Dealing with PDF documents online is definitely simple using our PDF editor. Anyone can fill in illinois tax eg 13 form here and try out many other functions available. To maintain our editor on the leading edge of efficiency, we aim to implement user-driven capabilities and enhancements regularly. We're always looking for feedback - assist us with remolding PDF editing. Getting underway is easy! All you need to do is follow the next simple steps below:

Step 1: Just click the "Get Form Button" above on this page to get into our pdf form editing tool. There you'll find all that is required to work with your file.

Step 2: The editor allows you to change PDF forms in various ways. Transform it with any text, correct original content, and put in a signature - all within a few mouse clicks!

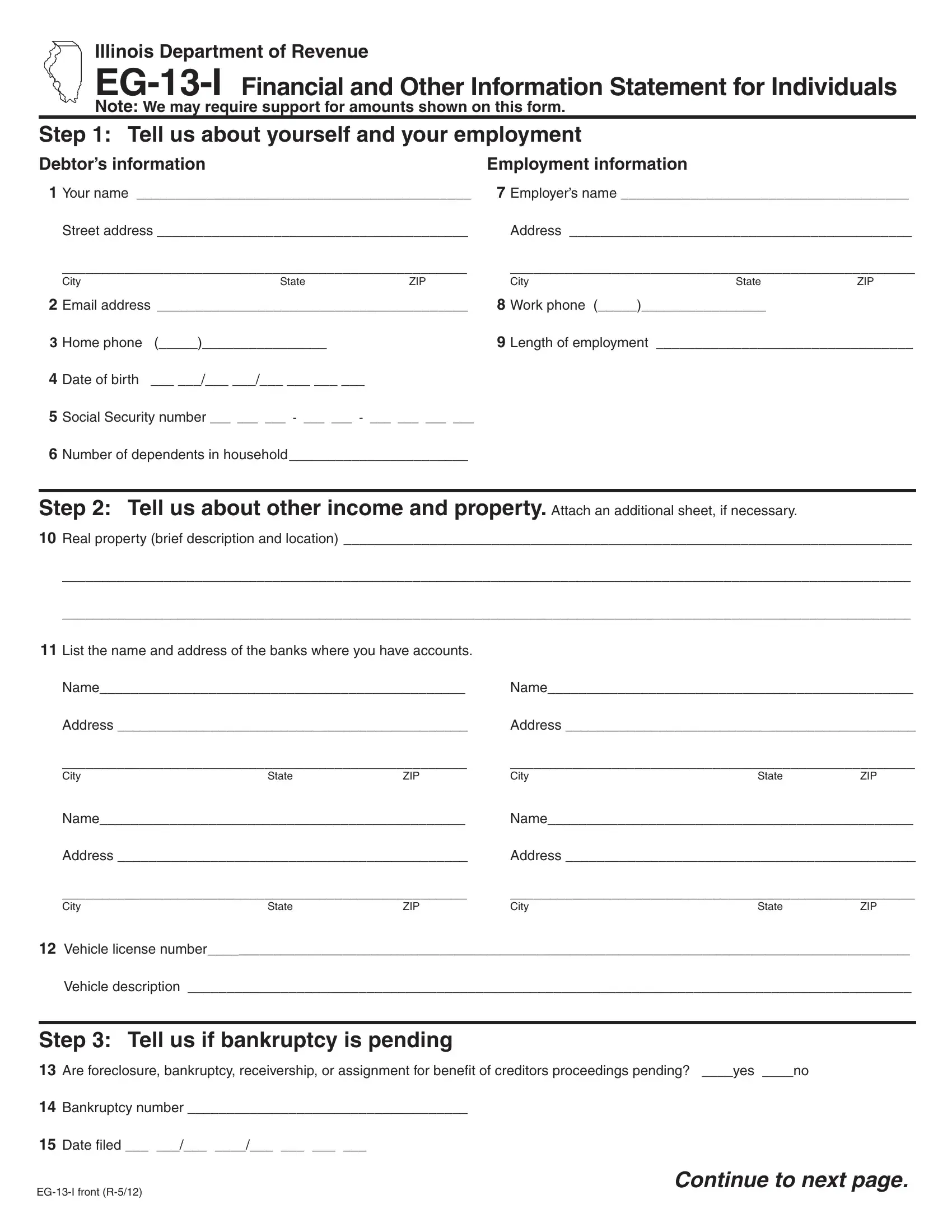

This PDF doc requires some specific information; to ensure accuracy, you should heed the guidelines listed below:

1. Begin completing the illinois tax eg 13 form with a selection of necessary blank fields. Get all the necessary information and ensure not a single thing overlooked!

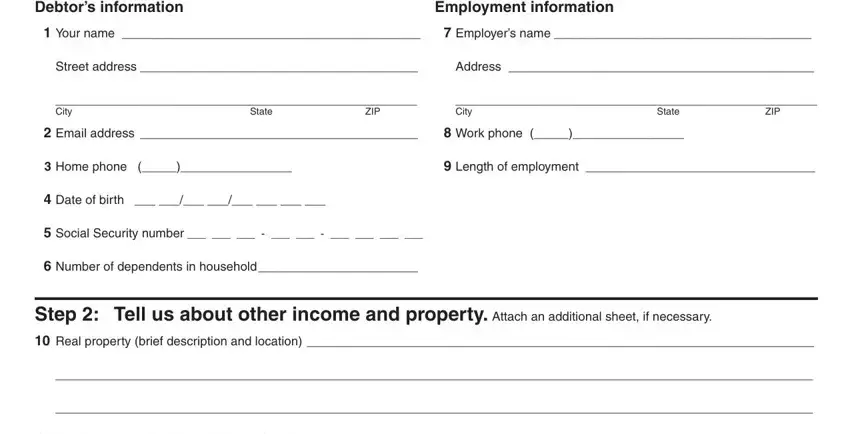

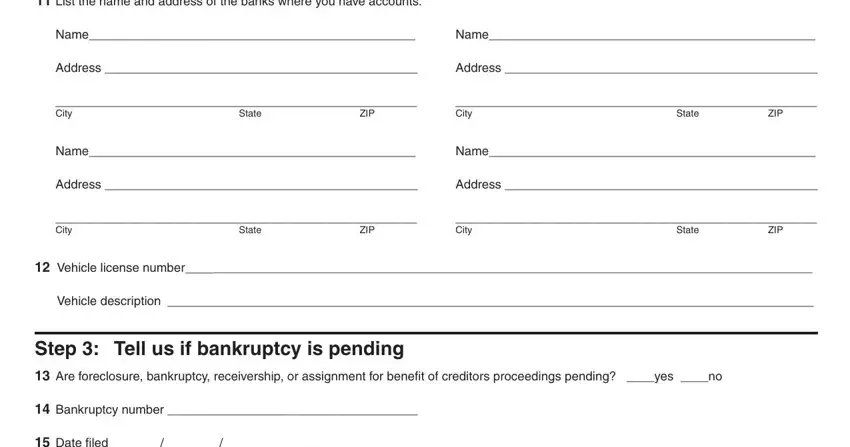

2. Once your current task is complete, take the next step – fill out all of these fields - List the name and address of the, Name, Name, Address, Address, City, State, ZIP, City, ZIP, State, Name, Name, Address, and Address with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Lots of people generally make some errors when completing Address in this section. You need to go over whatever you type in here.

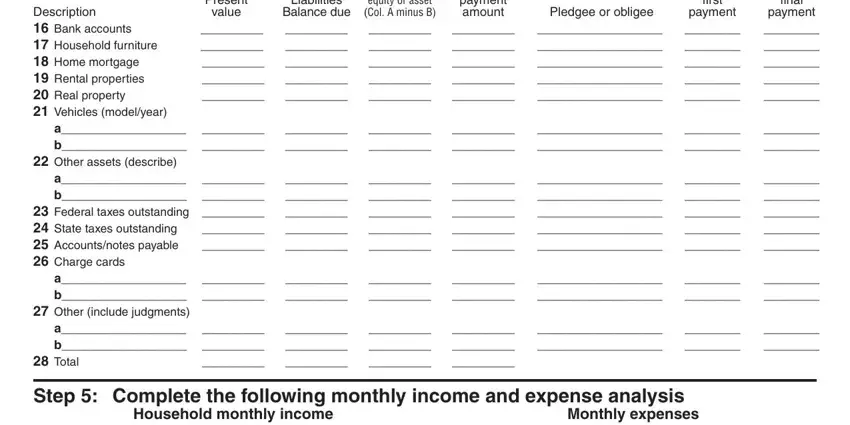

3. This next section is related to Monthly payment amount, a b, Present value, equity or asset Col A minus B, Liabilities Balance due, Step Complete the following, a b, a b, Pledgee or obligee, first, payment, final payment, Monthly expenses, Household monthly income, and Step Complete the following - fill in each of these fields.

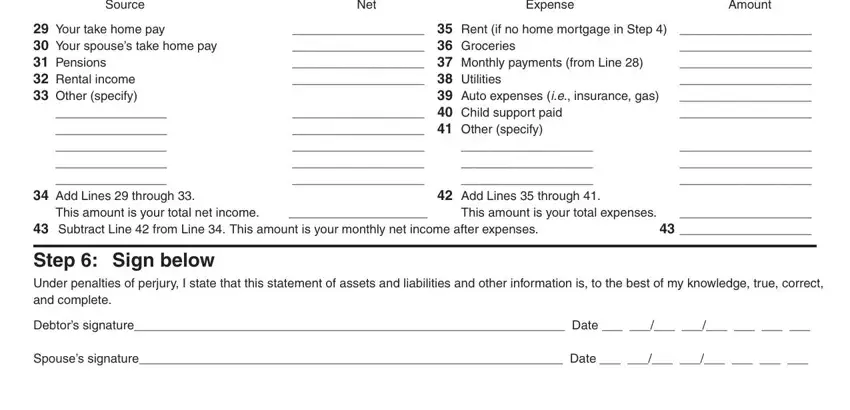

4. The form's fourth section comes next with these empty form fields to complete: Net, Source, Expense, Step Complete the following, Child support paid Other, Rent if no home mortgage in Step, Auto expenses ie insurance gas, This amount is your total net, This amount is your total expenses, Add Lines through, Amount, Step Sign below Under penalties, Debtors signature Date, and Spouses signature Date.

Step 3: After looking through the form fields you've filled out, press "Done" and you're all set! Make a 7-day free trial option with us and gain immediate access to illinois tax eg 13 form - downloadable, emailable, and editable in your FormsPal account page. FormsPal guarantees your information confidentiality by using a secure method that in no way records or shares any private information provided. You can relax knowing your files are kept protected every time you work with our services!