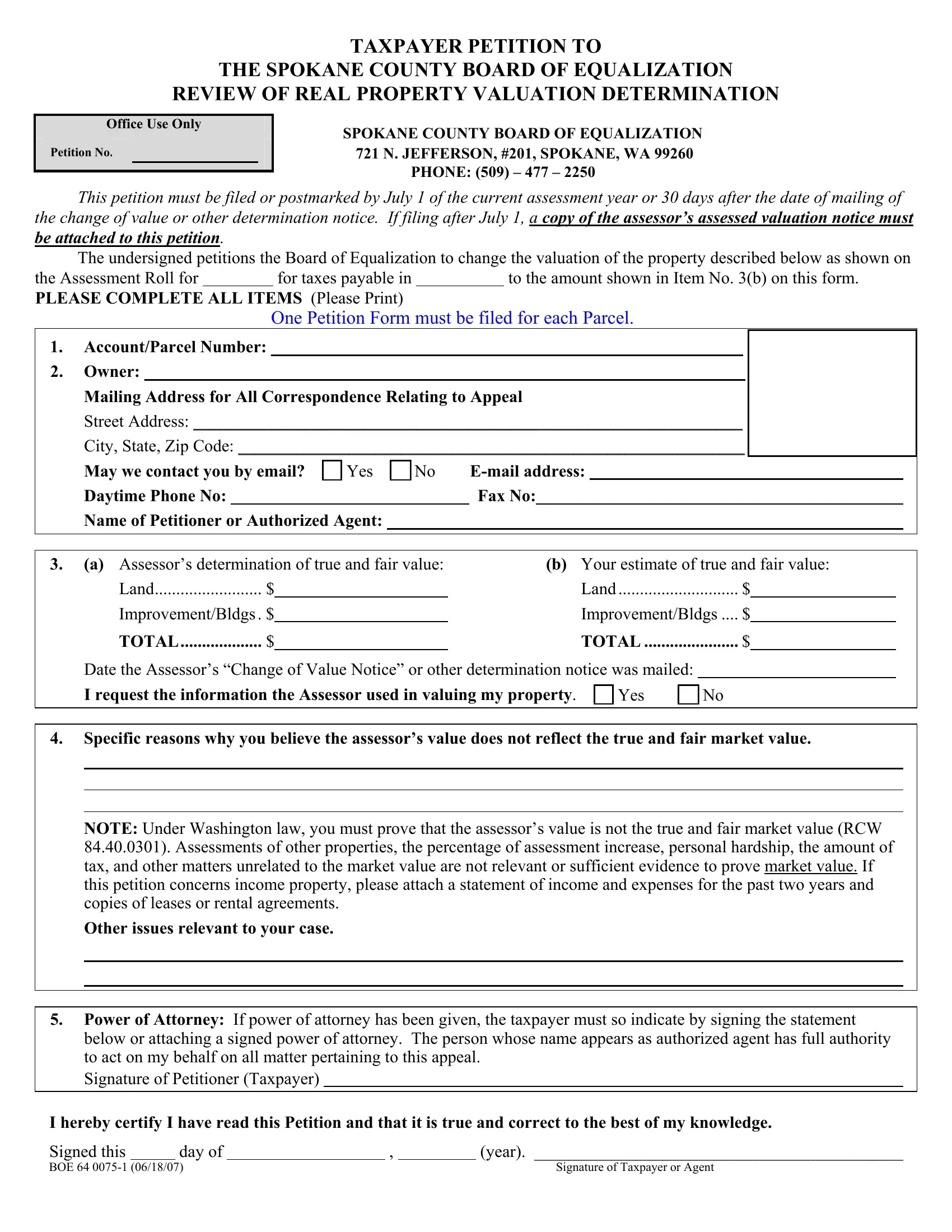

TAXPAYER PETITION TO

THE SPOKANE COUNTY BOARD OF EQUALIZATION

REVIEW OF REAL PROPERTY VALUATION DETERMINATION

Office Use Only

Petition No.:

SPOKANE COUNTY BOARD OF EQUALIZATION 721 N. JEFFERSON, #201, SPOKANE, WA 99260

PHONE: (509) – 477 – 2250

This petition must be filed or postmarked by July 1 of the current assessment year or 30 days after the date of mailing of the change of value or other determination notice. If filing after July 1, a copy of the assessor’s assessed valuation notice must be attached to this petition.

The undersigned petitions the Board of Equalization to change the valuation of the property described below as shown on

the Assessment Roll for for taxes payable in to the amount shown in Item No. 3(b) on this form. PLEASE COMPLETE ALL ITEMS (Please Print)

One Petition Form must be filed for each Parcel.

1.Account/Parcel Number: _______________________________________________________

2.Owner: ______________________________________________________________________

Mailing Address for All Correspondence Relating to Appeal

Street Address: ________________________________________________________________

City, State, Zip Code: ___________________________________________________________

May we contact you by email? |

|

Yes |

|

|

No |

E-mail address: |

|

|

|

|

|

|

Daytime Phone No: |

|

|

|

|

|

|

|

|

Fax No: |

|

|

|

|

|

|

|

|

|

|

|

|

Name of Petitioner or Authorized Agent: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. (a) Assessor’s determination of true and fair value: |

|

(b) Your estimate of true and fair value: |

|

Land |

$ |

|

|

|

|

|

|

|

|

Land |

|

$ |

|

|

Improvement/Bldgs. $ |

|

|

|

|

|

|

|

|

|

....Improvement/Bldgs |

$ |

|

|

|

TOTAL |

$ |

|

|

|

|

|

|

|

|

|

......................TOTAL |

|

$ |

|

|

|

Date the Assessor’s “Change of Value Notice” or other determination notice was mailed: |

|

|

|

|

|

|

I request the information the Assessor used in valuing my property. |

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.Specific reasons why you believe the assessor’s value does not reflect the true and fair market value.

NOTE: Under Washington law, you must prove that the assessor’s value is not the true and fair market value (RCW 84.40.0301). Assessments of other properties, the percentage of assessment increase, personal hardship, the amount of tax, and other matters unrelated to the market value are not relevant or sufficient evidence to prove market value. If this petition concerns income property, please attach a statement of income and expenses for the past two years and copies of leases or rental agreements.

Other issues relevant to your case.

5.Power of Attorney: If power of attorney has been given, the taxpayer must so indicate by signing the statement below or attaching a signed power of attorney. The person whose name appears as authorized agent has full authority to act on my behalf on all matter pertaining to this appeal.

Signature of Petitioner (Taxpayer)

I hereby certify I have read this Petition and that it is true and correct to the best of my knowledge.

Signed this |

|

day of |

|

, |

|

(year). ___________________________________________ |

BOE 64 0075-1 (06/18/07) |

|

|

|

Signature of Taxpayer or Agent |

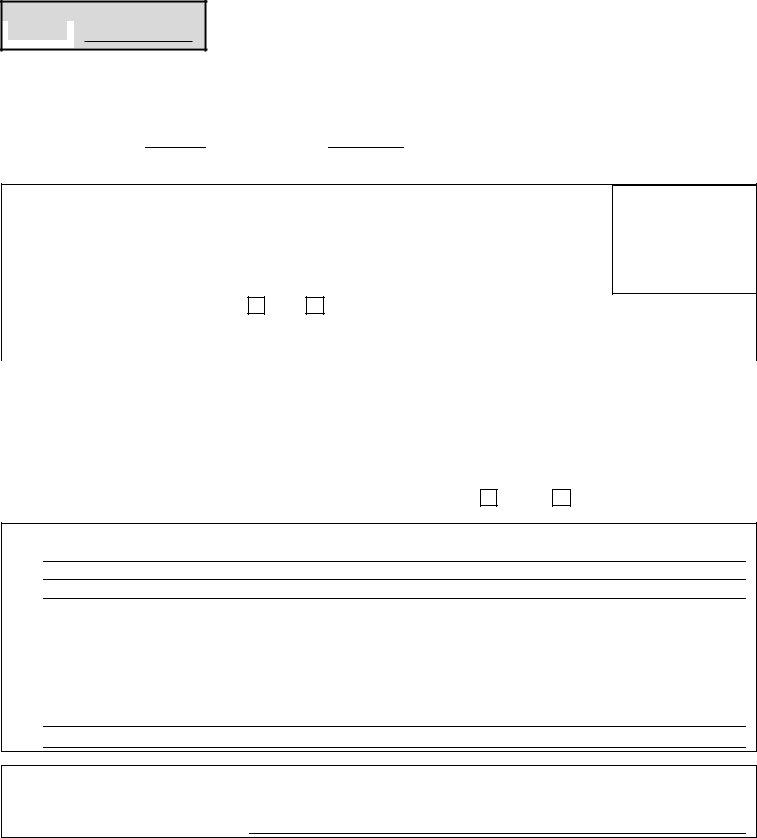

6.The property which is the subject of this petition is (check all which apply):

|

|

Farm/Agricultural Land |

|

Residential Building |

|

|

Residential Land |

|

Commercial Building |

|

|

|

|

|

Commercial Land |

|

Industrial Building |

|

|

|

|

|

Industrial Land |

|

Mobile Home |

|

|

|

|

|

Designated Forest Land |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

Open Space/Current Use Land |

|

|

|

7.General description of property:

a.Address/location:

b.Lot size (acres):

c.Zoning or permitted use:

d.Description of building:

|

e. View? |

|

|

Yes |

|

No |

|

|

|

|

|

|

f. Waterfront? |

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Purchase price of property: |

|

|

(If purchased within last 5 years) |

|

|

|

|

|

|

|

Date of purchase: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

Cost $ |

|

|

|

9. |

Remodeled or improved since purchase? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

10. |

Has the property been appraised by other than the County Assessor? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, appraisal date: |

|

|

|

|

|

|

|

|

By whom? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Appraised value: $ |

|

|

|

|

|

|

|

Purpose of appraisal: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please complete all of the above items (if applicable). Information in boxes 1 – 5 must be provided to be considered a complete petition.

You may submit additional information, either with this Petition or prior to seven business days before the hearing, to support your claim. The area below may be used for this purpose.

11.Check the following statement that applies.

I intend to submit additional documentary evidence to the Board of Equalization and the assessor no later than seven business days prior to my scheduled hearing.

My petition is complete. I have provided all the documentary evidence that I intend to submit and I request a hearing before the Board of Equalization as soon as possible.

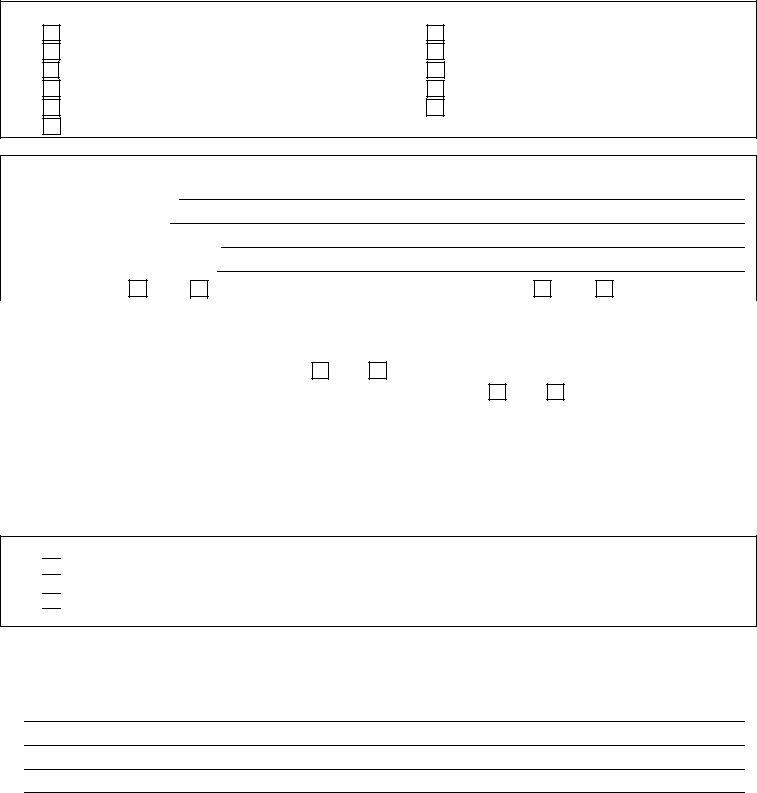

DOCUMENTARY EVIDENCE WORKSHEET

Most recent sales of comparable property: |

|

|

|

Parcel No. |

| Address |

| Land Size(SF) | House Type |

| Sale Price |

| Date of Sale |

a.

b.

c.

d.

Information regarding sales of comparable properties may be obtained through personal research, local realtors, appraisers, or at the county assessor’s office.

For tax assistance, visit http://dor.wa.gov/content/FindTaxesAndRates/PropertyTax/Default.aspx or call (360) 570-5900. To inquire about the availability of this document in an alternate format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users may call (800) 451-7985.

Instructions For Petition to the County Board of Equalization

for Review of Real Property Valuation Determination

All information in boxes 1 – 5 must be completed (if applicable). The petition must be signed and dated. Without this information, your Petition for Review will not be considered

complete.

1.Your account or parcel number appears on your determination notice, value change notice, and tax statement. If you are appealing multiple parcels, you must submit separate petitions for each parcel.

2.Self-explanatory.

3.You may appeal the assessed value of the property. The assessed value is based on the true and fair value of the property.

Check the box if you are requesting the information the assessor used to value the property.

Appeal of Assessed Value

To successfully appeal the Assessed Value of the property, you must show by clear, cogent, and convincing evidence the value established by the assessor is incorrect. In Section 4, you must list the reasons why you believe the Assessed Value is incorrect.

4.List the specific reasons for the appeal. Statements that simply indicate the assessor’s valuation is too high or the amount of tax is excessive are not sufficient (WAC 458-14-056). The reasons must specifically indicate why you believe the assessed value does not represent the true and fair value of the property.

Note any other issues you believe are relevant to the value of your property. If your appeal concerns a comparison of your assessment relative to assessments of other properties, the Board may determine if all of the properties are assessed at their true and fair value. The Board is limited to determining the market value of property. Therefore, any adjustment to the assessed value of your property or other properties must be based on evidence of the true and fair value of the property.

5.Indicate if you are acting under a written Power of Attorney. This section need not be completed if the agent is an attorney-at-law.

Sign and date the petition.

6.–10. Self-explanatory.

Additional information to support your estimate of value may be provided either with this petition or prior to seven business days before the hearing. You must also provide a copy of any additional information to the assessor.

The petition must be filed or postmarked by

July 1 of the current assessment year or 30 days after the date of mailing of the change of value

or other determination notice. If filing after July 1, a copy of the determination notice must be attached to this petition.

One original signed petition (including all attachments) should be filed with the Spokane County Board of Equalization.

Board of Equalization helpful TIPS for filing a Petition:

∙Please write legibly and use ink (not pencil or felt pen)

∙Remember the lien date of assessment is January 1, 2014 (based on your VALUATION NOTICE as shown on the Assessment Roll for 2014 for taxes payable in 2015)

∙Please submit a copy of the Valuation Notice you received in the mail from the County Assessor at all times, this will enable us to process your petition timely and efficiently and to avoid delays in processing

∙If you elect to provide an e-mail address on the petition, please realize that this will be the Assessor's primary source of communication with you (phone contact may also take place, but any assessor's data or their official response to the Petition will be sent by e-mail)

∙It is the taxpayer's responsibility to make copies of all documents submitted (we do not have the resources to do this for you)

∙Please no faxing or electronic filing

∙Please no staples or binding of documents (just arrange orderly with paperclips if necessary)

∙Please limit photographs to a maximum of 12

∙When submitting additional support documentation, please do not duplicate any data previously provided with the original Petition unless you have made actual changes, which must be noted as such

∙Please proof your Petition, as any necessary follow up with you can cause lengthy delay in processing

∙Please provide original Petition with original signature

∙Please try and group/mail multiple petitions in the same envelope

∙Please make sure you are filling out the "correct" petition form for the value in which you would like to appeal (real property, open space, personal property, etc.)

∙Most common oversight is forgetting to sign the Petition!