You can fill out fo1 form effectively in our online PDF editor. Our expert team is continuously working to expand the tool and insure that it is much easier for people with its cutting-edge features. Unlock an ceaselessly progressive experience now - explore and find out new opportunities along the way! Getting underway is simple! Everything you need to do is follow the next simple steps directly below:

Step 1: Click the "Get Form" button at the top of this page to access our PDF editor.

Step 2: Using our advanced PDF tool, it is possible to accomplish more than merely complete blank form fields. Edit away and make your docs seem perfect with customized textual content added, or adjust the file's original content to perfection - all comes along with the capability to incorporate almost any images and sign it off.

Completing this PDF typically requires attention to detail. Make certain all required areas are completed accurately.

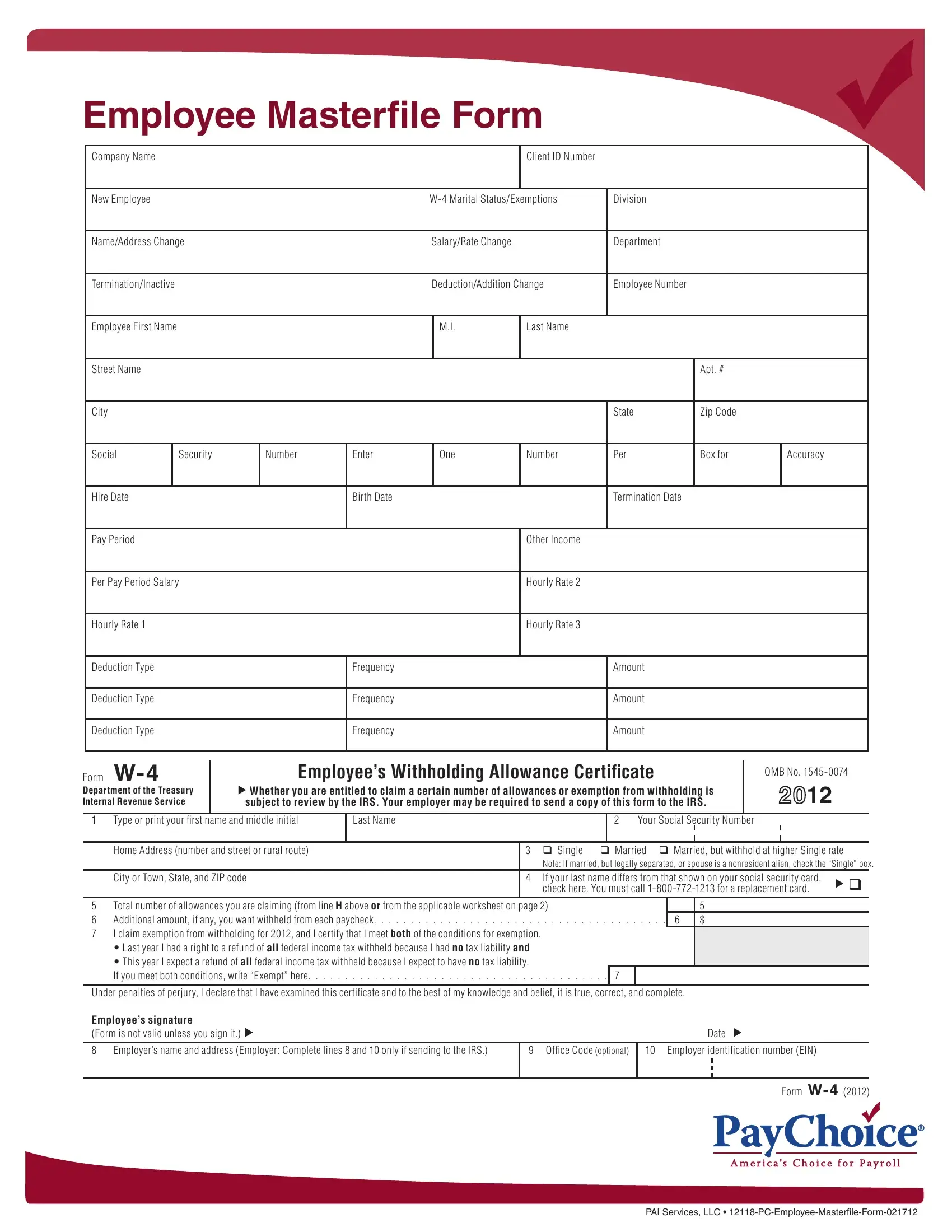

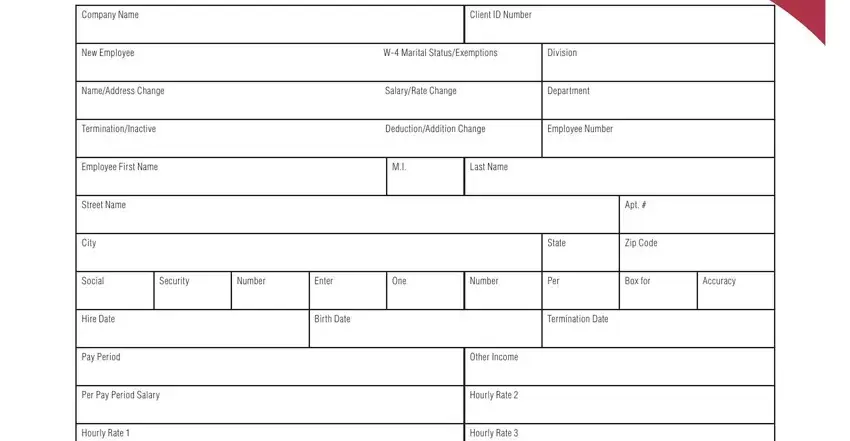

1. First of all, when filling out the fo1 form, start in the part that contains the next fields:

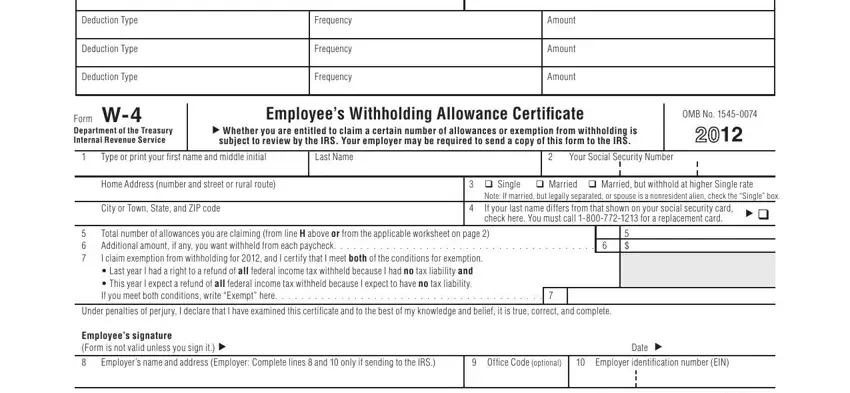

2. Once your current task is complete, take the next step – fill out all of these fields - Deduction Type, Deduction Type, Deduction Type, Frequency, Frequency, Frequency, Amount, Amount, Amount, Form W, Department of the Treasury, Employees Withholding Allowance, Whether you are entitled to claim, subject to review by the IRS Your, and OMB No with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to make a mistake when filling in the Form W, and so ensure that you reread it before you submit it.

Step 3: After you've reviewed the information in the fields, click "Done" to conclude your form at FormsPal. Sign up with FormsPal right now and immediately use fo1 form, available for download. All alterations made by you are saved , so that you can customize the document further as needed. FormsPal ensures your information privacy via a secure method that never saves or distributes any personal data typed in. Rest assured knowing your files are kept protected each time you use our service!