|

explanation of gain/loss items, but do not submit the federal |

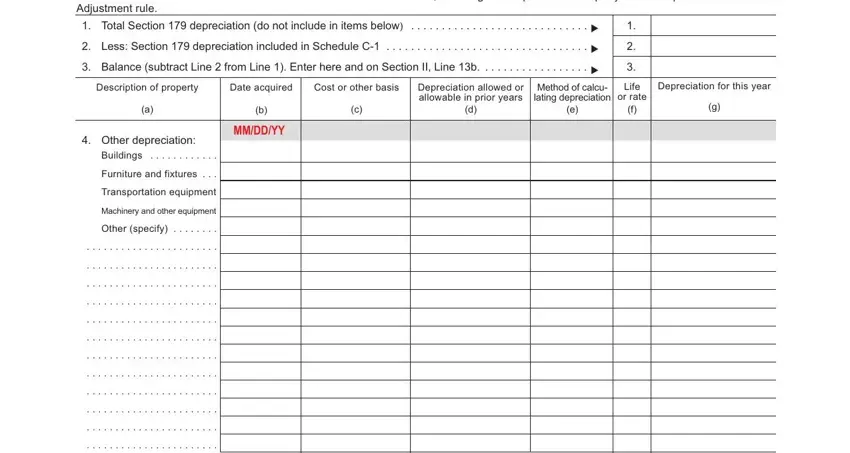

any differences in depreciation related to differences in basis |

|

schedule. |

of assets, amount of allowable Section 179 expense, or |

|

FORM 8271 |

method of depreciation for federal or PA purposes; and any |

|

other reductions in federal expenses allowed at 100 percent |

|

Do not report or deduct any transactions related to tax |

|

for PA personal income tax purposes. |

|

shelters. |

|

|

|

|

FORM 8594 |

Examples of items that Pennsylvania requires as reductions |

|

in federal income or expenses include: income taxes based |

|

Report the acquisition or disposition of business assets on |

|

upon gross or net income; any differences in depreciation |

|

Line 4 of PA Schedule C. Refer to the federal schedule for |

|

related to differences in basis of assets, amount of allowable |

|

an explanation for gain/loss items, but do not submit the |

|

Section 179 expense, or method of depreciation for federal |

|

federal schedule. |

|

or PA purposes; recognition of cancellation of debt income; |

|

|

|

|

|

FORM 8824 |

recognition of income from IRC Section 481(a) spread |

|

Do not report a like-kind exchange on PA Schedule C. PA |

adjustments; payments for owner pension, profit-sharing |

|

law does not have like-kind exchange provisions. You must |

plans, deferred, or welfare benefit plans; percentage deple- |

|

include the gain or loss from a sale, exchange or disposition |

tion; direct expensing of organizational expenses or syndi- |

|

of a business asset on Line 4 of PA Schedule C if the trans- |

cation fees; losses from the sale of property where PA basis |

|

action was a normal business transaction. You must report |

is different than federal basis; and any other income or |

|

any gain or loss from the sale of a nonbusiness asset or |

expenses where there is a specialized federal treatment that |

|

property or the sale of a business or segment thereof on PA |

is not specifically addressed or allowed by PA personal |

|

Schedule D if the property sold was not replaced. |

income tax law that might involve additional expensing, |

|

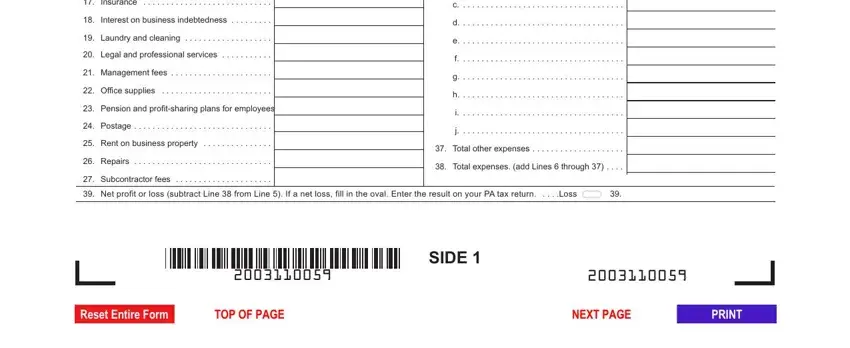

FORM 8829 |

expensing verses capitalization, carry back or carry forward |

|

of losses, income recognition, or other special treatments. |

|

Include your allowable expenses for the business use of |

|

Other differences between Pennsylvania and federal income |

|

your home on Line 37 of PA Schedule C. Refer to the federal |

|

schedule for an explanation of this expense, but do not sub- |

tax include the following: |

|

mit the federal schedule. Pennsylvania does not recognize |

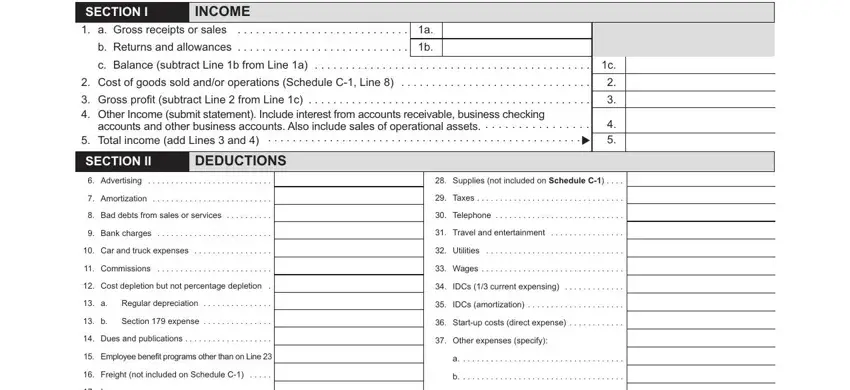

IDCs. Special rules apply for the direct expensing of intan- |

|

the federal safe harbor method for determining the allowable |

gible drilling & development costs (IDCs). Up to one-third of |

|

deduction for business use of a residence for Pennsylvania |

the amount of IDCs incurred in tax years beginning after |

|

Personal Income Tax purposes. All home office expenses |

Dec. 31, 2013 may be directly expensed, with the remaining |

|

must be determined by using actual costs incurred. |

amount amortized over 10 years. Taxpayers may also elect |

|

|

|

|

to amortize the full amount of the IDCs over 10 years. The |

|

|

OTHER PENNSYLVANIA AND FEDERAL |

|

election to expense any IDCs is made by including an |

|

|

|

amount on Line 34 of PA Schedule C. Amortization of the |

|

|

INCOME TAX DIFFERENCES |

|

|

|

|

IDCs must be reported separately on Line 35 of PA Schedule |

|

|

|

|

|

PA income from the operation of business generally differs |

C. IDCs incurred prior to Jan. 1, 2014 must be amortized |

|

over the life of the well. |

|

from the income determined for federal income tax purposes. |

|

|

|

|

Further, Pennsylvania will no longer accept a PA Schedule |

Qualified Joint Ventures. Pennsylvania is not a community |

|

C-F Reconciliation for the purpose of adjusting the federal |

property state. Therefore, for PA personal income tax |

|

business income to PA business income. Therefore, the |

purposes, a taxpayer and the taxpayer’s spouse must each |

|

items which were previously included as additions to PA |

report on a separate PA Schedule C their share of income |

|

income or expense on the PA Schedule C-F Reconciliation |

from a business entity they own that is considered a qualified |

|

should be included with the specific line of income or |

joint venture for federal income tax purposes. |

|

expense on the PA Schedule C. In addition, those items |

|

|

|

which Pennsylvania does not require be reported as income |

LINE INSTRUCTIONS |

|

|

or does not allow as expense in determining net business |

|

|

|

|

|

|

income, which are allowed in the determination of net federal |

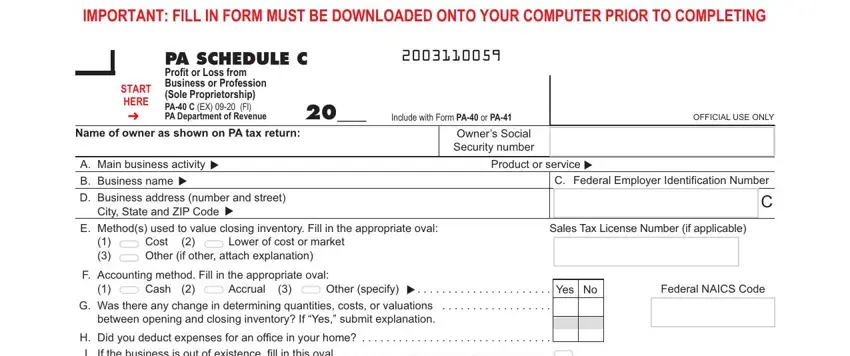

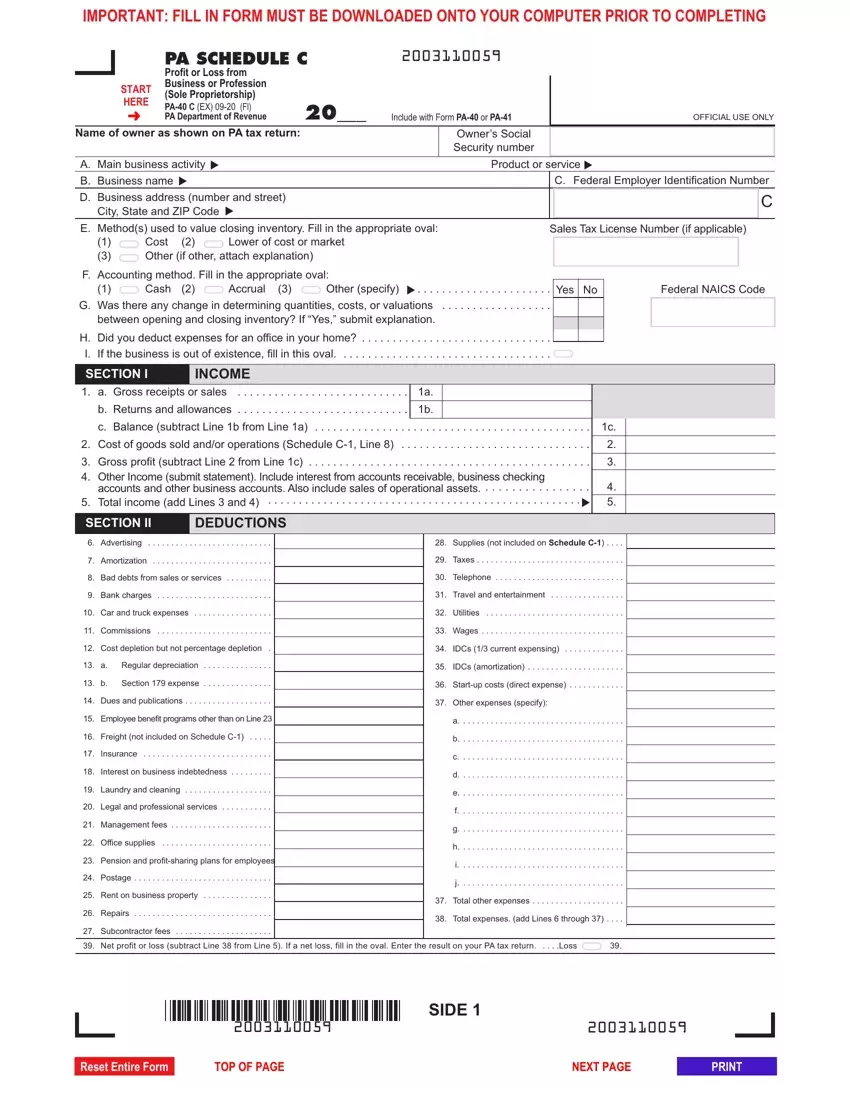

IDENTIFICATION INFORMATION |

|

business income, should not be included in the specific |

Complete each line. |

|

business income or expenses on PA Schedule C. |

OWNER'S NAME |

|

|

|

|

|

Examples of items that Pennsylvania requires as additions |

Enter the name of the business owner. If you are married |

|

to income include: any advance receipts for goods or serv- |

and you jointly owned the business with your spouse, you |

|

ices; working capital interest or dividend income including |

must complete separate PA Schedule C’s. If you and your |

|

federal-exempt interest and dividend income from obliga- |

spouse have separate business activities, complete separate |

|

tions of other states; gains from the sale of business assets |

PA Schedule(s) C. |

|

where the property is replaced by similar property; gains |

SALES TAX LICENSE NUMBER |

|

from like-kind exchanges; gains from involuntary conver- |

|

Enter your Pennsylvania Sales Tax License Number if you |

|

sions (such as those from IRC Section 1033); and gains |

|

have one. Otherwise, leave this space blank. |

|

from the sale of property where PA basis is different than |

|

|

|

|

federal basis. |

FEDERAL NAICS CODE |

|

Examples of items that Pennsylvania allows as additions to |

Provide your Federal NAICS Code as identified on your |

|

Federal Schedule C. |

|

expenses that require a reduction for federal tax purposes |

|

|

|

|

include: meals, travel and entertainment expense deduction |

SOCIAL SECURITY NUMBER (SSN) |

|

of 100 percent by Pennsylvania for the expenses incurred; |

Enter the SSN of the business owner. |

|

|

|

|

|

|

|

2 |

PA-40 C |

www.revenue.pa.gov |

Other (if other, attach explanation)

Other (if other, attach explanation)

entertainment facilities (boat, resort, ranch, etc.), living accommodations (except for employees on business) or vacations for yourself, your employees or their families. Reduce your total business expenses in Section II by the

entertainment facilities (boat, resort, ranch, etc.), living accommodations (except for employees on business) or vacations for yourself, your employees or their families. Reduce your total business expenses in Section II by the