The Form NYC-204EZ represents an abbreviated pathway for certain partnerships, including limited liability companies that elect to be treated as partnerships for tax purposes, to meet their Unincorporated Business Tax (UBT) obligations to New York City. Appropriate for the 2012 tax year, it simplifies the process for entities with no UBT liability, guiding them through reporting their income without the need to delve into more complex tax documentation. Partnerships whose gross income exceeds $95,000 are required to file, except those involved exclusively in exempt activities. The form mandates a straightforward declaration of income, adjustments, and tax liability, inclusive of specific clauses to address exemption claims, termination of business within the reporting period, and 9/11-related tax benefits. Entities that have undergone adjustments to taxable income by the IRS or New York State, have significant changes in partnership ownership, or possess real estate interests within New York City must provide additional information. Notably, the form restricts eligibility to those without certain financial adjustments, like credit for taxes paid or income allocation beyond city limits. It offers a final certification section for accuracy affirmation, underscoring the critical duty of reporting entities to ensure completeness and correctness, supported by obligatory attachment of detailed schedules and the federal Form 1065.

| Question | Answer |

|---|---|

| Form Name | Form Nyc 204Ez |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | NYC-114, 2013, 01-related, IRC |

*60911291*

TM |

|

UNINCORPORATED BUSINESS TAX RETURN 2012 |

|||

NEWYORK CITYDEPARTMENT OF FINANCE |

|

|

|

|

|

|

FOR PARTNERSHIPS (INCLUDING LIMITED LIABILITY COMPANIES) |

|

|

||

|

|||||

FINANCE |

|

|

|

|

|

|

For CALENDAR YEAR 2012 or FISCAL YEAR beginning _________________2012, and ending _________________ , ______ |

||||

Entity Type: ● ■general partnership |

● ■registered limited liability partnership |

● ■ limited partnership |

● ■limited liability company |

|

● ■ Amended return |

● ■ Final return - Check this box if you have ceased operations. |

|

||

●■ Check box if you are engaged in an exempt unincorporated business activity ● ■ Check box if you claim any

Date business |

- |

- |

Date business ended |

- |

- |

|

began in NYC: |

in NYC(if applicable): |

|||||

|

|

|

|

|||

|

|

|||||

IF BUSINESS TERMINATED DURING THE YEAR, ATTACH A STATEMENT SHOWING THE DISPOSITION OF BUSINESS PROPERTY

Name

In Care Of

Address (number and street)

City and State |

|

Zip Code |

|

|

|

Business Telephone Number |

Nature of Business |

|

|

|

|

TAXPAYER’S EMAIL ADDRESS

EMPLOYER IDENTIFICATION NUMBER

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

This form is for certain partnerships, including limited liability companies treated as partnerships for federal income tax purposes, who are required to file an Unincorporated Business Tax Return but have no tax liability. For taxable years beginning on or after January 1, 2009, a partnership engaged in an unincorpo- rated business is required to file an Unincorporated Business Tax return if its unincorporated business gross income is more than $95,000. This form may also be used by a partnership that is not required to file but wishes to disclaim any liability for tax because it is engaged solely in activities exempt from the tax.

You may not use this form if:

◆You have NYC modifications other than the addback of income and Unincorporated Business Taxes on Schedule B, line 13 of Form

◆You allocate total business income within and without NYC. (If you allocate 100% of your business income to NYC, you may use this form.)

◆

◆You claim a partial exemption for investment activities. (See instructions to Form

◆You have any investment income or loss (See instructions for

◆You claim any deduction for a net operating loss. (See Form

◆Your unincorporated business gross income less the allowance for active partners' services is more than $90,000. (See Form

1. AmountfromAnalysisofNetIncome(Loss)fromfederalForm1065,ScheduleK,line1 |

● 1. |

2.Otherincomeandexpensesnotincludedonline1thatarerequiredtobereported

separatelytopartners(attachscheduleandseeinstructions) |

● 2. |

3.IncometaxesandUnincorporatedBusinessTaxdeductedonfederalForm1065

(attachlistandseeinstructions) |

● 3. |

4. Total Income (add lines 1 through 3) |

● 4. |

5.Amountincludedinline4representingnetincomeorlossfromactivitiesexemptfromthetax(seeinstr.) ● 5.

6. |

Subtractanynetincomeonline5from,oraddanynetlossonline5to,line4amount |

● 6. |

|

7. |

Allowanceforactivepartners'services(seeinstructions)Numberofactivepartners: ● # |

● 7. |

|

8. |

Line6minusline7 |

● 8. |

|

9. |

EnterthenumberofmonthsinbusinessinNYCduringthetaxyear |

● 9. |

|

10. |

Enterthemaximumtotalallowedincomefromtableonpage2basedonthenumberofmonths |

|

|

|

online9. If the amount on line 8 exceeds the amount on line 10 by more than $100 you |

|

|

|

|

|

00 |

|

cannot use this form; - you must file on Form |

● 10. |

|

11.EnterpaymentofestimatedUnincorporatedBusinessTaxincludingcarryovercreditfrom

|

|

|

|

● 11. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

12. |

.Amountofline11toberefunded - ■ Direct deposit - fill out line 12a OR ■ Paper check |

............... |

● 12. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

12a. |

Routing |

|

|

|

|

|

|

|

|

|

Account |

|

|

|

|

ACCOUNT TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking ■ |

Savings ■ ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Number |

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

13. Amount of line 11 to be credited to 2013 estimated tax on form |

|

● 13. |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

14. |

NYC rent deducted on Federal return |

|

● 14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATION |

|

Iherebycertifythatthisreturn,includinganyaccompanyingrider,is,tothebestofmyknowledgeandbelief,true,correctandcomplete. |

|

|

Firm'sEmailAddress: |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) |

YES ■ |

|

●_____________________________________________ |

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

SIGN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

HERE: |

|

|

|

Signature of partner: |

|

|

|

|

|

|

|

Title |

Date |

|

|

|

|

|

|

● Preparer'sSocialSecurityNumberorPTIN |

|

||||||||||||||||||||||||||||||||

|

|

PREPARER'S |

|

Preparer's |

|

|

|

|

|

|

Preparer's |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

USE ONLY: |

|

|

signature: |

|

|

|

|

|

|

printed name: |

Date |

|

|

|

|

|

|

|

● Firm'sEmployerIdentificationNumber |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the box |

|

■ |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲ Firm's name |

|

|

|

|

▲ Address |

|

▲ Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

60911291 |

|

|

|

YOU MUST ATTACH A COPY OF FEDERAL FORM 1065, INCLUDING THE INDIVIDUAL |

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

COMPLETE THE ADDITIONAL INFORMATION SECTION ON PAGE 2. SEE OVER FOR MAILING INSTRUCTIONS. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

Form |

|

|

|

|

|

|

Page 2 |

|||

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS |

|

|

|

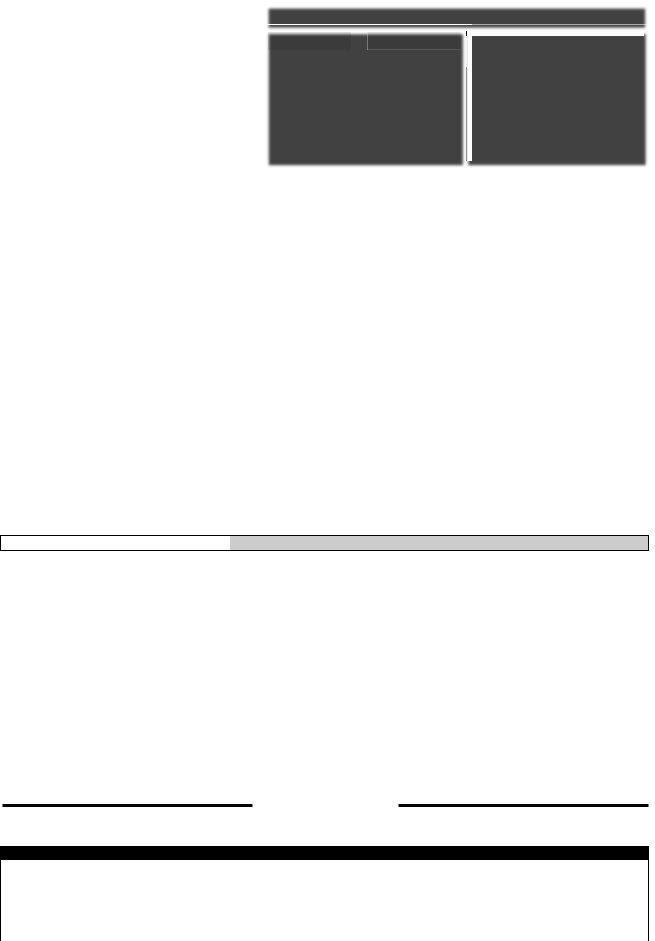

TABLE OF MAXIMUM ALLOWED INCOME FROM BUSINESS |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF MONTHS |

|

MAXIMUM TOTAL |

|

|

Iftotalincomefrombusiness |

||||

|

IN BUSINESS |

|

INCOME FROM BUSINESS |

|

|

|||||

ofthefollowingbenefitsonyourfederalreturn:(i)bonusdepreciationoradeduc- |

|

1 |

$85,416 |

|

|

|||||

|

|

|

after deduction for active |

|||||||

tion under IRC §179 for property in the NY Liberty Zone or Resurgence Zone, |

|

2 |

$85,833 |

|

|

|||||

|

3 |

$86,250 |

|

|

partnersʼ services is more |

|||||

whether or not you file form |

|

|

|

|||||||

|

4 |

$86,667 |

|

|

||||||

converted due to the attacks on the World Trade Center. Attach Federal forms |

|

|

|

than$90,000,youmustuse |

||||||

|

5 |

$87,083 |

|

|

||||||

4562, 4684 and 4797 to this return. See instructions for Form NYC 204, Sch. |

|

6 |

$87,500 |

|

|

Form |

||||

B, lines 14d, 19 and 20. |

|

7 |

$87,917 |

|

|

|||||

|

|

|

|

|

||||||

|

|

|

|

8 |

$88,333 |

|

|

|

|

|

Line 2. Enter the net amount of the partners' distributive shares of income |

|

9 |

$88,750 |

|

|

FIFTEEN OR MORE CALENDAR |

||||

and deduction items not included in line 1 but required to be reported |

|

10 |

$89,167 |

|

|

|||||

|

11 |

$89,583 |

|

|

|

|

||||

separately on federal Form 1065. Attach a schedule. |

|

|

|

DAYSCONSTITUTESONEMONTH |

||||||

|

12 |

$90,000 |

|

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Line 3. Enter the amount of income and unincorporated business taxes

imposed by New York City, New York State or any other taxing jurisdiction that was deducted in computing the amounts on lines 1 or 2. Attach a schedule.

Line 5. Enter on this line the amount included in line 4 that represents the net income or net loss from an activity that is not an unincorporated business carried on by the taxpayer wholly or partly in the City. See Instructions for Form

(i)exclude the income or loss of an entity, other than a dealer as defined in Ad. Code

(ii)for taxable years beginning on or after July 1, 1994, exclude the income, gain or loss from real property held to produce rental income or from the disposition of such property by an entity, other than a dealer. Also exclude income or loss from a business conducted at the property solely for the benefit of tenants at the property that is not open to the public, and eligible income from parking services rendered to tenants. SeeAd. Code

(iii)exclude the income or loss from any separate and distinct activity carried on wholly outside of New York City.

(iv)for tax years beginning on or after August 1, 2002, exclude all of the federal taxable income of partnerships that receive 80% or more of their gross receipts from charges for the provision of mobile telecommunications services to customers and exclude a partner's distributive share of income, gains, losses and deductions from any partnership subject to tax underAd. Code Title II, Ch. II as a “utility” as defined inAd. Code section

Line 7. Adeduction may be claimed for reasonable compensation for personal services rendered by the partners. The allowable deduction is the lower of (i) 20% of line 6 (if greater than zero) or (ii) $10,000 for each active partner.

PreparerAuthorization: If you want to allow the Department of Finance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return. This authorization applies only to the individual whose signature appears in the "Preparer's Use Only" section of your return. It does not apply to the firm, if any, shown in that section. By checking the "Yes" box, you are authorizing the Department of Finance to call the preparer to answer any questions that may arise during the processing of your return. Also, you are authorizing the preparer to:

◆Give the Department any information missing from your return,

◆Call the Department for information about the processing of your return or the status of your refund or payment(s), and

◆Respond to certain notices that you have shared with the preparer about math errors, offsets, and return preparation. The notices will not be sent to the preparer.

You are not authorizing the preparer to receive any refund check, bind you to anything (including any additional tax liability), or otherwise represent you before the Department. The authorization cannot be revoked, however, the authorization will automatically expire no later than the due date (without regard to any extensions) for filing next year's return. Failure to check the box will be deemed a denial of authority.

ADDITIONAL REQUIRED INFORMATION The following information must be entered for this return to be complete.

*60921291*

60921291

1. |

Did you file a NYC Partnership Return in 2010? |

■ YES |

■ NO |

2. |

Did you file a NYC Partnership Return in 2011? |

■ YES |

■ NO |

3.HastheInternalRevenueServiceortheNewYorkStateDepartmentofTaxationandFinanceincreased

ordecreasedanytaxableincome(loss)reportedinanytaxperiod,orareyoucurrentlybeingaudited? |

■ YES |

■ NO |

||

If"yes,"bywhom? |

InternalRevenueService ■ |

NewYorkStateDepartmentofTaxationandFinance ■ |

|

|

State periods: _________________________________________________________ and answer (4). |

|

|

||

4. |

■ YES |

■ NO |

||

5.At any time during the taxable year, did the partnership have an interest in real property

|

located in NYC or in an entity owning such real property? |

■ YES |

■ NO |

6. |

If "YES"to 5: |

|

|

|

a) Was there a partial or complete liquidation of the partnership? |

■ YES |

■ NO |

|

b) Was 50% or more of the partnership interests transferred in the last 3 years or according to a plan? |

■ YES |

■ NO |

7. |

If "YES" to 6a or 6b, was a Real Property Transfer Tax Return filed? |

■ YES |

■ NO |

8.If "NO" to 7, explain: (attach additional sheet if necessary) ___________________________________________________

9. |

Is this taxpayer subject to the Commercial Rent Tax? |

● |

■ YES |

■ NO |

10. |

If "YES", were all required Commercial Rent Tax Returns filed? |

● ■ YES |

■ NO |

|

PRIVACY ACT NOTIFICATION

The Federal PrivacyAct of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether compliance with the request is voluntary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by section

MAILING INSTRUCTIONS

|

The due date for calendar year 2012 is on or beforeApril 15, 2013. |

|

|

RETURNSCLAIMINGREFUNDS |

|

|

ALL OTHER RETURNS |

|

|

Forfiscalyearsbeginningin2012filebythe15thdayofthefourth |

|

|

NYC DEPT. OF FINANCE |

|

|

NYC DEPT. OF FINANCE |

|

|

month following the close of the fiscal year. |

|

|

UNINCORPORATEDBUSINESSTAX |

|

|

UNINCORPORATEDBUSINESSTAX |

|

|

To receive proper credit, you must enter your correct Employer |

|

|

P.O. BOX 5050 |

|

|

P.O. BOX 5060 |

|

|

Identification Number on your tax return. |

|

|

KINGSTON, NY |

|

|

KINGSTON, NY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Download forms and instructions online at nyc.gov/finance or call 311.

If calling from outside of the five NYC boroughs, please call