hawaii corporate extension form 2020 can be filled in easily. Just open FormsPal PDF editor to accomplish the job right away. To make our tool better and easier to use, we constantly develop new features, taking into consideration suggestions from our users. With some basic steps, you'll be able to start your PDF journey:

Step 1: Press the "Get Form" button in the top area of this webpage to open our PDF tool.

Step 2: With the help of our online PDF tool, you can actually do more than just fill out blank form fields. Try all of the functions and make your forms seem faultless with customized text added in, or fine-tune the file's original input to perfection - all that accompanied by the capability to add stunning images and sign it off.

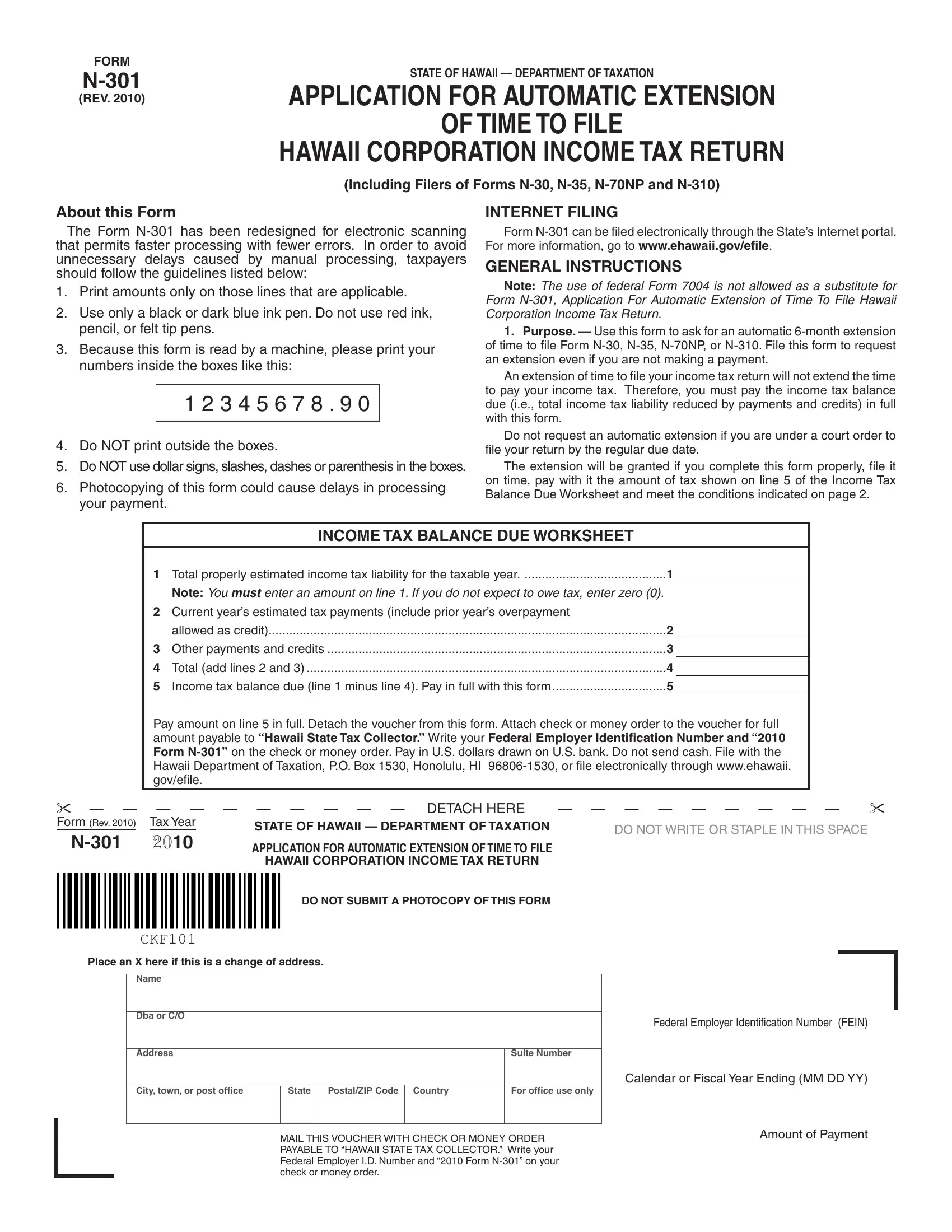

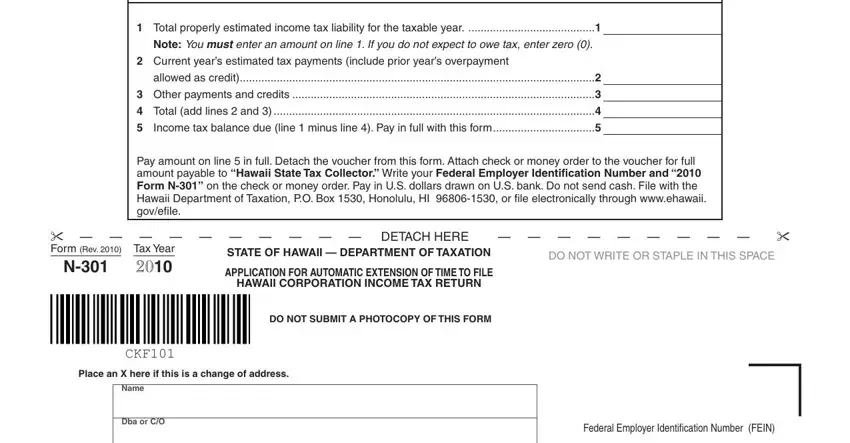

In an effort to complete this form, make certain you type in the necessary details in every single field:

1. While completing the hawaii corporate extension form 2020, be sure to incorporate all needed blanks in the associated area. It will help to facilitate the work, enabling your information to be processed promptly and accurately.

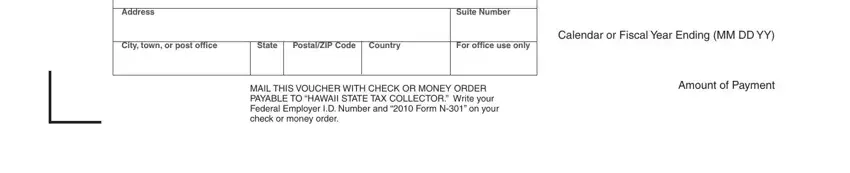

2. Soon after filling in the last step, go on to the subsequent part and fill in the essential particulars in all these blanks - Address, Suite Number, City town or post office, State, PostalZIP Code Country, For office use only, Calendar or Fiscal Year Ending MM, MAIL THIS VOUCHER WITH CHECK OR, and Amount of Payment.

When it comes to MAIL THIS VOUCHER WITH CHECK OR and Calendar or Fiscal Year Ending MM, be sure you don't make any mistakes in this section. Both these are viewed as the key fields in this document.

Step 3: After going through the fields and details, hit "Done" and you are all set! Try a free trial subscription at FormsPal and get instant access to hawaii corporate extension form 2020 - download or edit inside your personal cabinet. FormsPal ensures your data confidentiality via a secure system that never saves or distributes any sort of personal data provided. Be assured knowing your documents are kept safe every time you use our service!