Form Fae 170 can be filled in without any problem. Just make use of FormsPal PDF editor to complete the job right away. Our development team is continuously endeavoring to develop the tool and enable it to be much faster for clients with its cutting-edge functions. Discover an endlessly progressive experience now - check out and find out new possibilities along the way! With just a few easy steps, you may start your PDF journey:

Step 1: Access the form inside our tool by hitting the "Get Form Button" in the top area of this page.

Step 2: After you access the tool, you'll notice the document prepared to be completed. Besides filling out different fields, you can also perform various other actions with the PDF, particularly putting on any text, modifying the original textual content, adding images, affixing your signature to the form, and more.

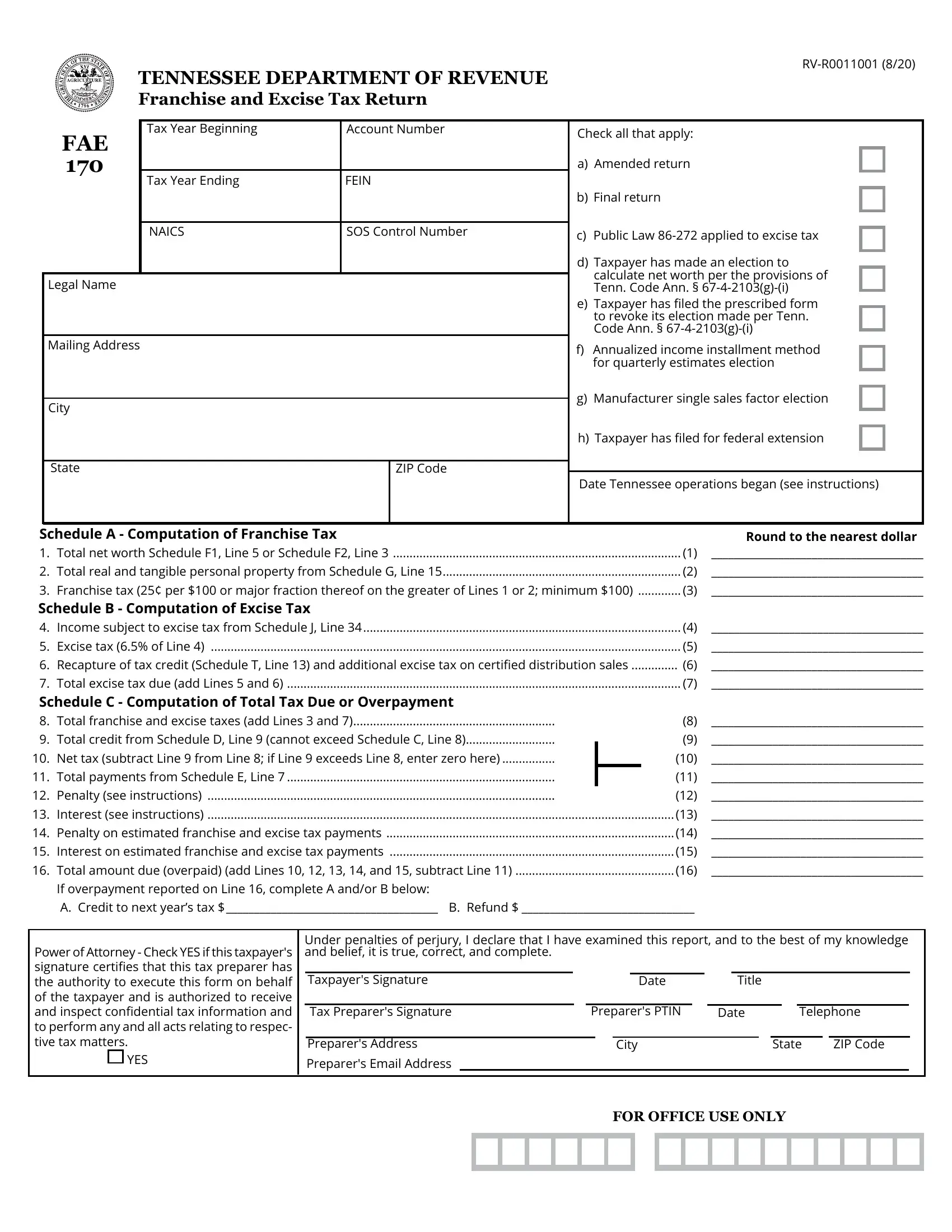

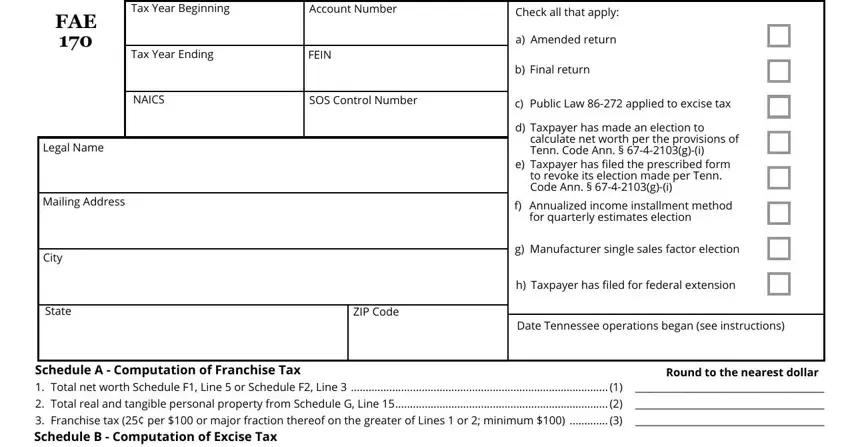

This PDF form requires particular data to be typed in, thus be sure to take some time to type in precisely what is required:

1. Whenever filling out the Form Fae 170, be certain to include all of the essential fields within its relevant part. This will help expedite the work, making it possible for your information to be handled efficiently and correctly.

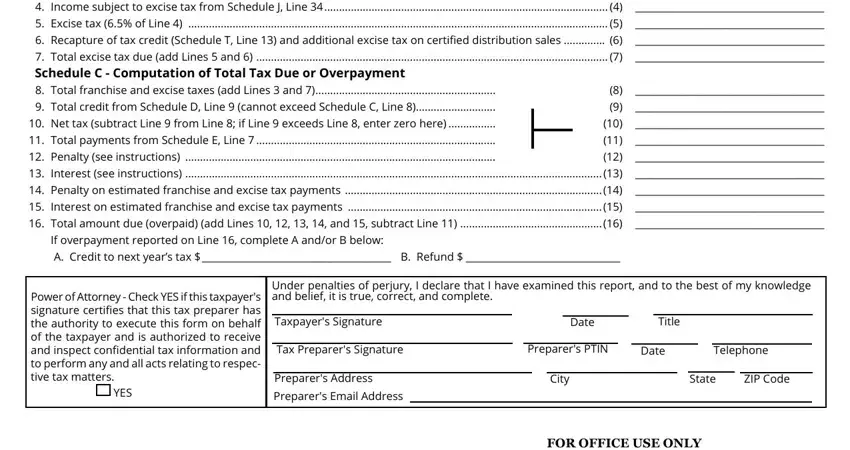

2. Soon after filling out the previous part, go on to the next step and fill in all required particulars in all these blank fields - Schedule A Computation of, If overpayment reported on Line, Power of Attorney Check YES if, YES, Under penalties of perjury I, Taxpayers Signature, Date, Title, Tax Preparers Signature, Preparers PTIN, Date, Telephone, Preparers Address, Preparers Email Address, and City.

3. Completing FOR OFFICE USE ONLY is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

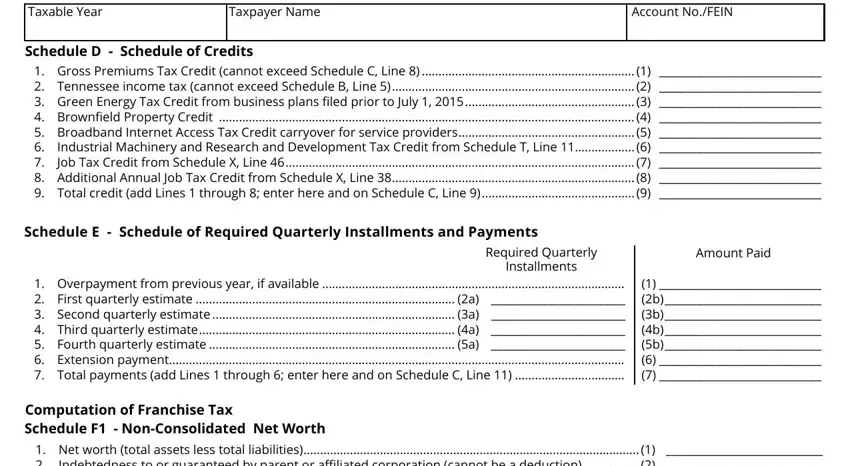

4. The next paragraph requires your information in the following areas: Taxable Year, Taxpayer Name, Account NoFEIN, Schedule D Schedule of Credits, Schedule E Schedule of Required, Overpayment from previous year if, b b b b, Required Quarterly, Installments, Amount Paid, Computation of Franchise Tax, and Net worth total assets less total. Just remember to provide all needed info to move forward.

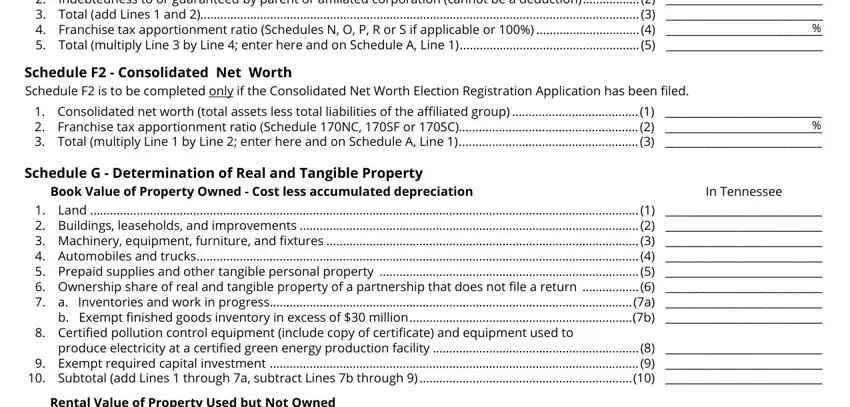

5. This last section to submit this PDF form is crucial. Make certain you fill out the necessary fields, particularly Net worth total assets less total, Schedule F Consolidated Net Worth, Schedule G Determination of Real, Book Value of Property Owned Cost, In Tennessee, Land Buildings leaseholds and, and Rental Value of Property Used but, before submitting. Otherwise, it could generate an incomplete and probably unacceptable paper!

People who use this PDF often make some mistakes when filling out Land Buildings leaseholds and in this part. Remember to read twice what you enter right here.

Step 3: Just after going through the form fields, press "Done" and you're good to go! Join FormsPal right now and easily use Form Fae 170, set for downloading. All changes made by you are kept , letting you edit the pdf later on when necessary. FormsPal provides risk-free form completion with no personal information record-keeping or distributing. Feel safe knowing that your information is secure here!