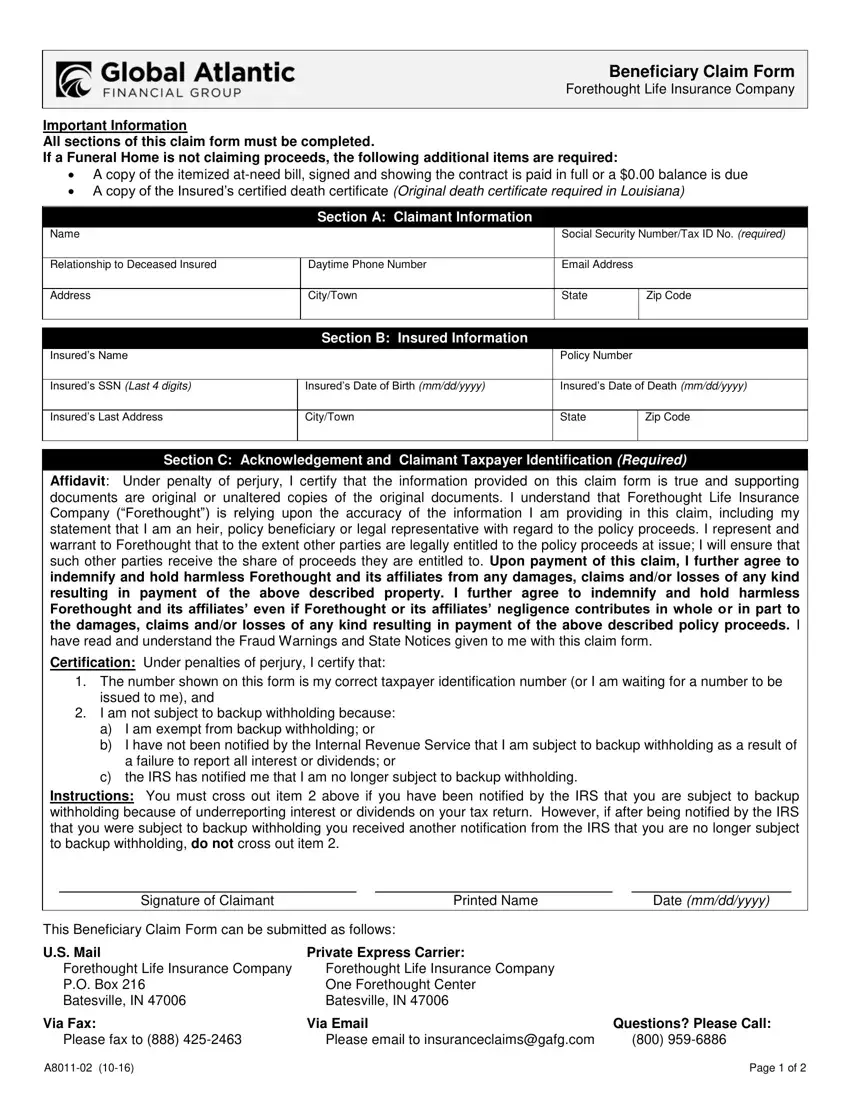

Beneficiary Claim Form

Forethought Life Insurance Company

Important Information

All sections of this claim form must be completed.

If a Funeral Home is not claiming proceeds, the following additional items are required:

A copy of the itemized at-need bill, signed and showing the contract is paid in full or a $0.00 balance is due

A copy of the Insured’s certified death certificate (Original death certificate required in Louisiana)

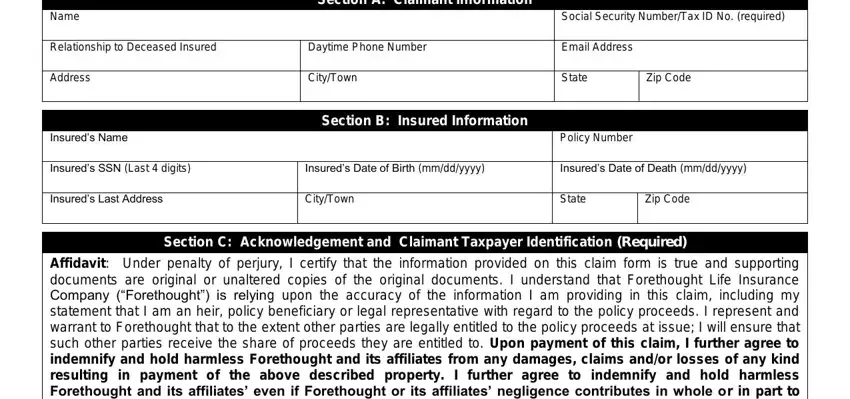

Section A: Claimant Information

Name |

|

Social Security Number/Tax ID No. (required) |

|

|

|

|

Relationship to Deceased Insured |

Daytime Phone Number |

Email Address |

|

|

|

|

|

Address |

City/Town |

State |

Zip Code |

|

|

|

|

Section B: Insured Information

Insured’s Name |

|

Policy Number |

|

|

|

|

|

Insured’s SSN (Last 4 digits) |

Insured’s Date of Birth (mm/dd/yyyy) |

Insured’s Date of Death (mm/dd/yyyy) |

|

|

|

|

Insured’s Last Address |

City/Town |

State |

Zip Code |

|

|

|

|

Section C: Acknowledgement and Claimant Taxpayer Identification (Required)

Affidavit: Under penalty of perjury, I certify that the information provided on this claim form is true and supporting documents are original or unaltered copies of the original documents. I understand that Forethought Life Insurance Company (“Forethought”) is relying upon the accuracy of the information I am providing in this claim, including my statement that I am an heir, policy beneficiary or legal representative with regard to the policy proceeds. I represent and warrant to Forethought that to the extent other parties are legally entitled to the policy proceeds at issue; I will ensure that such other parties receive the share of proceeds they are entitled to. Upon payment of this claim, I further agree to indemnify and hold harmless Forethought and its affiliates from any damages, claims and/or losses of any kind resulting in payment of the above described property. I further agree to indemnify and hold harmless Forethought and its affiliates’ even if Forethought or its affiliates’ negligence contributes in whole or in part to the damages, claims and/or losses of any kind resulting in payment of the above described policy proceeds. I have read and understand the Fraud Warnings and State Notices given to me with this claim form.

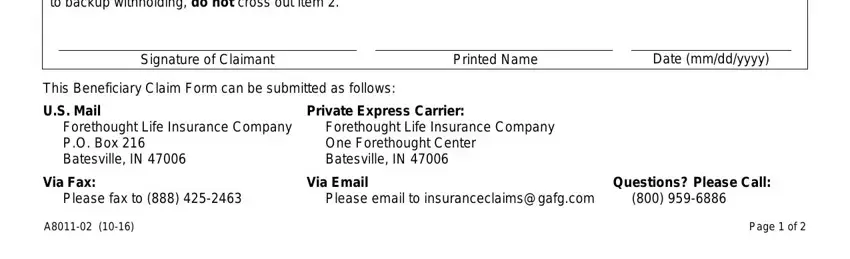

Certification: Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2.I am not subject to backup withholding because:

a)I am exempt from backup withholding; or

b)I have not been notified by the Internal Revenue Service that I am subject to backup withholding as a result of a failure to report all interest or dividends; or

c)the IRS has notified me that I am no longer subject to backup withholding.

Instructions: You must cross out item 2 above if you have been notified by the IRS that you are subject to backup withholding because of underreporting interest or dividends on your tax return. However, if after being notified by the IRS that you were subject to backup withholding you received another notification from the IRS that you are no longer subject to backup withholding, do not cross out item 2.

Signature of Claimant |

|

Printed Name |

|

Date (mm/dd/yyyy) |

This Beneficiary Claim Form can be submitted as follows:

U.S. Mail |

Private Express Carrier: |

Forethought Life Insurance Company |

Forethought Life Insurance Company |

P.O. Box 216 |

One Forethought Center |

Batesville, IN 47006 |

Batesville, IN 47006 |

Via Fax: |

Via Email |

Questions? Please Call: |

Please fax to (888) 425-2463 |

Please email to insuranceclaims@gafg.com |

(800) 959-6886 |

A8011-02 (10-16) |

Page 1 of 2 |

Beneficiary Claim Form

Forethought Life Insurance Company

Fraud Warnings & State Notices

California Residents – Reg. 789.8

The sale or liquidation of any asset in order to buy insurance, either life insurance or an annuity contract, may have tax consequences. Terminating any life insurance policy or annuity contract may have early withdrawal penalties or other costs or penalties, as well as tax consequences. You may wish to consult independent legal or financial advice before the sale or liquidation of any asset and before the purchase of any life insurance or annuity contract.

Colorado Residents

It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of any insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Department of Regulatory Agencies.

District of Columbia Residents

Warning: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant.

Hawaii, North Dakota, Pennsylvania Residents

Any person who knowingly and with intent to injure, defraud or deceive any insurance company, submits an application for insurance containing any materially false, incomplete, or misleading information, or conceals for the purpose of misleading, any material fact, is guilty of insurance fraud, which is a crime and in certain states, a felony. Penalties may include imprisonment, fine, denial of benefits, or civil damages.

Kansas Residents

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance may be guilty of insurance fraud as determined by a court of law and may be subject to fines and confinement in prison

Kentucky Residents

Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Maine and Tennessee Residents

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Massachusetts, New Mexico, Louisiana and Rhode Island Residents

Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

New Jersey Residents

Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

Virginia Residents

Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may have violated the state law.

All Other States

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

A8011-02 (10-16) |

Page 2 of 2 |