You'll be able to work with equipment heavy property without difficulty using our online PDF editor. We are aimed at giving you the ideal experience with our tool by constantly presenting new capabilities and upgrades. With these improvements, using our tool becomes easier than ever! For anyone who is looking to get going, here's what you will need to do:

Step 1: First of all, access the editor by clicking the "Get Form Button" above on this site.

Step 2: With the help of this online PDF editing tool, it is easy to do more than simply fill out blanks. Try all of the functions and make your docs look faultless with customized textual content incorporated, or modify the original input to perfection - all that supported by an ability to incorporate your own images and sign the file off.

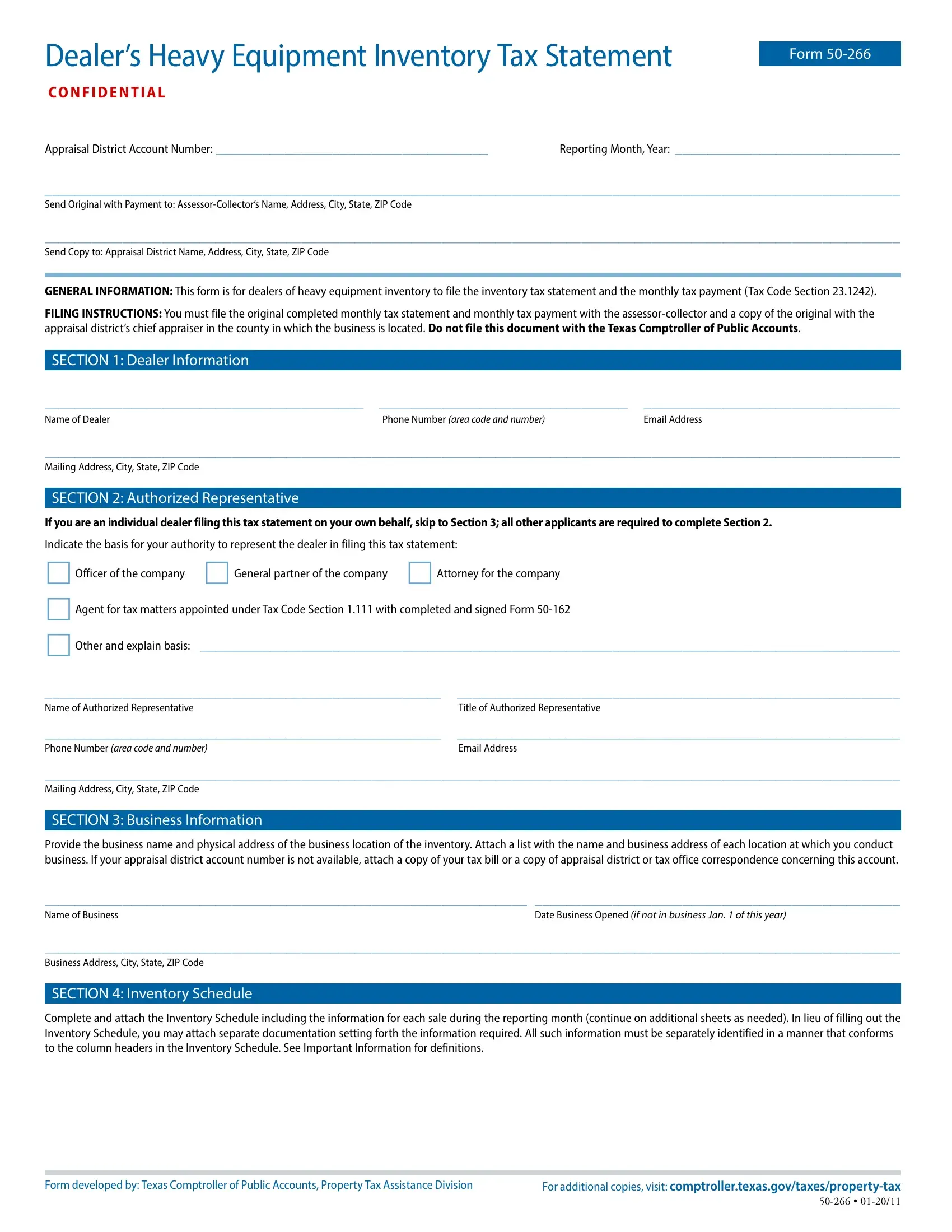

So as to fill out this document, make sure that you enter the necessary information in every single field:

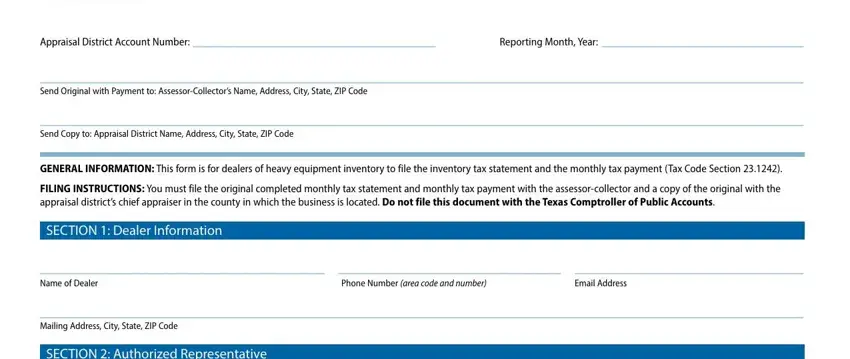

1. The equipment heavy property necessitates particular information to be entered. Be sure that the subsequent fields are finalized:

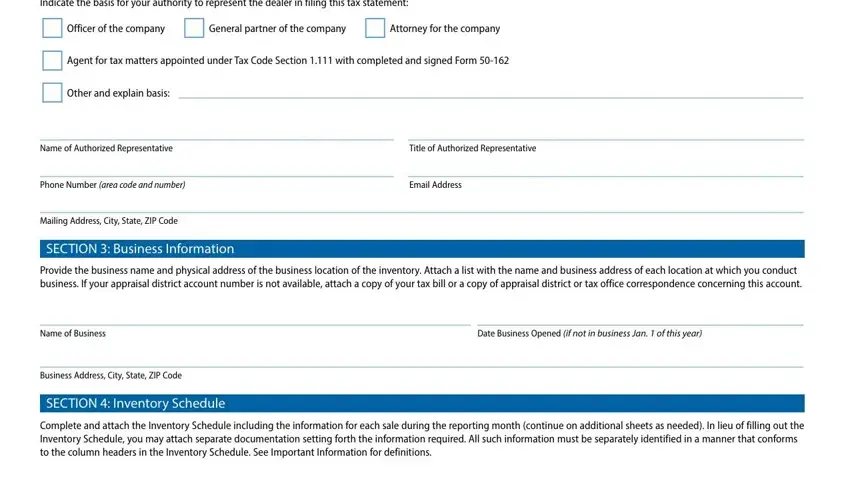

2. Right after completing the last step, head on to the next part and fill out all required details in all these blanks - Indicate the basis for your, Officer of the company General, Name of Authorized Representative, Title of Authorized Representative, Phone Number area code and number, Email Address, Mailing Address City State ZIP, SECTION Business Information, Provide the business name and, Name of Business, Date Business Opened if not in, Business Address City State ZIP, SECTION Inventory Schedule, and Complete and attach the Inventory.

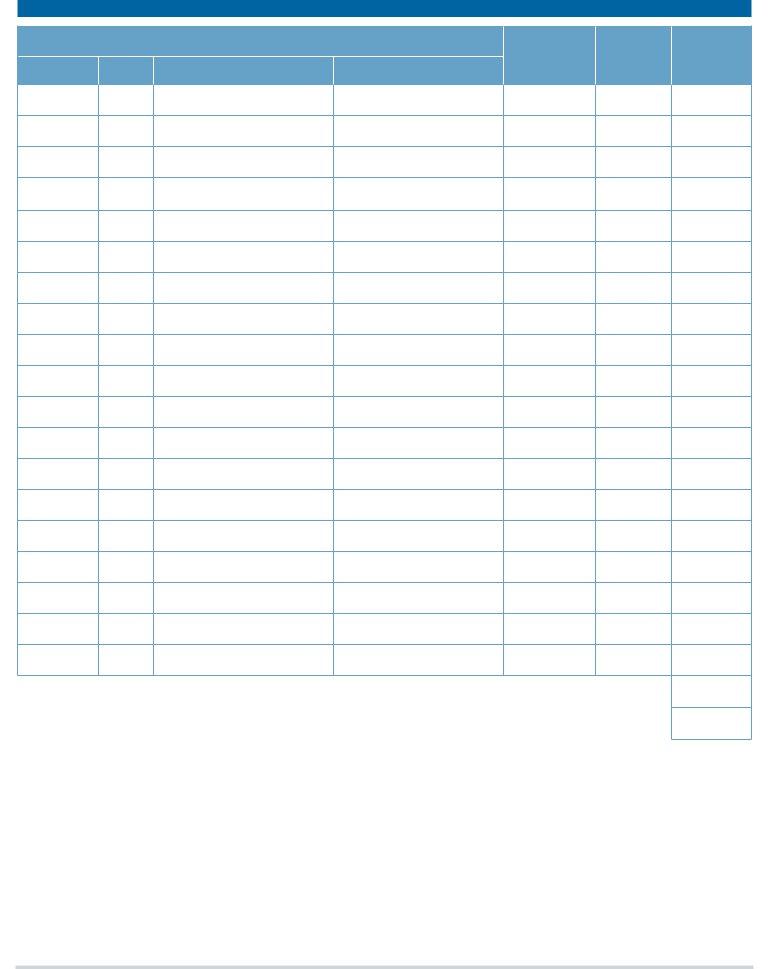

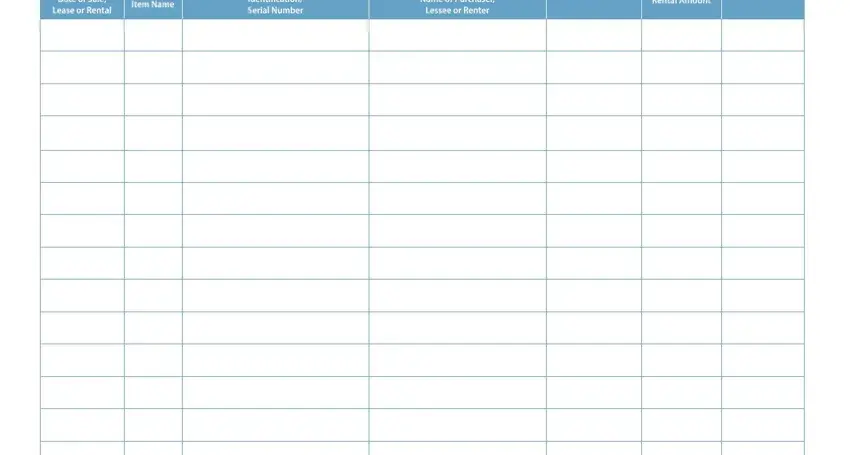

3. The following part will be about Date of Sale Lease or Rental, Item Name, Identification Serial Number, Name of Purchaser, Lessee or Renter, Type of Sale Lease or Rental, Rental Amount, and Property Tax - type in every one of these fields.

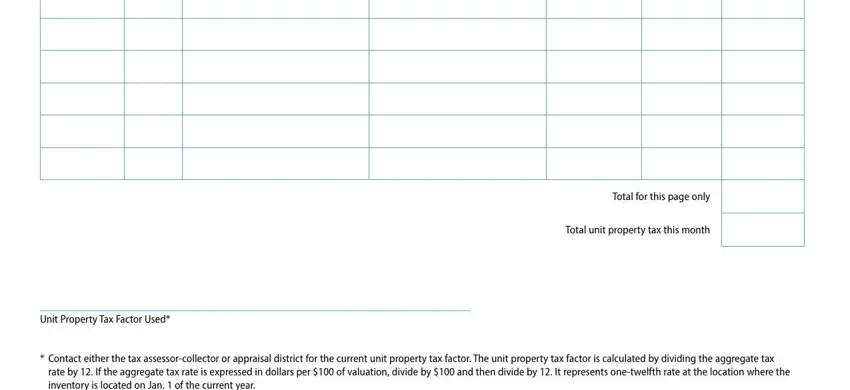

4. Now begin working on the next portion! Here you've got all these Total for this page only, Total unit property tax this month, Unit Property Tax Factor Used, Contact either the tax, and rate by If the aggregate tax rate blank fields to do.

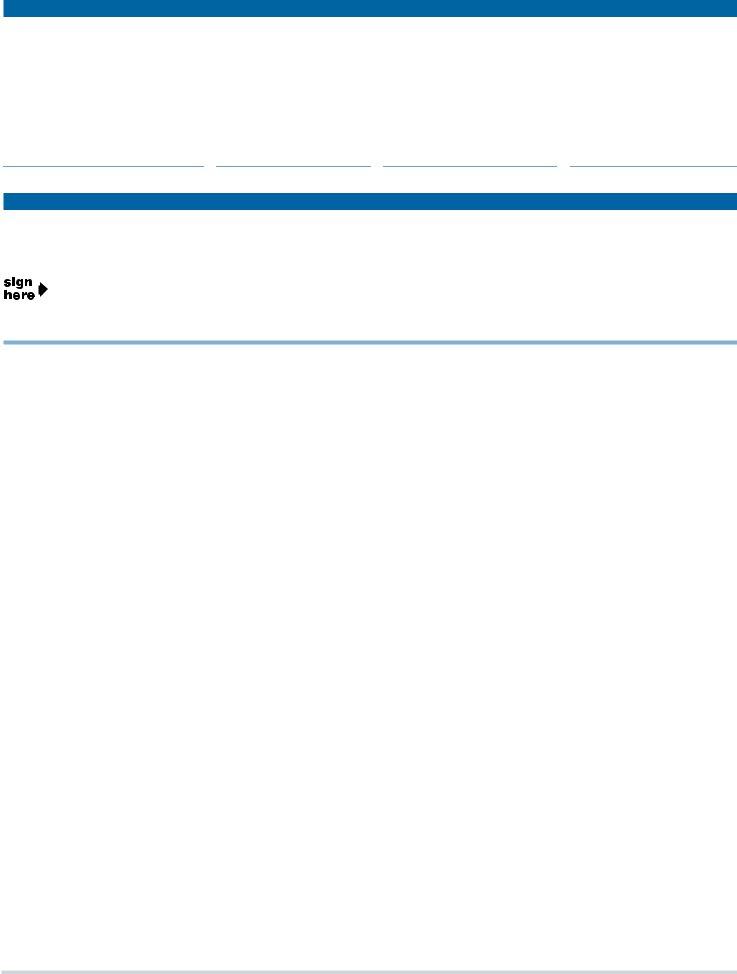

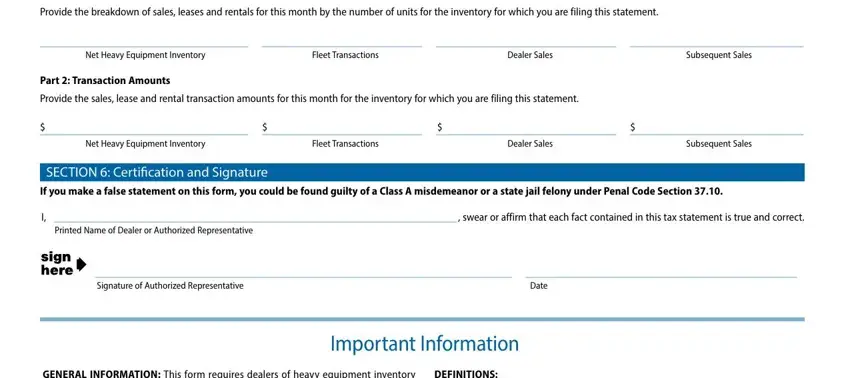

5. To conclude your document, the last subsection requires several extra fields. Filling in Provide the breakdown of sales, Net Heavy Equipment Inventory, Fleet Transactions, Dealer Sales, Subsequent Sales, Part Transaction Amounts, Provide the sales lease and rental, Net Heavy Equipment Inventory, Fleet Transactions, Dealer Sales, Subsequent Sales, SECTION Certification and, If you make a false statement on, I swear or affirm that each fact, and Signature of Authorized will wrap up the process and you're going to be done in a tick!

Be really attentive when filling out Fleet Transactions and Provide the breakdown of sales, as this is the section in which most people make a few mistakes.

Step 3: Right after you've glanced through the information you given, click on "Done" to finalize your FormsPal process. After starting a7-day free trial account here, you'll be able to download equipment heavy property or send it through email immediately. The PDF document will also be accessible in your personal account with your every single edit. FormsPal offers risk-free form editor devoid of personal information record-keeping or sharing. Be assured that your data is secure with us!