It's very easy to fill in the Schedule gaps. Our PDF tool makes it practically effortless to fill in almost any PDF file. Down the page are the basic four steps you'll want to follow:

Step 1: Click the button "Get form here" to access it.

Step 2: After you have entered your Schedule edit page, you will notice all options you can use with regards to your document in the upper menu.

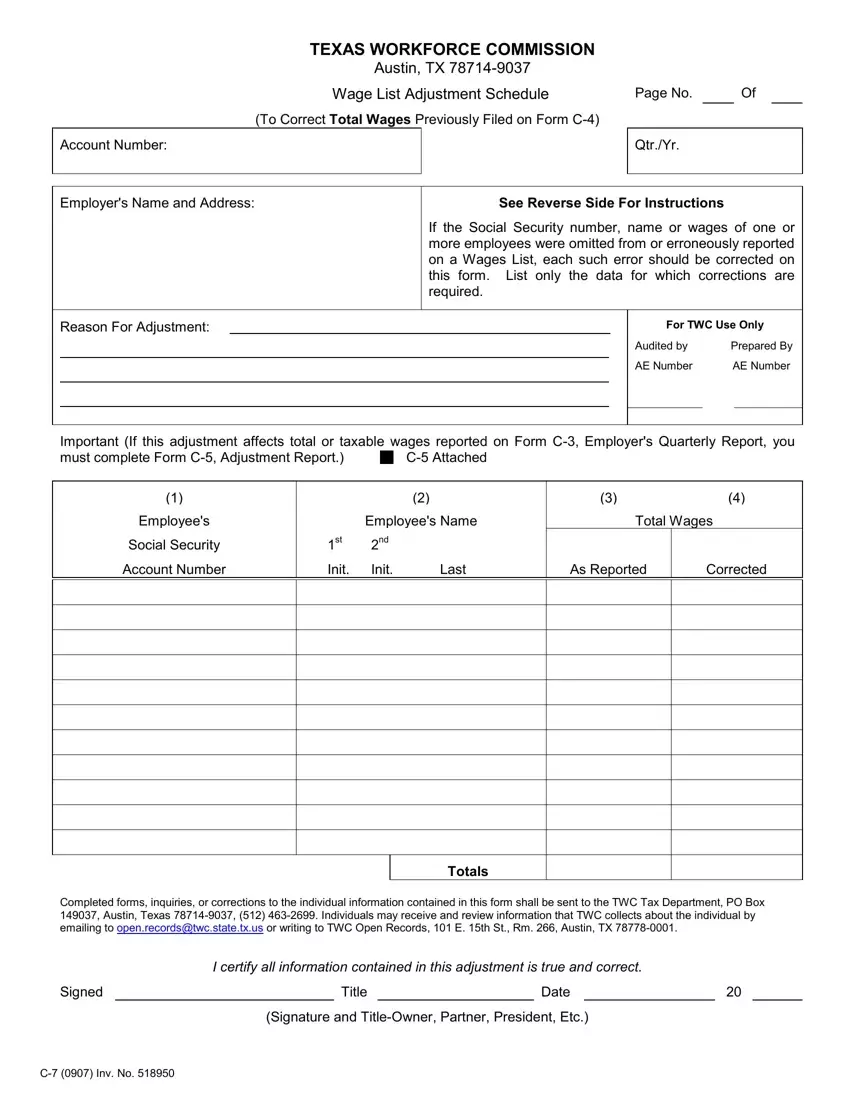

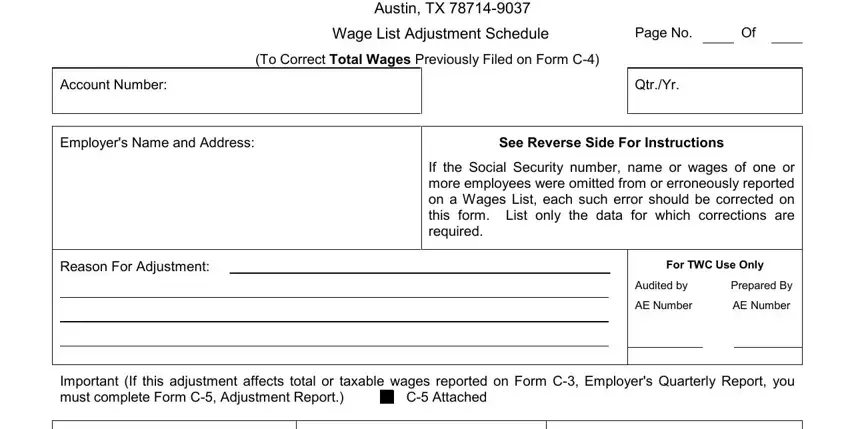

Prepare the Schedule PDF and type in the details for every single segment:

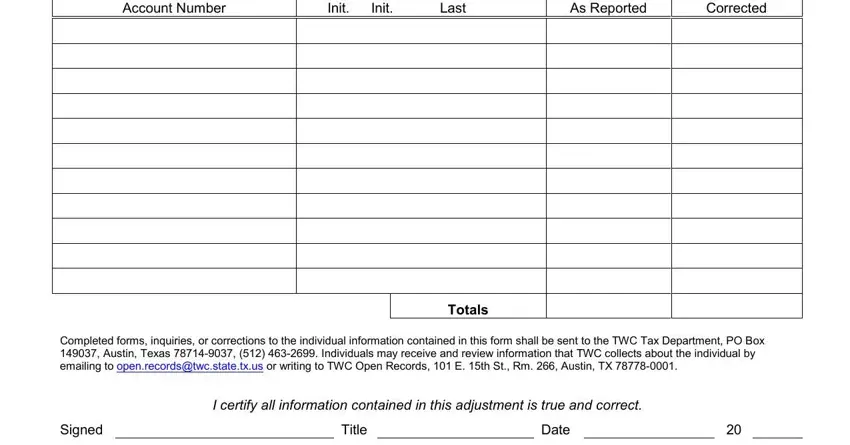

Write the required information in the Account Number, Init, Init, Last, As Reported, Corrected, Totals, Completed forms inquiries or, Signed, Title, Date, and I certify all information box.

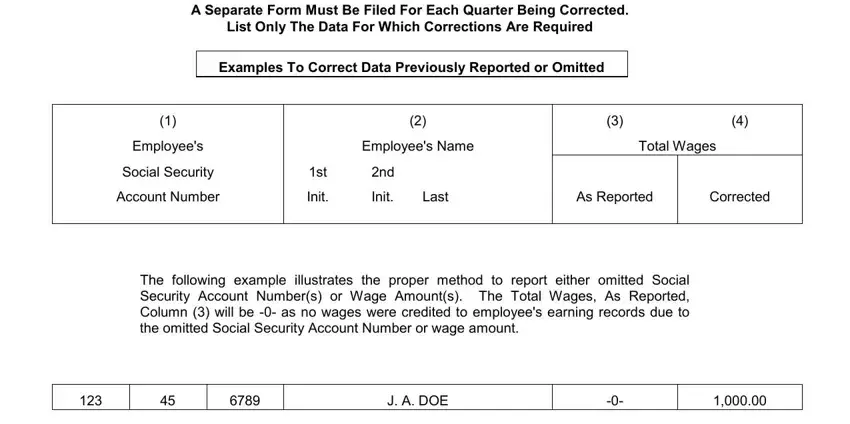

Put down any information you need within the field A Separate Form Must Be Filed For, Examples To Correct Data, Employees, Social Security, Account Number, Init, Employees Name, Total Wages, Init, Last, As Reported, Corrected, The following example illustrates, and J A DOE.

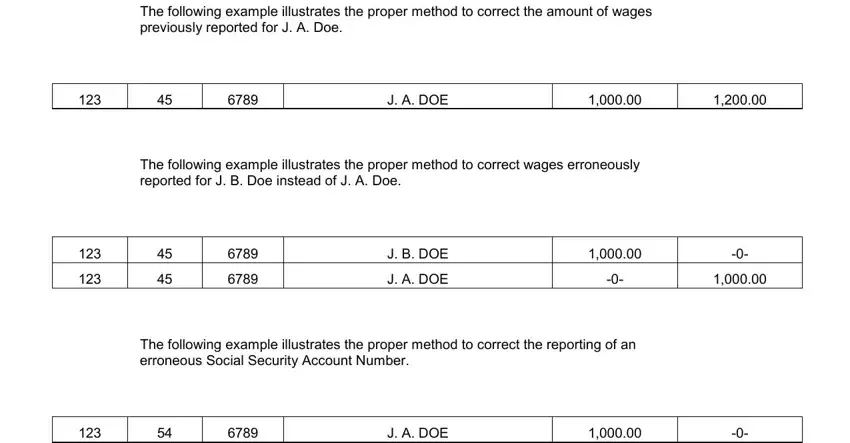

The The following example illustrates, J A DOE, The following example illustrates, J B DOE, J A DOE, The following example illustrates, and J A DOE box enables you to point out the rights and responsibilities of either side.

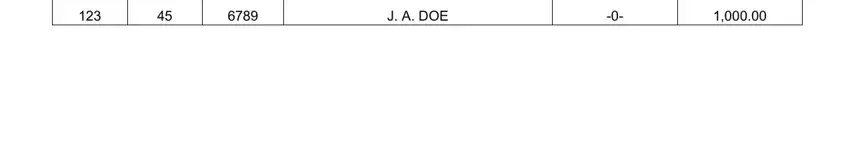

End by reading the following areas and completing them as needed: J A DOE.

Step 3: As soon as you choose the Done button, your prepared form can be easily exported to any of your gadgets or to electronic mail chosen by you.

Step 4: You can create copies of the form toprevent any type of possible concerns. You need not worry, we don't distribute or track your data.