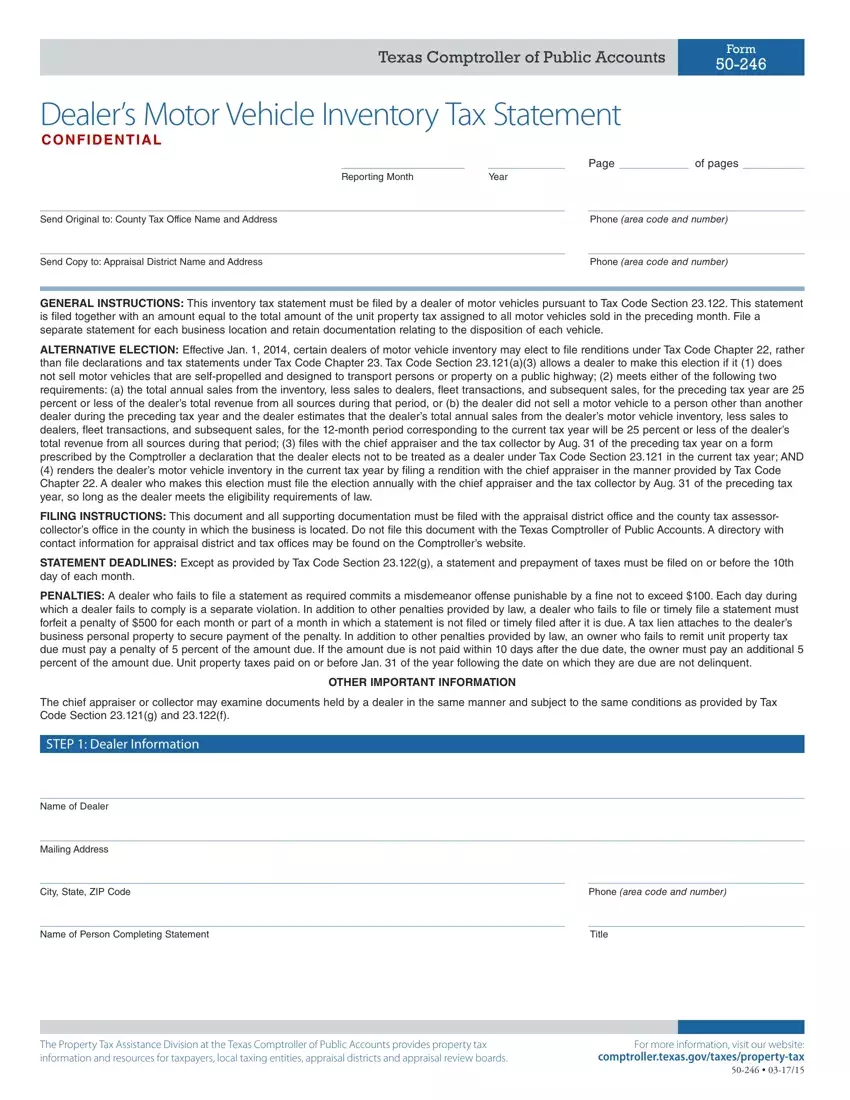

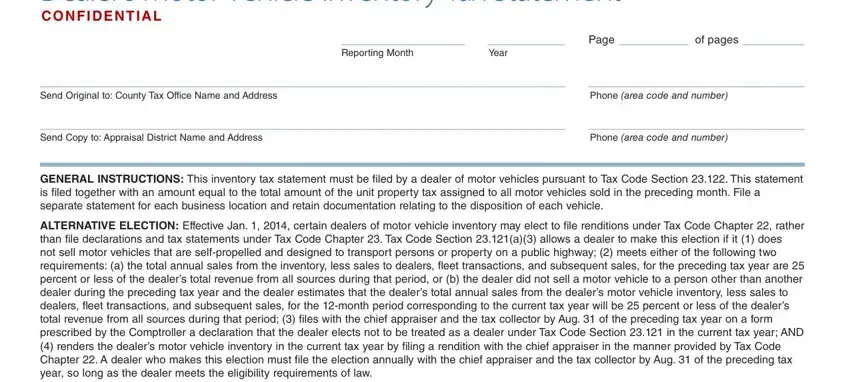

Having the purpose of making it as quick to use as it can be, we developed our PDF editor. The whole process of filling out the tx will be painless should you use the following steps.

Step 1: Select the button "Get Form Here" and press it.

Step 2: Once you have entered the editing page tx, you should be able to find all the functions available for your document at the upper menu.

Fill out the tx PDF by typing in the data needed for every single section.

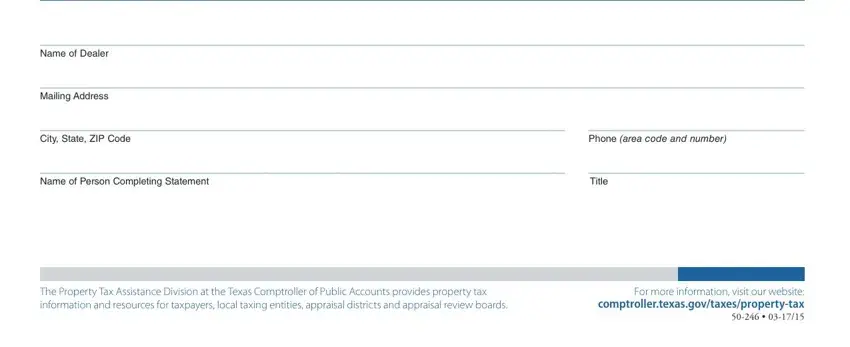

Type in the appropriate information in the space Name of Dealer, Mailing Address, City State ZIP Code, Phone area code and number, Name of Person Completing, Title, The Property Tax Assistance, and For more information visit our.

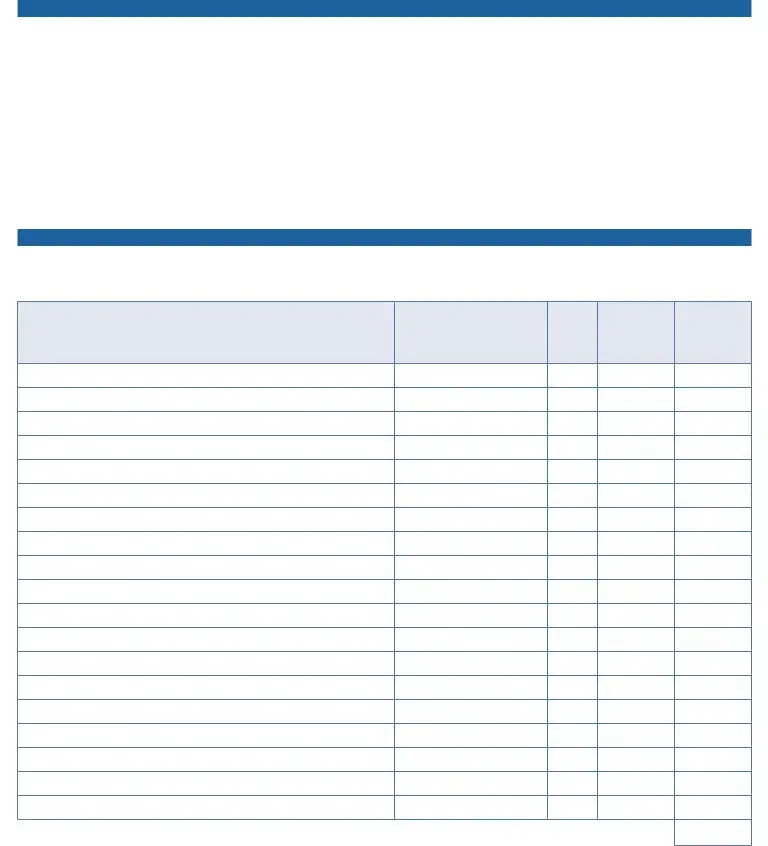

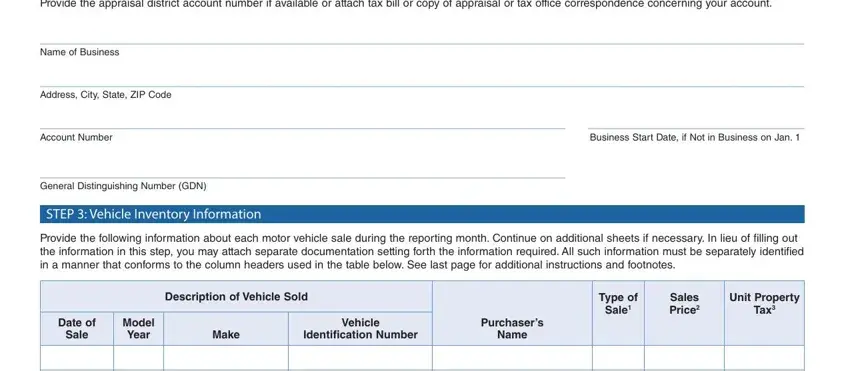

You have to emphasize the key details within the Provide the appraisal district, Name of Business, Address City State ZIP Code, Account Number, Business Start Date if Not in, General Distinguishing Number GDN, STEP Vehicle Inventory Information, Provide the following information, Description of Vehicle Sold, Type of Sale, Sales Price, Unit Property Tax, Date of Sale, Model Year, and Make box.

For space , specify the rights and responsibilities.

Fill in the document by looking at these sections: Unit Property Tax Factor, For more information visit our, Page, and Total Unit Property Tax.

Step 3: After you've hit the Done button, your document will be accessible for upload to each electronic device or email you specify.

Step 4: Prepare around two or three copies of your document to keep clear of any specific potential future challenges.