You may work with indiana entity annual report form e 1 effectively with the help of our PDFinity® editor. FormsPal team is devoted to providing you the perfect experience with our tool by continuously introducing new features and improvements. With these improvements, working with our tool gets better than ever before! With some simple steps, you'll be able to start your PDF editing:

Step 1: Access the PDF file in our tool by clicking on the "Get Form Button" at the top of this page.

Step 2: This tool helps you customize nearly all PDF files in a variety of ways. Change it by including any text, adjust original content, and add a signature - all when you need it!

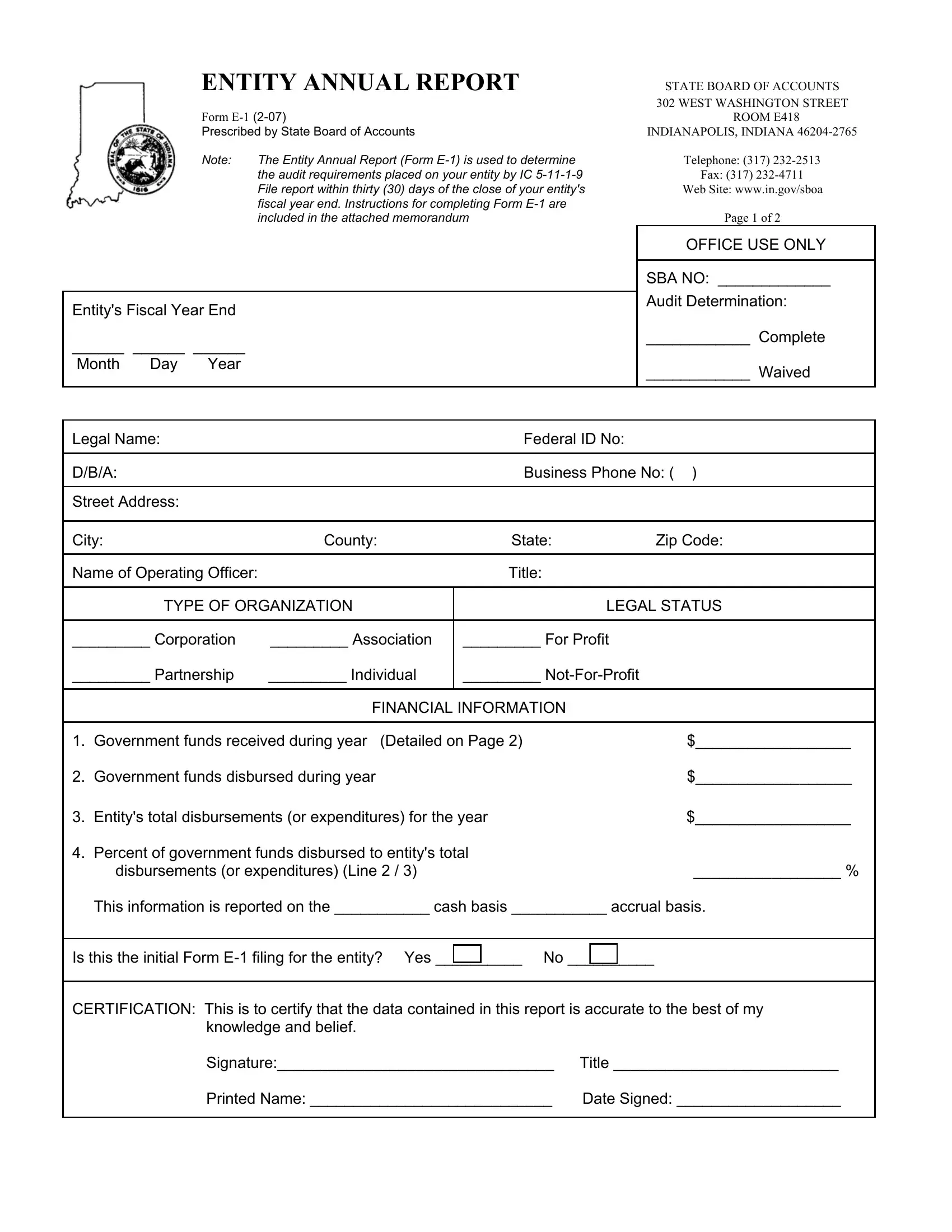

This document requires particular info to be filled in, therefore you should take whatever time to enter exactly what is asked:

1. It's vital to complete the indiana entity annual report form e 1 properly, hence be attentive while filling out the areas that contain these particular blanks:

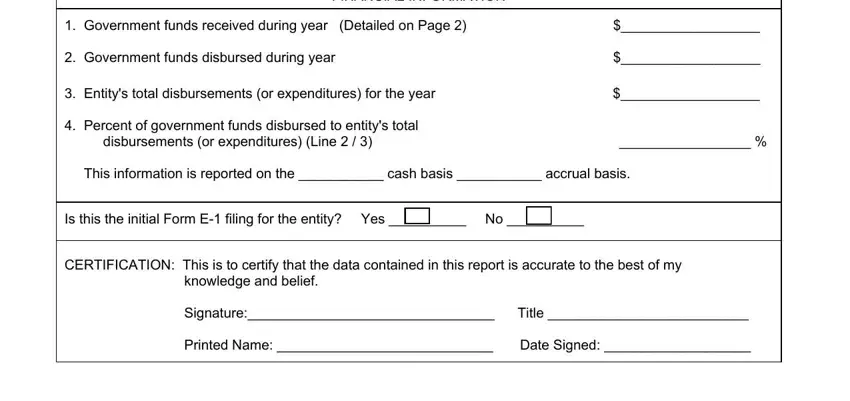

2. Once your current task is complete, take the next step – fill out all of these fields - FINANCIAL INFORMATION, Government funds received during, and CERTIFICATION This is to certify with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

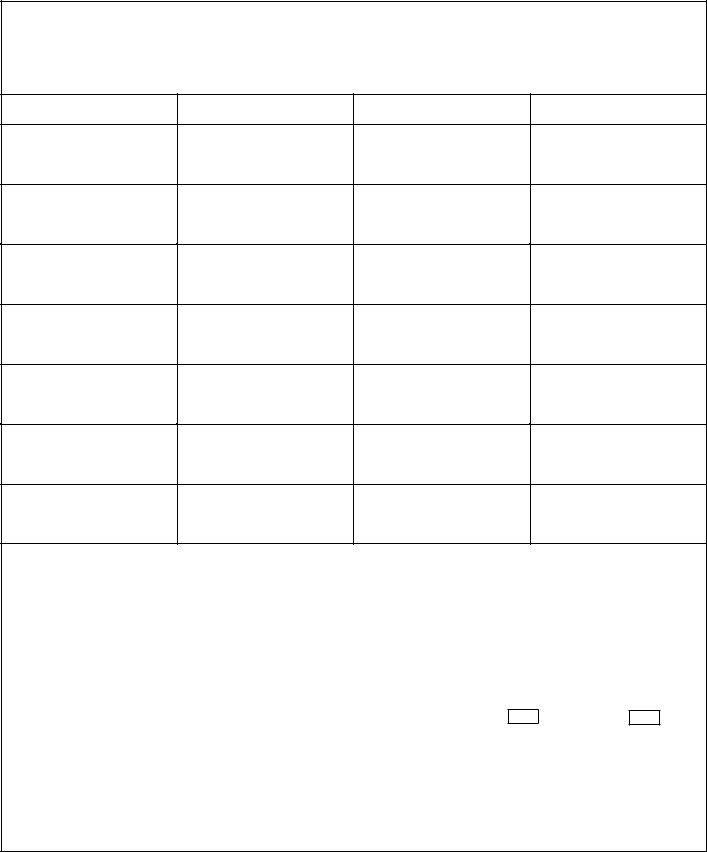

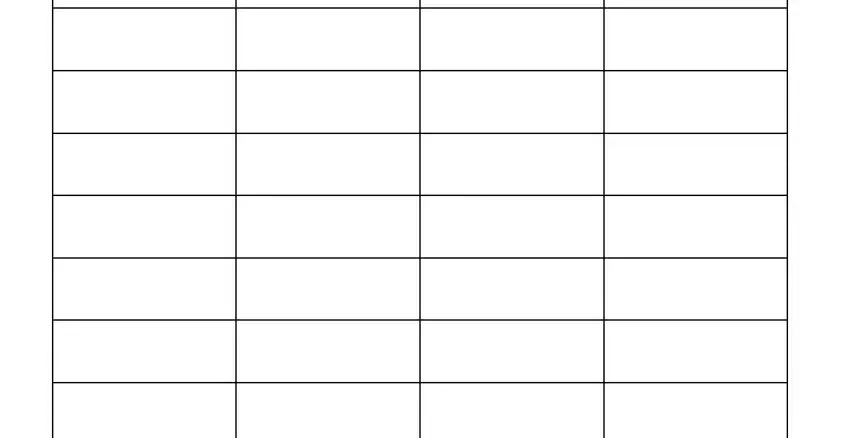

3. This third segment is considered pretty easy, GOVERNMENT AGENCY, ADDRESS, PROGRAM TITLE, and AMOUNT RECEIVED - every one of these empty fields needs to be filled out here.

Always be really attentive while completing ADDRESS and AMOUNT RECEIVED, as this is the section in which most people make mistakes.

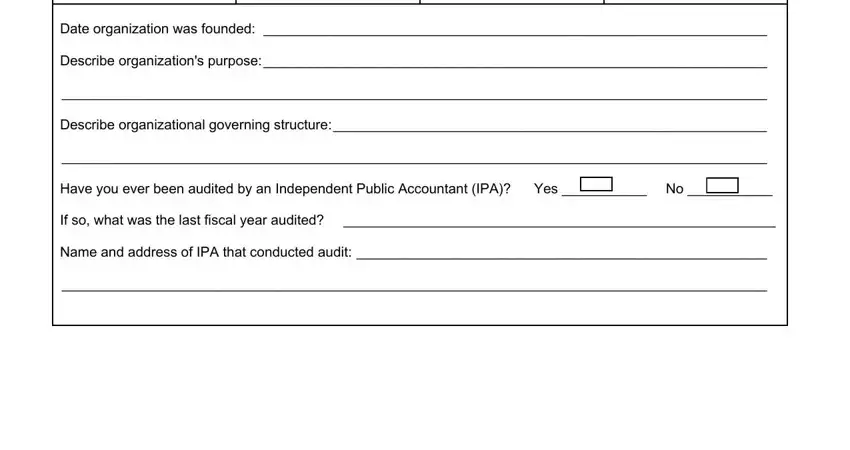

4. It's time to fill out the next segment! Here you will get all of these Date organization was founded empty form fields to complete.

Step 3: Soon after taking another look at your fields you have filled in, hit "Done" and you are all set! After setting up afree trial account here, you will be able to download indiana entity annual report form e 1 or email it promptly. The PDF file will also be accessible via your personal account menu with your every modification. We don't share any details you provide when filling out documents at our site.