Should you intend to fill out LLCs, you won't need to download and install any applications - simply make use of our PDF editor. To make our tool better and more convenient to use, we consistently design new features, considering feedback coming from our users. All it takes is several simple steps:

Step 1: Press the "Get Form" button in the top section of this webpage to access our editor.

Step 2: Once you open the online editor, you will notice the form made ready to be filled out. Besides filling in different blank fields, you might also do other sorts of actions with the Document, including writing any words, changing the original text, inserting images, affixing your signature to the document, and much more.

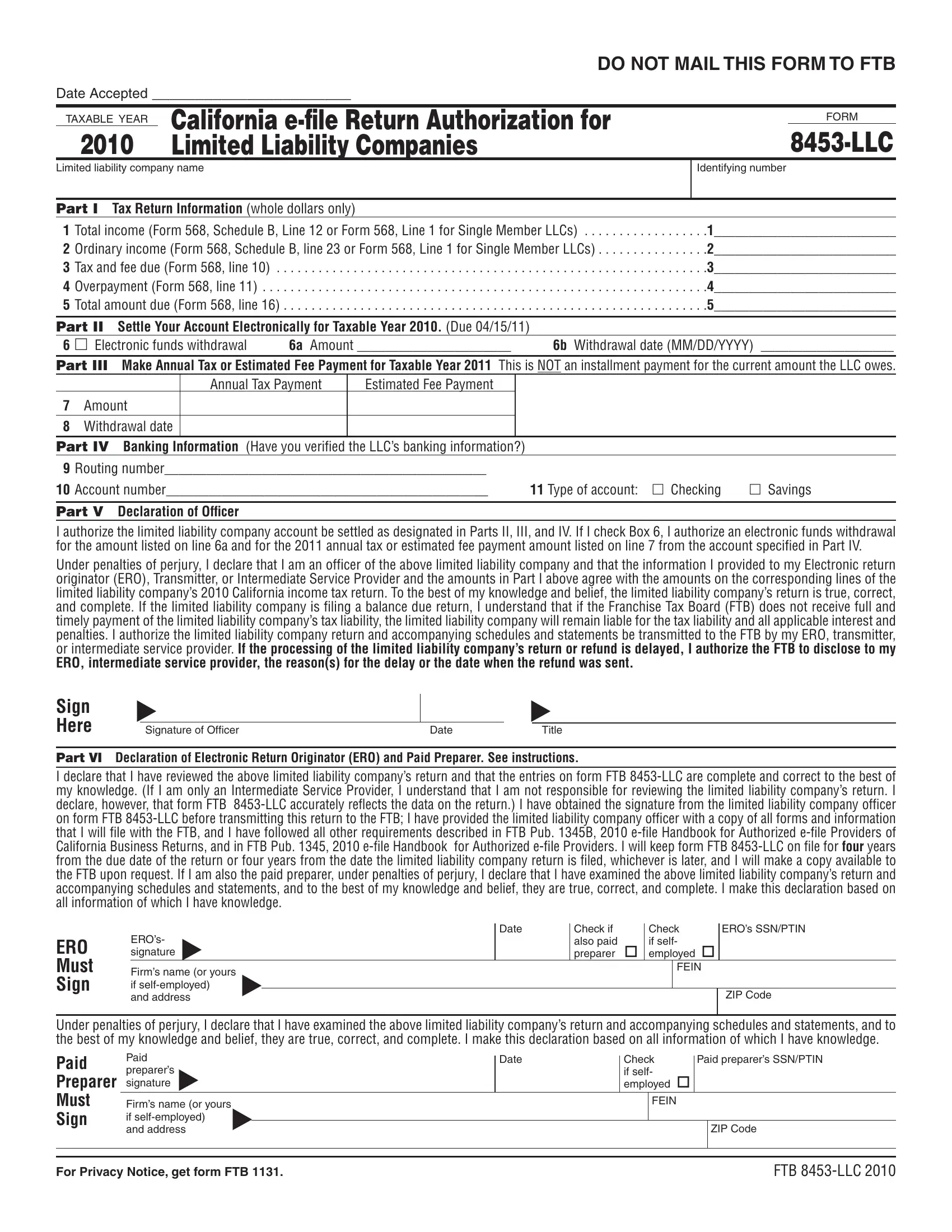

As a way to fill out this PDF document, make sure that you provide the required information in every area:

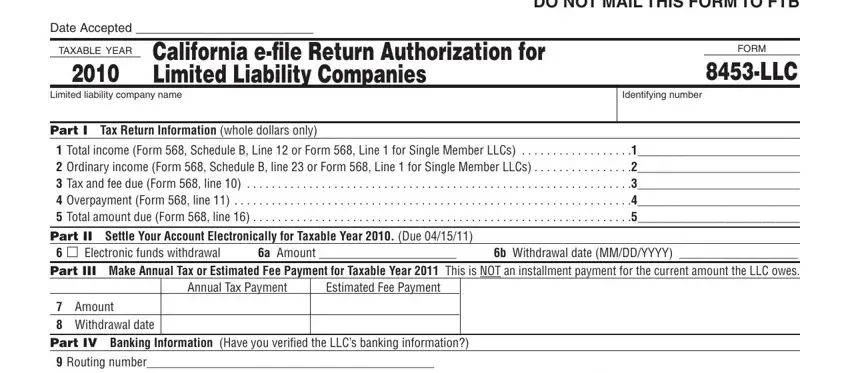

1. To start with, once filling in the LLCs, start in the page that has the following blank fields:

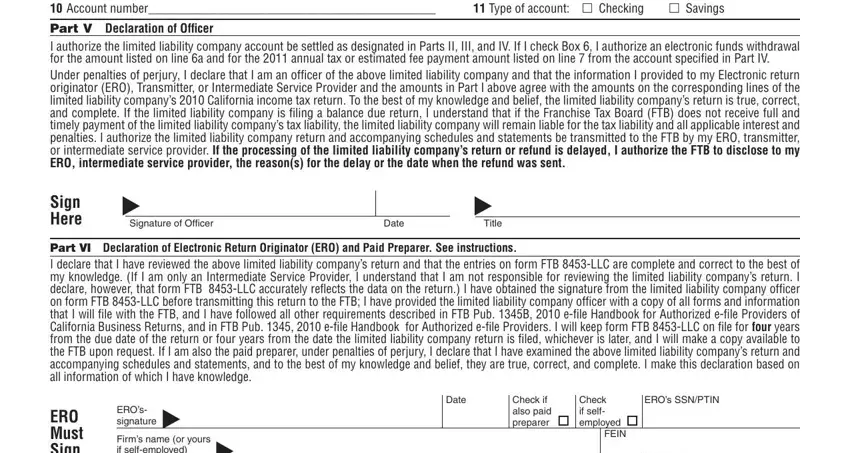

2. Your next stage is usually to complete these fields: Account number, Type of account m Checking, m Savings, Part V Declaration of Oficer I, Sign Here, Signature of Officer, Date, Title, Part VI Declaration of Electronic, ERO Must Sign, EROs signature, Firms name or yours if, Date, Check if also paid preparer, and Check if self employed.

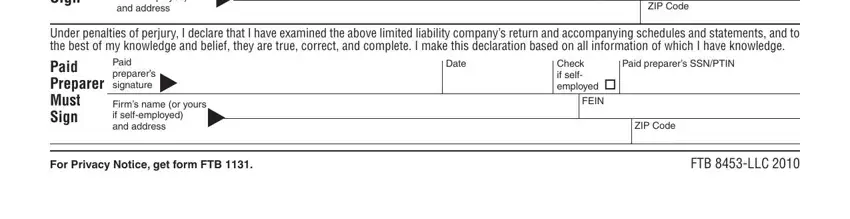

3. The following step is related to ERO Must Sign, Firms name or yours if, ZIP Code, Under penalties of perjury I, Paid Preparer Must Sign, Paid preparers signature, Firms name or yours if, Date, Paid preparers SSNPTIN, Check if self employed, FEIN, ZIP Code, For Privacy Notice get form FTB, and FTB LLC - fill out all these blanks.

Be extremely careful when filling in For Privacy Notice get form FTB and FTB LLC, as this is where a lot of people make errors.

Step 3: Right after double-checking your form fields you have filled in, hit "Done" and you're all set! Right after starting afree trial account here, you will be able to download LLCs or send it through email immediately. The PDF will also be readily accessible from your personal account menu with your edits. At FormsPal.com, we endeavor to guarantee that your details are stored secure.