In case you desire to fill out mo form 53 c, you won't have to download any sort of applications - simply try our online PDF editor. The editor is constantly maintained by us, getting new features and turning out to be better. Getting underway is easy! What you need to do is take the next basic steps directly below:

Step 1: First of all, open the pdf tool by pressing the "Get Form Button" above on this webpage.

Step 2: After you start the tool, you will get the form ready to be filled out. Aside from filling out different fields, you may also perform many other actions with the PDF, including writing any words, modifying the initial text, adding illustrations or photos, affixing your signature to the PDF, and more.

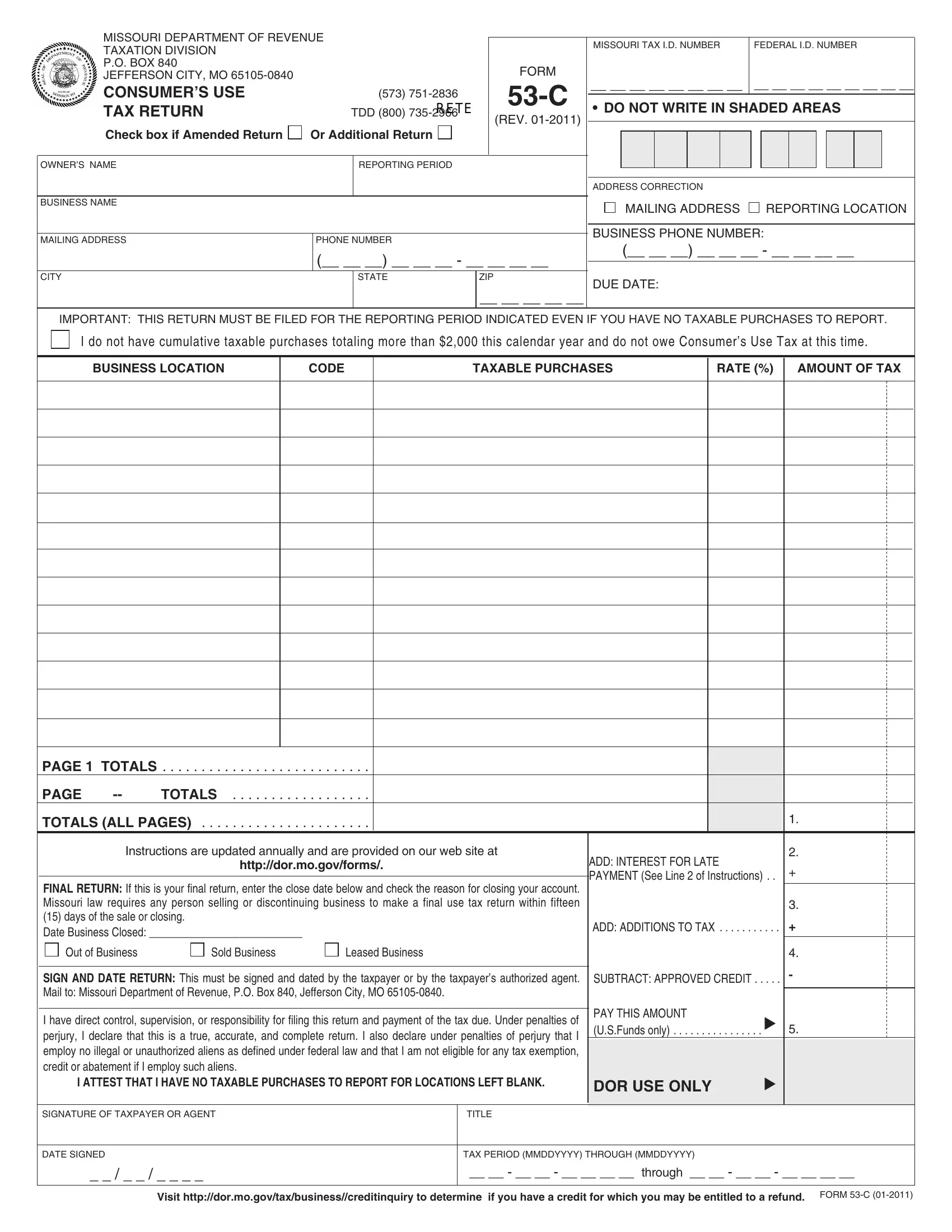

This form will need particular info to be filled in, so ensure that you take your time to enter what is required:

1. The mo form 53 c involves specific information to be entered. Make certain the following blanks are complete:

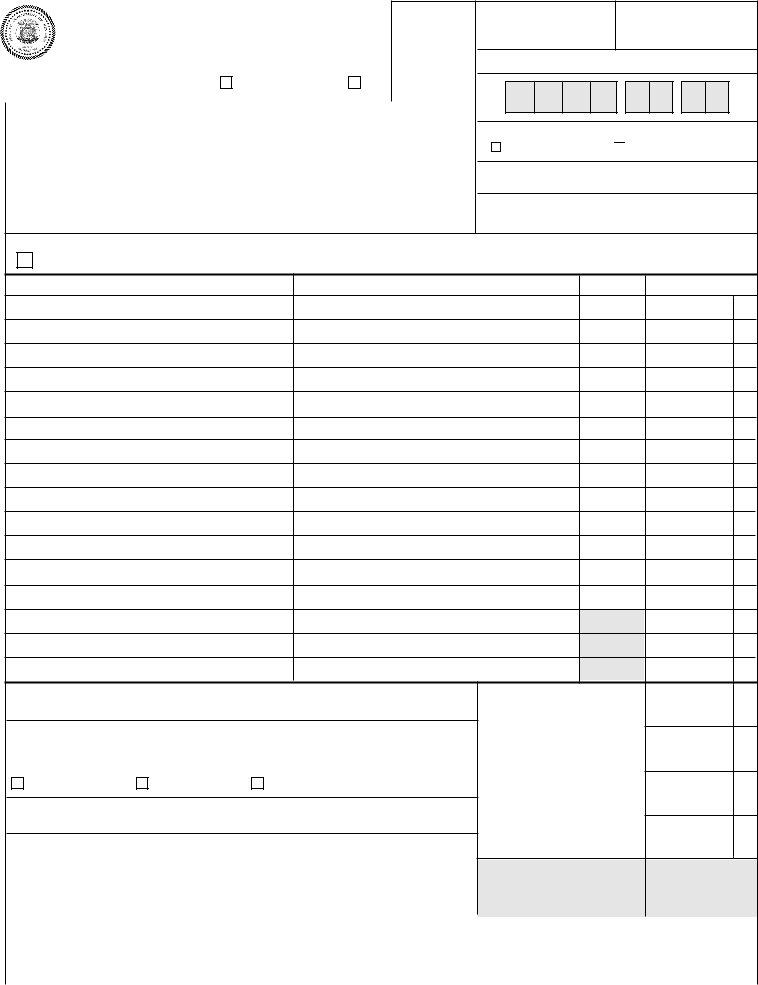

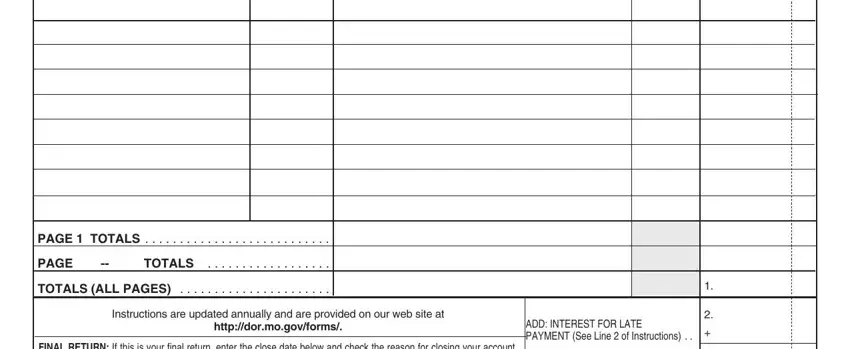

2. Once your current task is complete, take the next step – fill out all of these fields - PAGE TOTALS, PAGE, TOTALS, TOTALS ALL PAGES, Instructions are updated annually, httpdormogovforms, FINAL RETURN If this is your final, and ADD INTEREST FOR LATE PAYMENT See with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can potentially make errors when filling out your TOTALS, thus ensure that you look again before you decide to submit it.

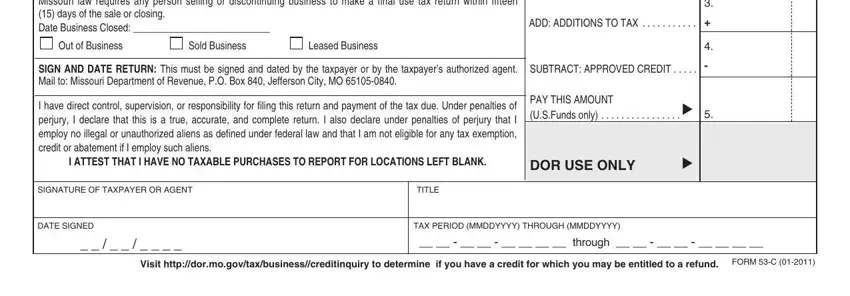

3. The following segment is related to FINAL RETURN If this is your final, Out of Business, Sold Business, Leased Business, ADD ADDITIONS TO TAX, SIGN AND DATE RETURN This must be, SUBTRACT APPROVED CREDIT, I have direct control supervision, I ATTEST THAT I HAVE NO TAXABLE, PAY THIS AMOUNT USFunds only, DOR USE ONLY, SIGNATURE OF TAXPAYER OR AGENT, TITLE, DATE SIGNED, and TAX PERIOD MMDDYYYY THROUGH - complete each one of these fields.

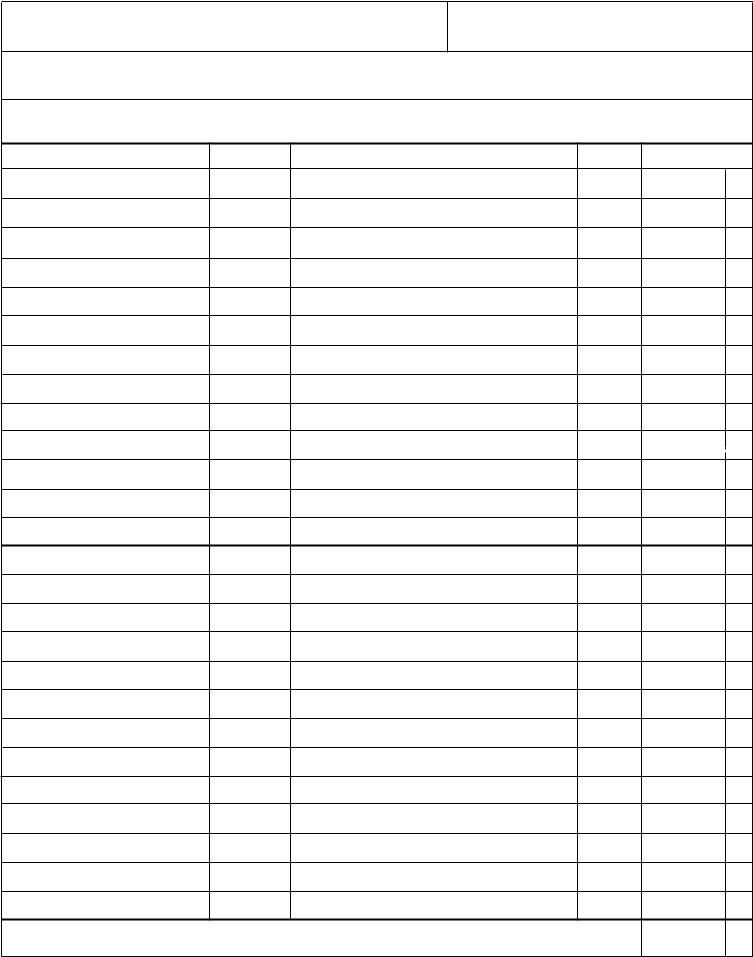

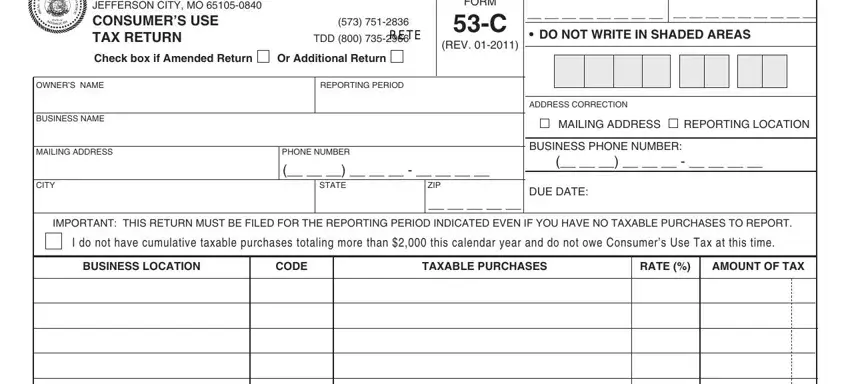

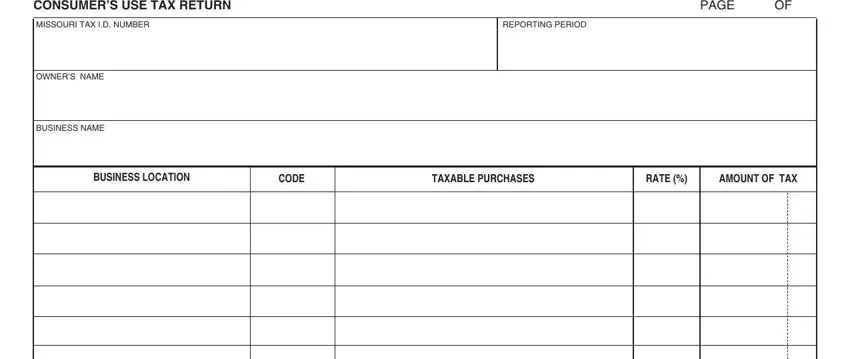

4. Your next section needs your attention in the subsequent places: CONSUMERS USE TAX RETURN, MISSOURI TAX ID NUMBER, REPORTING PERIOD, PAGE, OWNERS NAME, BUSINESS NAME, BUSINESS LOCATION, CODE, TAXABLE PURCHASES, RATE, and AMOUNT OF TAX. Just remember to fill out all requested details to move onward.

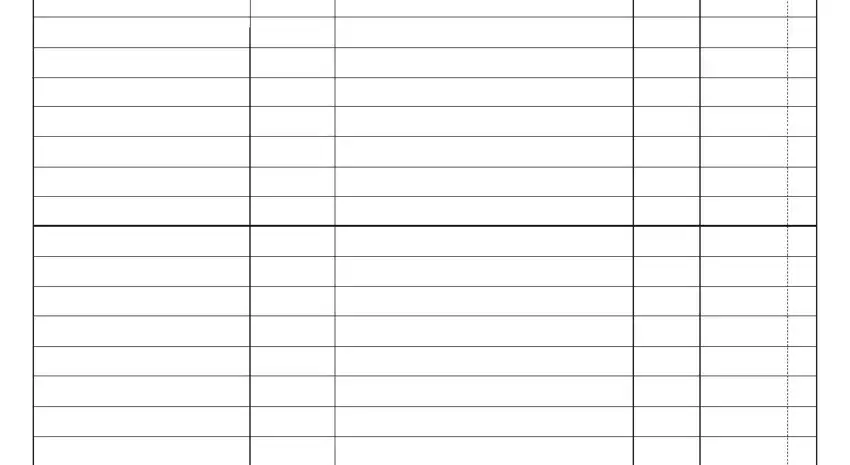

5. The form must be wrapped up by going through this segment. Below there can be found a comprehensive set of form fields that need appropriate details for your form submission to be accomplished: .

Step 3: Reread all the details you have typed into the form fields and press the "Done" button. Acquire the mo form 53 c once you join for a 7-day free trial. Readily view the pdf file within your personal account page, along with any edits and adjustments being automatically preserved! FormsPal is devoted to the confidentiality of all our users; we ensure that all personal data used in our tool remains protected.