Through the online PDF editor by FormsPal, it is possible to fill in or alter ca7 form usps right here and now. To keep our editor on the forefront of efficiency, we aim to put into action user-driven features and improvements regularly. We're always looking for feedback - play a vital part in revampimg PDF editing. By taking some simple steps, you may start your PDF journey:

Step 1: Access the PDF in our editor by clicking the "Get Form Button" in the top part of this page.

Step 2: As you start the PDF editor, you will get the form all set to be filled out. Apart from filling in various blank fields, you could also do some other things with the Document, specifically putting on custom text, changing the original textual content, adding graphics, putting your signature on the form, and much more.

Completing this form calls for care for details. Make certain all mandatory fields are completed accurately.

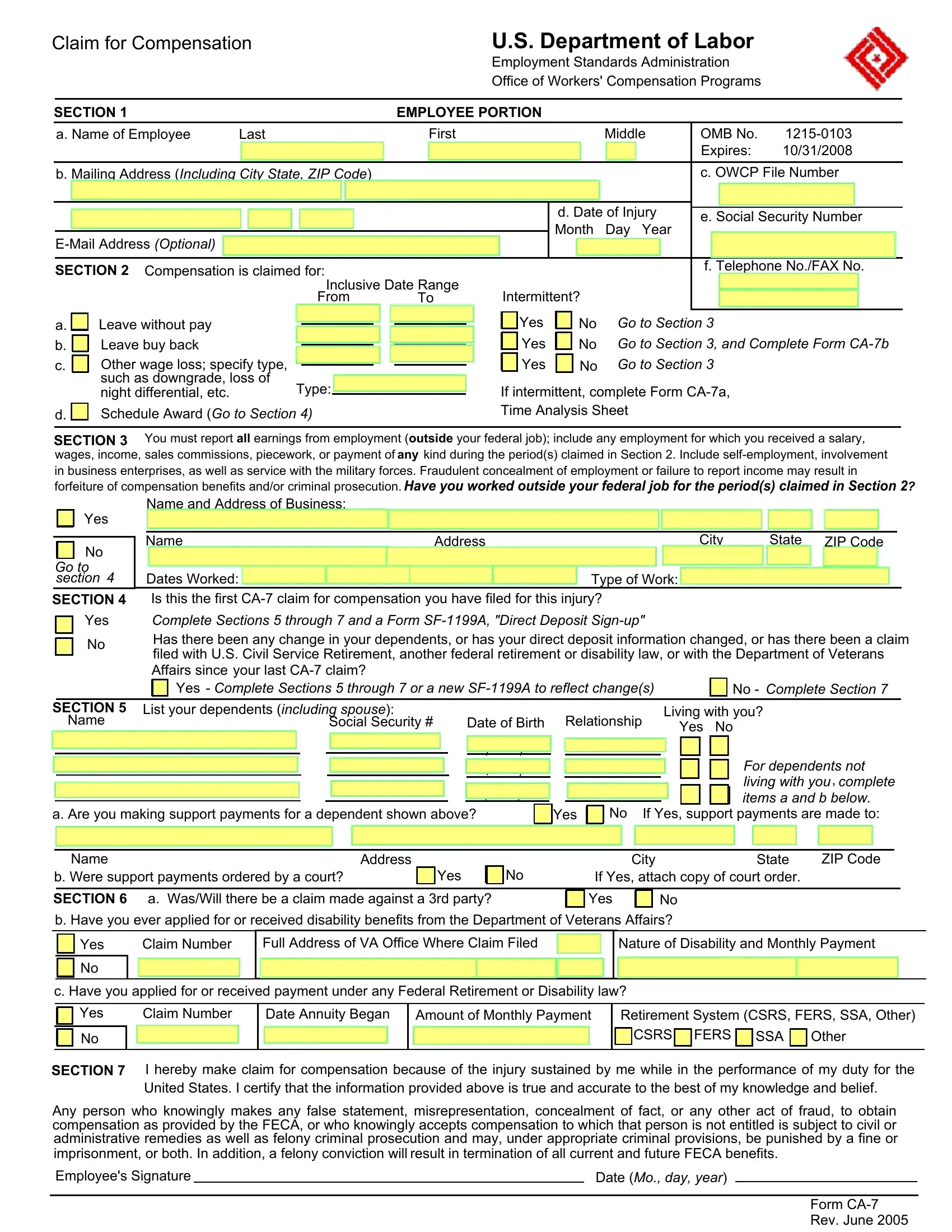

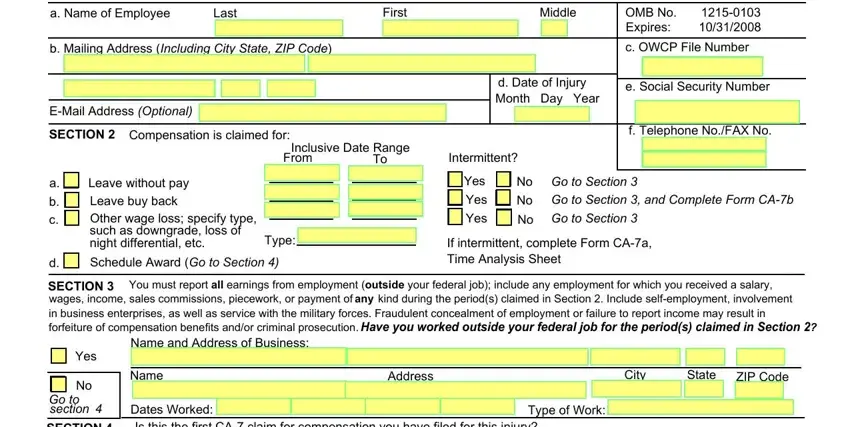

1. The ca7 form usps needs specific information to be inserted. Be sure that the next blanks are filled out:

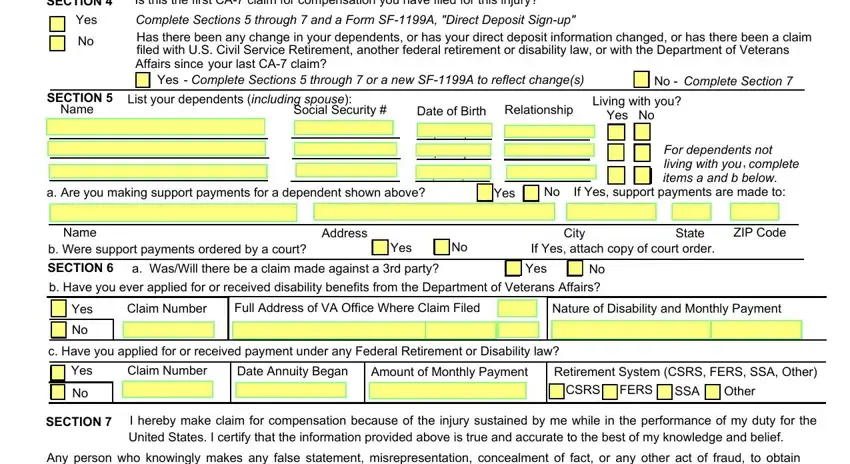

2. The next step would be to submit the following fields: SECTION, Yes, Dates Worked Is this the first CA, Complete Sections through and a, your last CA claim, Yes Complete Sections through, No Complete Section, SECTION, Name, List your dependents including, Social Security, Date of Birth, Relationship, Living with you, and Yes No.

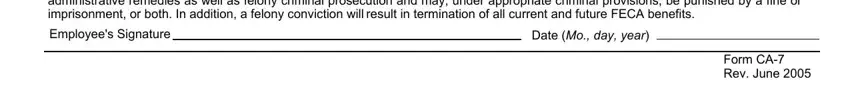

3. Throughout this step, review Any person who knowingly makes any, result in termination of all, Employees Signature, Date Mo day year, and Form CA Rev June. All these will have to be completed with utmost accuracy.

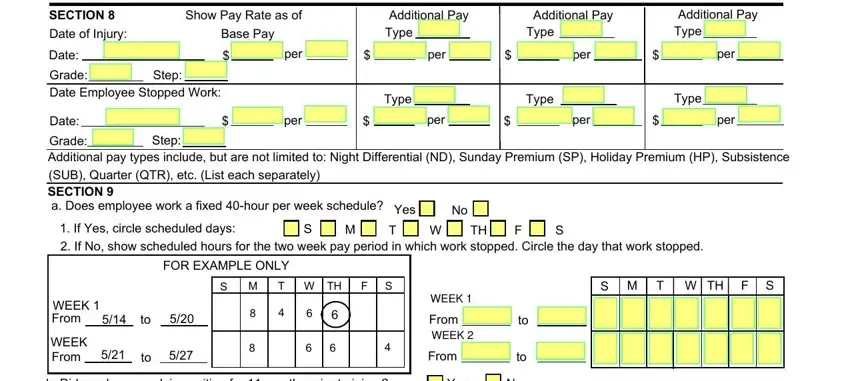

4. The subsequent section requires your input in the subsequent areas: SECTION, Date of Injury, Show Pay Rate as of, Base Pay, Additional Pay Type, Additional Pay, Type, Additional Pay Type, Date, Grade Date Employee Stopped Work, Step, Date, per, per, and Type. Be sure you fill out all required information to go onward.

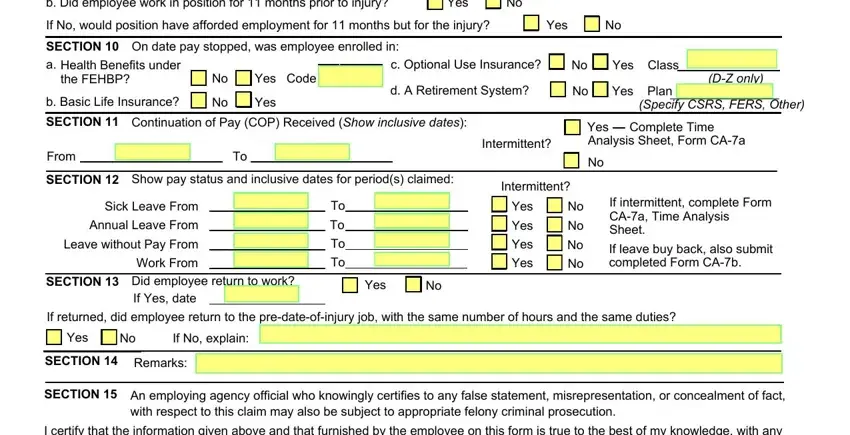

5. The pdf should be concluded with this particular part. Further you will see an extensive listing of blanks that require specific details for your form usage to be complete: b Did employee work in position, Yes, If No would position have afforded, Yes, On date pay stopped was employee, SECTION a, Health Benefits under the FEHBP, b Basic Life Insurance, Yes Code, Yes, c Optional Use Insurance, d A Retirement System, Yes Class, Yes Plan, and DZ only.

People frequently make mistakes when completing Yes in this area. Be certain to read twice everything you type in here.

Step 3: Right after rereading the fields you've filled out, click "Done" and you are all set! Obtain the ca7 form usps when you register here for a free trial. Conveniently get access to the form within your FormsPal account, together with any edits and changes all synced! FormsPal is committed to the personal privacy of our users; we always make sure that all personal information coming through our system stays protected.