When using the online PDF tool by FormsPal, it is easy to fill in or change nj njk here and now. Our team is devoted to providing you with the absolute best experience with our tool by regularly introducing new features and improvements. With these updates, using our tool gets easier than ever before! Starting is simple! Everything you need to do is follow the following simple steps directly below:

Step 1: Firstly, access the editor by clicking the "Get Form Button" in the top section of this site.

Step 2: As you access the tool, you'll notice the form ready to be filled in. Besides filling out different blanks, you might also do many other things with the form, including putting on your own text, modifying the initial text, adding graphics, signing the form, and much more.

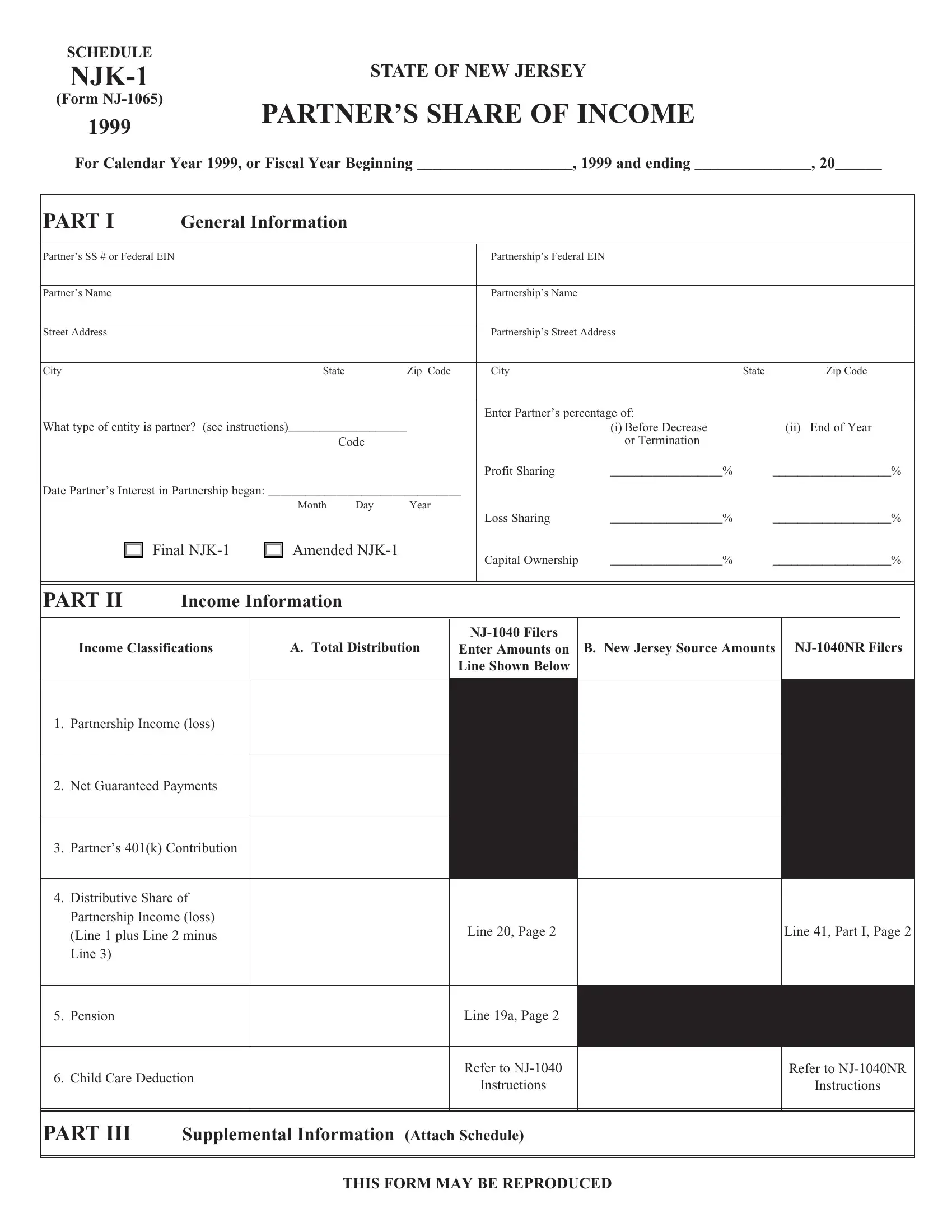

This document needs some specific information; to guarantee correctness, you should take heed of the subsequent tips:

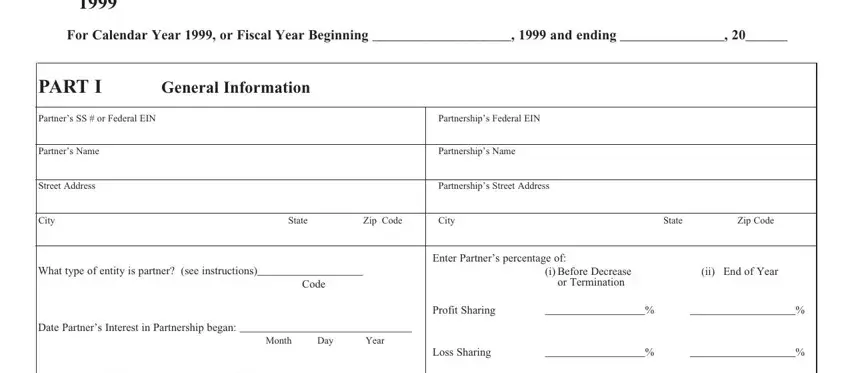

1. You need to complete the nj njk correctly, so be careful when working with the segments comprising these particular blanks:

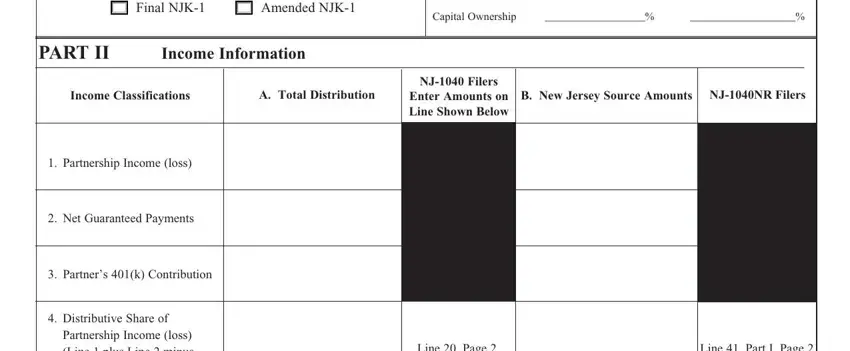

2. Right after filling in the previous section, head on to the subsequent part and complete the essential particulars in these fields - Final NJK, Amended NJK, Capital Ownership, PART II, Income Information, Income Classifications, A Total Distribution, NJ Filers, Enter Amounts on Line Shown Below, B New Jersey Source Amounts, NJNR Filers, Partnership Income loss, Net Guaranteed Payments, Partners k Contribution, and Distributive Share of.

Lots of people frequently make mistakes when filling out Partners k Contribution in this section. You should definitely double-check everything you type in right here.

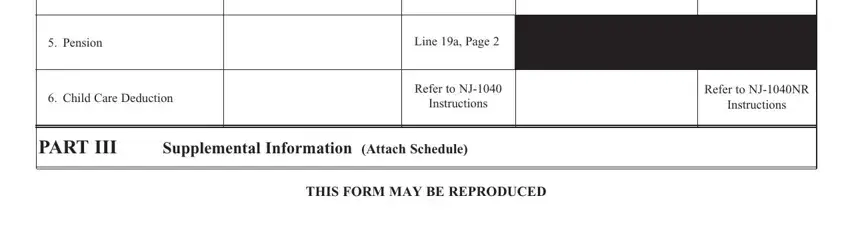

3. In this particular step, look at Pension, Child Care Deduction, Line a Page, Refer to NJ, Instructions, Refer to NJNR, Instructions, PART III, Supplemental Information Attach, and THIS FORM MAY BE REPRODUCED. All these must be taken care of with utmost awareness of detail.

Step 3: As soon as you have glanced through the details you filled in, click on "Done" to conclude your form at FormsPal. Find the nj njk once you sign up for a free trial. Conveniently gain access to the pdf form inside your FormsPal cabinet, together with any edits and adjustments being automatically kept! FormsPal guarantees your data confidentiality with a secure system that in no way saves or distributes any type of private information used. Be assured knowing your files are kept safe when you use our editor!