1986 can be completed very easily. Just use FormsPal PDF tool to finish the job promptly. Our editor is constantly developing to deliver the best user experience achievable, and that's because of our commitment to constant improvement and listening closely to user comments. By taking several easy steps, you are able to begin your PDF journey:

Step 1: Hit the orange "Get Form" button above. It will open up our pdf tool so that you can begin completing your form.

Step 2: When you access the online editor, you will notice the form made ready to be filled in. Apart from filling out various fields, you might also do many other actions with the Document, that is writing your own words, modifying the original text, inserting graphics, affixing your signature to the document, and much more.

It is straightforward to finish the form using this helpful tutorial! This is what you should do:

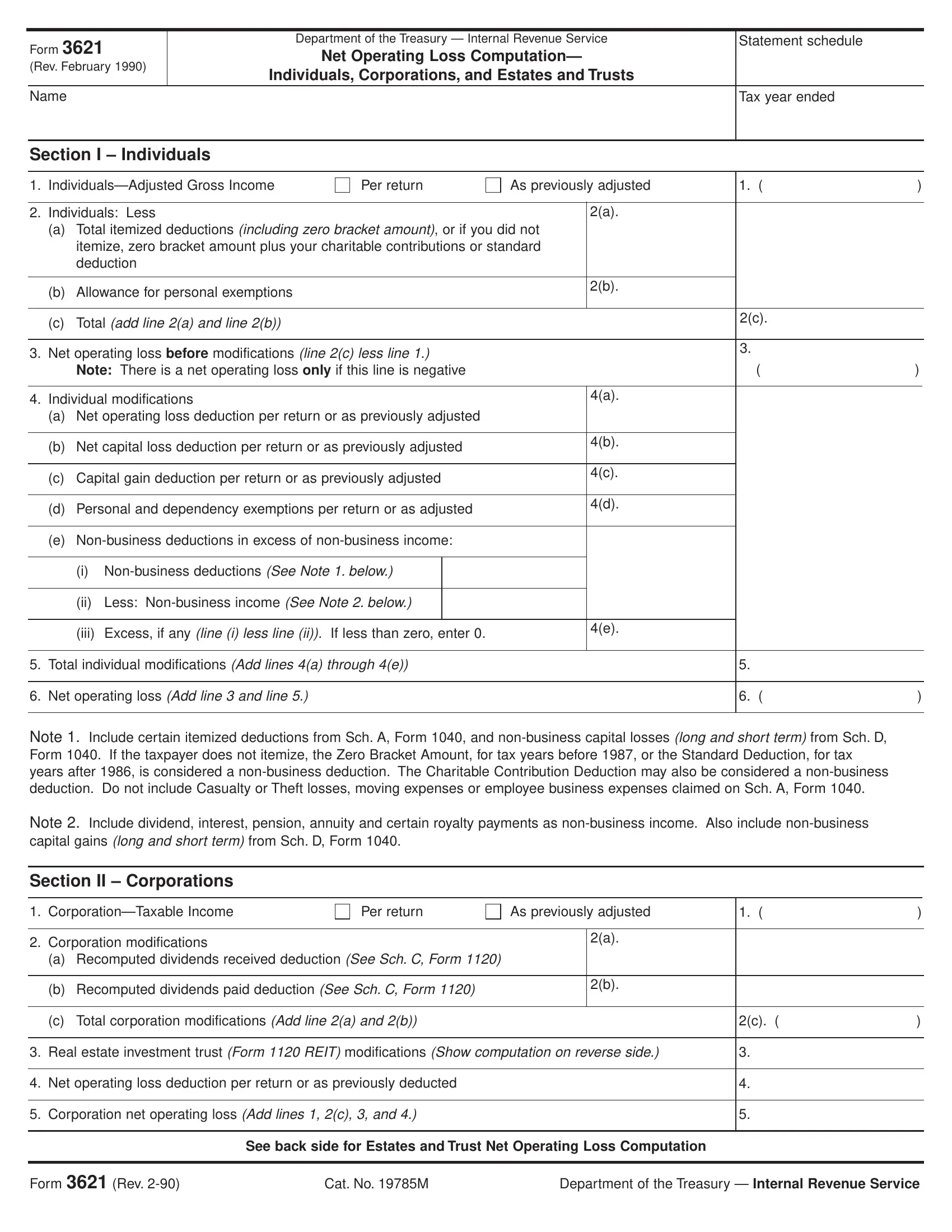

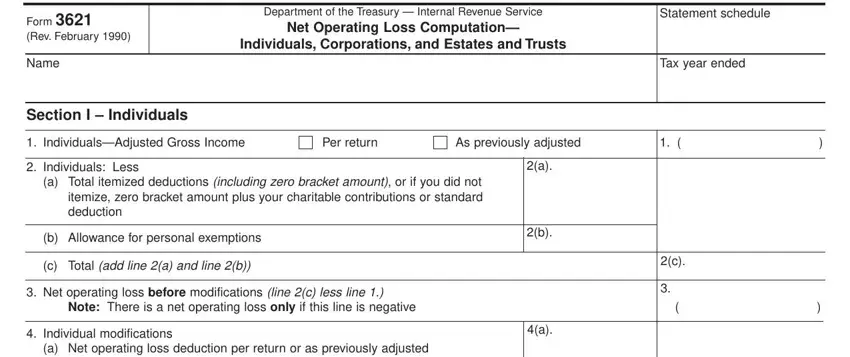

1. To begin with, while completing the 1986, beging with the part that contains the subsequent blanks:

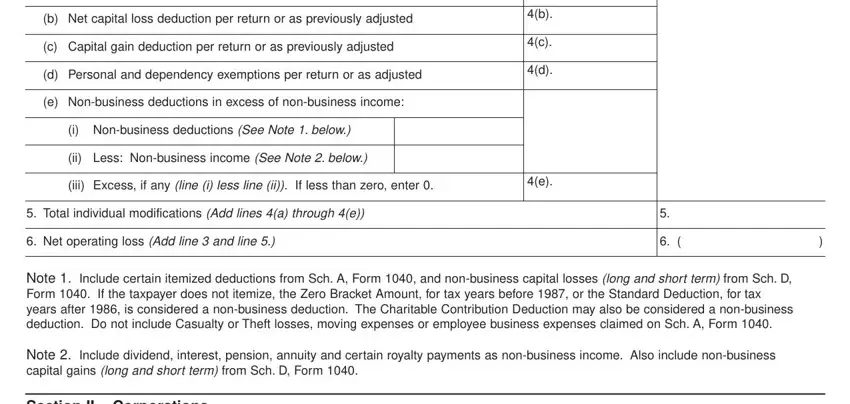

2. Once this section is finished, it's time to insert the required details in b Net capital loss deduction per, c Capital gain deduction per, d Personal and dependency, e Nonbusiness deductions in excess, i Nonbusiness deductions See Note, ii Less Nonbusiness income See, iii Excess if any line i less line, Total individual modifications, Net operating loss Add line and, Note Include certain itemized, Note Include dividend interest, and Section II Corporations so that you can progress further.

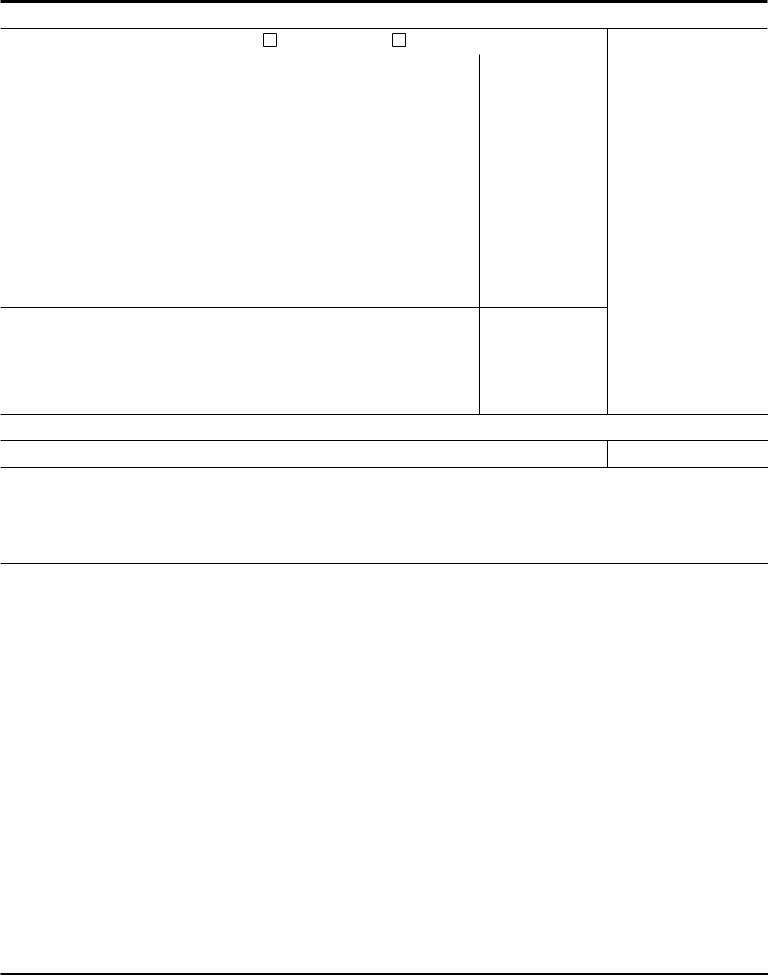

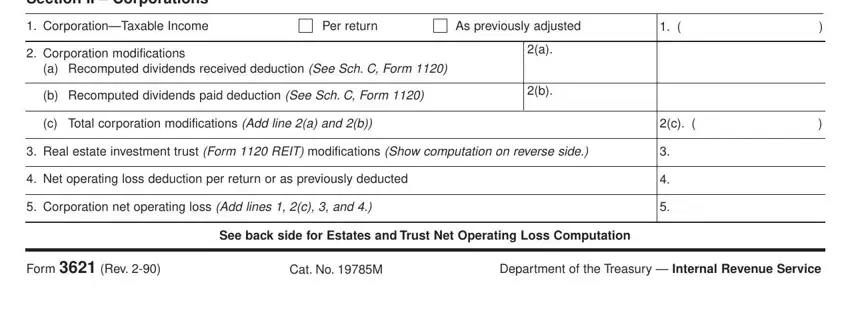

3. The following segment is all about Section II Corporations, CorporationTaxable Income, Per return, As previously adjusted, Corporation modifications, a Recomputed dividends received, b Recomputed dividends paid, c Total corporation modifications, Real estate investment trust Form, Net operating loss deduction per, Corporation net operating loss, See back side for Estates and, Form Rev, Cat No M, and Department of the Treasury - complete every one of these blanks.

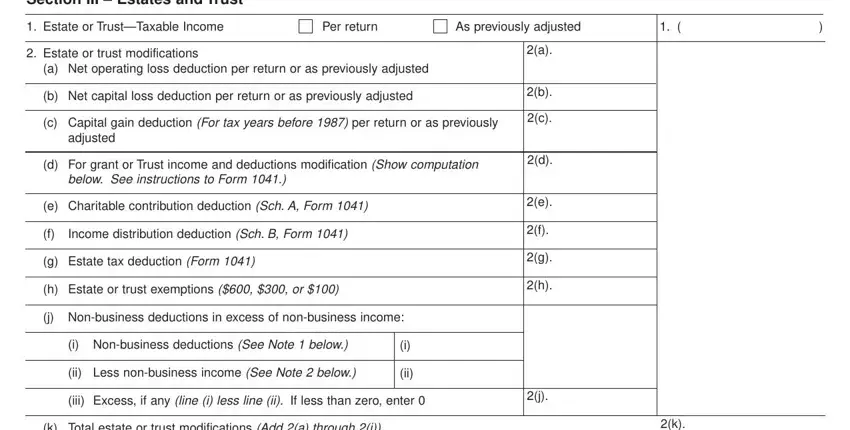

4. To go ahead, this next section requires completing a few blanks. These include Section III Estates and Trust, Estate or TrustTaxable Income, Per return, As previously adjusted, Estate or trust modifications, a Net operating loss deduction per, b Net capital loss deduction per, c Capital gain deduction For tax, adjusted, d For grant or Trust income and, below See instructions to Form, e Charitable contribution, Income distribution deduction SchB, g Estate tax deduction Form, and h Estate or trust exemptions or, which you'll find crucial to going forward with this PDF.

Many people generally make errors when filling in a Net operating loss deduction per in this section. Be sure to go over whatever you enter right here.

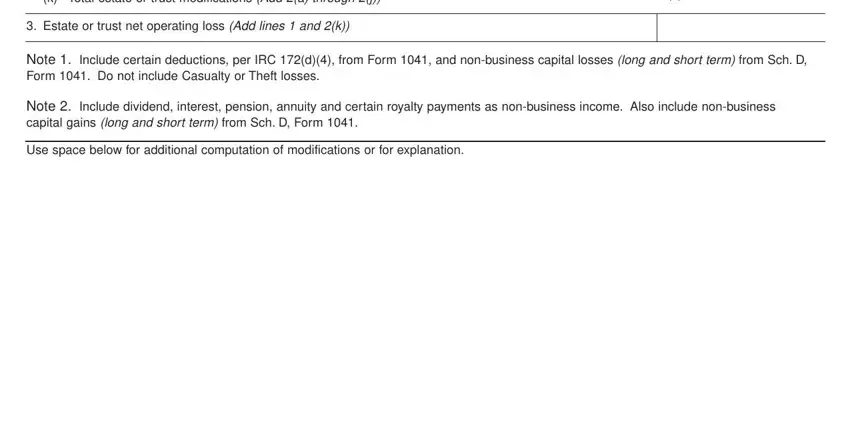

5. The form has to be finished within this section. Further there is an extensive list of fields that require correct information for your document usage to be faultless: k Total estate or trust, Estate or trust net operating, Note Include certain deductions, Note Include dividend interest, and Use space below for additional.

Step 3: Glance through the information you've entered into the blank fields and then hit the "Done" button. Download the 1986 once you join for a free trial. Easily access the pdf form from your personal account page, with any edits and adjustments conveniently synced! FormsPal offers secure form tools without data recording or sharing. Rest assured that your details are secure with us!