When individuals participate in the National Pension System (NPS), it's crucial they understand the mechanisms available for managing their accounts effectively, especially when it comes to making significant changes such as shifting their subscription. The NPS Subscriber Shifting Form, formally known as Form-ISS-1, serves as a vital tool for those looking to transfer their NPS subscription from one sector to another, be it from Central Government to State Government, from the government sector to the all-citizens model, otherwise known as the Unorganized Sector (UOS), or to the corporate sector. This comprehensive document requires subscribers to meticulously fill out several sections in CAPITAL LETTERS using BLACK INK, emphasizing mandatory fields that include general information like name, PRAN (Permanent Retirement Account Number), and details pertinent to both current and target PRAN associations. Moreover, it demands specifics about the subscriber's scheme preference, offering options between various fund managers and investment choices, alongside a detailed asset allocation table for those opting for an active choice in their investment strategy. Essential KYC details are also a requirement, especially for those moving away from the government sector, ensuring that identity, address, and birth date are adequately verified. Additional sections cater to the nuances of shifting to different government sectors or the corporate realm, requesting employment details, PAN information, and bank details, all of which underscore the form's role in facilitating a smooth transition between sectors while adhering to the stringent guidelines set forth by the regulatory authority.

| Question | Answer |

|---|---|

| Form Name | Nps Subscriber Shifting Form |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | nps inter sector shifting form, inter sector shifting nps online, iss1 form, iss 1 form |

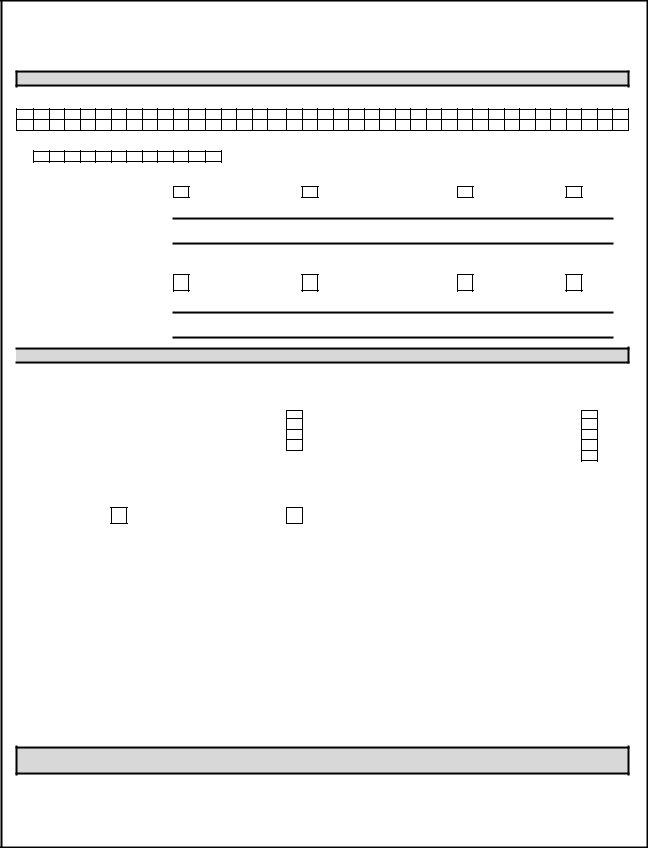

National Pension System (NPS)

Subscriber Shifting

(Please fill all the details in CAPITAL LETTERS & in BLACK INK only. All fields / sections marked in * are mandatory.)

(Please tick the respective block which is applicable to you)

A. General Information:

I) NAME *

II) PRAN (Permanent Retirement Account Number) *

III) Existing PRAN association (refer Instruction no. I)

a) Sector: * Central Government

State Government

All Citizens of India (UOS)

Corporate Sector

b)DDO / CBO /

c)DDO / CBO /

IV) Target PRAN association (refer Instruction no. II)

a) Sector:* |

Central Government |

State Government

All Citizens of India (UOS)

Corporate Sector

b)DDO / CBO /

c)DDO / CBO /

B. Additional information for subscribers shifting to All Citizens of India - UOS

V. Subscriber Scheme Preference

a) PFM (Name in alphabetical order) |

Please tick only one |

1DSP BlackRock Pension Fund Managers Private Limited

2HDFC Pension Management Company Limited

3ICICI Pension Fund Management Company Limited

4Kotak Mahindra Pension Fund Limited

5LIC Pension Fund Limited

6Reliance Capital Pension Fund Limited

7SBI Pension Funds Private Limited

8UTI Retirement Solutions Limited

(Selection of PFM is mandatory both in Active and Auto Choice. In case you do not indicate a choice of PFM, your application form shall be summarily rejected).

b) Investment Option (refer Instruction no. VI & VII)

Active Choice

Auto Choice

(For details on Auto Choice, please refer to the Offer Document)

Note:-

1.In case you do not indicate any investment option, your funds will be invested in Auto Choice

2.In case you have opted for Auto Choice, DO NOT fill up section (V.c) below relating to Asset Allocation. In case you do, the Asset Allocation instructions will be ignored and investment will be made as per Auto Choice.

c) Asset Allocation table (to be filled up only in case you have selected the ‘Active Choice’ investment option)

|

E |

C |

G |

Total |

|

Asset Class |

(Cannot exceed 50%) |

||||

|

|

|

|||

% share |

|

|

|

100% |

Note:- The allocation across E, C and G asset classes must equal 100%. In case, the allocation is left blank and/or does not equal 100%, the application shall be rejected by the POP.

VI. KYC details (Applicable only if subscriber is shifting from Government Sector)(Refer instruction no. X)

a) KYC document accepted for identify proof : _____________________________________

b) KYC document accepted for address proof : _____________________________________

c) Document accepted for Date of birth proof : _____________________________________

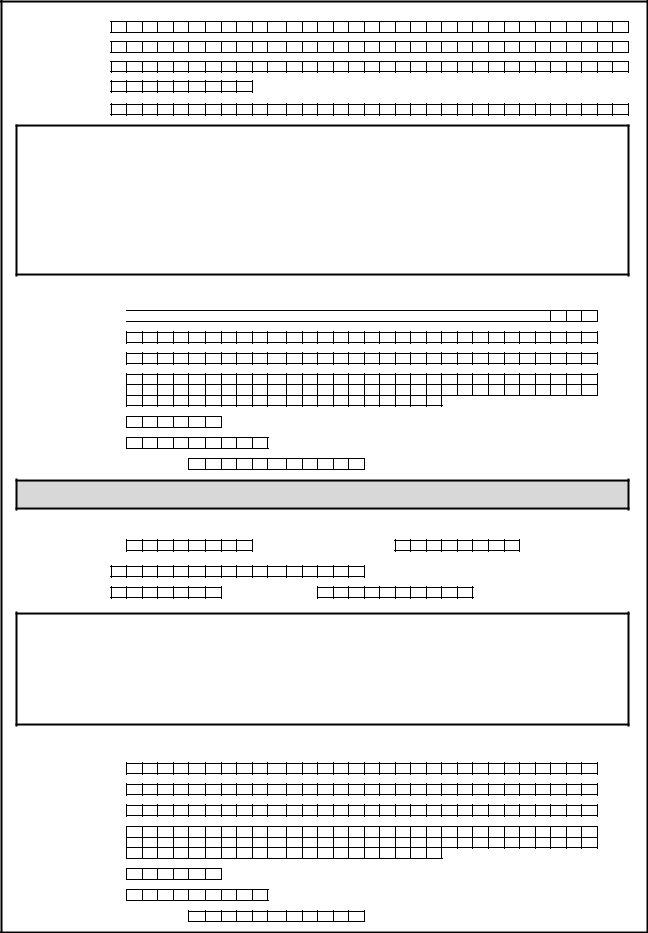

C. Additional information for subscribers shifting to Central Government or State Government (to be filled by target DDO) (Please refer to instruction No. VIII & IX)

VII. Subscribers Employment Details to be filled and attested by DDO (All Details are Mandatory)

a) Date of Joining: |

|

|

|

|

|

|

|

|

|

|

|

b) Date of Retirement: |

|

|

|

|

|

|

|

|

|||

|

D D M M Y Y Y Y |

|

|

|

|

|

|

|

D D M M Y Y Y Y |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

c) Group of the Employee |

|

|

A |

|

|

|

|

|

B |

|

C |

|

D |

|

|

|

|

|

|

|

|

|

|

Page 1 of 4

d) Office

e) Department

f) Ministry

g) Basic Salary

h) Pay Scale

Certified that the above declaration has been signed / thumb impressed before me by _______________________________________________________

after he / she has read the entries / entries have been read over to him / her by me and got confirmed by him / her. Also certified that the date of birth and employment details is as per employee records available with the Department.

Signature of the Authorised Person |

|

. |

|

|

Designation of the Authorised Person |

|

|

Rubber Stamp of the DDO |

|

Name of the DDO ______________________

Date :

Department / Ministry _______________________

VIII. Subscriber's Bank Details* (The subscribe shall provide a cancelled cheque, the details of which should match the bank details provided) a) Bank A/c Number

b) Bank Name

c) Bank Branch

d) Bank Address

e) Pin Code

f) Bank MICR Code

g) IFS code (Wherever applicable)

D. Additional information for subscribers shifting to Corporate Sector (to be verified by the Corporate Office of the subscriber concerned)

IX. Subscribers Employment and PAN Details

a) Date of Joining* :

D D M M Y Y Y Y

c) Employee ID*

b) Date of Retirement* :

D D M M Y Y Y Y

d) CHO Reg No*:

e) PAN :

Certified that the above declaration has been signed before me by _______________________________________________________

after he / she has read the entries / entries have been read over to him / her by me and got confirmed by him / her. Also certified that the date of birth and employment details is as per employee records available with the Corporate.

Signature of the Authorised Person |

|

. |

|

|

Designation of the Authorised Person |

|

|

Rubber Stamp of the Corporate |

|

|

|

|

|

Rubber Stamp of the Corporate |

X. Subscriber's Bank Details (The subscribe shall provide a cancelled cheque, the details of which should match the bank details provided)

a) Bank A/c Number

b) Bank Name

c) Bank Branch

d) Bank Address

e) Pin Code

f) Bank MICR Code

g) IFS code (Wherever applicable)

Page 2 of 4

XI. Subscriber Scheme Preference (Applicable only if the target Corporate has given the option of selecting scheme preference to the associated employees)

a) PFM (Name in alphabetical order) |

Please tick only one |

1DSP BlackRock Pension Fund Managers Private Limited

2HDFC Pension Management Company Limited

3ICICI Pension Fund Management Company Limited

4Kotak Mahindra Pension Fund Limited

5LIC Pension Fund Limited

6Reliance Capital Pension Fund Limited

7SBI Pension Funds Private Limited

8UTI Retirement Solutions Limited

(Selection of PFM is mandatory both in Active and Auto Choice. In case you do not indicate a choice of PFM, your application form shall be summarily rejected).

b) Investment Option (refer Instruction no. VI & VII)

Active Choice |

|

Auto Choice |

|

(For details on Auto Choice, please refer to the Offer Document) |

Note:- |

|

|

|

|

1.In case you do not indicate any investment option, your funds will be invested in Auto Choice

2.In case you have opted for Auto Choice, DO NOT fill up section (V.c) below relating to Asset Allocation. In case you do, the Asset Allocation instructions will be ignored and investment will be made as per Auto Choice.

c) Asset Allocation table (to be filled up only in case you have selected the ‘Active Choice’ investment option)

Asset Class |

E |

C |

G |

Total |

% share |

|

|

|

100% |

Note:- The allocation across E, C and G asset classes must equal 100%. In case, the allocation is left blank and/or does not equal 100%, the application shall be rejected by the POP.

XII. KYC details (Applicable only if subscriber is shifting from State / Central Government Sector) |

(Refer instruction no. X) |

a)KYC document accepted for identify proof : _____________________________________

b)KYC document accepted for address proof : _____________________________________

c)Document accepted for Date of birth proof : _____________________________________

Declaration (Applies to subscribers across all sectors):

I agree to be bound by the terms and conditions for the target sector (in which my PRAN will belong after processing of this Intersector Shifting request) and understand that CRA may, as approved by PFRDA, amend any of the services completely or partially without any new Declaration / Undertaking being signed. Further, I agree to pay all the necessary charges, as applicable, of the target sector.

Date _______________ |

Signature/Left Thumb impression of Subscriber*________________________________________ |

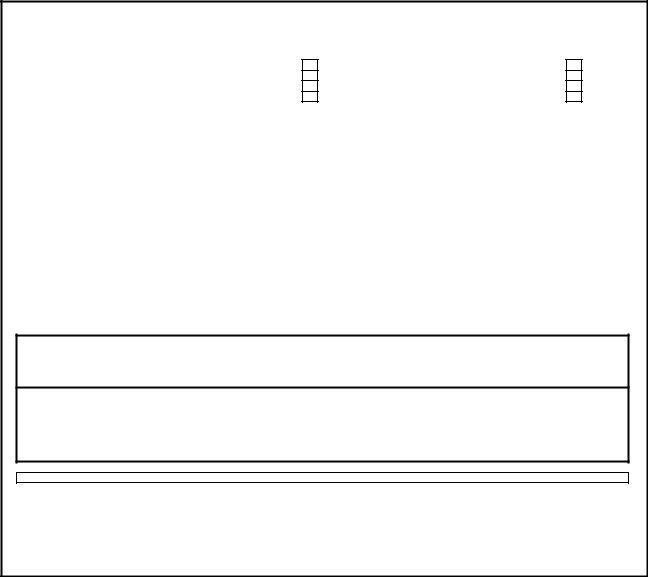

For Officie use only (To be filled up by the officer accepting the form)

Received by: |

|

|

|

|

|

PAO/POP |

|||||||||||||||||

Received at: |

|

|

|

|

|

Date: ______________ Time Stamp: __________________ |

|||||||||||||||||

Details verified by: |

|

|

|

|

|

Date: ______________ Time stamp:__________________ |

|||||||||||||||||

Receipt Number Issued by the receiving office (only for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

XXXXXXXXXXXXXXXXXXXXXXXX |

|||||||||||||||||||||

Page 3 of 4

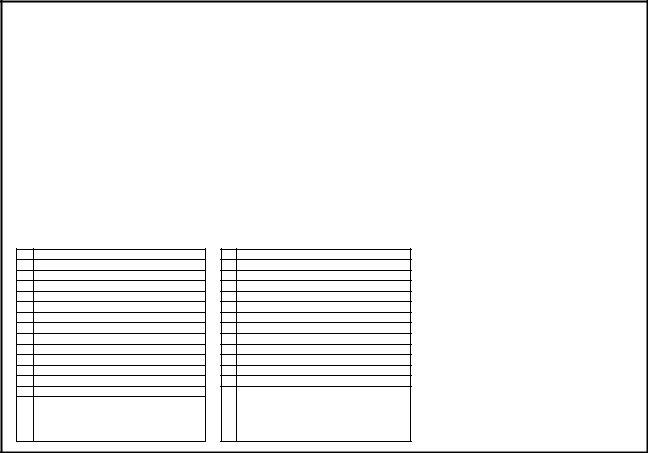

Instructions for filling the form

I. Details of the DDO /

II.Details of the DDO /

III. Please quote the correct PRAN and attach a copy of the PRAN Card IV. This form is to be used by the subscriber only

V. Sector for 'Existing PRAN association' and 'Target PRAN association' can be the same only if a subscriber is shifting from one State Governemnt to another State

VI. Active choice - Under Active choice, subscribers have an option to choose a fund manager and provide the ratio in which his / her funds are to be invested among asset classes.

a. PFM selection is mandatory. The form shall be rejected f |

PFM is not opted for. |

||

c. A subscriber opting for active choice may select the |

available |

asset classes E , G , & C . (owever, the sum of percentage allocation across all the selected asset |

|

b. llocation under Equity (E) cannot xceed 50% |

|

|

|

classes must equal 100. If the sum of percentage allocations is not equal to 100%, or the asset allocation table is left blank, the application shall be rejected.

VII. Auto choice - Under Auto choice inv stm nt will be made in |

lifecycle fund in the sch mes of PFM chosen by Subscriber. |

||||||||

)n case both investment option and the asset |

allocation |

table |

are |

left blank, the |

subscriber’s |

funds will be |

invested |

as per Auto Choice |

|

A subscriber opting for Auto Choice must also select PFM. The application shall rejected if the subscriber do |

not indicate his/h r choice of PFM. |

||||||||

For more details on investment options and asset classes, please refer to the Offer Document..

VIII. Employment details are to be captured in CRA system by the target PAO/DTO along with other details, if the subscriber is shiifting from UOS to Central / State Governemnt sector

IX. PAO/DTO have to modify the employment details of the subscriber after the shifting of the PRAN, in case of subscriber shifting from Central Government to State Government or vice versa or across two State Governments, i.e, both existing and new PRAN association are Government Sectors

X. Illustrative list of documents acceptable as proof of identity and address

No. |

Proof of Identity (Copy of any one) |

i)School Leaving Certificate

ii)Matriculation Certificate

iii)Degree of Recognized Educational Institution

iv)Depository Account Statement

v)Bank Account Statement / Passbook

vi)Credit Card

vii)Water Bill

viii)Ration Card

ix)Property Tax Assessment Order

x)Passport

xi)Voter's Identity Card

xii)Driving License

xiii)PAN Card

Certificate of identity signed by a Member of

xiv)Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted Officer.

No. |

Proof of Address (Copy of any one) |

i)Electricity bill^

ii)Telephone bill^

iii)Depository Account Statement^

iv)Credit Card Statement^

v)Bank Account Statement / Passbook^

vi)Employer Certificate^

vii)Rent Receipt^

viii)Ration Card

ix)Property Tax Assessment Order

x)Passport

xi)Voter's Identity Card

xii)Driving License

Certificate of address signed by a Member of Parliament or Member of Legislative Assembly or

xiii)Municipal Councillor or a Gazetted Officer.

Note:

1)Proof of Address mentioned in Sr. No. i) to vii) (^) should not be more than six months old on the date of application.

2)You are required to bring original documents & two

counter after verification)

Page 4 of 4