The PDF editor helps make creating forms stress-free. It is really an easy task to update the [FORMNAME] file. Keep up with the following steps in an attempt to achieve this:

Step 1: This web page has an orange button that says "Get Form Now". Merely click it.

Step 2: After you have entered the editing page 17138N, you will be able to see each of the actions available for your file inside the top menu.

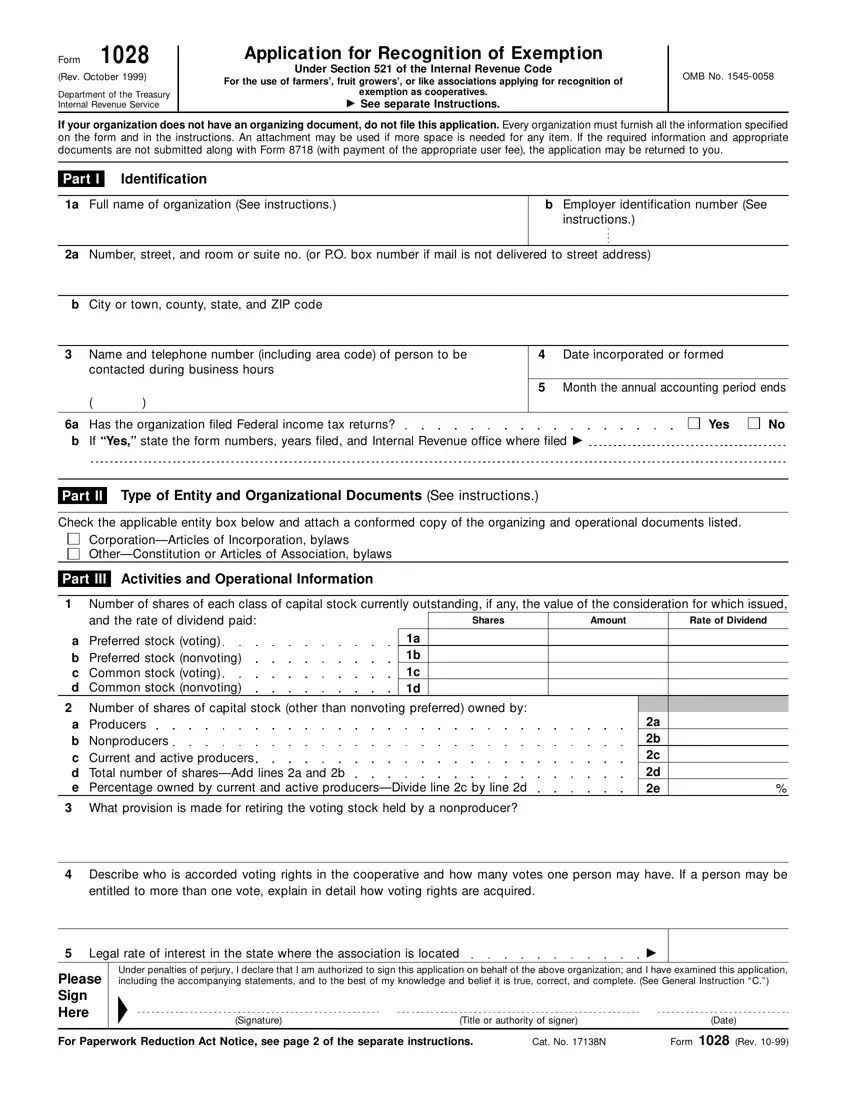

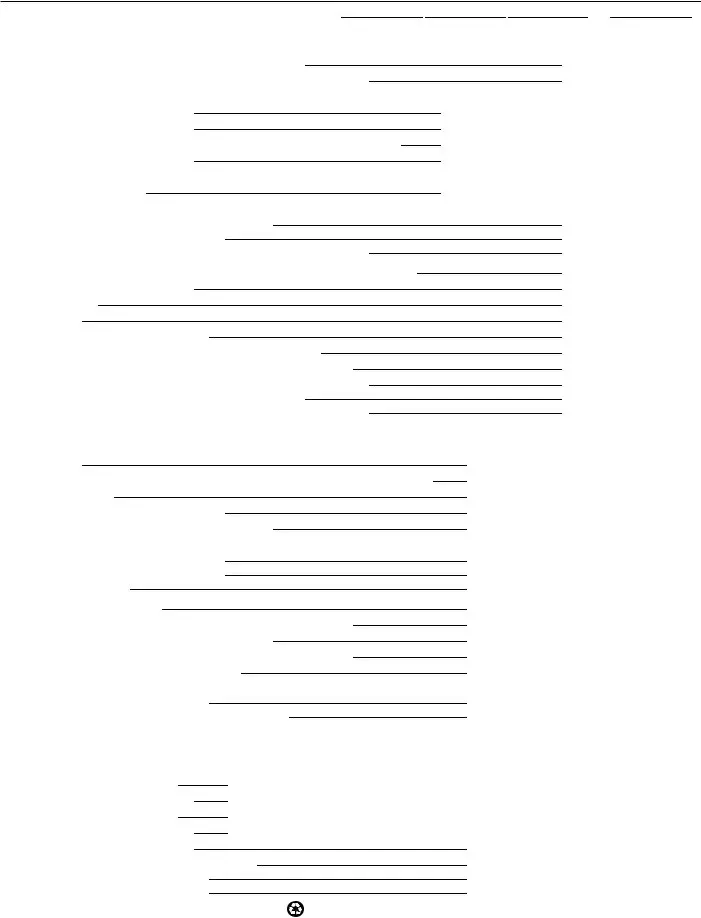

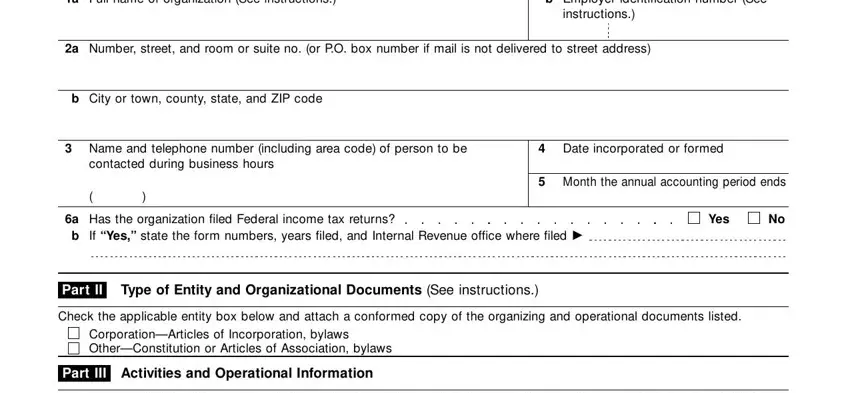

Create the 17138N PDF and enter the details for each part:

Include the expected information in the a b c d, a b c d e, Number of shares of each class of, Rate of Dividend, Amount, Shares, Preferred stock voting Preferred, a b c d, Number of shares of capital stock, a b c d e, What provision is made for, Describe who is accorded voting, entitled to more than one vote, Legal rate of interest in the, and cid area.

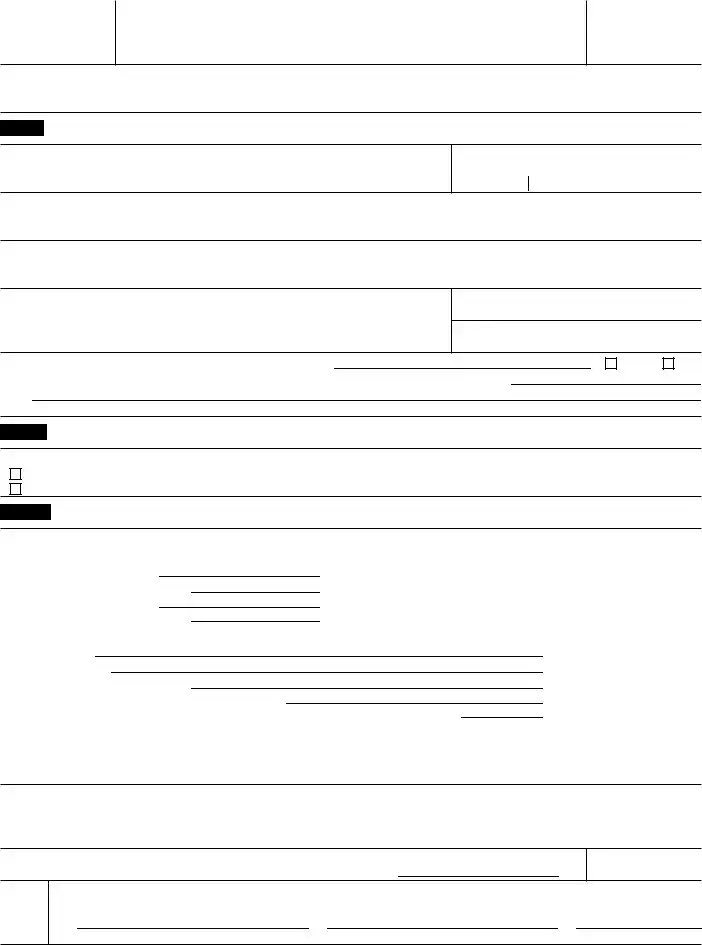

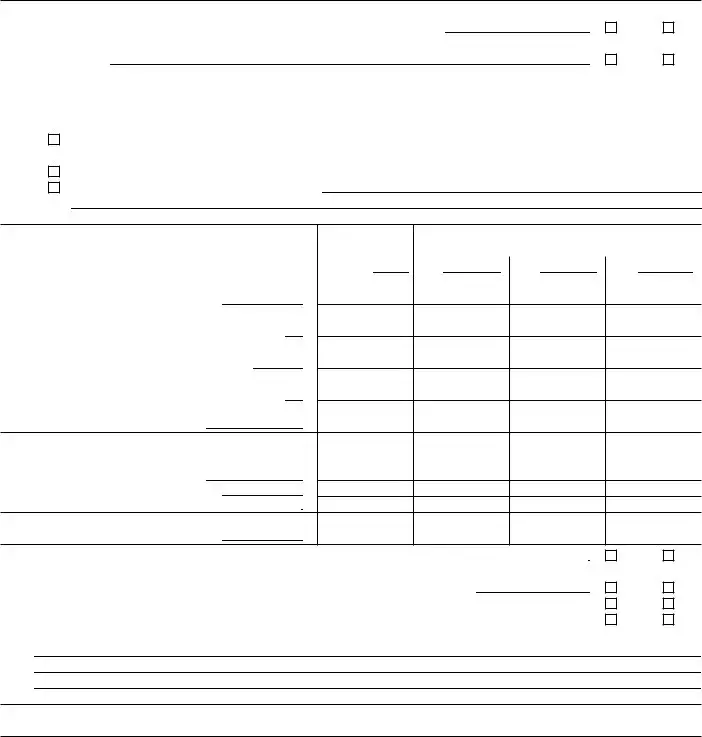

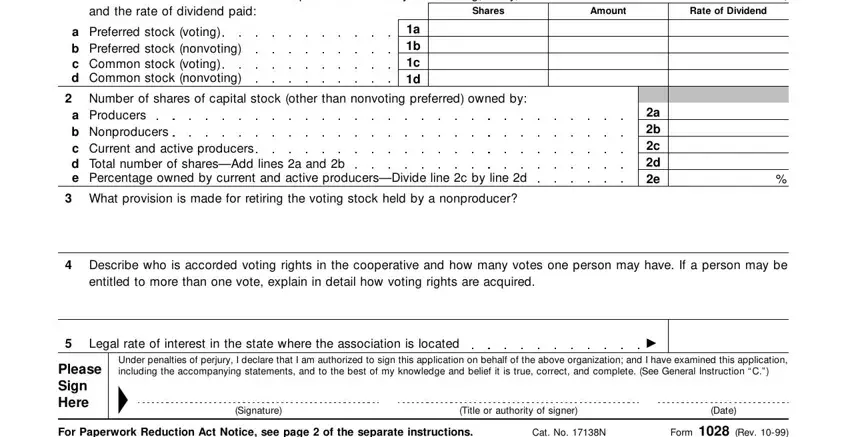

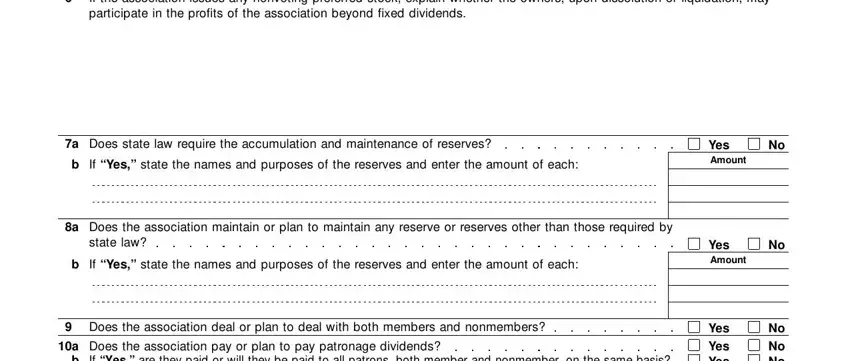

You'll need to give some data in the box If the association issues any, Does state law require the, If Yes state the names and, Yes Amount, a Does the association maintain or, state law, If Yes state the names and, Does the association deal or plan, a Does the association pay or plan, If Yes are they paid or will they, Yes Amount, Yes Yes Yes, and No No No.

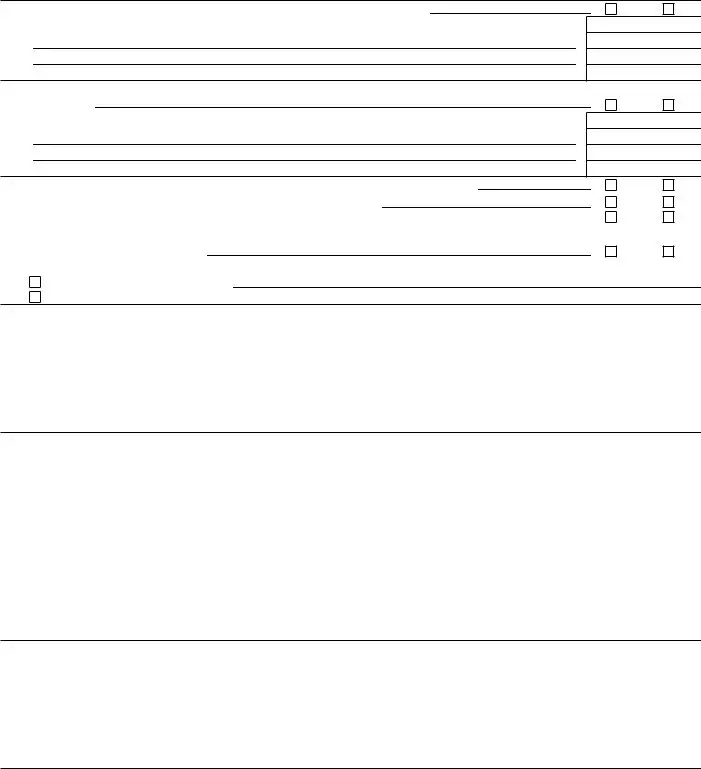

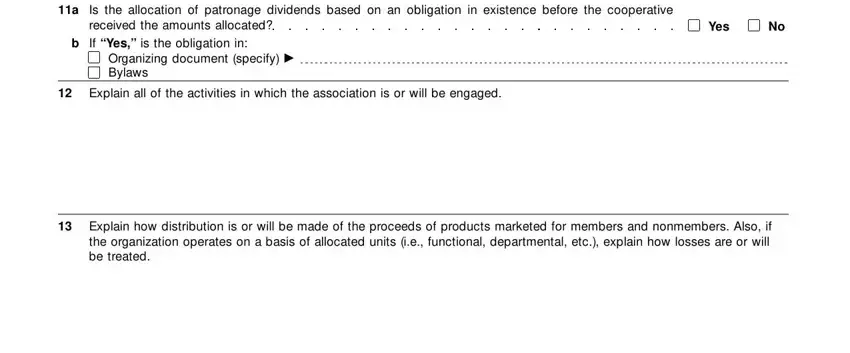

The a Is the allocation of patronage, received the amounts allocated If, Organizing document specify cid, Explain all of the activities in, Yes, and Explain how distribution is or field is the place where both parties can place their rights and obligations.

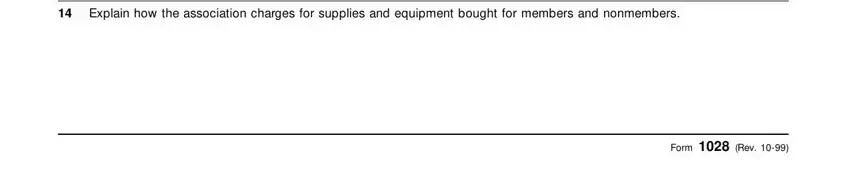

End by reviewing these fields and submitting the required information: Explain how the association, and Form Rev.

Step 3: As you hit the Done button, your ready file can be transferred to any kind of your devices or to email chosen by you.

Step 4: To prevent yourself from possible upcoming challenges, you should definitely hold a minimum of a pair of copies of every file.