Working with PDF forms online is very simple with this PDF editor. Anyone can fill out Form 14153 here painlessly. We at FormsPal are aimed at providing you the ideal experience with our editor by regularly presenting new features and enhancements. Our editor has become much more useful with the latest updates! At this point, working with documents is simpler and faster than before. Getting underway is effortless! Everything you should do is adhere to the following easy steps below:

Step 1: Click on the "Get Form" button above. It is going to open up our tool so that you could start filling in your form.

Step 2: With this state-of-the-art PDF tool, it is possible to do more than simply complete blank fields. Edit away and make your forms seem sublime with customized text put in, or tweak the file's original input to perfection - all that comes along with the capability to incorporate just about any images and sign the PDF off.

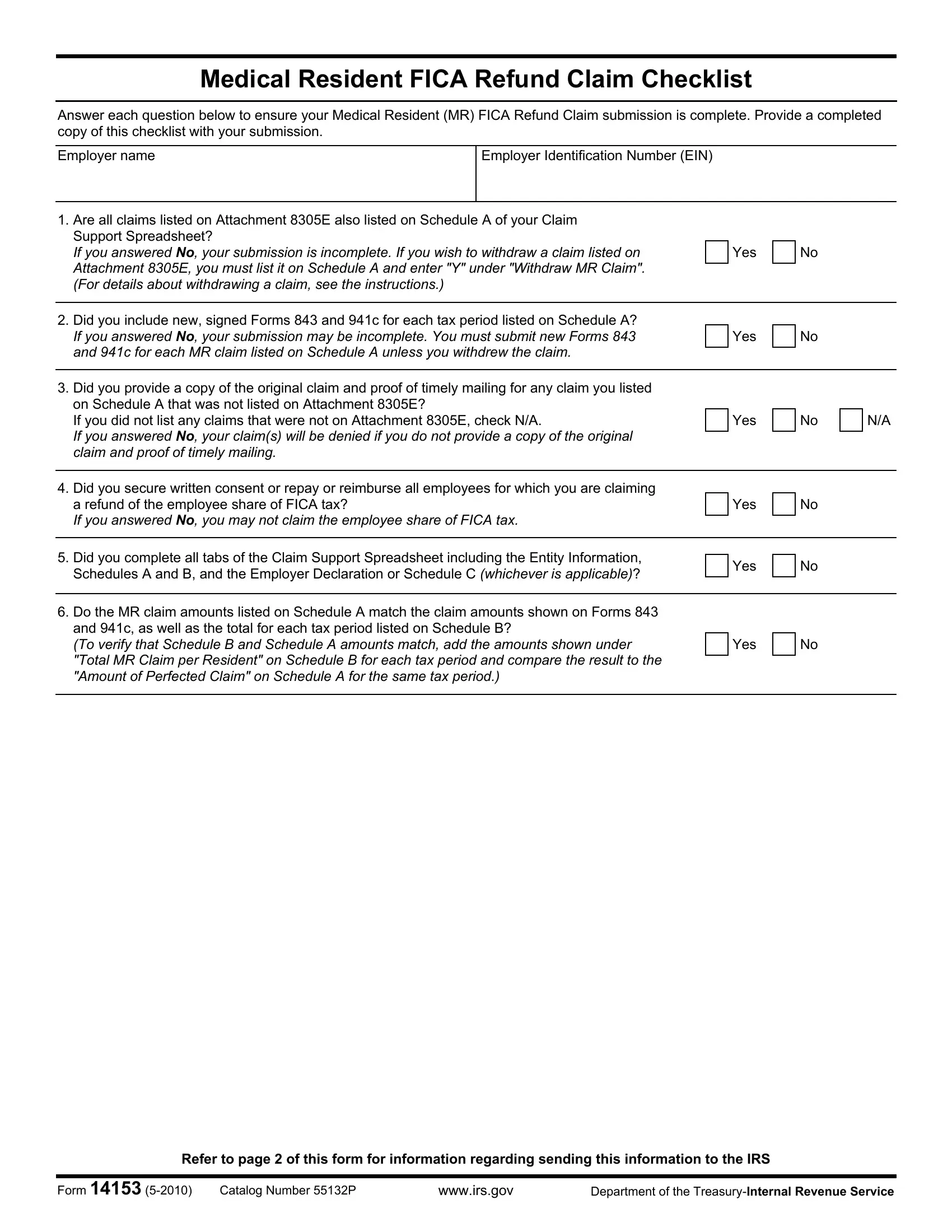

This form will require you to enter specific information; in order to guarantee accuracy, remember to adhere to the subsequent recommendations:

1. Begin filling out the Form 14153 with a selection of essential blanks. Get all the information you need and ensure nothing is neglected!

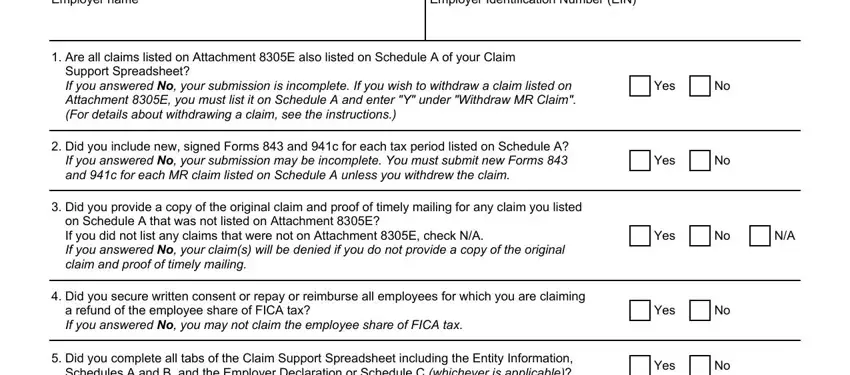

2. After filling out the previous part, head on to the next stage and fill out all required particulars in all these fields - Do the MR claim amounts listed on, and Yes.

As for Do the MR claim amounts listed on and Yes, be sure you do everything right in this current part. Both of these could be the key ones in this document.

Step 3: Soon after taking another look at your entries, hit "Done" and you are good to go! Join us now and easily access Form 14153, ready for download. Each and every edit you make is handily preserved , which enables you to edit the file later on as required. At FormsPal, we aim to make sure your information is kept private.