This PDF editor allows you to prepare documents. You don't have to do much to enhance form 205 texas pdf documents. Basically use these particular steps.

Step 1: Hit the orange button "Get Form Here" on the following website page.

Step 2: Once you've got accessed the editing page tx form 205, you will be able to notice all the options available for the file within the upper menu.

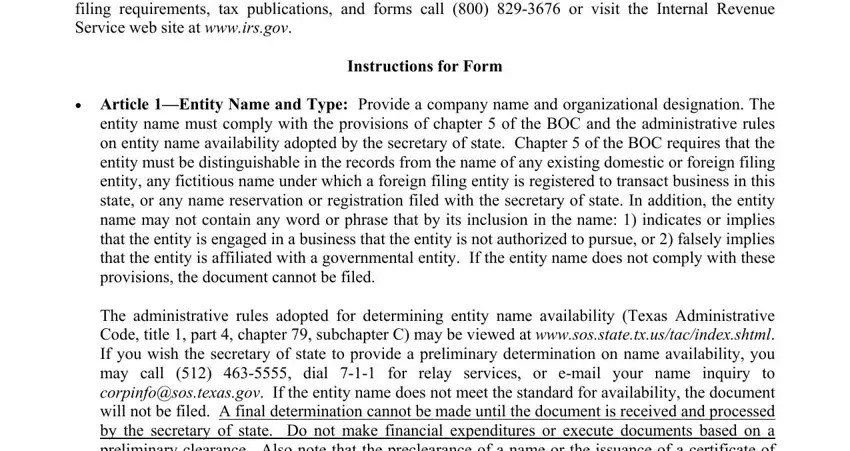

The following parts are going to make up the PDF document:

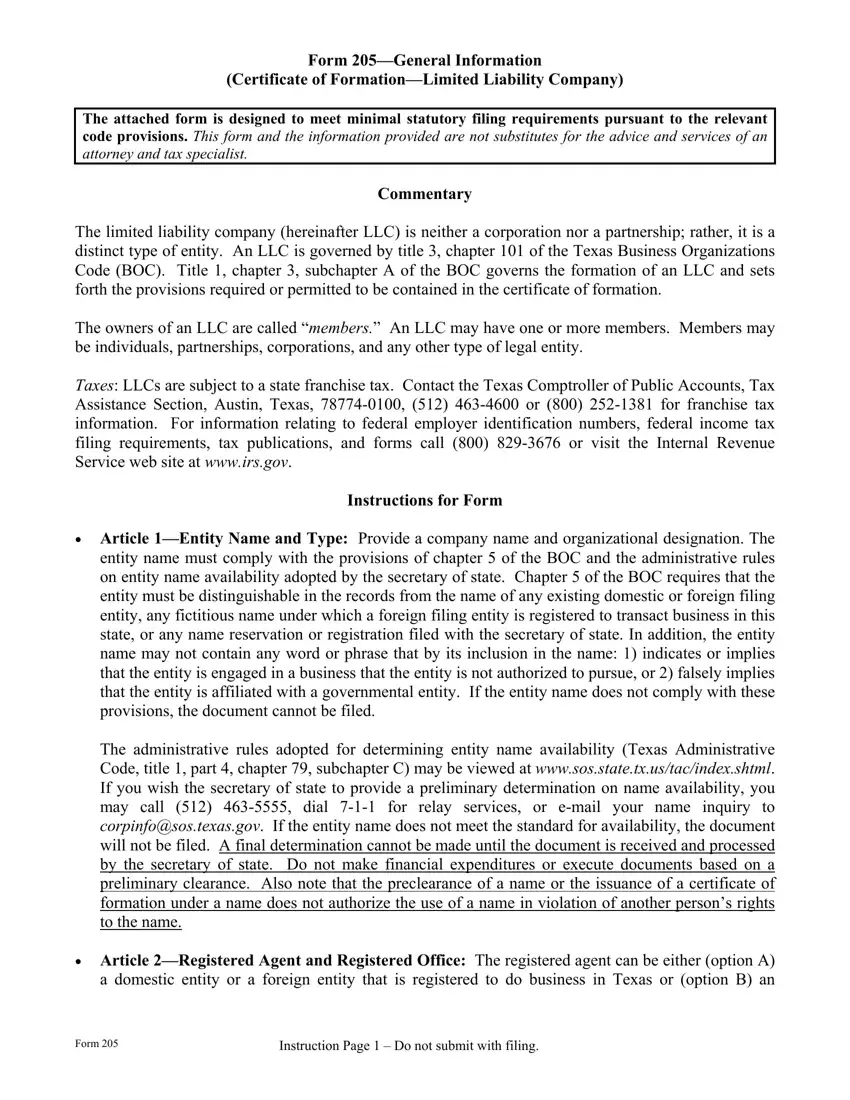

Provide the asked information in the Need Faster Delivery and, FYI An LLC is required to, and Revised segment.

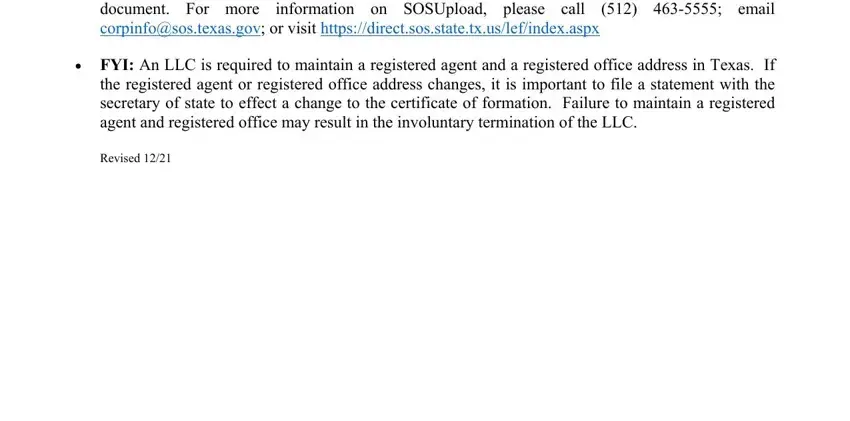

It is crucial to provide specific particulars inside the box The filing entity being formed is, The name must contain the words, Article Registered Agent and, A The initial registered agent is, B The initial registered agent is, First Name, Last Name, Suffix, C The business address of the, Street Address, City, TX State, Zip Code, and Article Governing Authority Select.

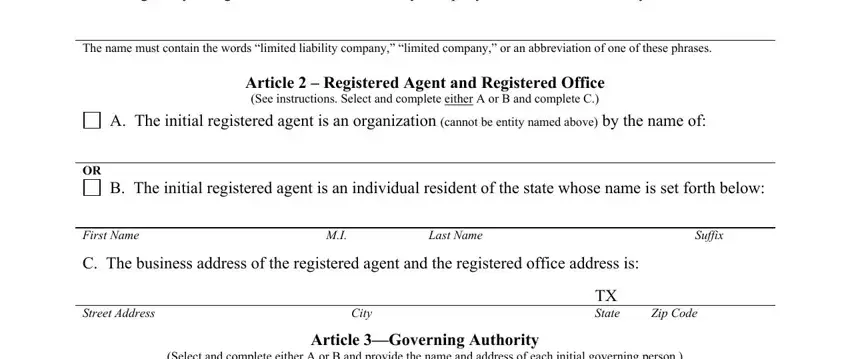

You have to record the rights and responsibilities of the sides within the Article Governing Authority Select, A The limited liability company, manager are set forth below, B The limited liability company, initial member are set forth below, INITIAL GOVERNING PERSON NAME, IF INDIVIDUAL, First Name OR IF ORGANIZATION, Organization Name, ADDRESS, Street or Mailing Address, Form, Last Name, Suffix, and City paragraph.

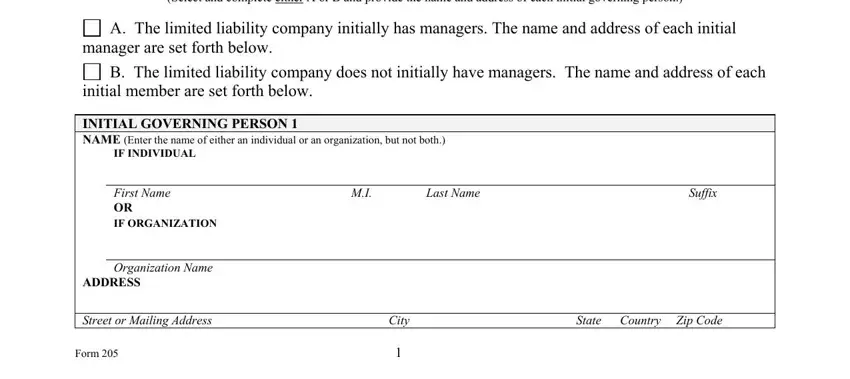

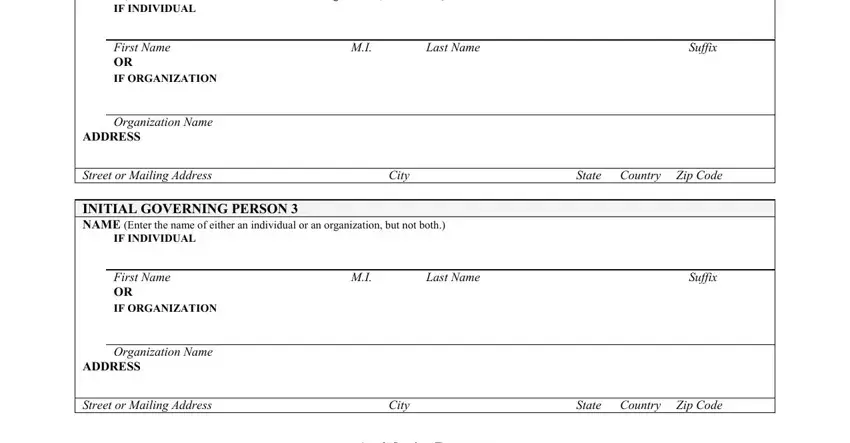

End by analyzing all these areas and filling them in as required: INITIAL GOVERNING PERSON NAME, IF INDIVIDUAL, First Name OR IF ORGANIZATION, Organization Name, ADDRESS, Last Name, Suffix, Street or Mailing Address, City, State Country Zip Code, INITIAL GOVERNING PERSON NAME, IF INDIVIDUAL, First Name OR IF ORGANIZATION, Organization Name, and ADDRESS.

Step 3: Click the button "Done". Your PDF document may be exported. It's possible to obtain it to your computer or email it.

Step 4: Create duplicates of your file - it will help you keep away from potential future challenges. And fear not - we do not disclose or view your details.

A. The limited liability company initially has managers. The name and address of each initial manager are set forth below.

A. The limited liability company initially has managers. The name and address of each initial manager are set forth below. B. The limited liability company does not initially have managers. The name and address of each initial member are set forth below.

B. The limited liability company does not initially have managers. The name and address of each initial member are set forth below.

This document becomes effective when the document is filed by the secretary of state.

This document becomes effective when the document is filed by the secretary of state. This document becomes effective at a later date, or a later date and time, not more than 90 days from the date of signing. The later effective date, or date and time is:

This document becomes effective at a later date, or a later date and time, not more than 90 days from the date of signing. The later effective date, or date and time is: This document takes effect upon the occurrence of the future event or fact, other than the passage of time. The 90

This document takes effect upon the occurrence of the future event or fact, other than the passage of time. The 90