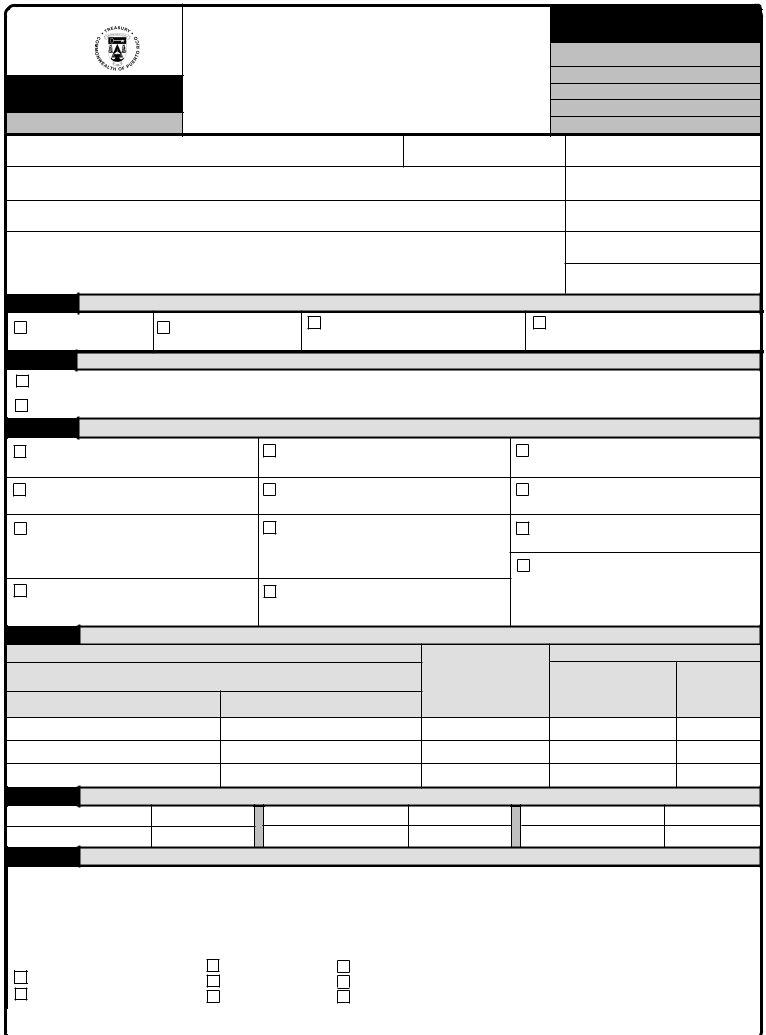

Facing the need to access tax or gift records can be daunting for individuals, estates, or businesses navigating through their financial responsibilities or during times of significant life changes. The Form AS 2907.1, set forth by the Commonwealth of Puerto Rico Department of the Treasury, serves as a crucial tool in such situations. Revised on January 13, 2009, this form, previously known as 330-05, is designed for official use by entities like the Negociado de Procesamiento de Planillas or Negociado de Impuesto al Consumo, facilitating individuals or representatives to request copies of returns, estate, or gift certificates of release. Key elements of this form range from identifying taxpayer information—including names, social security numbers, and contact details—to specifying the type of taxpayer and the documentation being requested. With distinct parts outlining the service sought, details of documents needed, associated costs, and the inclusion of Internal Revenue stamps for payment, the form is comprehensive. Additionally, a declaration and signature section ensures the accountability and authenticity of the request. Moreover, instructions integrated into the form guide applicants through each step, whether they are individuals, fiduciaries, partnerships, or corporations, and include specifications for scenarios like the death of a taxpayer or spouse, showcasing the form's thorough approach to handling various requests with sensitivity and precision.

| Question | Answer |

|---|---|

| Form Name | Form As 2907 1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | commonwealth of puerto rico form 2907 fillable, testamentary, commonwealth of puerto rico form 2907, 2907.1 |

Form AS 2907.1

(previously

OFFICIAL USE

Negociado de Procesamiento de Planillas o Negociado de Impuesto al Consumo

Preparada por:

Commonwealth of Puerto Rico

Department of the Treasury

INTERNAL REVENUE AREA

REQUEST FOR COPY OF THE RETURN, ESTATE

OR GIFT CERTIFICATE OF RELEASE

OFFICIAL USE

Negociado de Procesamiento de Planillas o Negociado de Impuesto al Consumo

Número de solicitud

Número(s) de serie

Name of taxpayer, merchant, deceased or donor (as applicable)

Social Security No.

Merchant’s Registration No.

Name of spouse (as applicable)

Social Security No.

Name of administrator or authorized agent (as applicable)

Social Security No.

Taxpayer’s postal address

Office Telephone:

Home Telephone:

PART I

TYPE OF TAXPAYER - Please, check only one type of taxpayer per request form

Individual/Deceased |

Fiduciary or Estate |

Partnership (Indicate date of |

Corporation (Indicate date of |

|

organization:_________________) |

incorporation:__________________) |

|||

|

|

PART II |

SERVICE REQUESTED - Please, check only one service per request |

- Copy of Return (not protocolar) - one $5.00 Internal Revenue stamp for each copy of return requested.

- Copy of Return (protocolar) - one $7.00 Internal Revenue stamp for each copy of return requested.

PART III |

TYPE OF DOCUMENT REQUESTED - Please, select only one type of document per request |

|

|||

- Individual Income Tax Return |

- Employer’s Quarterly Return of Income Tax |

- Informative Return of Segregation,Aggregation |

|||

|

|

Withheld (Form |

|

or Transfer or Real Property (Form SC 2821) |

|

- Corporations and Partnerships Income Tax |

- Excise Taxes Monthly Return (Form SC 2225) |

- Sales and Use Tax Monthly Return (Forrm |

|||

Return |

|

|

|

SC 2915) |

|

- Certificate of Release of Gift Tax Lien (Form SC |

- Certificate of Release of Estate Tax Lien (Form |

- Sales and Use Tax Annual Informative Return |

|||

6136) - Please, indicate the following: |

SC 6136) - Please, indicate the following: |

(Form SC 2935) |

|

||

Date of Gift: ___________________________ |

Date of Death: _________________________ |

- Other - (Indicate name and number of the |

|||

Case No. (control): ____________________ |

Case No. (control): ____________________ |

||||

|

|

|

|

form):_______________________________ |

|

- Gift Tax Return (Form SC 2788) |

- Estate Tax Return (Forms SC 2800, SC 2800A |

___________________________________ |

|||

|

|

or AS 2801) |

|

___________________________________ |

|

|

|

|

|

___________________________________ |

|

PART IV |

DETAIL OF DOCUMENTS REQUESTED |

|

_____________________________________ |

||

|

|

|

|||

|

Tax Period |

|

|

Total amount to pay in Internal Revenue stamps |

|

This request form provides only for 3 tax periods. Please complete another form for additional tax |

Amount of |

Cost for each document |

|

||

periods. |

|

|

documents |

requested (see Part II for |

Total amount to |

|

Beginning |

Ending |

requested |

details of cost) |

pay |

|

|

|

|

||

PART V |

DETAIL OF INTERNAL REVENUE STAMPS INCLUDED WITH THIS REQUEST |

|

|

||

Serial number |

Cost |

Serial number |

Cost |

Serial number |

Cost |

|

$ |

$ |

|

|

$ |

PART VI |

|

DECLARATION AND SIGNATURE |

|

|

|

I hereby declare under the penalty of perjury, that the information provided on this document is true, correct and complete. Also, I certify that the information of my identification card is correct and that I am available to present the same if it is required by the Department.

|

|

|

Name (Print) |

|

|

Signature |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Person requesting the service: |

Type of Identification (Please include copy of the same): |

Identification Card No. |

|

|||

|

|

|

Taxpayer / Spouse |

License |

|

Employee card - public sector |

|

|

|

|

|

|

Electoral card |

|

Student card - public system |

|

|

|

|

|

|

|

Authorized Agent / Administrator |

Passport |

|

Veteran identification card |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retention: Six (6) years. |

|

SEE INSTRUCTIONS ON BACK. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM AS 2907.1 - REQUEST FOR COPY OF THE RETURN, ESTATE OR GIFT CERTIFICATE OF RELEASE

Instructions

1.The Request for Copy of the Return, Estate or Gift Certificate of Release, Form AS 2907.1 (from now on Request), will be used by any taxpayer (authorized agent / administrator) interested in obtaining copy of any of the documents indicated in Part II of this form.

As general rule, the Department will issue Form SC 2903, Certification of the Information Included on the Individual Income Tax Return, in substitution of the copy of the individual income tax return. This Certification has the same validity for every purpose as the copy of the return and contains the most relevant facts of the same, including the biographical and financial information presented by the taxpayer and any adjustment made by the Department of the Treasury.

2.The Request must include an Internal Revenue stamp (please do not send cash with this request) for each one of the documents requested, and copy of the photo identification card of the taxpayer and authorized agent or administrator, whichever applies. If the applicant is an authorized agent, the Request must include Form AS

The petitioner will submit a valid photo identification card, with a legible name and signed. The identification must be issued by the Agencies, Municipalities, Public Corporations or Instrumentalities of the Commonwealth of Puerto Rico or the United States. The qualified identifications are the following: (a)- Driver’s license;

(b)- Electoral card; (c)- Student card of the public sector; (d)- Employee card of the public sector; (e)- Veteran identification card; (f)- Passport (in these cases it will be accepted the passport issued by any foreign authority).

3.The Request must be completed in all of its parts and delivered to any of the Taxpayer’s Service Centers of the Taxpayer’s Service Bureau (Centers). For the location of the Centers and to obtain additional information regarding this procedure, you may call the following telephone numbers: [San Juan (787)

– [Ponce (787)

If the Request is regarding exclusively to the Sales and Use Tax Monthly Return (Form SC 2915) or to the Sales and Use Tax Annual Informative Return (Form SC 2635), it must be delivered to any of the Merchant’s Service Districts of the Consumption Tax Bureau (Districts). For the location of the Districts and to obtain additional information regarding this procedure, you may call the following telephone numbers: [San Juan (787)

4. If the taxpayer or the spouse died, the Request can be completed by the following:

mWidow (er) – If the taxpayer or his spouse filed the return as married living with spouse, the surviving taxpayer or spouse can request copy of the document. Nevertheless, if the taxpayer or his spouse filed separate returns, the surviving taxpayer or spouse can not request copy of the document for the other unless in addition to be the spouse, he/she is one of the heirs, one of the testamentary beneficiaries or the testamentary executor, in which case the Heirs Declaration or Testament must be included, as applicable.

mAny heir – Can request copy of the document and must include the Heirs Declaration with the Request. If the heir is a minor, the legal representative must complete and sign the form Power and Declaration of Representation (Form AS

mAny beneficiary or testamentary executor – Can request copy of the document and include the Testament with the Request. If the beneficiary is a minor, the legal representative must complete and sign the form Power and Declaration of Representation (Form AS

Also, the petitioner must include with the Request the Certificate of Death and copy of the photo identification, in accordance with the established procedures.

5.If the Request is incomplete, the necessary information will be required in writing. The Department of the Treasury will consider the case terminated after 20 working days without receiving the answer and will return all the documents submitted by mail, including the Internal Revenue canceled stamps. The Internal Revenue stamps will be canceled as payment for the administrative expenses incurred by the Department in the receipt, handling and return of the documents that could not be processed, and the same can not be used to request any other service, neither you can claim their cost. If the taxpayer is still interested in copy of the document, he/she must submit another request with the purchase of the corresponding Internal Revenue stamps.