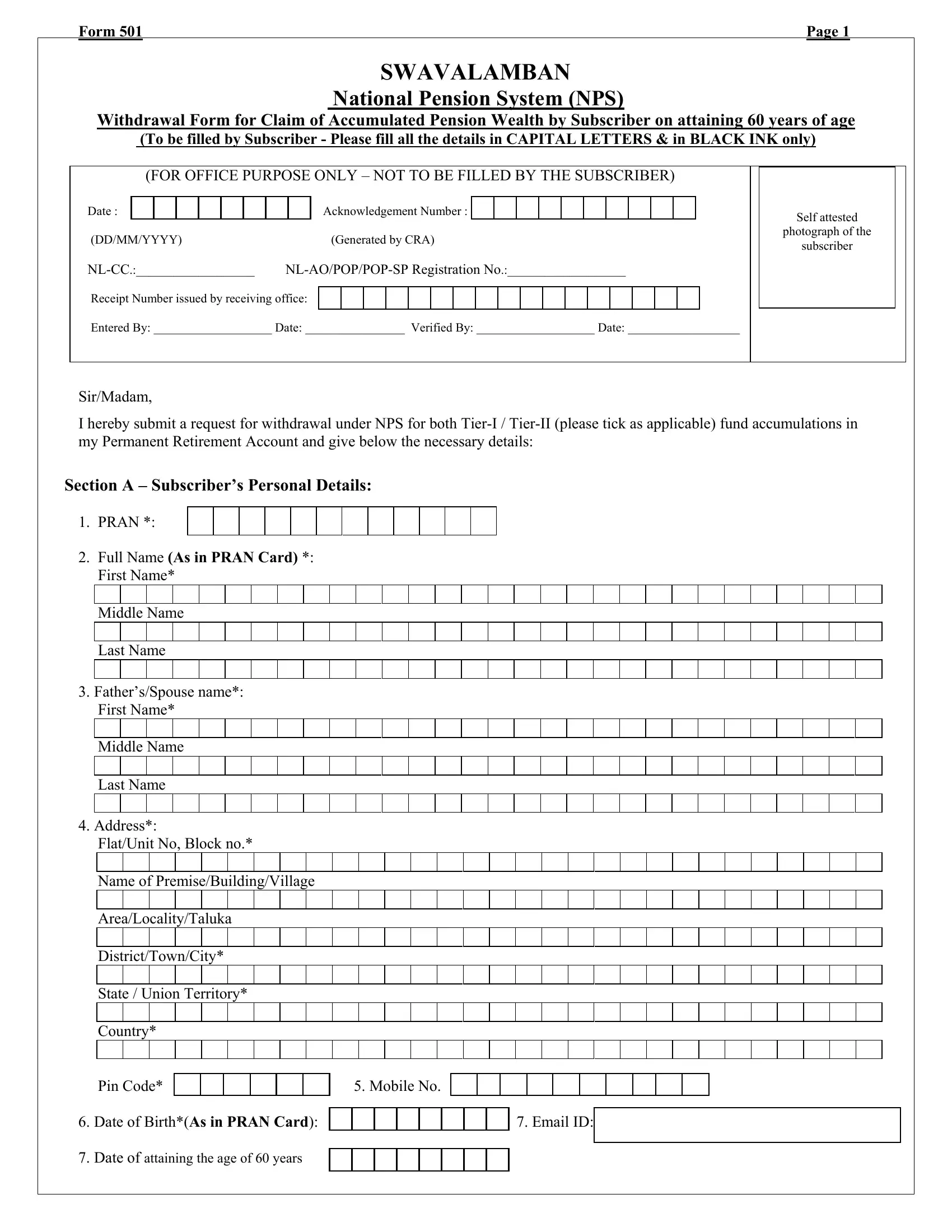

SWAVALAMBAN

National Pension System (NPS)

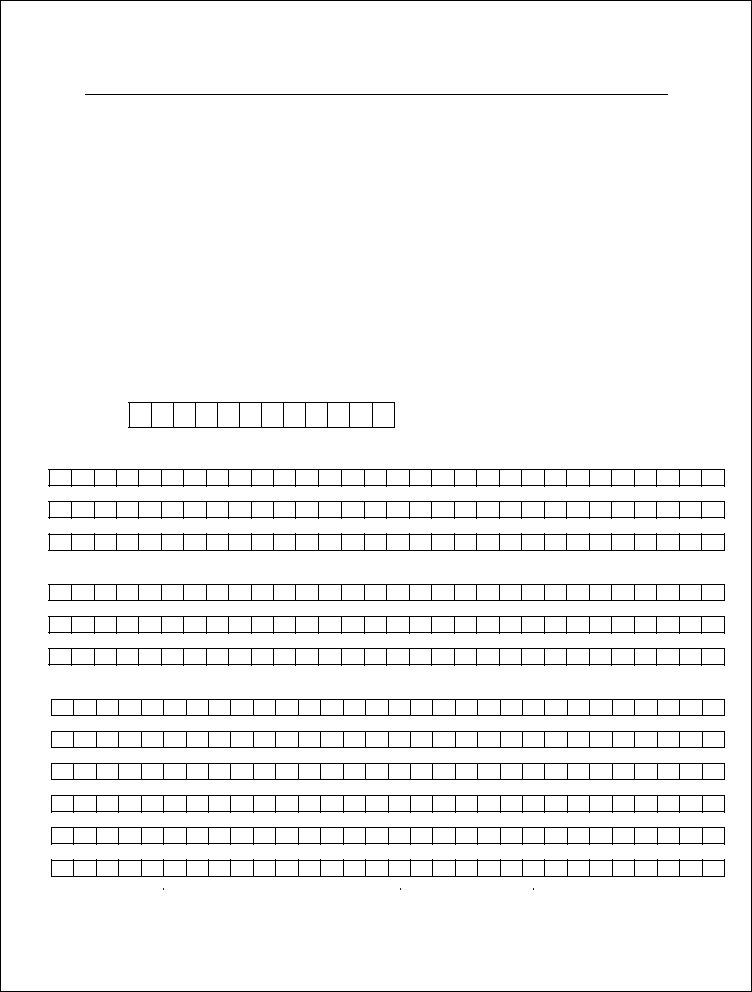

Withdrawal Form for Claim of Accumulated Pension Wealth by Subscriber on attaining 60 years of age

(To be filled by Subscriber - Please fill all the details in CAPITAL LETTERS & in BLACK INK only)

|

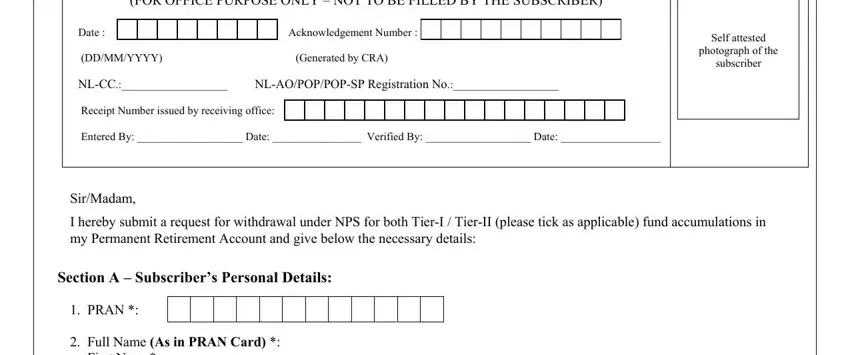

(FOR OFFICE PURPOSE ONLY – NOT TO BE FILLED BY THE SUBSCRIBER) |

|

|

|

Date : |

|

|

|

|

|

|

|

|

|

Acknowledgement Number : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self attested |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(DD/MM/YYYY) |

|

|

|

(Generated by CRA) |

|

photograph of the |

|

|

|

|

|

subscriber |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

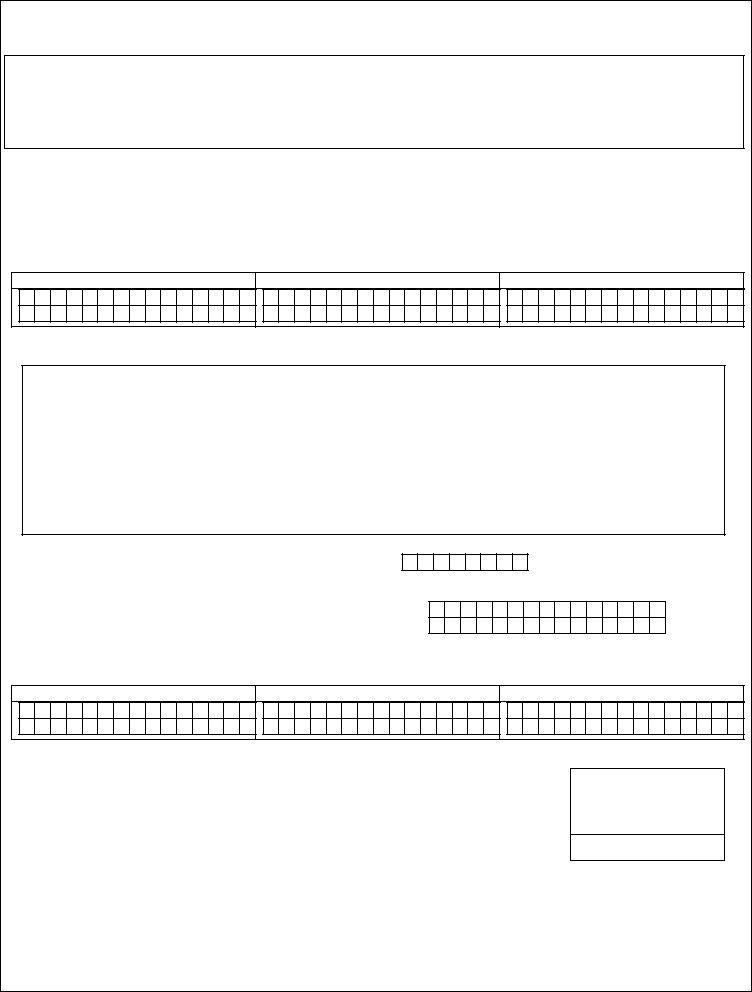

NL-CC.:___________________ |

NL-AO/POP/POP-SP Registration No.:___________________ |

|

|

|

Receipt Number issued by receiving office: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entered By: ___________________ Date: ________________ Verified By: ___________________ Date: __________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sir/Madam,

I hereby submit a request for withdrawal under NPS for both Tier-I / Tier-II (please tick as applicable) fund accumulations in my Permanent Retirement Account and give below the necessary details:

Section A – Subscriber’s Personal Details:

1. PRAN *:

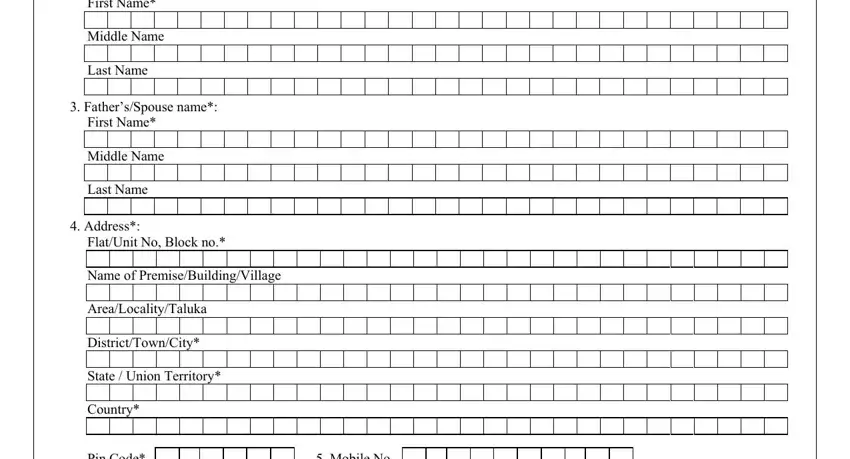

2.Full Name (As in PRAN Card) *: First Name*

Middle Name Last Name

3.Father’s/Spouse name*:

First Name*

Middle Name

Last Name

4. Address*:

Flat/Unit No, Block no.*

Name of Premise/Building/Village

Area/Locality/Taluka

District/Town/City*

State / Union Territory*

Country*

|

Pin Code* |

|

|

|

|

|

|

|

5. Mobile No. |

|

|

|

|

|

|

|

|

|

|

|

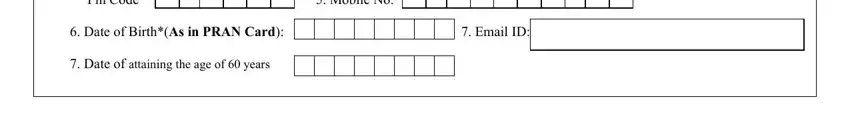

6. |

Date of Birth*(As in PRAN Card): |

|

|

|

|

|

|

|

|

|

|

|

7. Email ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Date of attaining the age of 60 years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

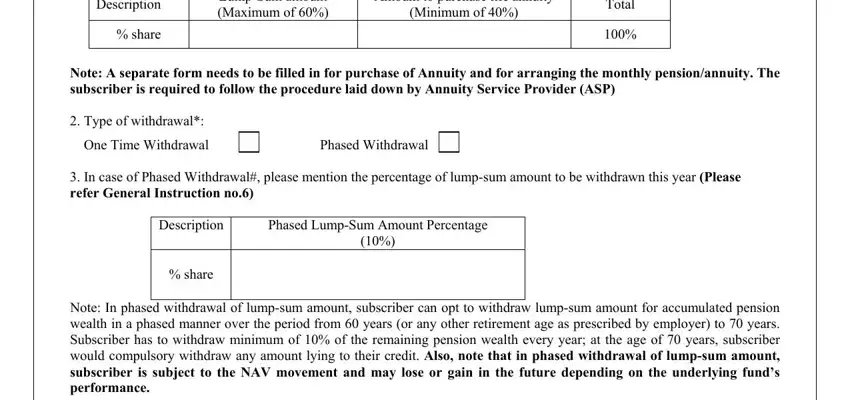

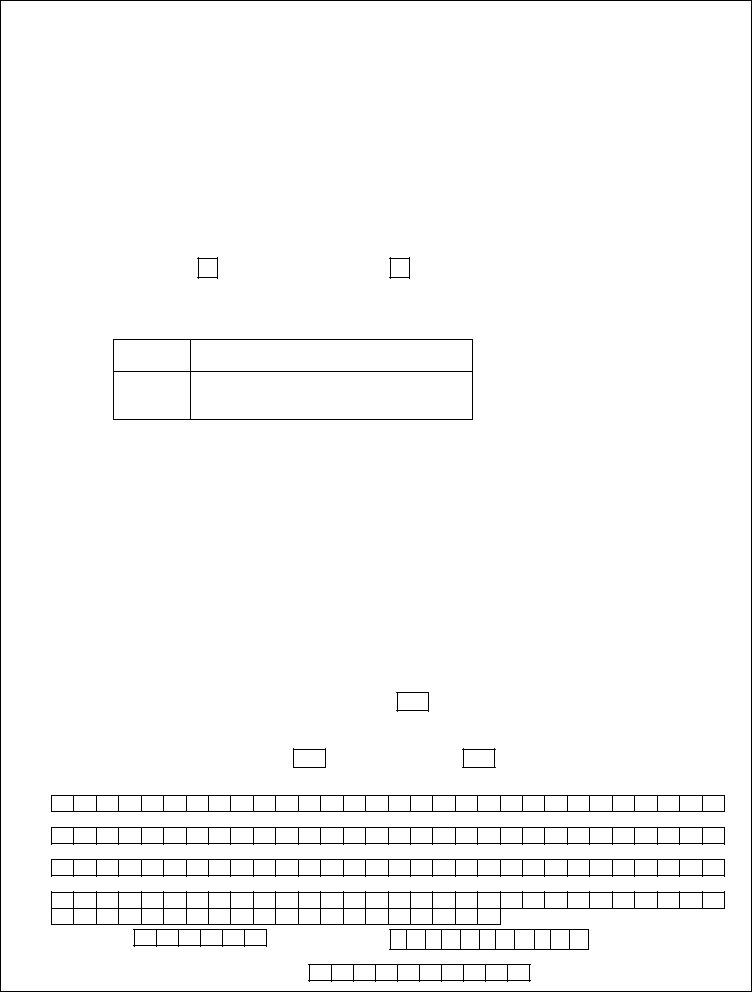

Section B – Subscriber’s Withdrawal Details:

Tier – I Account:

1.The Lump-sum amount to be withdrawn and amount to purchase annuity in case of normal withdrawal*(Please refer

General Instruction no.4&5)

|

Description |

Lump-Sum amount |

Amount to purchase life annuity |

Total |

|

(Maximum of 60%) |

(Minimum of 40%) |

|

|

|

|

% share |

|

|

100% |

|

|

|

|

|

Note: A separate form needs to be filled in for purchase of Annuity and for arranging the monthly pension/annuity. The subscriber is required to follow the procedure laid down by Annuity Service Provider (ASP)

2.Type of withdrawal*: One Time Withdrawal

3.In case of Phased Withdrawal#, please mention the percentage of lump-sum amount to be withdrawn this year (Please refer General Instruction no.6)

Phased Lump-Sum Amount Percentage

(10%)

% share

Note: In phased withdrawal of lump-sum amount, subscriber can opt to withdraw lump-sum amount for accumulated pension wealth in a phased manner over the period from 60 years (or any other retirement age as prescribed by employer) to 70 years. Subscriber has to withdraw minimum of 10% of the remaining pension wealth every year; at the age of 70 years, subscriber would compulsory withdraw any amount lying to their credit. Also, note that in phased withdrawal of lump-sum amount, subscriber is subject to the NAV movement and may lose or gain in the future depending on the underlying fund’s performance.

For subscriber opting for phased withdrawal, the Central Recordkeeping Agency (CRA) maintenance charges would be deducted from the corpus/units lying in the account of the subscriber

Tier – II Account:

The entire accumulated pension wealth would be paid out in single lump sum along with the withdrawal/payment of the Tier-I account.

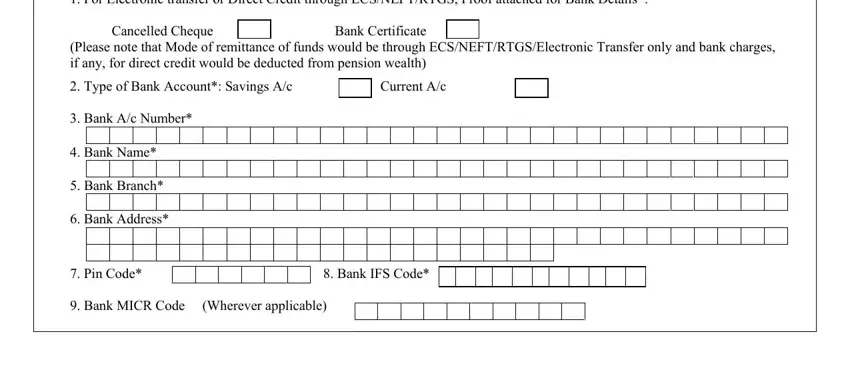

Section C – Subscriber’s Bank Details:

1. For Electronic transfer or Direct Credit through ECS/NEFT/RTGS, Proof attached for Bank Details*:

Cancelled Cheque |

|

Bank Certificate |

(Please note that Mode of remittance of funds would be through ECS/NEFT/RTGS/Electronic Transfer only and bank charges, if any, for direct credit would be deducted from pension wealth)

2. Type of Bank Account*: Savings A/c

3.Bank A/c Number*

4.Bank Name*

5.Bank Branch*

6.Bank Address*

9. Bank MICR Code (Wherever applicable)

Section D – Subscriber’s Annuity Details:

1. Annuity Service Provider (ASP) Name *:

2. ASP ID*:

3. ASP Scheme Name *:

4. ASP Scheme ID *:

Declaration:

I_______________________________________, NPS Subscriber, my PRAN is ______________________, do hereby declare that the information provided above is true to the best of my knowledge and belief.

Date :

D D M M Y YYY

Signature/ Thumb

Impression of the Subscriber

*Note: Left thumb impression in case of illiterate male claimants and Right thumb impression in case of illiterate female claimants must be obtained.

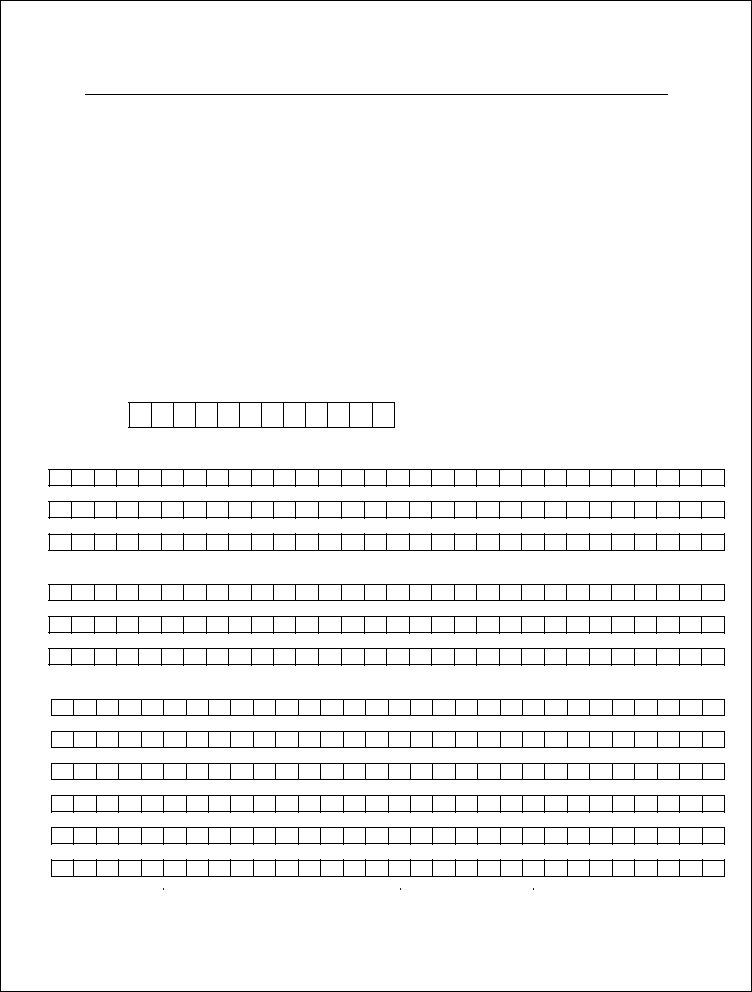

Annexure for Nomination Details

INSTRUCTIONS FOR FILLING IN THE FORM

The details of nominees to whom the outstanding pension wealth of the subscriber is payable in case of the demise of the subscriber before entire proceeds are withdrawn (Please refer general instruction no: 7) is to be provided hereunder. Also, please note that in case of demise of the subscriber after opting for phased withdrawal, all the outstanding pension wealth out of the phased lump sum withdrawal in the account of the subscriber will be paid to the nominee(s) as mentioned in this form and the same would be treated as full and final discharge of the obligation. In case, if you wish to appoint multiple nominees, please fill in the form 401-AN.

I, ____________________________________ hereby nominate the person(s) mentioned below who is/are member(s)/non-

member(s) of my family to receive the amount that may stand to my credit in the National Pension System as indicated below, in the event of my death before that eligible accumulated pension wealth amount has become payable or having become payable or having become payable has not been paid.

1. Name of the Nominee:

2. Nominee’s current communication Address

Flat/Unit No, Block no*_____________________________________________________________________

Name of Premise/Building/Village ____________________________________________________________

Area/Locality/Taluka___________________________ ____________________________________________

District/Town/City*________________________________________________________________________

State / Union Territory*_____________________________________________________________________

Country*____________ Pin Code*____________ Email ID:_________________________________________ Mobile No.:_____________

3. Date of Birth of the Nominee* (Only in case of a minor):

4.Relationship of the nominee with the Subscriber*:

(e.g. If nominee is son, subscriber should fill the relationship as ‘Son’)

5.Nominee’s Guardian Details*(only in case of a minor):

Dated this ______________day of____________20 |

at ______________. |

in the presence of the following witnesses: |

|

|

|

|

|

|

|

|

Particulars |

1st Witness |

|

2nd Witness |

|

Name |

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

Signature/ Thumb

Impression of the Subscriber

*Note: Left thumb impression in case of illiterate male Subscriber and Right thumb impression in case of illiterate female subscriber must be obtained.

The date of attaining the age of 60 years of the subscriber is as given below:

TO BE FILLED/ATTESTED BY NL-CC/POP/POP-SP

Certified that the above declaration and nomination details has been signed / thumb impressed before me by Sh/Smt/Ms. _________

________________________________________after he / she have read the entries / entries have been read over to him / her by me

and got confirmed by him / her.

(DDMMYYYY)

Rubber Stamp of the NL-CC/POP/POP-SP

Signature of the Authorised Person

NL-CC/POP/POP-SP Registration Number _______________________ |

Designation of the Authorised Person : __________________________________ |

(Allotted by CRA) |

|

NL-CC/POP/POP-SP Office Name : ___________________________________

TO BE FILLED/ATTESTED BY NL-AO/POP/POP-SP

NL-AO/POP/POP-SP Registration Number (Allotted by CRA):

___________________________________________________________

Rubber Stamp of the NL-AO/DTO/POP/POP-SP

Signature of the Authorised Person

-------------------------------------------------------------------------------------------------------------

CLAIM FOR THE WITHDRAWAL OF ACCUMULATED PENSION WEALTH OF THE

SUBSCRIBER UNDER NATIONAL PENSION SYSTEM

Advanced Stamped Receipt

I _________________________________covered under the National Pension System with Permanent Retirement Account

Number (PRAN) _____________________has received a sum of Rs./-

(Rupees_____________________________________________________________only) from National Pension System /

National Pension System Trust by deposit in my Saving Bank / Current Account towards the settlement of my National

Pension System (NPS) account.

Affix 1 Rupee

Revenue Stamp and sign across

Signature or Left/ Right hand thumb impression of the NPS Subscriber*

(*Note: Left thumb impression in case of illiterate male claimants and Right thumb impression in case of illiterate female claimants must be obtained.)

-------------------------------------------------------------------------------------------------------------

ACKNOWLEDGMENT RECEIPT

Acknowledgment slip to the NPS Subscriber on receipt of completed application form for Withdrawal on attaining 60 years of age

(To be filled by NL-AO/POP/POP-SP)

Received from PRAN :

|

|

|

NL-CC: _____________________ |

NL-AO/POP/POP-SP Registration Number: _____________________ |

Received at: _________________________ Date : ____________________________ |

Time: __________________ |

Acknowledgement Number : (Generated by CRA)

INSTRUCTIONS FOR FILLING UP THE FORM

This application should be filled by the Subscriber seeking to withdraw pension wealth benefits upon attaining 60 years of age

Documents to be enclosed along with this application:-

1.PRAN card in original. In case PRAN card is not available, the subscriber needs to submit a duly notarized Affidavit as to the reasons of non-submission of the PRAN card.

2.Cancelled cheque (containing Subscriber Name, Bank Account Number and IFS Code) or Bank Certificate Containing Name, Bank Account Number and IFSC code, for direct credit or electronic transfer.

3.A pre-signed receipt acknowledging the receipt of the proceed under NPS by the subscriber

4.In addition to the PRAN card any other Identification and address proof of the subscriber. The photocopies of documents (Sr. No. a to h) and original document (Sr No. i) that can be provided as identification and address proof are as mentioned below:

a)Ration Card with photograph of the subscriber and residential address

b)Bank Passbook with photograph and residential address

c)Credit Card with photograph, any other address proof like latest telephone bill, electricity bill in the name of the subscriber.

d)Passport

e)Aadhar Card issued by UIAD

f)Voter’s Photo Identity Card with residential address

g)Driving license with photograph and residential address

h)PAN card and any other address proof like latest telephone bill, electricity bill in the name of the subscriber.

i)Certificate of identity with photograph signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted Officer and any other address proof like latest telephone bill, electricity bill in the name of the subscriber (to be provided original)

In case if the address is not present on any of the above documents or differs with address provided in this form, proof in respect of current residential address like latest telephone bill, electricity bill in the name of the subscriber should be submitted.

GENERAL INSTRUCTIONS:

1.All the columns in the form should be filled with black ink pen without any overwriting.

2.Fields marked with (*) are mandatory.

3.Correct postal address, including the pin code should be provided.

4.Percentage of allocation for amount to be withdrawn as Lump-sum and amount to purchase life annuity. Subscriber can withdraw maximum 60% of pension wealth and is required to transfer minimum 40% of pension wealth to annuity. For example, for a total corpus of Rs.1000, if subscriber wants Rs.300 as lump-sum and Rs.700 for annuitisation, subscriber to select 30% and 70%.

5.For any Swavalamban subscriber, if monthly pension to be received by the subscriber goes below the threshold limit as decided by PFRDA, the percentage of corpus allocated towards purchase of annuity may increase above the mandatory 40% limit

6.Please select the type of lump-sum withdrawal as one-time or phased. For e.g. for a total corpus of Rs. 1000/- subscriber has selected Rs. 300 as lump-sum amount. For one time withdrawal subscriber will be given Rs. 300 as lump-sum amount on processing of withdrawal request. For phased withdrawal subscriber will be given minimum of 10% i.e. Rs. 30 for the period of 10 years, at the age of 70 years, subscriber would compulsorily withdraw any amount lying to their credit.

7.Instructions for nomination

•Subscriber can nominate maximum of three nominees.

•Subscriber cannot fill the same nominee details more than once.

•Percentage share value for all the nominees must be integer. Fractional value will not be accepted.

•Sum of percentage share across all the nominees must be equal to 100. If sum of percentage is not equal to 100, entire nomination will be rejected.

•If a nominee is a minor, then nominee’s guardian details will be mandatory

For the purpose of this document Pension Wealth means: The total amount of contributions made by the subscriber in the scheme plus the investment income derived from the investment of the contributions made by the subscriber from the date of joining of National Pension System till the date of execution of withdrawal request in the CRA System.