You are able to work with Form Ftb 1096 easily with our PDFinity® editor. FormsPal team is continuously working to enhance the editor and insure that it is much better for people with its cutting-edge functions. Discover an ceaselessly revolutionary experience now - explore and discover new opportunities along the way! If you are seeking to start, here is what it takes:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" above on this webpage.

Step 2: This editor helps you work with the majority of PDF documents in a variety of ways. Change it by including any text, adjust what's originally in the document, and place in a signature - all manageable within a few minutes!

When it comes to blanks of this specific PDF, this is what you want to do:

1. It is important to fill out the Form Ftb 1096 properly, so be mindful while working with the segments comprising these specific fields:

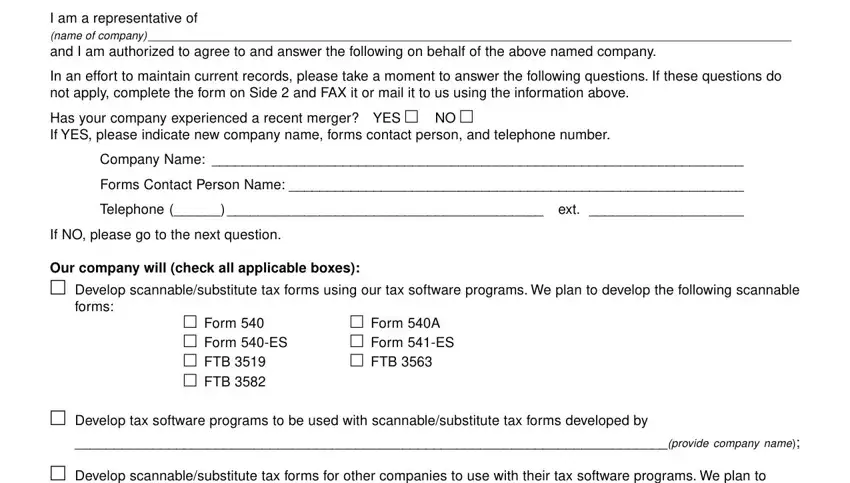

2. Just after this part is done, proceed to type in the applicable details in all these - Develop scannablesubstitute tax, develop the following scannable, Form Form ES FTB FTB, Form A Form ES FTB, Develop Paperless Schedules K or, and FTB REV SIDE.

People who use this PDF generally make mistakes while completing Develop Paperless Schedules K or in this area. Remember to read again everything you enter right here.

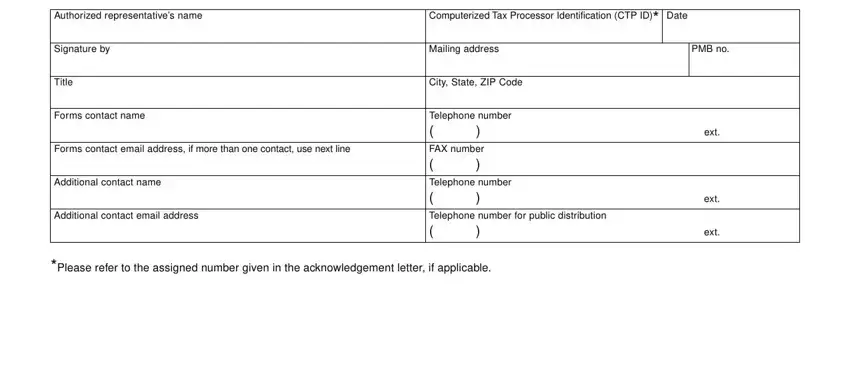

3. Within this stage, look at Authorized representatives name, Computerized Tax Processor, Signature by, Title, Forms contact name, Forms contact email address if, Additional contact name, Additional contact email address, Mailing address, PMB no, City State ZIP Code, Telephone number FAX number, ext, ext, and ext. These need to be taken care of with greatest precision.

Step 3: Ensure your information is right and click on "Done" to finish the process. Sign up with us right now and immediately use Form Ftb 1096, prepared for download. All changes you make are saved , so that you can edit the file at a later time if required. With FormsPal, it is simple to fill out forms without having to worry about database incidents or records being distributed. Our secure software ensures that your personal data is stored safe.