With the goal of making it as easy to use as it can be, we generated this PDF editor. The procedure of creating the 2155-Rev is going to be easy for those who check out the following steps.

Step 1: To start out, choose the orange button "Get Form Now".

Step 2: Now, you're on the document editing page. You can add information, edit current data, highlight particular words or phrases, put crosses or checks, insert images, sign the file, erase needless fields, etc.

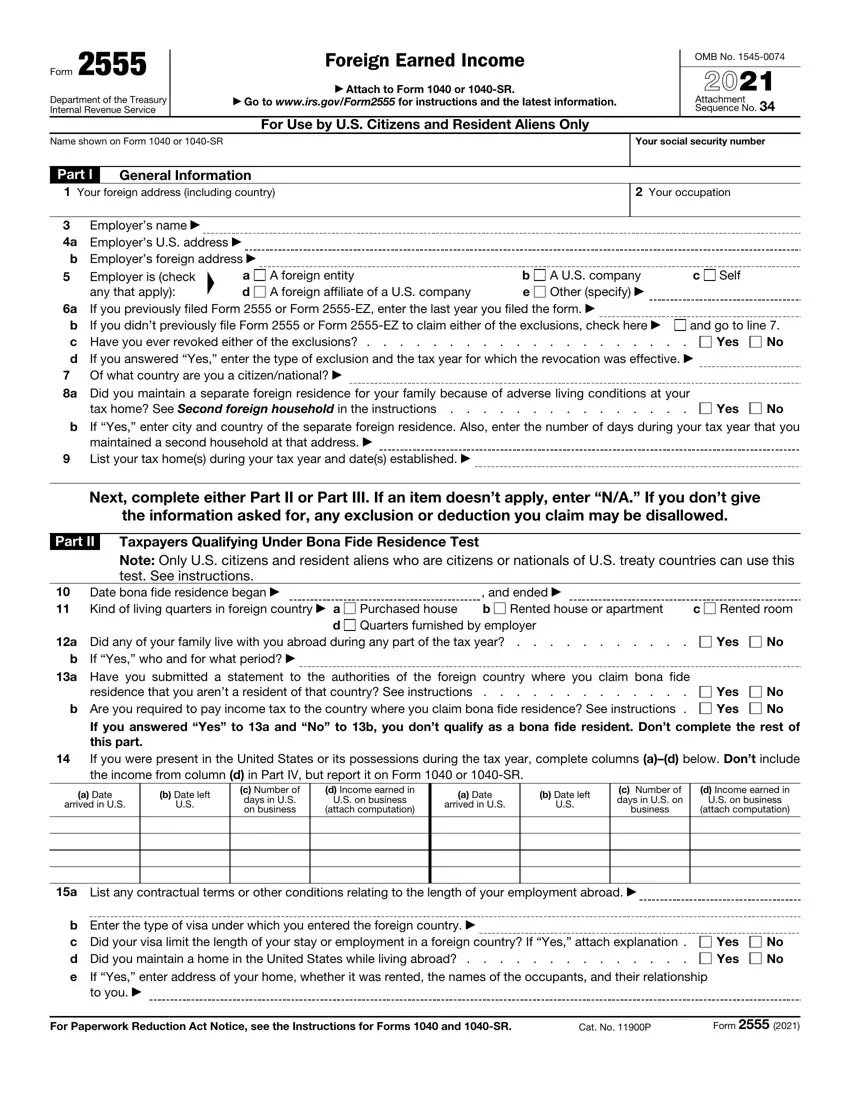

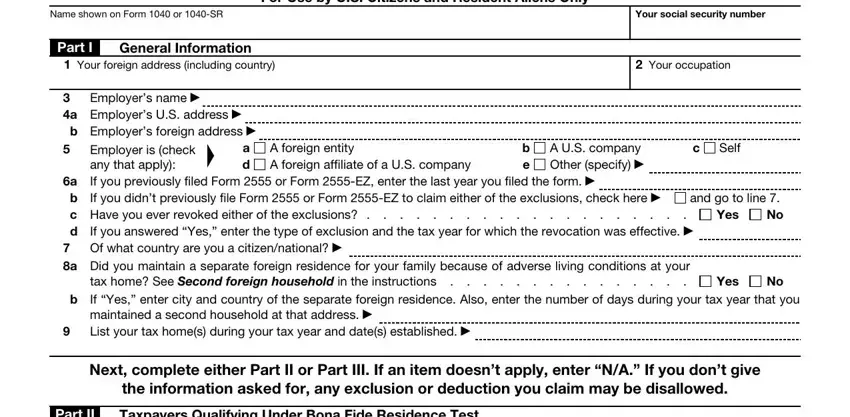

For every single segment, fill in the data required by the system.

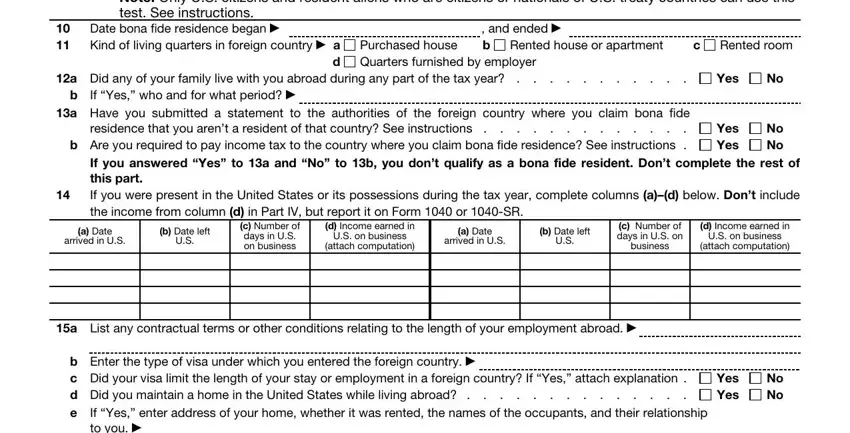

Type in the essential information in the Taxpayers Qualifying Under Bona, Date bona fide residence began, and ended b Rented house or, c Rented room, a Did any of your family live with, d Quarters furnished by employer, Yes, If Yes who and for what period, a Have you submitted a statement, residence that you arent a, b Are you required to pay income, Yes Yes, No No, If you answered Yes to a and No to, and a Date arrived in US area.

Within the section referring to to you, For Paperwork Reduction Act Notice, Cat No P, and Form, you should put down some significant information.

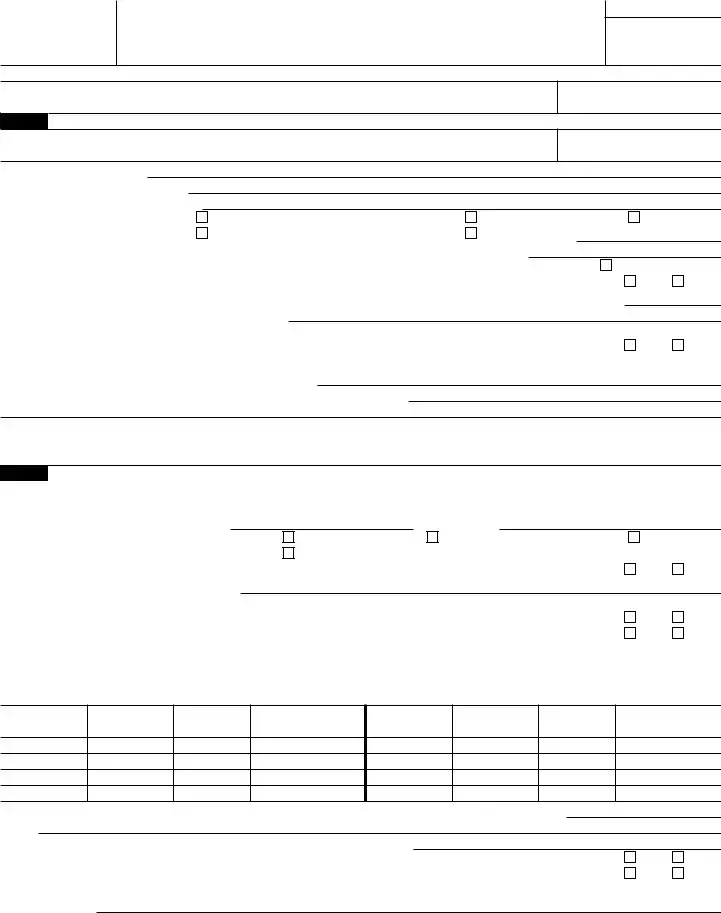

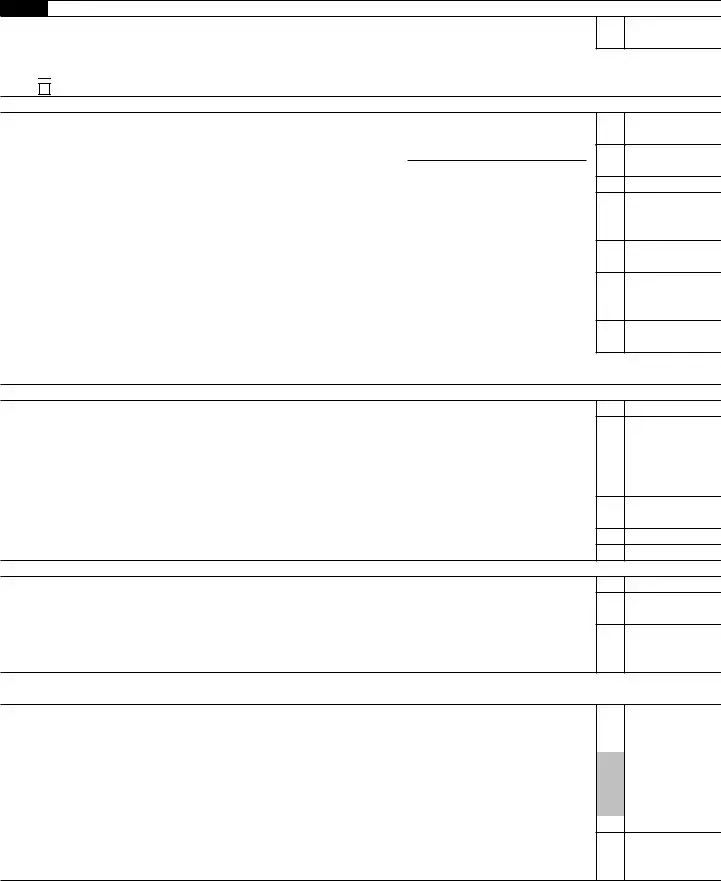

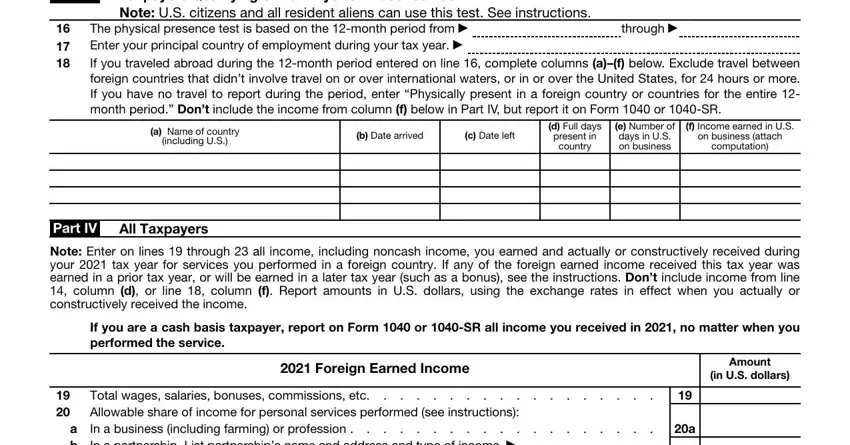

The Form Part III, Taxpayers Qualifying Under, The physical presence test is, through, a Name of country including US, b Date arrived, c Date left, d Full days present in country, e Number of days in US on business, f Income earned in US on business, Part IV All Taxpayers, Note Enter on lines through all, If you are a cash basis taxpayer, Foreign Earned Income, and Amount in US dollars field is the place where either side can insert their rights and obligations.

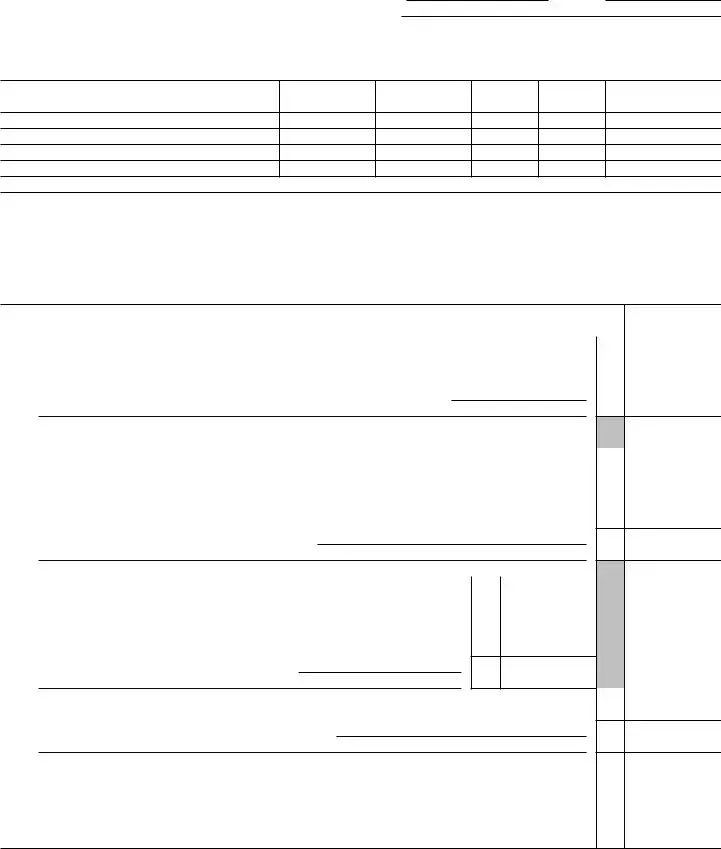

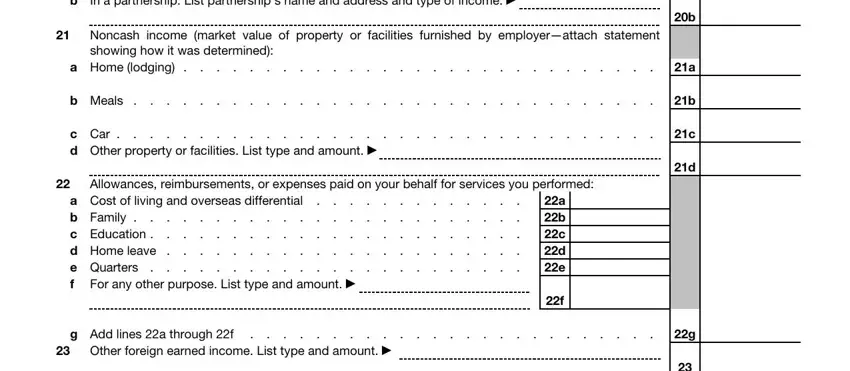

End by analyzing the following sections and filling them in as required: a b, Total wages salaries bonuses, Noncash income market value of, a Home lodging, b Meals, c Car d Other property or, Allowances reimbursements or, a Cost of living and overseas, a b c d e, g Add lines a through f, and Other foreign earned income List.

Step 3: The moment you click on the Done button, your finished file is simply transferable to every of your devices. Alternatively, you can deliver it by using email.

Step 4: Make duplicates of your form. This may save you from potential future issues. We do not see or disclose the information you have, therefore be certain it's going to be protected.