Having the purpose of allowing it to be as effortless to work with as it can be, we built this PDF editor. The entire process of filling up the w 4 form is going to be straightforward when you follow the next actions.

Step 1: Choose the orange button "Get Form Here" on the website page.

Step 2: The file editing page is currently available. You can add text or change current content.

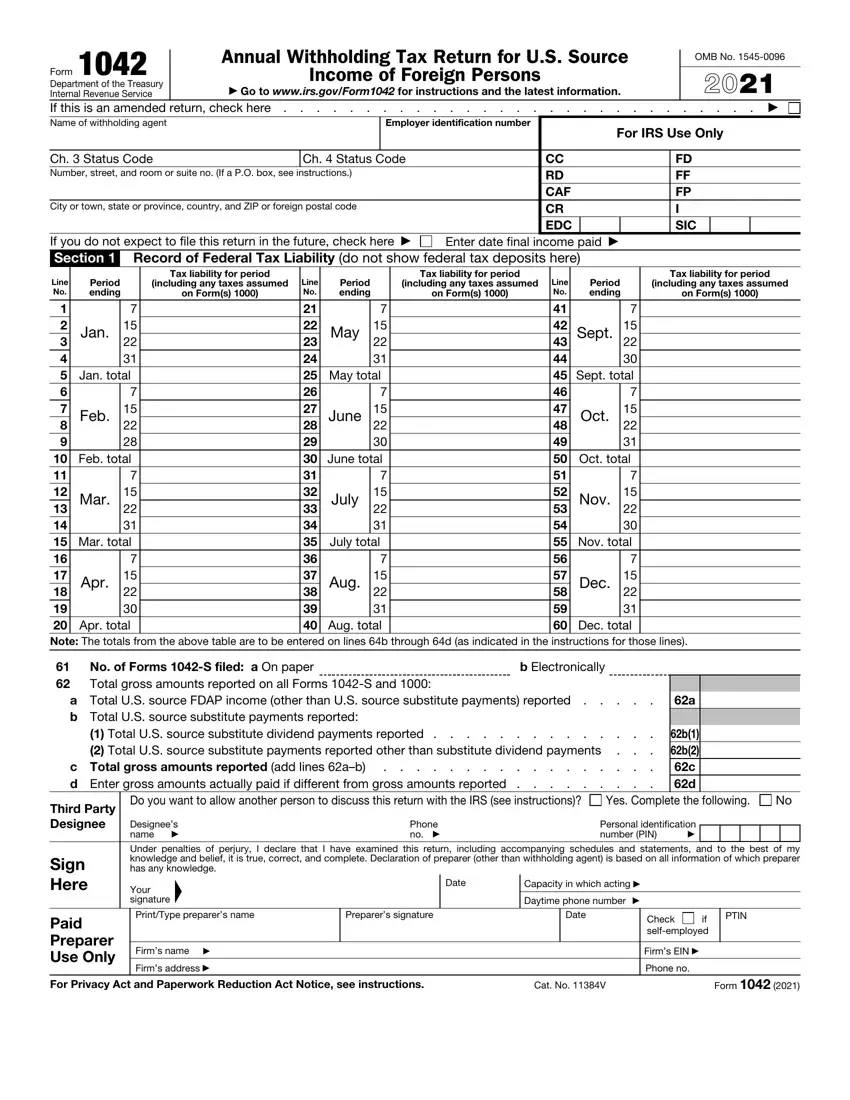

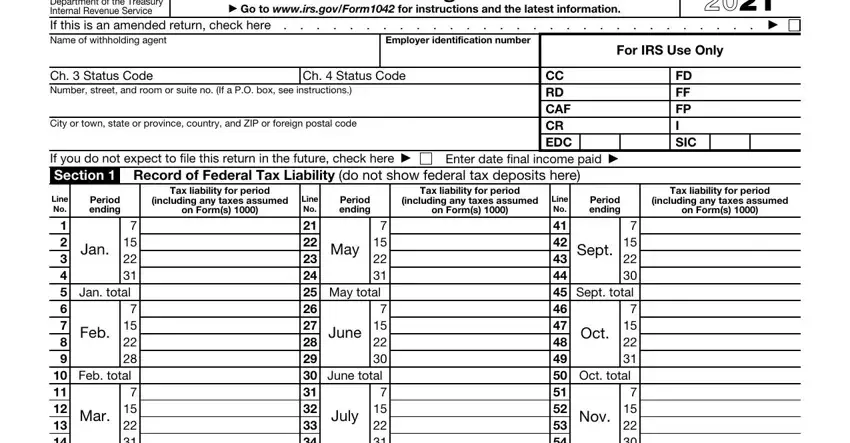

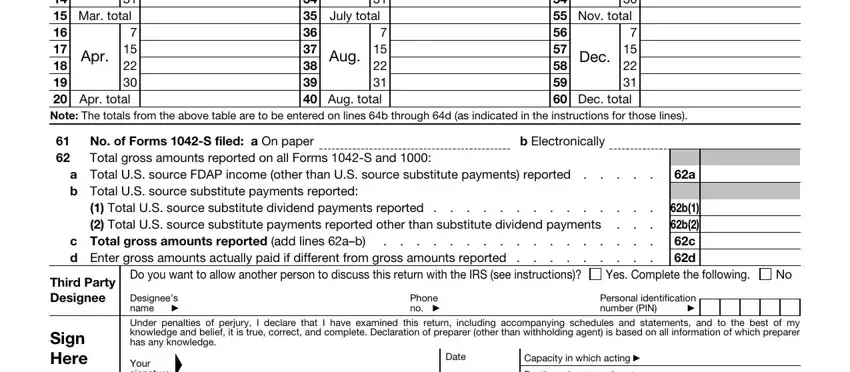

The next parts will make up the PDF template that you'll be filling out:

Include the expected details in the Jan total Feb, Sept total Oct, May total June, Aug, Dec, Apr, No of Forms S filed a On paper, b Electronically, a Total US source FDAP income, Total US source substitute, c Total gross amounts reported add, b b c d, Third Party Designee, Sign Here, and Do you want to allow another area.

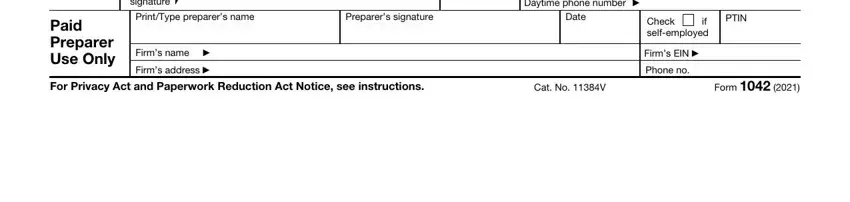

Point out the most crucial information on the Paid Preparer Use Only, signature, Daytime phone number, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, Check if selfemployed, PTIN, Firms EIN, Phone no, For Privacy Act and Paperwork, Cat No V, and Form segment.

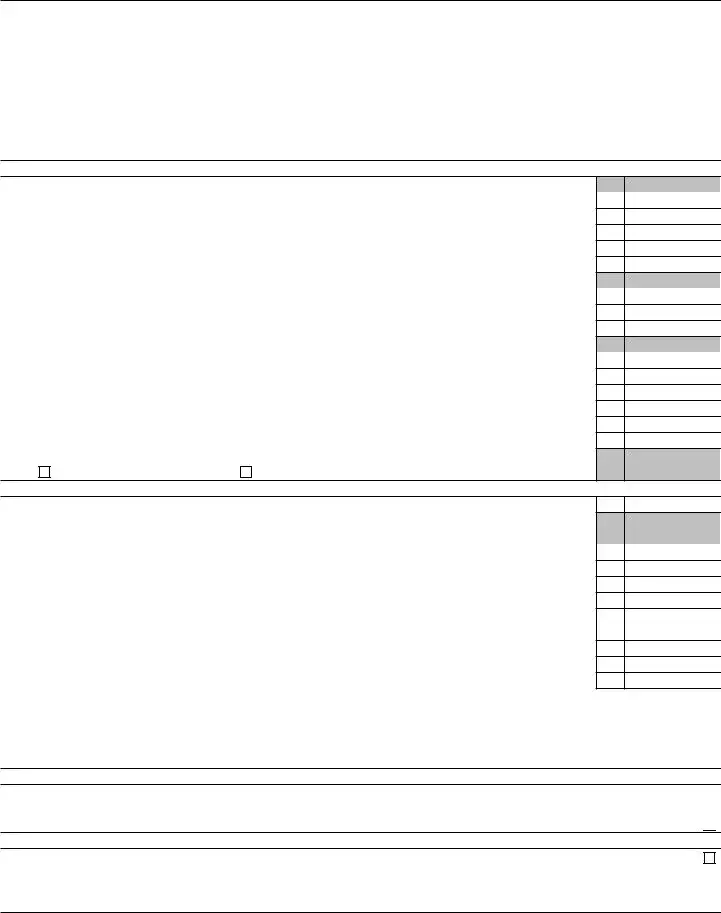

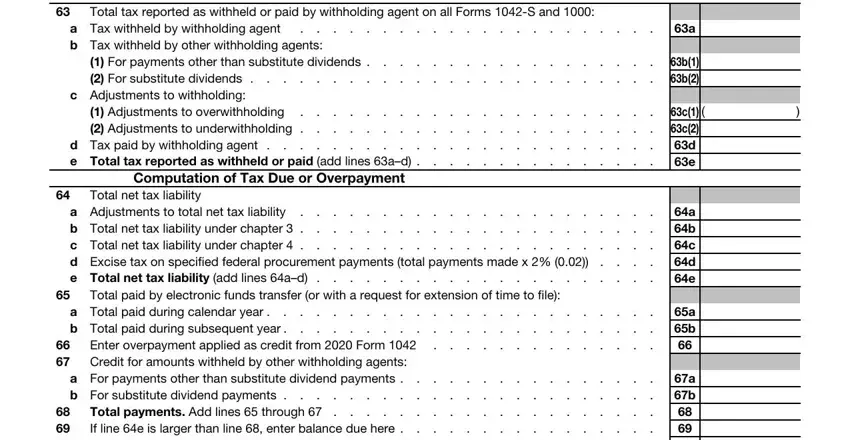

Please include the rights and responsibilities of the sides in the Total tax reported as withheld or, Page, a Tax withheld by withholding, For payments other than, c Adjustments to withholding, Adjustments to overwithholding, d Tax paid by withholding agent, Computation of Tax Due or, Total net tax liability, a Adjustments to total net tax, Total paid by electronic funds, a Total paid during calendar year, Enter overpayment applied as, a Enter overpayment, and b b box.

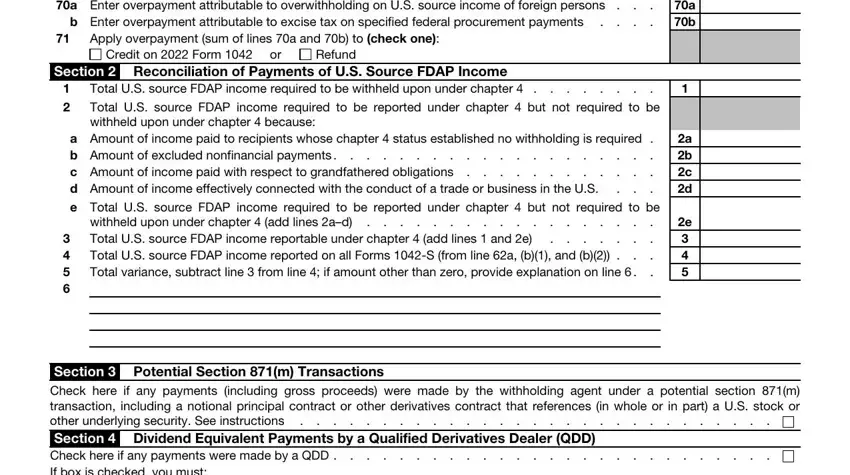

Terminate by checking the following areas and filling them in correspondingly: a Enter overpayment, Apply overpayment sum of lines a, Credit on Form, or Section Reconciliation of, Refund, Total US source FDAP income, a Amount of income paid to, withheld upon under chapter add, a b a b, a b c d, and Section Potential Section m.

Step 3: Click the Done button to save the document. Now it is obtainable for transfer to your electronic device.

Step 4: To prevent yourself from any kind of risks as time goes on, try to make at least several duplicates of the form.