Code and Contact Number.

8)On the eBIRForms screen, proceed to List of BIR Forms row.

9)From the List of BIR Forms row, find the appropriate form to use

10)Click on the preferred form to use

11)When the chosen form appears on the list box, click the

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

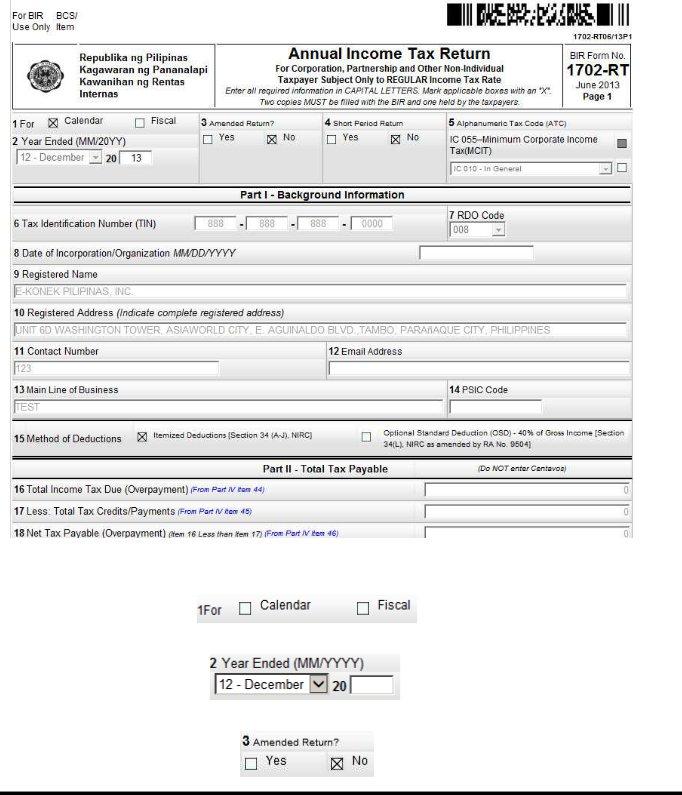

12)System will now display full image of the chosen BIR form.

13)In filling up the whole form, proceed to Field No. 1 to click the appropriate year for the tax return

14)Go to Field No. 2 and fill up specific Month and Year Ended

15)Go to Field No. 3 and check if form to file is Amended Return or not

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

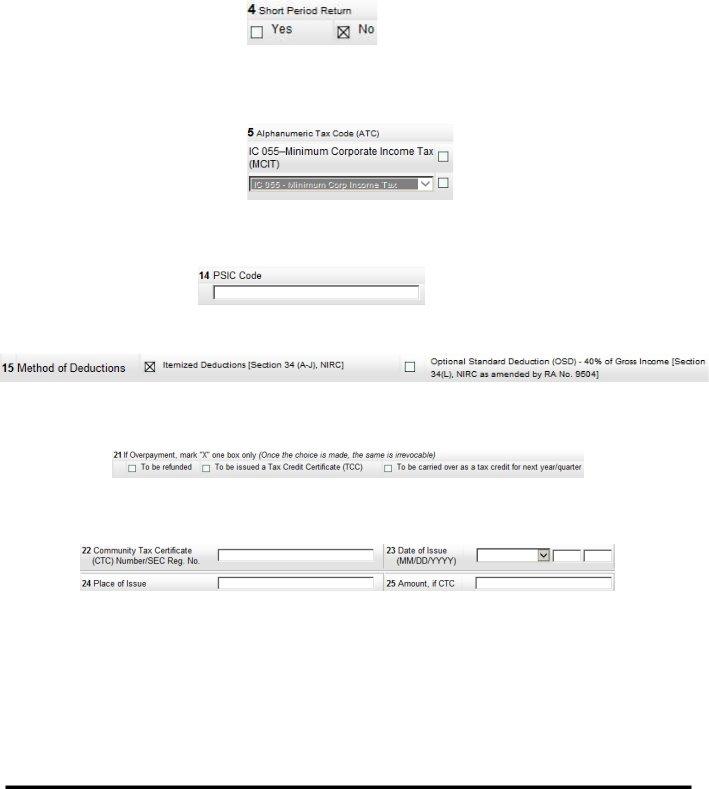

16)Proceed to Field No. 4 to select if form to file is Short Period Return or not

17)Go to Field No. 5 to determine specific type of Alphanumeric Tax Code (ATC)

18)Proceed to Field No. 14 and type in the PSIC Code, refer to your Certificate of Registration (BIR Form 2303) or www.bir.gov.ph

19)For Field No. 15, check appropriate box for Method of Deductions

20)If there is an Overpayment, proceed to Field No. 21 and check appropriate box for action to be done for the overpayment

21)Provide the necessary details to validate identity of Tax Filer on Field Nos. 22 to 25

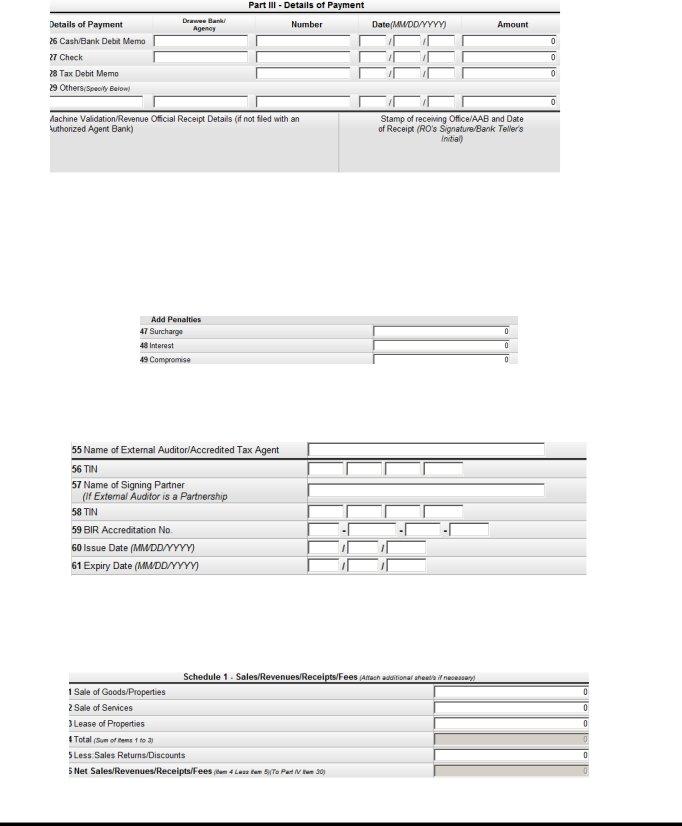

22)Enter necessary Details of Payment on Field Nos. 26 to 29

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

23)Click the Next button to proceed to adjoining page

24)Proceed to Field Nos. 47 to 49 of the Part IV Computation of Tax – Add Penalties and fill out details, if applicable

25)Fill out details Field Nos. 55 to 61 for Part V Tax Relief Availment, if applicable

26)Click the Next button to proceed to adjoining page

27)Fill out details on Schedule 1 – Sales/Revenues/Receipts/Fees, if applicable

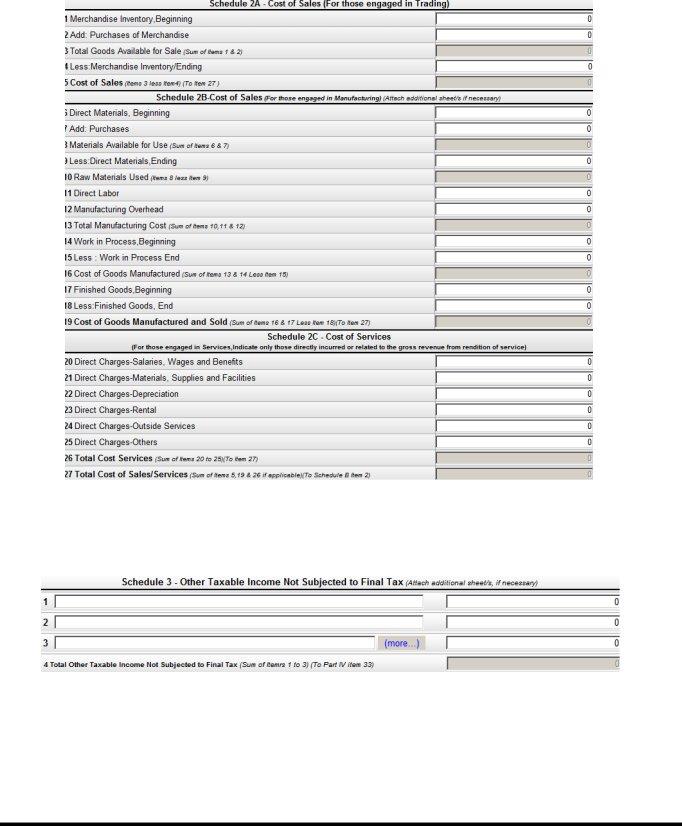

28) Fill out details on Schedule 2 – Cost of Sales, if applicable

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

29)Click the Next button to proceed to adjoining page

30)Fill out details on Schedule 3 – Other Taxable Income not Subjected to Final Tax, if applicable

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

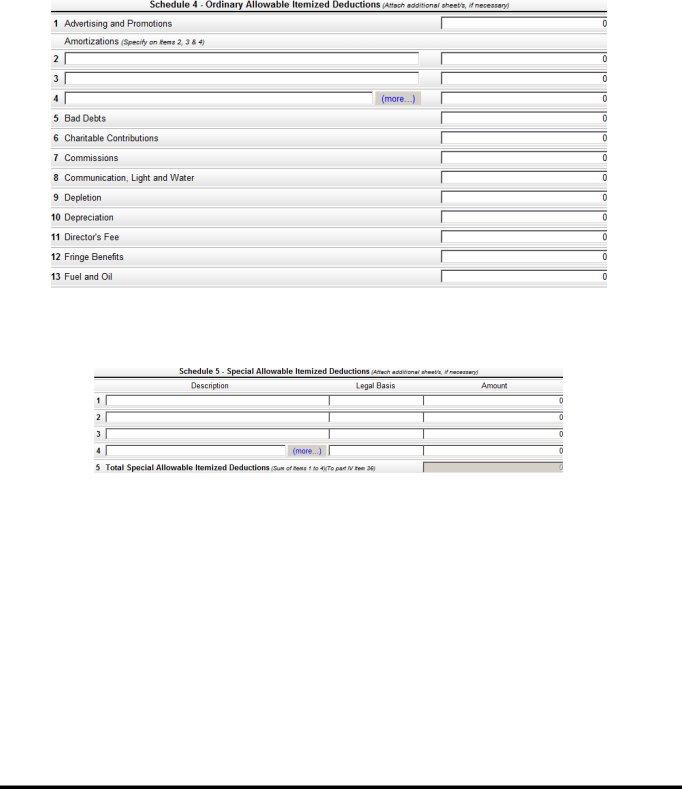

31)Fill out details on Schedule 4 – Ordinary Allowable Itemized Deductions, if applicable

32)Click the Next button to proceed to adjoining page

33)Fill out details on Schedule 5 – Special Allowable Itemized Deductions, if applicable

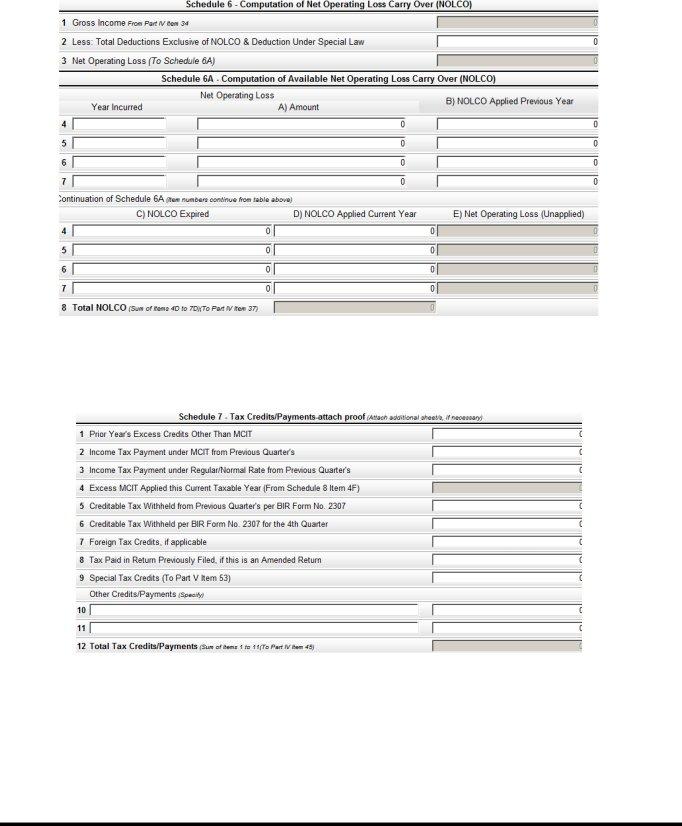

34)Fill out details on Schedule 6 – Computation of Available Net Operating Loss Carry Over (NOLCO), if applicable

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

35)Click the Next button to proceed to adjoining page

36)Fill out details on Schedule 7 – Tax Credits/Payments, if applicable

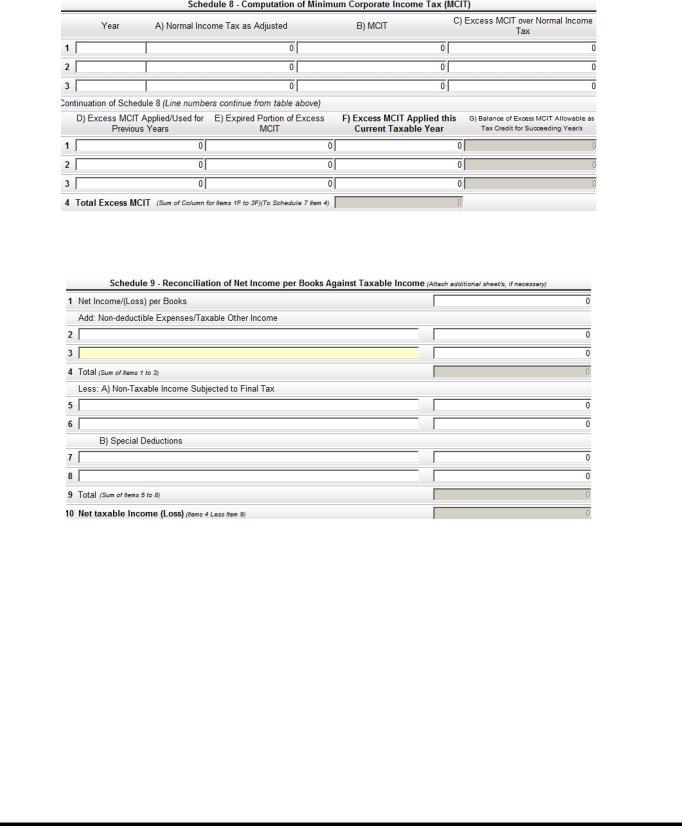

37)Fill out details on Schedule 8 – Computation of Minimum Corporate Income Tax (MCIT), if applicable

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

38)Fill out details on Schedule 9 – Reconciliation of Net Income per Books against Taxable Income

39) Click the Next button to proceed to adjoining page

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

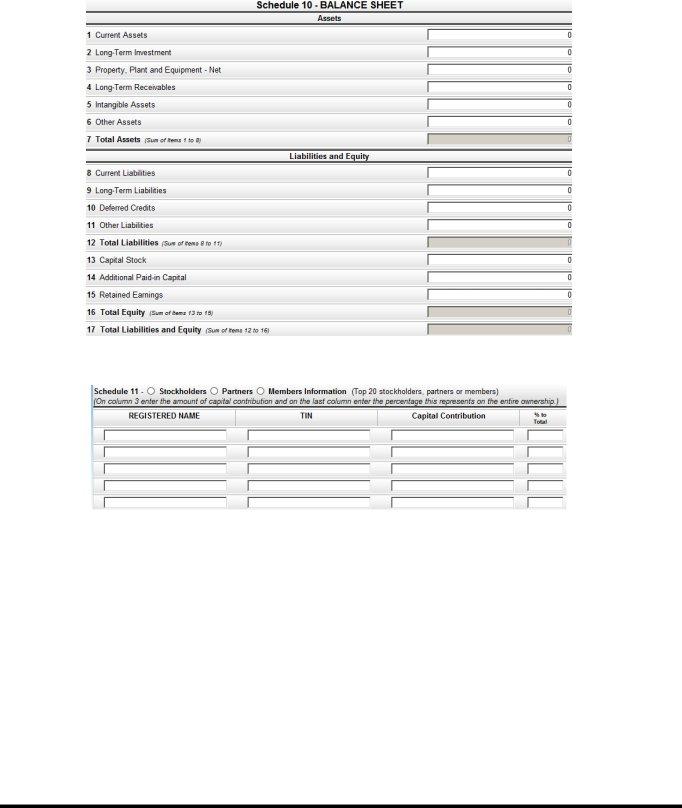

40)Fill out details on Schedule 10 – Balance Sheet

41)Fill out details on Schedule 11 – Stockholders/Members Information

42) Click the Next button to proceed to adjoining page

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

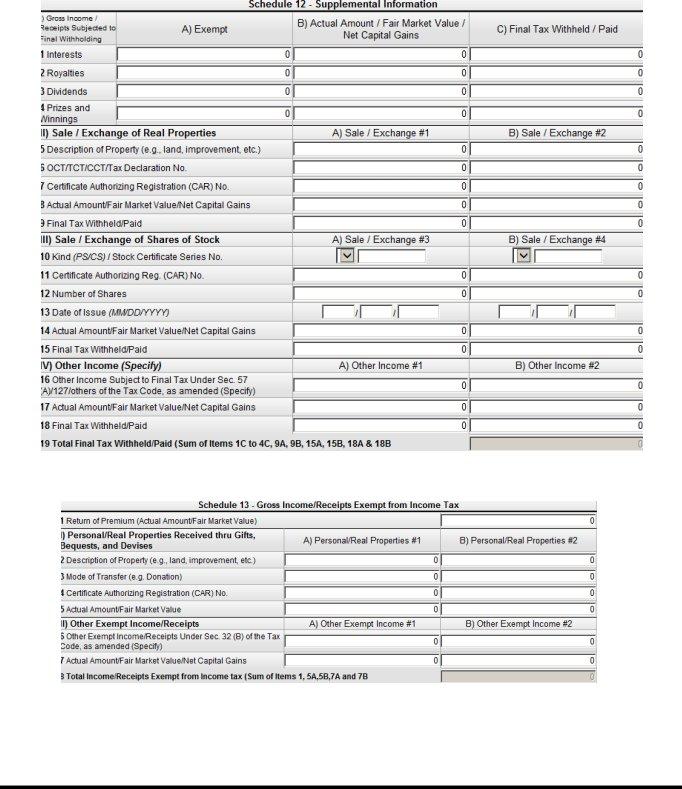

43)Fill out details on Schedule 12 – Supplemental Information, if applicable

44)Fill out details on Schedule 13 – Gross Income/Receipts Exempt from Income Tax, if applicable

Job Aid |

|

BIR Form No. 1702 - RT (Annual Income Tax Return) |

|

45) When filling up of document has been completed, click the Validate

button to allow system to determine if there are fields which have been overlooked and not filled properly

46)Once validation has been completed, click the Edit button to go over each field to check for correctness of data typed in.

47)After editing, User can let the files typed in be stored into the system by

clicking the Save button

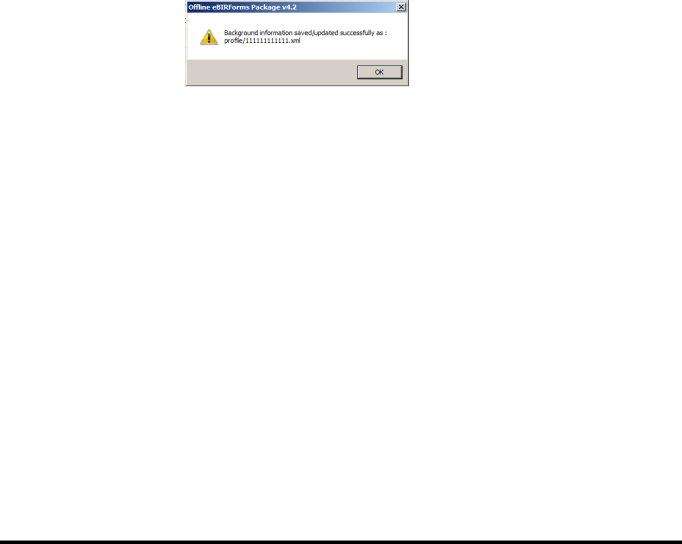

48)System will show a message stating that all information typed in the fields have been successfully saved.

49)Click the OK button to acknowledge receipt of the message.

50)User can submit online the duly filled up document by clicking the Submit

button. NOTE: This functionality shall be available on the next release.

51)If User wishes to have a copy of the duly filled form, the Print button to enable printing of a specific page.