Handling PDF files online is certainly very easy using our PDF tool. Anyone can fill out Form 592 F here in a matter of minutes. Our team is focused on making sure you have the best possible experience with our editor by consistently presenting new capabilities and enhancements. With all of these improvements, working with our tool becomes easier than ever! With a few simple steps, you'll be able to begin your PDF editing:

Step 1: Click on the "Get Form" button at the top of this webpage to access our tool.

Step 2: This tool grants the ability to modify PDF forms in a range of ways. Improve it by writing any text, correct what is already in the document, and include a signature - all manageable in minutes!

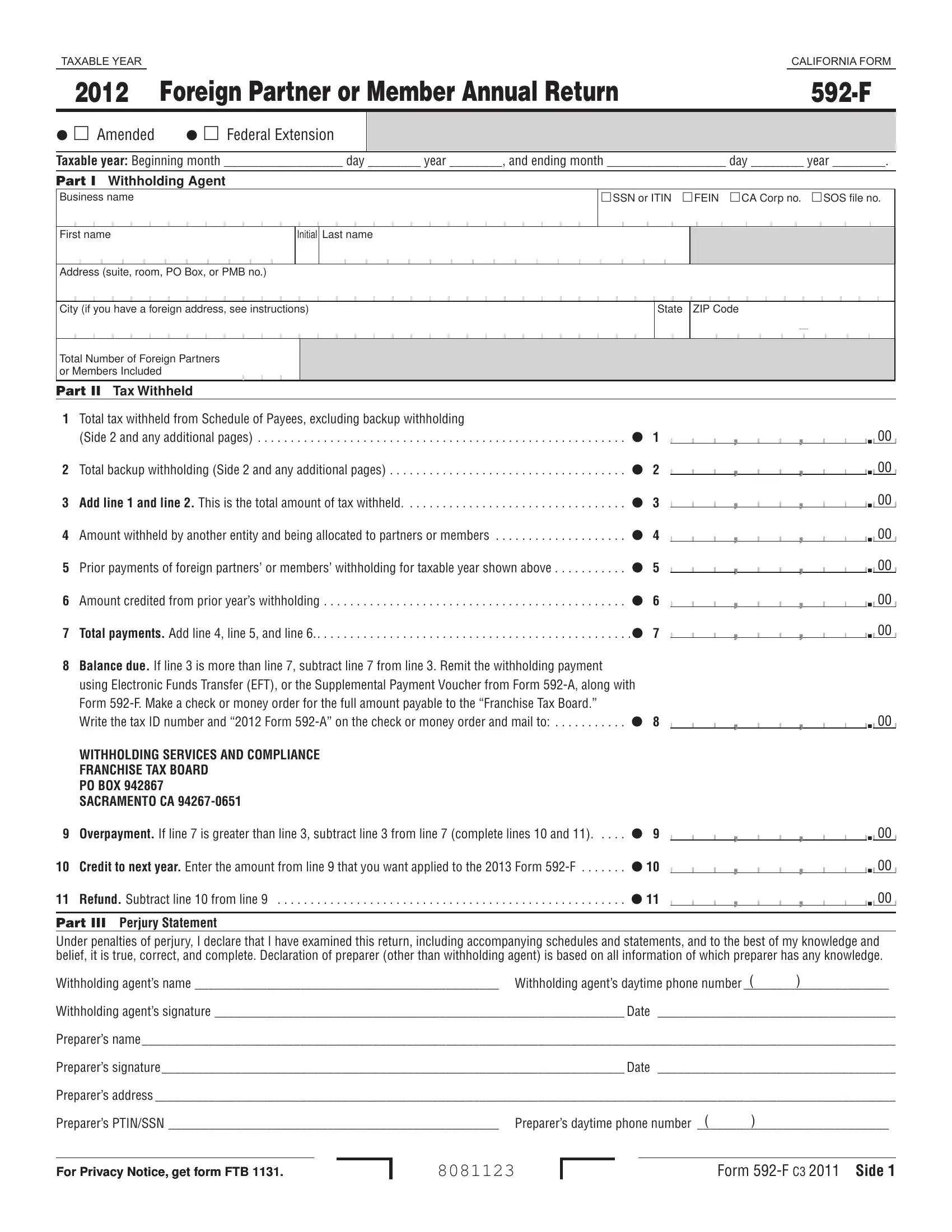

For you to complete this form, make sure that you enter the necessary information in every single blank field:

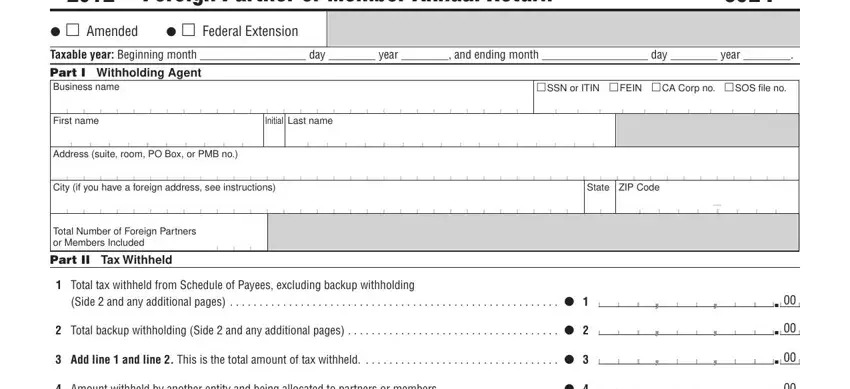

1. Firstly, once completing the Form 592 F, start out with the form section that includes the next fields:

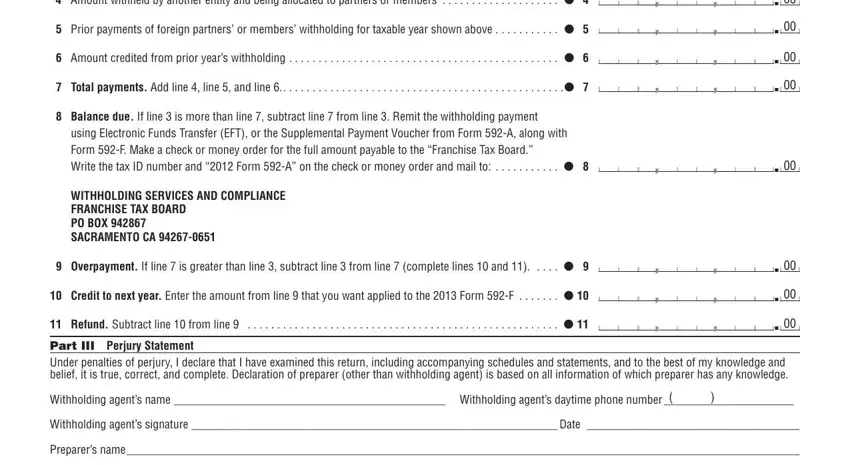

2. The subsequent step is to fill out these blanks: Side and any additional pages, Balance due If line is more than, using Electronic Funds Transfer, Write the tax ID number and Form, WITHHOLDING SERVICES AND COMPLIANCE, FRANCHISE TAX BOARD PO BOX, Overpayment If line is greater, Part III Perjury Statement Under, Withholding agents name, Withholding agents signature Date, and Preparers name.

Be really attentive while filling in Write the tax ID number and Form and Withholding agents name, because this is the part where many people make mistakes.

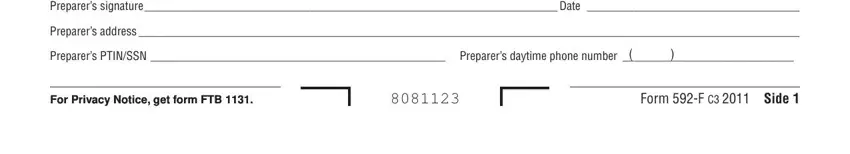

3. Completing Preparers signature Date, Preparers address, Preparers PTINSSN Preparers, For Privacy Notice get form FTB, and Form F C Side is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

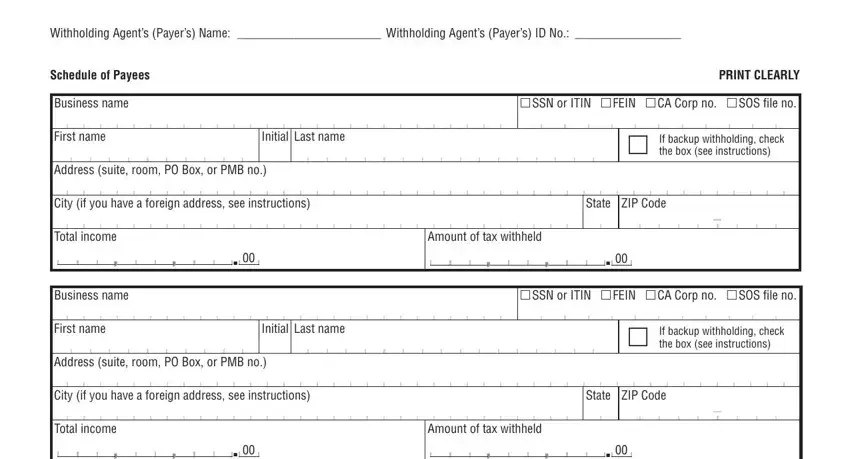

4. To move onward, the following step will require filling out a few empty form fields. Examples include Withholding Agents Payers Name, Schedule of Payees, Business name, First name, Initial Last name, Address suite room PO Box or PMB no, SSN or ITIN FEIN CA Corp no, PRINT CLEARLY, If backup withholding check the, City if you have a foreign address, State ZIP Code, Total income, Amount of tax withheld, Business name, and First name, which are fundamental to continuing with this process.

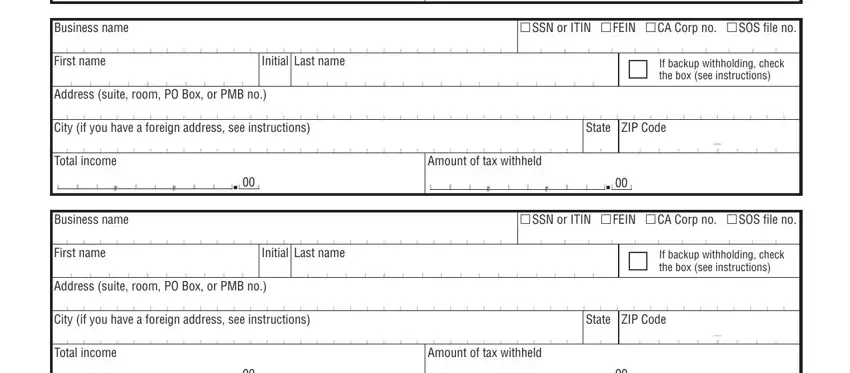

5. Finally, this final part is precisely what you need to finish prior to using the form. The fields in this case include the next: Business name, First name, Initial Last name, Address suite room PO Box or PMB no, SSN or ITIN FEIN CA Corp no, If backup withholding check the, City if you have a foreign address, State ZIP Code, Total income, Amount of tax withheld, Business name, First name, Initial Last name, Address suite room PO Box or PMB no, and SSN or ITIN FEIN CA Corp no.

Step 3: Before finalizing the file, ensure that form fields have been filled in as intended. The moment you believe it is all fine, click on “Done." Acquire the Form 592 F once you sign up for a free trial. Readily view the pdf form inside your FormsPal account, together with any modifications and adjustments being automatically kept! FormsPal provides risk-free form completion without personal data record-keeping or sharing. Be assured that your data is safe with us!