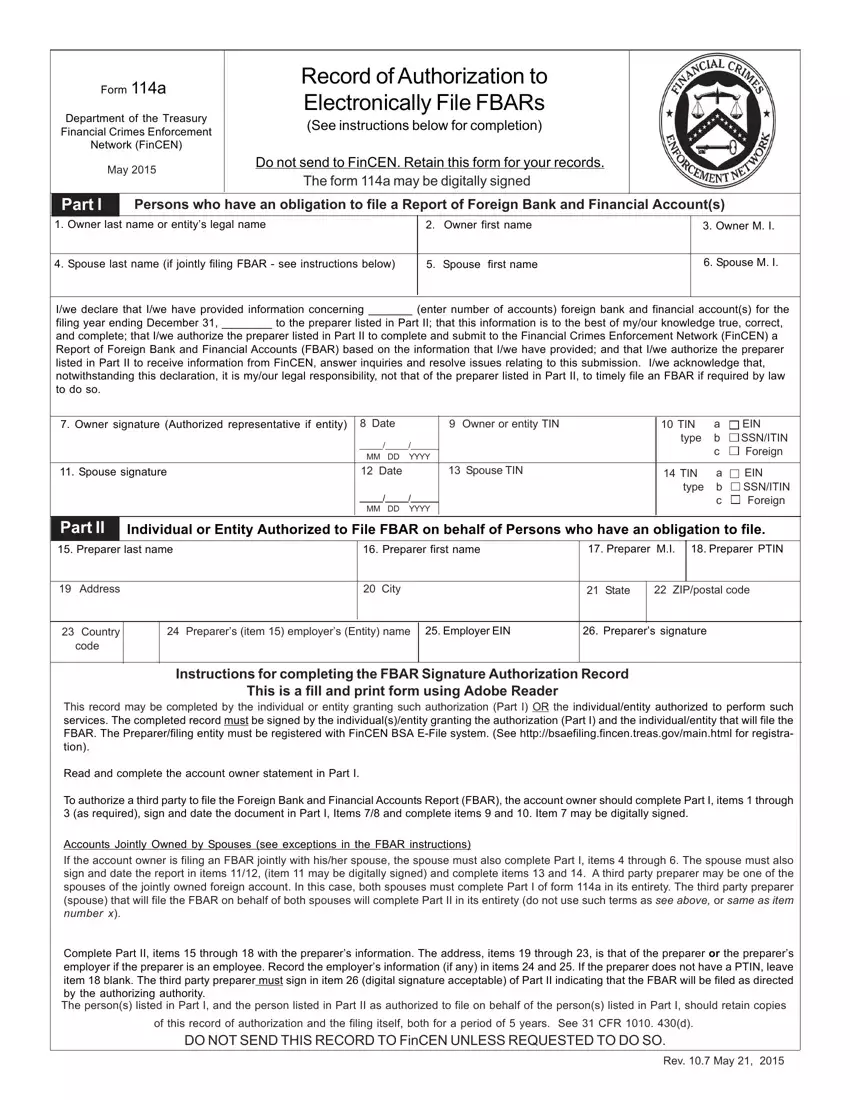

Form 114a

Department of the Treasury

Financial Crimes Enforcement

Network (FinCEN)

May 2015

Record of Authorization to

Electronically File FBARs

(See instructions below for completion)

Do not send to FinCEN. Retain this form for your records. The form 114a may be digitally signed

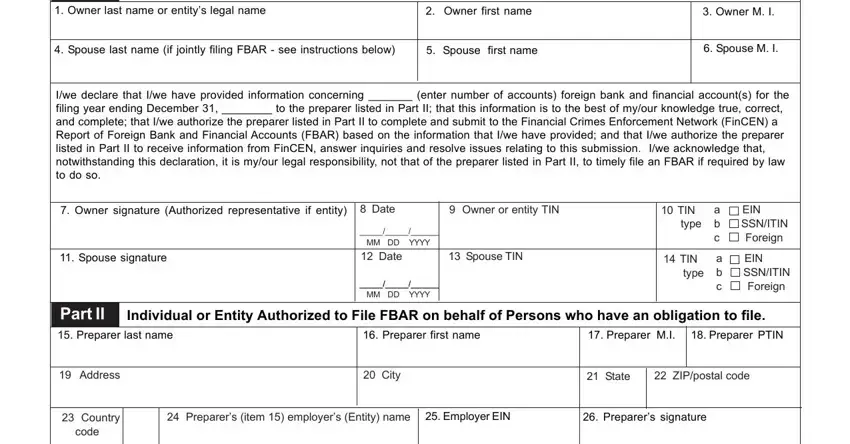

Persons who have an obligation to file a Report of Foreign Bank and Financial Account(s)

1. Owner last name or entity’s legal name

4. Spouse last name (if jointly filing FBAR - see instructions below)

I/we declare that I/we have provided information concerning _______ (enter number of accounts) foreign bank and financial account(s) for the

filing year ending December 31, ________ to the preparer listed in Part II; that this information is to the best of my/our knowledge true, correct,

and complete; that I/we authorize the preparer listed in Part II to complete and submit to the Financial Crimes Enforcement Network (FinCEN) a Report of Foreign Bank and Financial Accounts (FBAR) based on the information that I/we have provided; and that I/we authorize the preparer listed in Part II to receive information from FinCEN, answer inquiries and resolve issues relating to this submission. I/we acknowledge that, notwithstanding this declaration, it is my/our legal responsibility, not that of the preparer listed in Part II, to timely file an FBAR if required by law to do so.

7. Owner signature (Authorized representative if entity) |

8 Date |

|

9 Owner or entity TIN |

10 TIN |

a |

EIN |

|

_____/_____/______ |

|

type |

b |

SSN/ITIN |

|

|

|

c |

Foreign |

|

MM DD |

YYYY |

|

|

|

|

|

|

|

11. Spouse signature |

12 Date |

|

13 Spouse TIN |

14 TIN |

a |

EIN |

|

|

|

|

type |

b |

SSN/ITIN |

|

_____/_____/______ |

|

|

c |

Foreign |

|

MM DD |

YYYY |

|

|

|

|

|

|

|

Individual or Entity Authorized to File FBAR on behalf of Persons who have an obligation to file.

15. Preparer last name |

|

16. Preparer first name |

17. Preparer |

M.I. |

18. Preparer PTIN |

|

|

|

|

|

|

|

|

|

|

|

19 |

Address |

|

|

|

20 City |

21 State |

|

22 ZIP/postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

Country |

|

24 |

Preparer’s (item 15) employer’s (Entity) name |

25. Employer EIN |

26. Preparer’s signature |

|

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for completing the FBAR Signature Authorization Record

This is a fill and print form using Adobe Reader

This record may be completed by the individual or entity granting such authorization (Part I) OR the individual/entity authorized to perform such services. The completed record must be signed by the individual(s)/entity granting the authorization (Part I) and the individual/entity that will file the FBAR. The Preparer/filing entity must be registered with FinCEN BSA E-File system. (See http://bsaefiling.fincen.treas.gov/main.html for registra- tion).

Read and complete the account owner statement in Part I.

To authorize a third party to file the Foreign Bank and Financial Accounts Report (FBAR), the account owner should complete Part I, items 1 through 3 (as required), sign and date the document in Part I, Items 7/8 and complete items 9 and 10. Item 7 may be digitally signed.

Accounts Jointly Owned by Spouses (see exceptions in the FBAR instructions)

If the account owner is filing an FBAR jointly with his/her spouse, the spouse must also complete Part I, items 4 through 6. The spouse must also sign and date the report in items 11/12, (item 11 may be digitally signed) and complete items 13 and 14. A third party preparer may be one of the spouses of the jointly owned foreign account. In this case, both spouses must complete Part I of form 114a in its entirety. The third party preparer (spouse) that will file the FBAR on behalf of both spouses will complete Part II in its entirety (do not use such terms as SEE ABOVE, or SAME AS ITEM NUMBER X).

Complete Part II, items 15 through 18 with the preparer’s information. The address, items 19 through 23, is that of the preparer or the preparer’s employer if the preparer is an employee. Record the employer’s information (if any) in items 24 and 25. If the preparer does not have a PTIN, leave item 18 blank. The third party preparer must sign in item 26 (digital signature acceptable) of Part II indicating that the FBAR will be filed as directed by the authorizing authority.

The person(s) listed in Part I, and the person listed in Part II as authorized to file on behalf of the person(s) listed in Part I, should retain copies

of this record of authorization and the filing itself, both for a period of 5 years. See 31 CFR 1010. 430(d).

DO NOT SEND THIS RECORD TO FinCEN UNLESS REQUESTED TO DO SO.