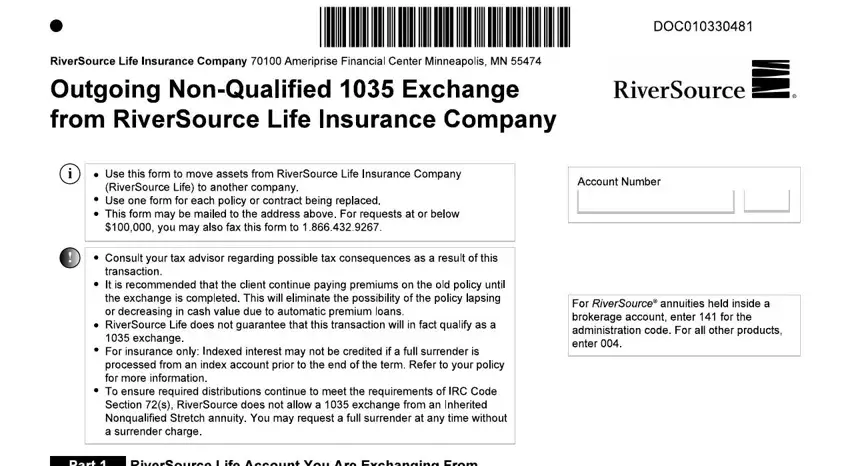

The entire process of completing the outgoing non qualified 1035 exchange from riversource life insurance company 30481 is really quick. Our team made sure our software is not difficult to understand and can help prepare virtually any form without delay. Learn about a couple of simple steps you will need to follow:

Step 1: Choose the orange "Get Form Now" button on this page.

Step 2: So, you are on the form editing page. You can add information, edit existing details, highlight certain words or phrases, insert crosses or checks, insert images, sign the file, erase unnecessary fields, etc.

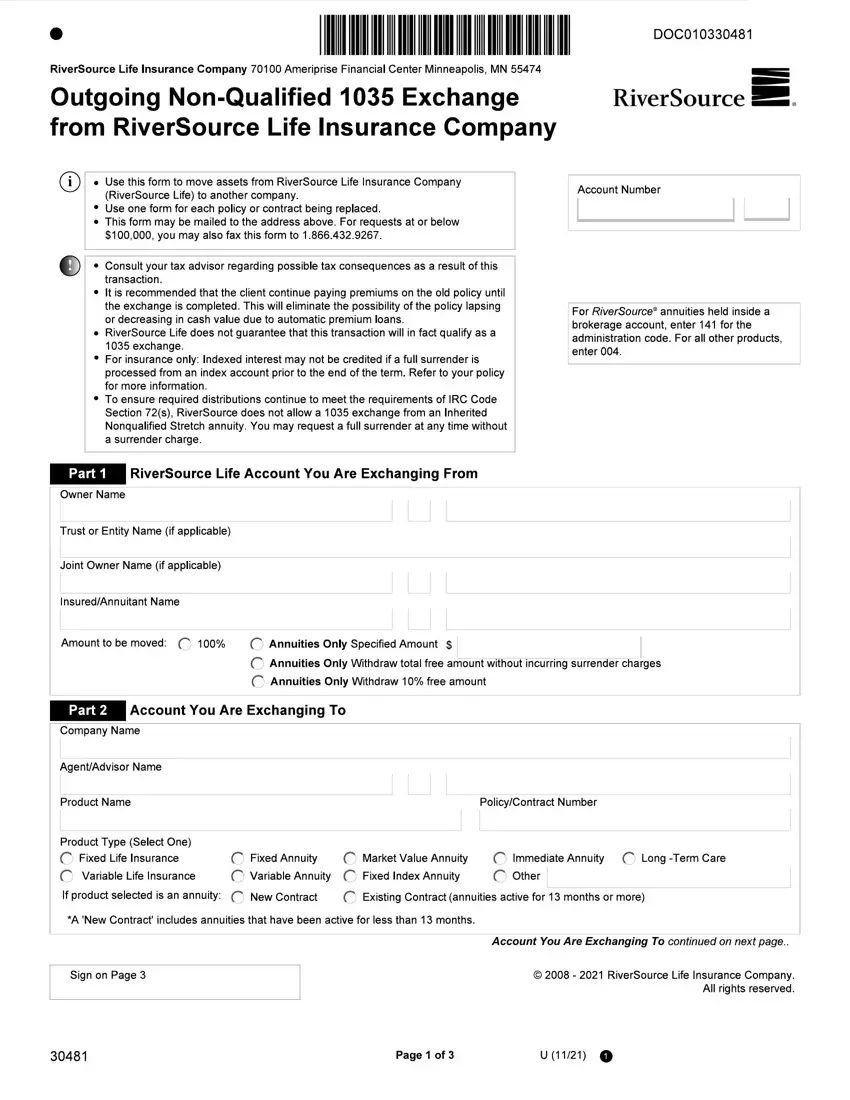

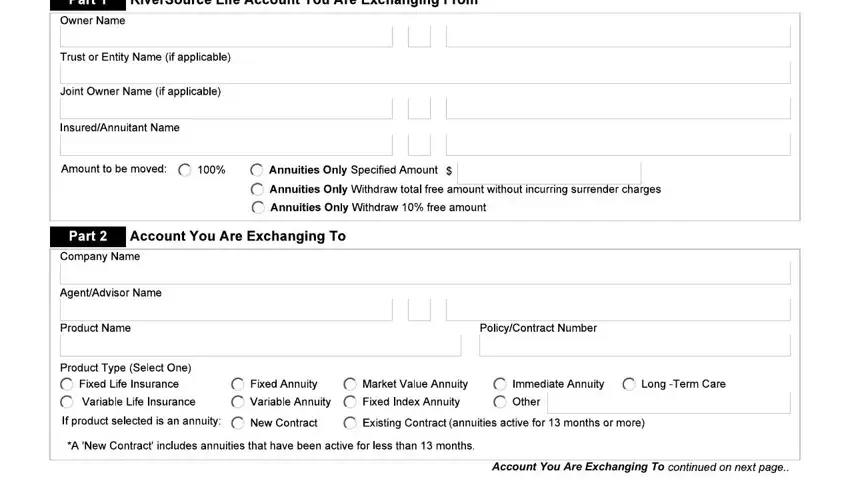

To be able to obtain the file, type in the information the system will require you to for each of the following sections:

Type in the demanded particulars in the section Account You Are Exchanging To.

You will be expected to enter the details to help the program fill in the segment .

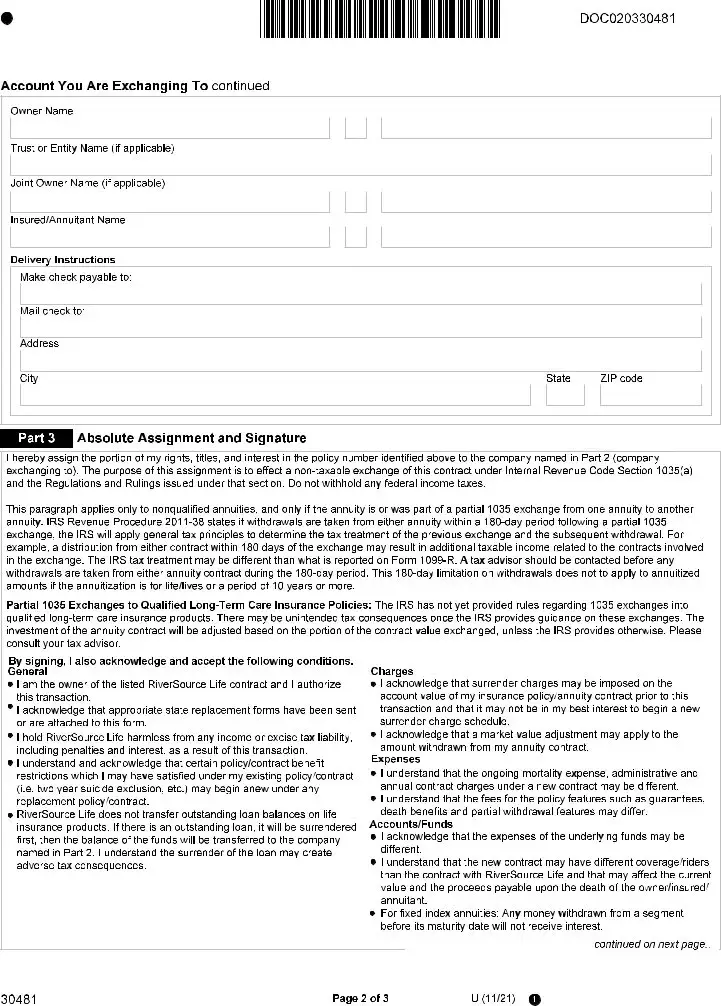

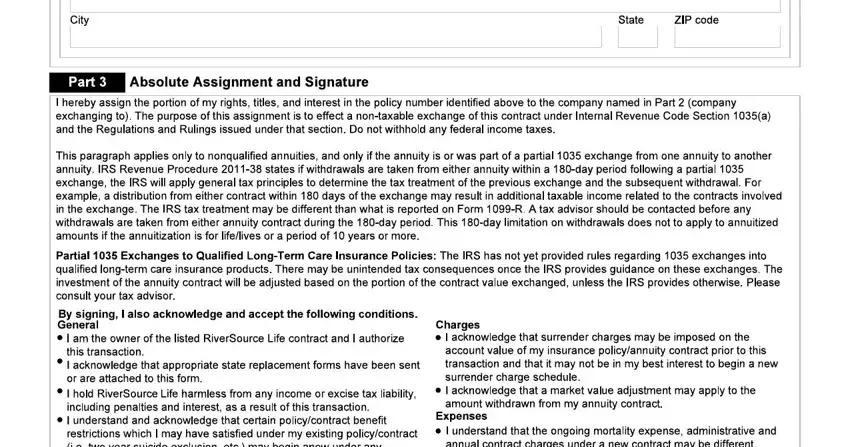

Describe the rights and responsibilities of the sides inside the section .

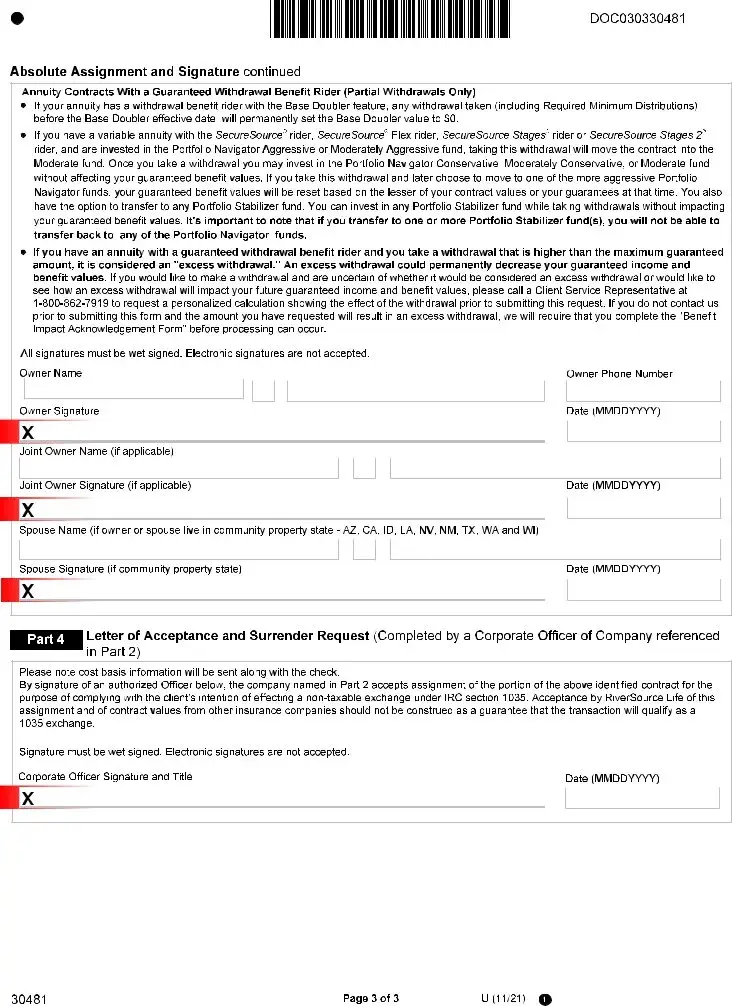

Finish by reviewing the next sections and submitting the suitable details: .

Step 3: Hit the button "Done". Your PDF file is available to be transferred. You will be able save it to your device or email it.

Step 4: To avoid potential forthcoming challenges, ensure that you hold up to two copies of every single form.