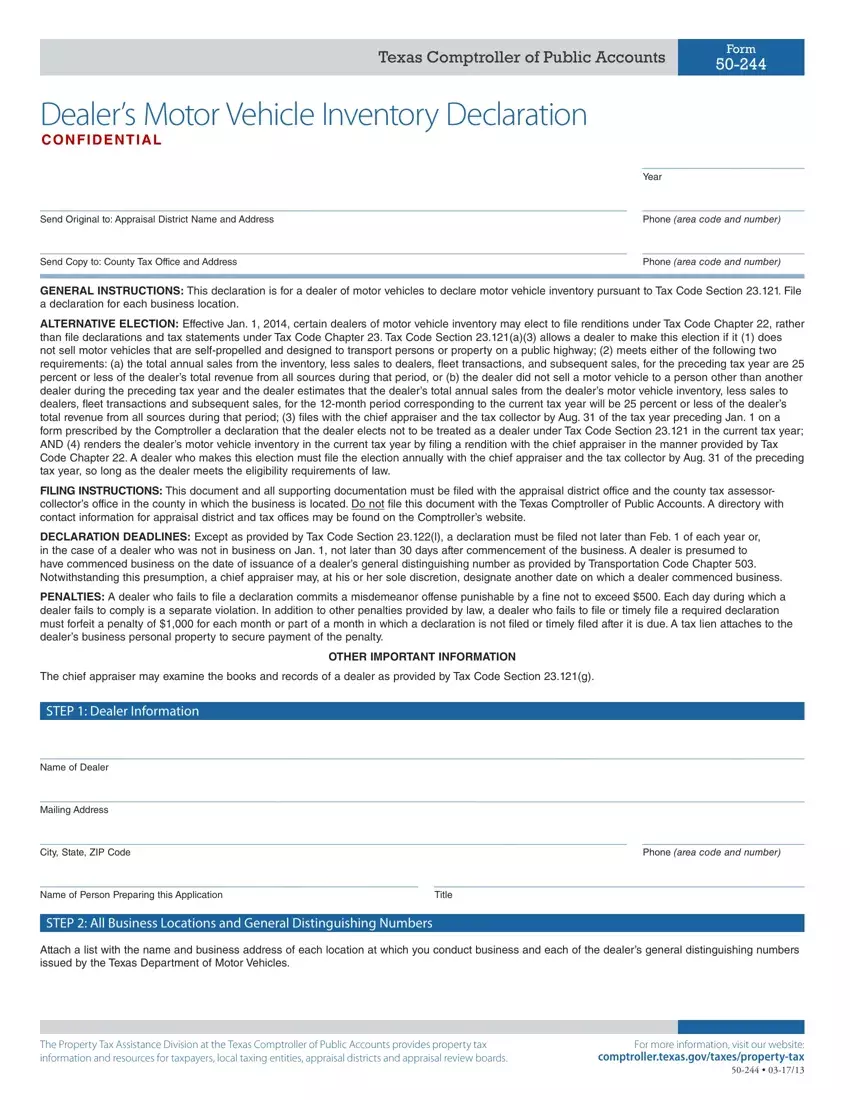

The objective powering our PDF editor was to allow it to be as simple as possible. You'll find the whole procedure of managing inventory form 50 effortless should you keep to the following actions.

Step 1: Click on the "Get Form Here" button.

Step 2: Now you're on the document editing page. You may modify and add text to the file, highlight specified content, cross or check selected words, insert images, insert a signature on it, get rid of needless areas, or eliminate them entirely.

For every single section, prepare the data demanded by the application.

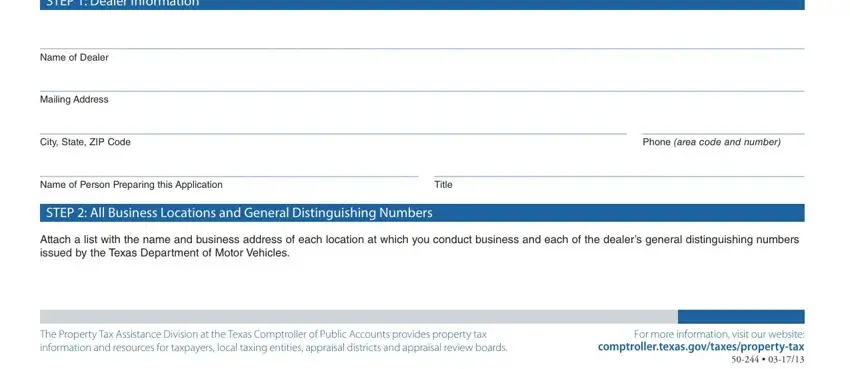

Remember to insert the information inside the part STEP Dealer Information, Name of Dealer, Mailing Address, City State ZIP Code, Phone area code and number, Name of Person Preparing this, Title, STEP All Business Locations and, Attach a list with the name and, The Property Tax Assistance, and For more information visit our.

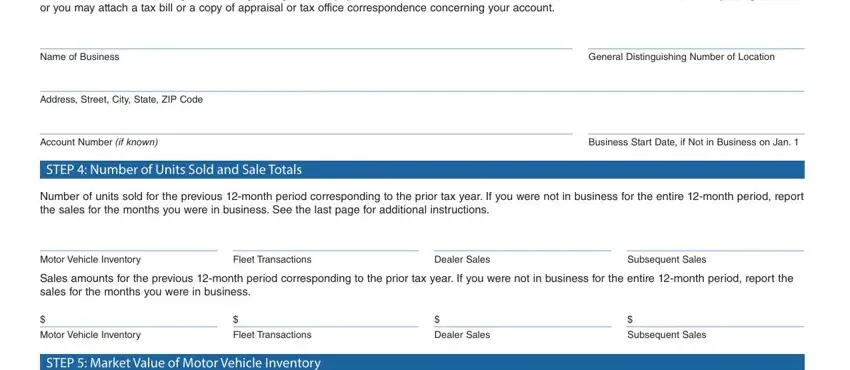

The software will require details to automatically fill in the area Provide the business name general, Name of Business, General Distinguishing Number of, Address Street City State ZIP Code, Account Number if known Business, STEP Number of Units Sold and, Number of units sold for the, Motor Vehicle Inventory, Fleet Transactions, Subsequent Sales, Dealer Sales, Sales amounts for the previous, Motor Vehicle Inventory, Fleet Transactions, and Subsequent Sales.

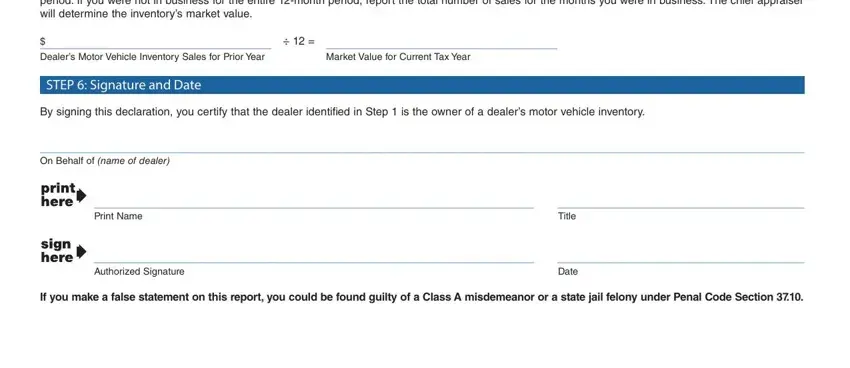

In the section State the market value of the, Dealers Motor Vehicle Inventory, Market Value for Current Tax Year, STEP Signature and Date, By signing this declaration you, On Behalf of name of dealer, Print Name, Title, Authorized Signature, Date, and If you make a false statement on, specify the rights and obligations of the parties.

End by reviewing all of these sections and filling in the suitable particulars: For more information visit our, and Page.

Step 3: Hit the Done button to save your document. So now it is ready for export to your gadget.

Step 4: You can make duplicates of the file tostay clear of any kind of upcoming issues. Don't be concerned, we don't share or monitor your details.