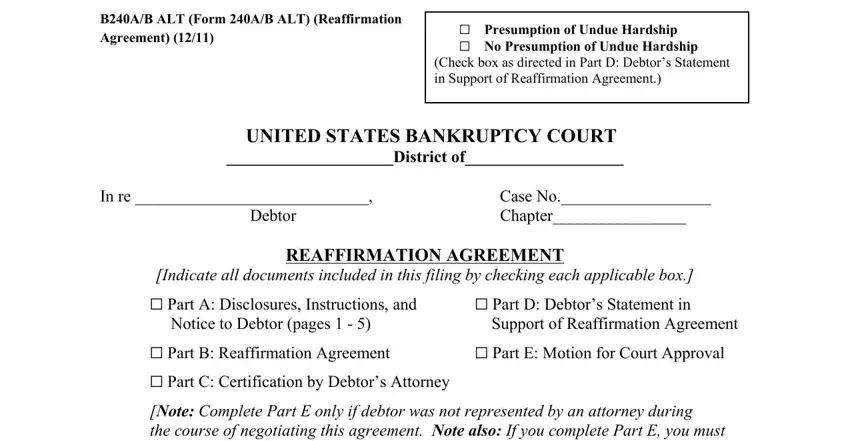

B240A/B ALT (Form 240A/B ALT) (Reaffirmation Agreement) (12/11)

GPresumption of Undue Hardship

GNo Presumption of Undue Hardship (Check box as directed in Part D: Debtor’s Statement in Support of Reaffirmation Agreement.)

UNITED STATES BANKRUPTCY COURT

____________________District of___________________

In re ____________________________, |

Case No.__________________ |

Debtor |

Chapter________________ |

REAFFIRMATION AGREEMENT

[Indicate all documents included in this filing by checking each applicable box.]

G Part A: Disclosures, Instructions, and |

G Part D: Debtor’s Statement in |

Notice to Debtor (pages 1 - 5) |

Support of Reaffirmation Agreement |

G Part B: Reaffirmation Agreement |

G Part E: Motion for Court Approval |

G Part C: Certification by Debtor’s Attorney |

|

[Note: Complete Part E only if debtor was not represented by an attorney during

the course of negotiating this agreement. Note also: If you complete Part E, you must prepare and file Form 240C ALT - Order on Reaffirmation Agreement.]

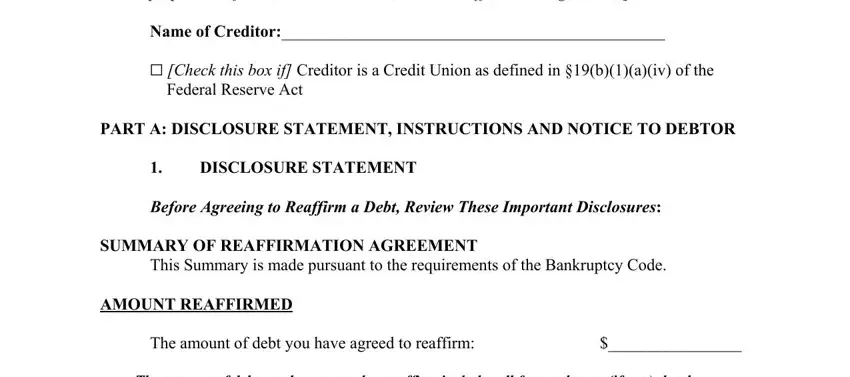

Name of Creditor:______________________________________________

G [Check this box if] Creditor is a Credit Union as defined in §19(b)(1)(a)(iv) of the Federal Reserve Act

PART A: DISCLOSURE STATEMENT, INSTRUCTIONS AND NOTICE TO DEBTOR

1.DISCLOSURE STATEMENT

Before Agreeing to Reaffirm a Debt, Review These Important Disclosures:

SUMMARY OF REAFFIRMATION AGREEMENT

This Summary is made pursuant to the requirements of the Bankruptcy Code.

AMOUNT REAFFIRMED

The amount of debt you have agreed to reaffirm: |

$________________ |

The amount of debt you have agreed to reaffirm includes all fees and costs (if any) that have accrued as of the date of this disclosure. Your credit agreement may obligate you to pay additional amounts which may come due after the date of this disclosure. Consult your credit agreement.

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

2 |

ANNUAL PERCENTAGE RATE

[The annual percentage rate can be disclosed in different ways, depending on the type of debt.]

a.If the debt is an extension of “credit” under an “open end credit plan,” as those terms are defined in § 103 of the Truth in Lending Act, such as a credit card, the creditor may disclose the annual percentage rate shown in (i) below or, to the extent this rate is not readily available or not applicable, the simple interest rate shown in (ii) below, or both.

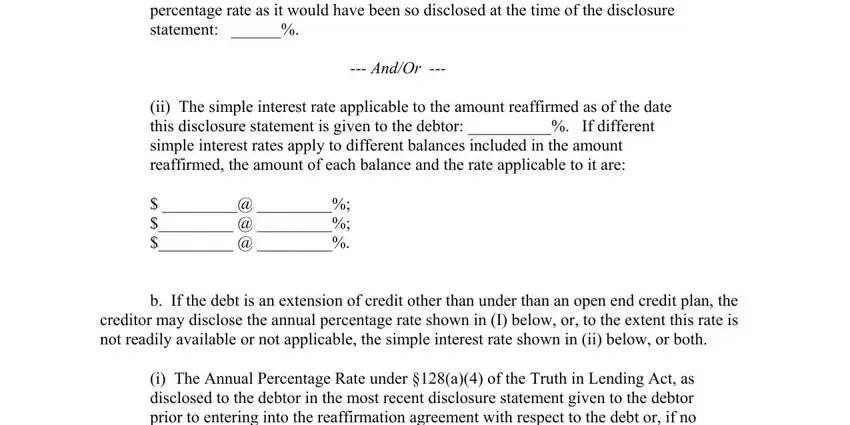

(i)The Annual Percentage Rate disclosed, or that would have been disclosed, to the debtor in the most recent periodic statement prior to entering into the reaffirmation agreement described in Part B below or, if no such periodic statement was given to the debtor during the prior six months, the annual percentage rate as it would have been so disclosed at the time of the disclosure statement: ______%.

---And/Or ---

(ii)The simple interest rate applicable to the amount reaffirmed as of the date this disclosure statement is given to the debtor: __________%. If different simple interest rates apply to different balances included in the amount reaffirmed, the amount of each balance and the rate applicable to it are:

$_________@ _________%; $_________ @ _________%; $_________ @ _________%.

b.If the debt is an extension of credit other than under than an open end credit plan, the creditor may disclose the annual percentage rate shown in (I) below, or, to the extent this rate is not readily available or not applicable, the simple interest rate shown in (ii) below, or both.

(i)The Annual Percentage Rate under §128(a)(4) of the Truth in Lending Act, as disclosed to the debtor in the most recent disclosure statement given to the debtor prior to entering into the reaffirmation agreement with respect to the debt or, if no such disclosure statement was given to the debtor, the annual percentage rate as it would have been so disclosed: _________%.

---And/Or ---

(ii)The simple interest rate applicable to the amount reaffirmed as of the date this disclosure statement is given to the debtor: __________%. If different simple interest rates apply to different balances included in the amount reaffirmed, the amount of each balance and the rate applicable to it are:

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

3 |

$_________@ _________%; $_________ @ _________%; $_________ @ _________%.

c.If the underlying debt transaction was disclosed as a variable rate transaction on the most recent disclosure given under the Truth in Lending Act:

The interest rate on your loan may be a variable interest rate which changes from time to time, so that the annual percentage rate disclosed here may be higher or lower.

d.If the reaffirmed debt is secured by a security interest or lien, which has not been waived or determined to be void by a final order of the court, the following items or types of items of the debtor’s goods or property remain subject to such security interest or lien in connection with the debt or debts being reaffirmed in the reaffirmation agreement described in Part B.

Item or Type of Item |

Original Purchase Price or Original Amount of Loan |

Optional---At the election of the creditor, a repayment schedule using one or a combination of the following may be provided:

Repayment Schedule:

Your first payment in the amount of $___________ is due on _________(date), but the future

payment amount may be different. Consult your reaffirmation agreement or credit agreement, as applicable.

— Or —

Your payment schedule will be: _________(number) payments in the amount of $___________

each, payable (monthly, annually, weekly, etc.) on the __________ (day) of each ____________

(week, month, etc.), unless altered later by mutual agreement in writing.

—Or —

A reasonably specific description of the debtor’s repayment obligations to the extent known by the creditor or creditor’s representative.

2. INSTRUCTIONS AND NOTICE TO DEBTOR

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

4 |

Reaffirming a debt is a serious financial decision. The law requires you to take certain steps to make sure the decision is in your best interest. If these steps are not completed, the reaffirmation agreement is not effective, even though you have signed it.

1.Read the disclosures in this Part A carefully. Consider the decision to reaffirm carefully. Then, if you want to reaffirm, sign the reaffirmation agreement in Part B (or you may use a separate agreement you and your creditor agree on).

2.Complete and sign Part D and be sure you can afford to make the payments you are agreeing to make and have received a copy of the disclosure statement and a completed and signed reaffirmation agreement.

3.If you were represented by an attorney during the negotiation of your reaffirmation agreement, the attorney must have signed the certification in Part C.

4.If you were not represented by an attorney during the negotiation of your reaffirmation agreement, you must have completed and signed Part E.

5.The original of this disclosure must be filed with the court by you or your creditor. If a separate reaffirmation agreement (other than the one in Part B) has been signed, it must be attached.

6.If the creditor is not a Credit Union and you were represented by an attorney during the negotiation of your reaffirmation agreement, your reaffirmation agreement becomes effective upon filing with the court unless the reaffirmation is presumed to be an undue hardship as explained in Part D. If the creditor is a Credit Union and you were represented by an attorney during the negotiation of your reaffirmation agreement, your reaffirmation agreement becomes effective upon filing with the court.

7.If you were not represented by an attorney during the negotiation of your reaffirmation agreement, it will not be effective unless the court approves it. The court will notify you and the creditor of the hearing on your reaffirmation agreement. You must attend this hearing in bankruptcy court where the judge will review your reaffirmation agreement. The bankruptcy court must approve your reaffirmation agreement as consistent with your best interests, except that no court approval is required if your reaffirmation agreement is for a consumer debt secured by a mortgage, deed of trust, security deed, or other lien on your real property, like your home.

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

5 |

YOUR RIGHT TO RESCIND (CANCEL) YOUR REAFFIRMATION AGREEMENT

You may rescind (cancel) your reaffirmation agreement at any time before the bankruptcy court enters a discharge order, or before the expiration of the 60-day period that begins on the date your reaffirmation agreement is filed with the court, whichever occurs later. To rescind (cancel) your reaffirmation agreement, you must notify the creditor that your reaffirmation agreement is rescinded (or canceled).

Frequently Asked Questions:

What are your obligations if you reaffirm the debt? A reaffirmed debt remains your personal legal obligation. It is not discharged in your bankruptcy case. That means that if you default on your reaffirmed debt after your bankruptcy case is over, your creditor may be able to take your property or your wages. Otherwise, your obligations will be determined by the reaffirmation agreement which may have changed the terms of the original agreement. For example, if you are reaffirming an open end credit agreement, the creditor may be permitted by that agreement or applicable law to change the terms of that agreement in the future under certain conditions.

Are you required to enter into a reaffirmation agreement by any law? No, you are not required to reaffirm a debt by any law. Only agree to reaffirm a debt if it is in your best interest. Be sure you can afford the payments you agree to make.

What if your creditor has a security interest or lien? Your bankruptcy discharge does not eliminate any lien on your property. A ‘‘lien’’ is often referred to as a security interest, deed of trust, mortgage or security deed. Even if you do not reaffirm and your personal liability on the debt is discharged, because of the lien your creditor may still have the right to take the property securing the lien if you do not pay the debt or default on it. If the lien is on an item of personal property that is exempt under your State’s law or that the trustee has abandoned, you may be able to redeem the item rather than reaffirm the debt. To redeem, you must make a single payment to the creditor equal to the amount of the allowed secured claim, as agreed by the parties or determined by the court.

NOTE: When this disclosure refers to what a creditor ‘‘may’’ do, it does not use the word “may’’ to give the creditor specific permission. The word ‘‘may’’ is used to tell you what might occur if the law permits the creditor to take the action. If you have questions about your reaffirming a debt or what the law requires, consult with the attorney who helped you negotiate this agreement reaffirming a debt. If you don’t have an attorney helping you, the judge will explain the effect of your reaffirming a debt when the hearing on the reaffirmation agreement is held.

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

6 |

PART B: REAFFIRMATION AGREEMENT.

I (we) agree to reaffirm the debts arising under the credit agreement described below.

1.Brief description of credit agreement:

2.Description of any changes to the credit agreement made as part of this reaffirmation agreement:

SIGNATURE(S):

Borrower:

______________________________

(Print Name)

______________________________

(Signature)

Date: ________________

Co-borrower, if also reaffirming these debts:

____________________________

(Print Name)

____________________________

(Signature)

Date: ________________

Accepted by creditor:

______________________________

(Printed Name of Creditor)

______________________________

(Address of Creditor)

______________________________

(Signature)

______________________________

(Printed Name and Title of Individual Signing for Creditor)

Date of creditor acceptance:

_______________________

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

7 |

PART C: CERTIFICATION BY DEBTOR’S ATTORNEY (IF ANY).

[To be filed only if the attorney represented the debtor during the course of negotiating this agreement.]

I hereby certify that (1) this agreement represents a fully informed and voluntary agreement by the debtor; (2) this agreement does not impose an undue hardship on the debtor or any dependent of the debtor; and (3) I have fully advised the debtor of the legal effect and consequences of this agreement and any default under this agreement.

G [Check box, if applicable and the creditor is not a Credit Union.] A presumption of undue hardship has been established with respect to this agreement. In my opinion, however, the debtor is able to make the required payment.

Printed Name of Debtor’s Attorney: _______________________________

Signature of Debtor’s Attorney: ___________________________________

Date: ______________

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

8 |

PART D: DEBTOR’S STATEMENT IN SUPPORT OF REAFFIRMATION AGREEMENT

[Read and complete sections 1 and 2, OR, if the creditor is a Credit Union and the debtor is represented by an attorney, read section 3. Sign the appropriate signature line(s) and date your signature. If you complete sections 1 and 2 and your income less monthly expenses does not leave enough to make the payments under this reaffirmation agreement, check the box at the top of page 1 indicating “Presumption of Undue Hardship.” Otherwise, check the box at the top of page 1 indicating “No Presumption of Undue Hardship”]

1.I believe this reaffirmation agreement will not impose an undue hardship on my dependents or me. I can afford to make the payments on the reaffirmed debt because my monthly income (take home pay plus any other income received) is $________, and my actual current monthly expenses including monthly payments on post-bankruptcy debt and other reaffirmation agreements total $________, leaving $________ to make the required payments on this reaffirmed debt.

I understand that if my income less my monthly expenses does not leave enough to make the payments, this reaffirmation agreement is presumed to be an undue hardship on me and must be reviewed by the court. However, this presumption may be overcome if I explain to the satisfaction of the court how I can afford to make the payments here:

.

(Use an additional page if needed for a full explanation.)

2.I received a copy of the Reaffirmation Disclosure Statement in Part A and a completed and signed reaffirmation agreement.

Signed: ____________________________________

(Debtor)

_____________________________________

(Joint Debtor, if any) Date: ___________________

— Or —

[If the creditor is a Credit Union and the debtor is represented by an attorney]

3.I believe this reaffirmation agreement is in my financial interest. I can afford to make the payments on the reaffirmed debt. I received a copy of the Reaffirmation Disclosure Statement in Part A and a completed and signed reaffirmation agreement.

Signed: ____________________________________

(Debtor)

_____________________________________

(Joint Debtor, if any) Date: ___________________

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

9 |

PART E: MOTION FOR COURT APPROVAL

[To be completed and filed only if the debtor is not represented by an attorney during the course of negotiating this agreement.]

MOTION FOR COURT APPROVAL OF REAFFIRMATION AGREEMENT

I (we), the debtor(s), affirm the following to be true and correct:

I am not represented by an attorney in connection with this reaffirmation agreement.

I believe this reaffirmation agreement is in my best interest based on the income and expenses I have disclosed in my Statement in Support of this reaffirmation agreement, and because (provide any additional relevant reasons the court should consider):

Therefore, I ask the court for an order approving this reaffirmation agreement under the following provisions (check all applicable boxes):

G 11 U.S.C. § 524(c)(6) (debtor is not represented by an attorney during the course of the negotiation of the reaffirmation agreement)

G11 U.S.C. § 524(m) (presumption of undue hardship has arisen because monthly expenses exceed monthly income)

Signed:_______________________________

(Debtor)

_______________________________

(Joint Debtor, if any) Date: __________________